Together with

Good Morning,

Novo Nordisk is getting smoked by Lilly, Princeton's endowment could give up $11B in asset growth over the next decade, SpaceX is seeking early entry to major stock indexes, Google will double AI CapEx this year, and software stocks continued to slide on an AI-induced existential crisis.

The flagship Wharton Online-Wall Street Prep Private Equity Certificate Program begins next week. If you've been debating it for some time, this is your sign to jump right in. (Our discount is still active!)

Let's dive in.

Before The Bell

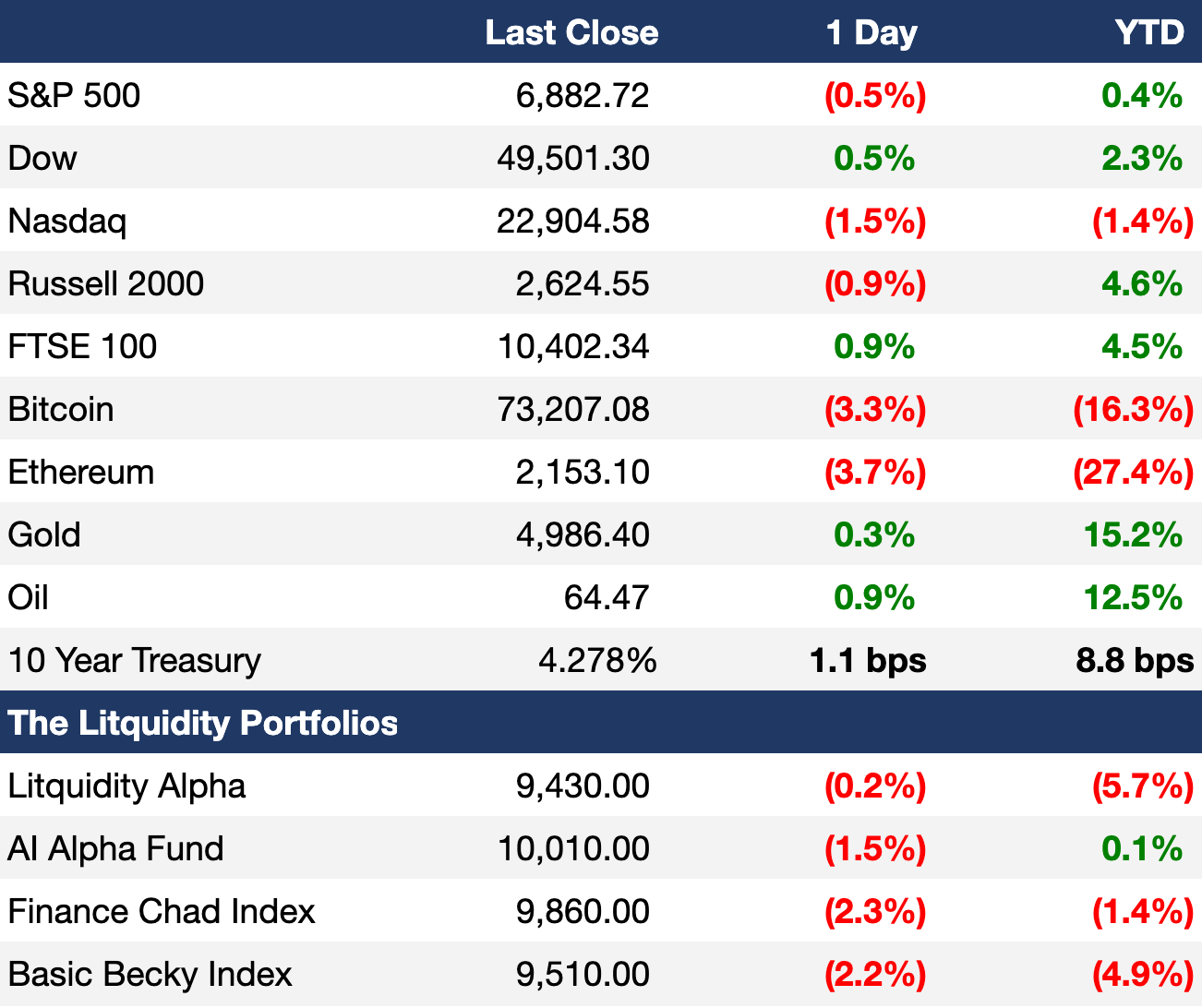

As of 2/4/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks extended their tech-led selloff yesterday on growing AI-related software disruption fears

S&P 500 Software (Industry) is down 14% YTD

Nasdaq posted consecutive 1% declines for the first time since April

UK's FTSE 100 hit an ATH

US 2Y-10Y yield curve widened to 69 bps to a four-year high

Europe's safest corporate bond spreads fell to the lowest since 2007

Bitcoin fell to a 15-month low

Earnings

Alphabet beat Q4 earnings and revenue estimates on 48% growth in cloud revenue and rapid adoption of Gemini AI but forecast FY CapEx to more than double (CNBC)

Qualcomm beat Q1 earnings and revenue estimates but issued soft guidance amid a global memory shortage (CNBC)

Uber beat Q4 earnings on strong food delivery revenue but issued soft profit guidance on a use acquisition push; the firm is extremely bullish on self-driving opportunities (CNBC)

Eli Lilly issued a Q4 beat-and-raise to hit a $1T market cap on surging GLP-1 demand from Zepbound and Mounjaro (CNBC)

Novo Nordisk beat Q4 earnings and revenue estimates but warned of worsening results and guided to a sharp FY decline as Lilly's competitive advantage intensifies (CNBC)

AbbVie beat Q4 revenue and earnings estimates and gave a promising FY forecast on strong growth in its immunology drugs (WSJ)

Snap beat Q4 revenue estimates on higher ARPU but issued a soft outlook as a reduction in marketing spend weighs on DAU (CNBC)

What we're watching this week:

