Together with

Good Morning,

Mamdani will meet with NYC finance leaders, Wall Street bonuses are set to rise to a post-Covid high, PE megafunds are forecasting an industry consolidation, BofA held its first investor day in a decade, OpenAI's CFO thinks the AI rally needs more exuberance, and Trump's tariffs were dealt a major blow in SCOTUS arguments.

Vanta just released data from their comprehensive survey on AI risks in security. See how business leaders around the globe are responding. Get the report.

Let's dive in.

Before The Bell

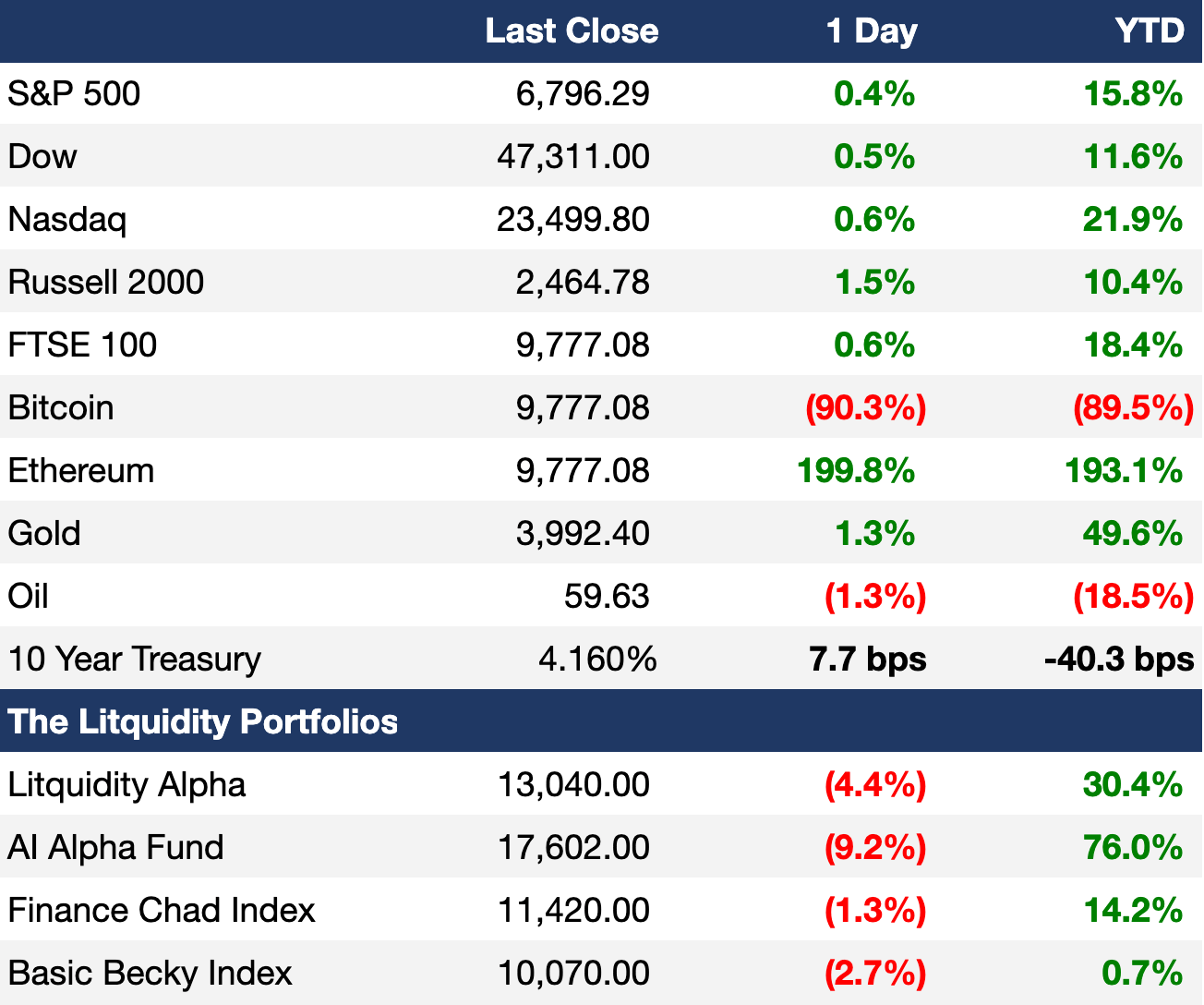

As of 11/5/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks advanced yesterday as investors weighed private economic data and SCOTUS arguments on the legality of Trump's tariffs

UK's FTSE 100 hit a new ATH

US yields rose across the board

Earnings

Novo Nordisk beat Q3 earnings and revenue estimates but lowered its growth outlook for obesity and diabetes drugs amid mounting price pressures and intensifying competition; the company is in a bidding war with Pfizer for Metsera (CNBC)

Robinhood smashed Q3 earnings and revenue estimates as revenue doubled and net income surged 270% amid relentless new product velocity in prediction markets, banking, ventures, and more, though crypto revenues missed estimates (BBG)

McDonald's missed Q3 earnings and revenue estimates but beat same-store sales expectations with growth in US and abroad, though it warned of weakening low-income consumer spending into next year (CNBC)