Today: Amazon, Shell, Reddit, Roblox

Friday: Toyota

Full calendar here

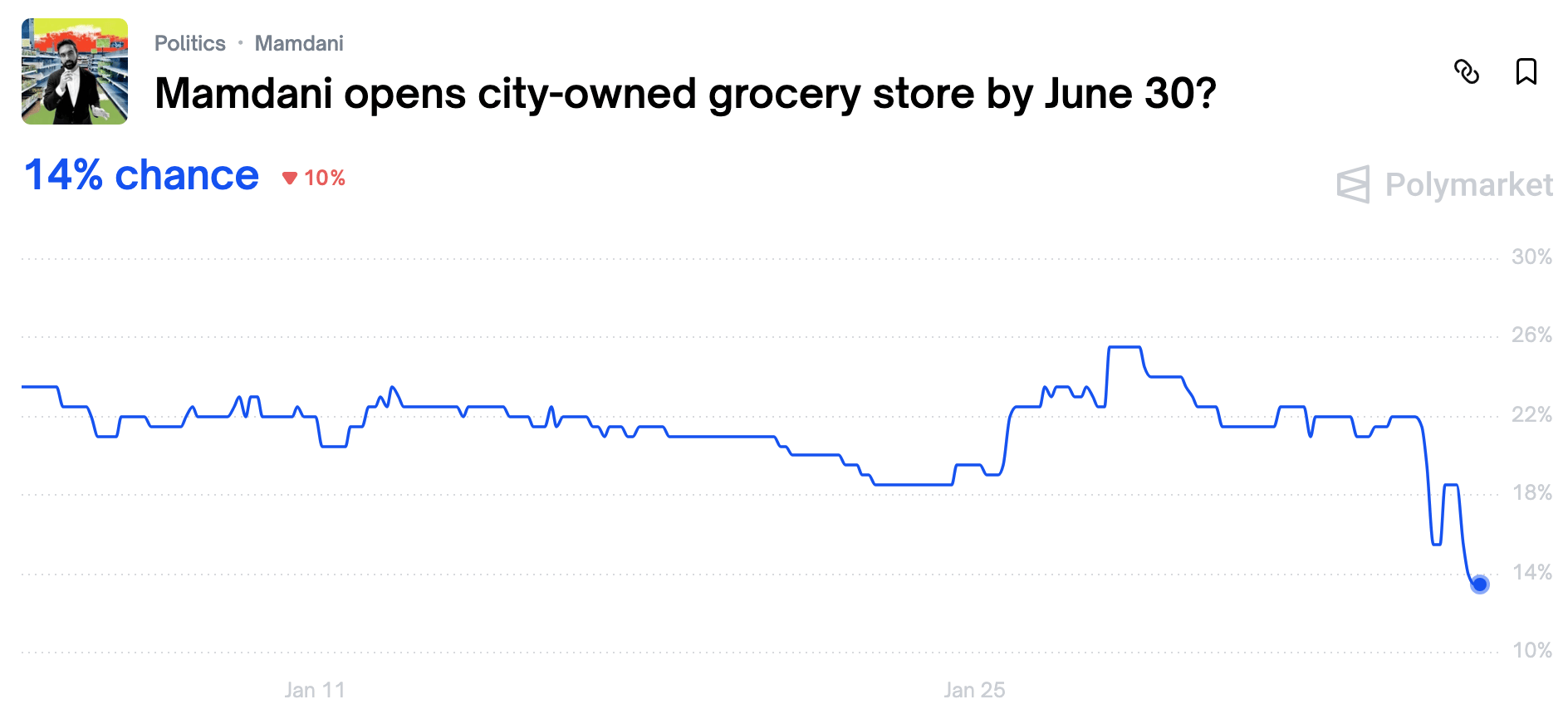

Prediction Markets

Polymarket is planning a free grocery store in NYC for next week. No update yet on Mamdani's NYC grocery stores however 🤷♂️

Trade event contracts on Polymarket, the world's largest prediction market.

Headline Roundup

House Democrats grilled Bessent in Congressional oversight hearing (CNBC)

AI is suddenly threatening the software growth thesis (WSJ)

Software short seller minted $24B in Tuesday's selloff (BBG)

Distressed software loans swelled by $18B in span of weeks (BBG)

Private credit is starting to crack under software threats (NYT)

Jensen Huang dismissed AI-related software fears as selloff deepens (RT)

Princeton endowment cut long-term return forecast from 10% to sub-8% (FT)

Taiwan's AI boom is minting millionaires (BBG)

China stock rally draws 5M retail accounts in January (BBG)

Australia weighs minerals price floor to lure overseas funds (BBG)

SpaceX is seeking early entry to major stock indexes (WSJ)

Brookfield Asset Management named Connor Teskey as new CEO (BBG)

Anthropic takes aim at OpenAI in Super Bowl ad debut (WSJ)

Jeff Bezos' Washington Post laid off one-third of staff (WSJ)

Russian oil revenues plunged to a five-year low (BBG)

A Message from Wall Street Prep

Learn the modern PE playbook from Blackstone, KKR, and leading funds.

Earn your Private Equity certificate through hands-on learning, real-time discussions, and direct access to Wharton Business School faculty during LIVE office hours.

Plus, celebrate your certificate in NYC with a photo in front of the Nasdaq sign 📸

Starts February 9. Save $300 with code LITQUIDITY. Enroll today.

Deal Flow

M&A / Strategic

Hedge fund D.E. Shaw is pushing for major leadership and strategic changes at $22B-listed CRE data firm CoStar Group, including a sale of loss-making Homes.com; activist Third Point is concurrently planning a proxy fight

Zurich Insurance Group reached a deal to acquire UK insurer Beazley in a sweetened $11B deal

Semiconductor company Texas Instruments agreed to acquire peer Silicon Labs in a $7.5B cash deal, including cash and debt, at a 70% premium

KKR and Singapore Telecommunications agreed to acquire the remaining 82% majority stake in ST Telemedia Global Data Centers in a $5.2B deal, with KKR holding 75%

German consumer and industrial goods giant Henkel agreed to acquire specialty coatings company Stahl in a $2.5B deal, including debt

Germany's Heidelberg Materials agreed to acquire Australian industrial service and real estate business Maas Group's construction materials division for $1.2B

VC

Stablecoin giant Tether reduced funding plans from $15-$20B to ~$5B after investor pushback on its $500B valuation target

AI chipmaker Cerebras Systems raised a $1B Series H at a tripled $23B valuation led by Tiger Global

AI voice generation startup ElevenLabs raised a $500M Series D at an $11B valuation led by Sequoia

Autonomous construction startup Bedrock Robotics raised a $270M Series B at a $1.75B valuation co-led by CapitalG

Home battery and VPP startup Lunar Energy raised a $130M Series C led by Activate Capital and a $102M Series D led by B Capital and Prelude Ventures

AI semiconductor startup Positron raised a $230M Series B at a $1B valuation from Arena Private Wealth, Jump Trading, Unless, and SWF QIA

Machina Labs, an AI-enabled metal manufacturing startup, raised a $124M Series C round from Woven Capital, Lockheed Martin Ventures, and others

French advanced nuclear startup newcleo raised an $85M round from Kairos, Indaco Ventures, and others

Digital scent design startup Osmo raised a $70M Series B led by Two Sigma Ventures

TRM Labs, an AI-driven blockchain intelligence startup, raised a $70M Series C led by Blockchain Capital

Blockchain prediction-market startup Opinion raised a $20M pre-Series A led by Hack VC and Jump Crypto

Apeiron Labs, an autonomous underwater vehicle startup, raised a $9.5M Series A from Dyne Ventures, S2G Investments, and others

Agentic web startup Fibr AI raised a $7.5M seed round led by Accel

SENAI, an AI video-intelligence startup, raised a $6.2M seed round led by 10D Ventures

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

SpaceX opened pitching to non-US banks for its $50B IPO

Wall Street brokerage fintech Clear Street is looking to raise $1.05B at a $12B valuation in an IPO

Hair loss-focused biotech Veradermics raised $256M at a $1.3B valuation in its IPO

European defense firm WB Electronics is preparing for a Poland IPO

Danish brewer Carlsberg is weighing an IPO of its India unit

SPAC / SPV

Biotech PrimeGen will merge with DT Cloud Star Acquisition in a $1.5B deal

Debt

EU agreed to a a $106B loan for Ukraine, funded through joint debt

Banks are seeking to offload $56B in investment grade loans tied to Oracle data centers

Black Pearl Compute, a data center unit of crypto firm Cipher Mining, attracted $13B of orders for its $2B junk bond sale

UAE state-owned oil giant ADNOC is seeking to raise $2B in its first-ever yuan bond sale

A group of lenders led by Deutsche Bank are stuck with $1.2B of hung debt tied to Thoma Bravo-backed Conga's acquisition of PROS Holdings' B2B unit

Southeast Asian tower operator EdgePoint Infrastructure secured a $475M syndicated loan from Allianz Global Investors, NEC Capital, Affin Bank and others

Chinese miner Tianqi Lithium re-priced a $375M convertible bond after the previous one didn't comply with Hong Kong regulator rules

Indian non-bank lender Capri Global is exploring a debut $200M-$300M dollar bond sale

South Korea's National Pension Service plans to sell eurobonds to bolster FX reserves

Bankruptcy / Restructuring / Distressed

Collapsed sub-prime auto lender Tricolor founder Daniel Chu won court approval to tap $5M in D&O insurance for his fraud defense

UK is seeking to block O&G firm Waldorf Production's restructuring in London as part of an increasingly aggressive tax collection stance

Funds / Secondaries

Millennium energy and commodities PM Chaitanya Mehra will spin out his pod to launch Echion Capital with $1.5B, with Millennium as the sole seed backer

Sports-focused PE investor Otro Capital raised $1.2B for its debut fund

PE firm Shore Capital Partners raised $400M for its second industrial fund

MM investment firm Wincove raised $300M for its sophomore industrial and infra products and services-focused fund

Secondaries specialist Timber Bay Partners raised $280M for its third flagship secondaries fund

Crypto Sum Snapshot

Bitcoin-led crypto rout erased $500B in a week

Strategy has over $2.1B in unrealized loss on Bitcoin

CME is exploring launching its own 'CME Coin' as 24/7 trading nears

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Biotech is making money again. After a volatile the sector had an extraordinary comeback, outperforming the S&P 500 and broader market index, and closing out 2025 with its best annual returns since the Covid-19 pandemic. Read more.

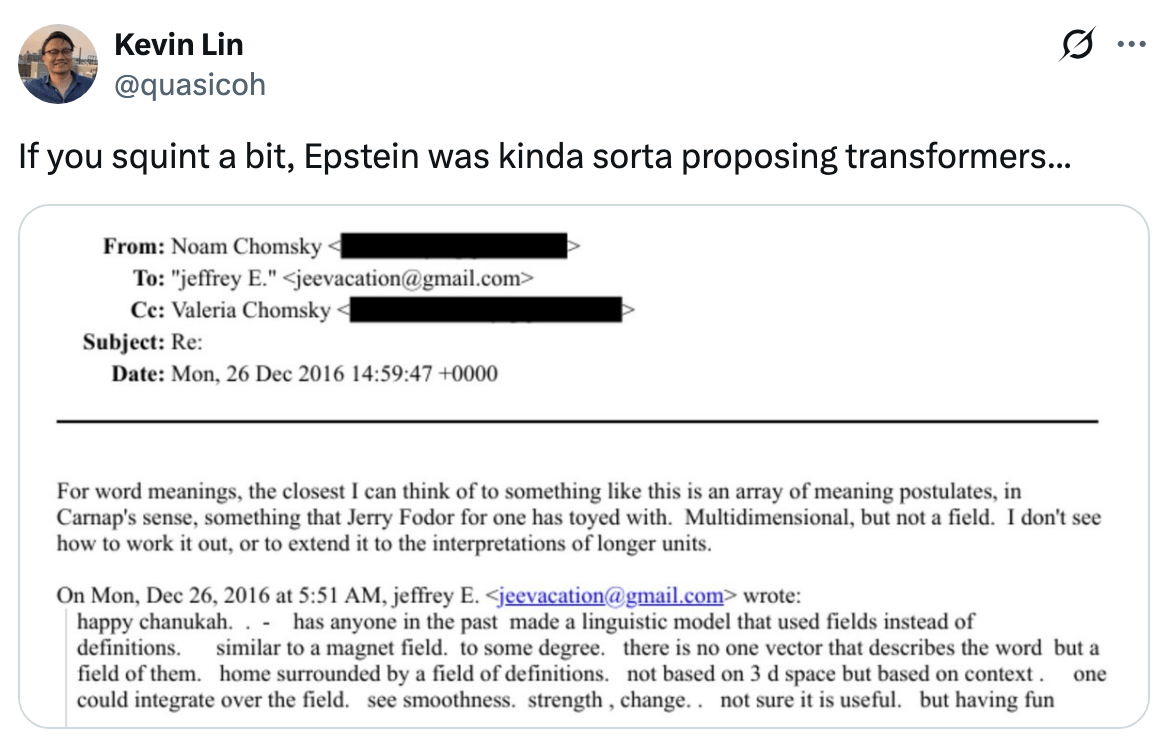

What's behind the AI models rattling markets? WSJ published a short primer making sense of what's happening.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.