Qualcomm beat Q4 earnings and revenue estimates and issued a strong forecast as it continues to expand into AI and diversify beyond Apple (CNBC)

Snap beat Q3 revenue estimates and announced a $400M deal with Perplexity as it seeks to integrate AI into its social media vision (CNBC)

Duolingo posted a Q3 beat-and-raise with DAU surpassing 50M and strong adoption of its premium AI-powered Max tier driving 7% higher ARPU (BBG)

Figma beat Q3 revenue estimates and issued strong guidance on surging adoption of its AI-powered design tool, though losses hit $1.1B (CNBC)

DoorDash beat Q3 revenue estimates but missed on earnings as it continues to increase spending to develop its new global tech platform and autonomous delivery initiatives (CNBC)

Chime beat Q3 earnings and revenue estimates and raised FY revenue guidance driven by 29% YoY growth and a 21% increase in active members as more consumers adopt its digital banking platform (RT)

What we're watching this week:

Today: Warner Bros. Discovery, Airbnb, DraftKings, Opendoor, MP Materials

Friday: Six Flags, Wendy's

Full calendar here

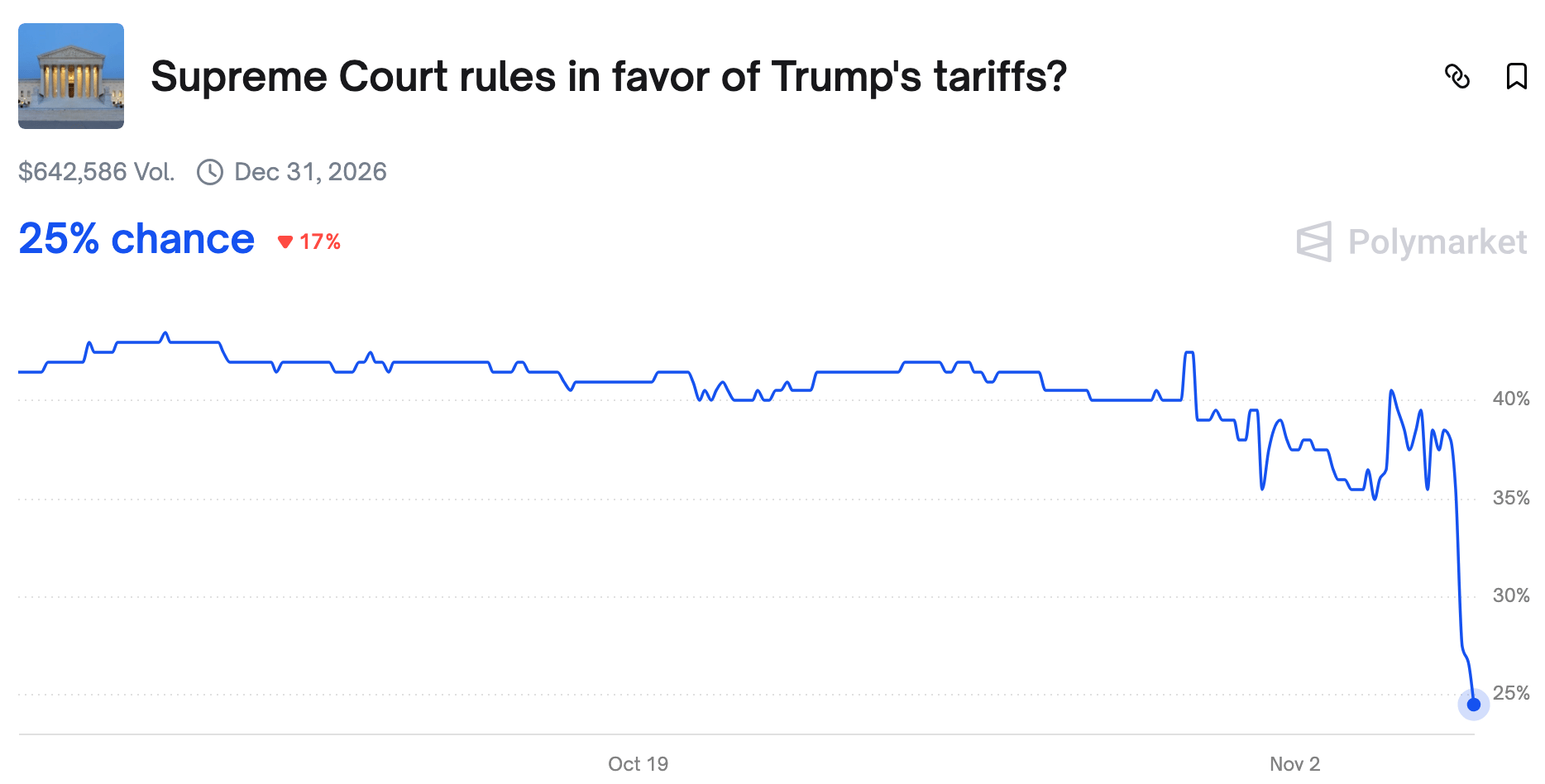

Prediction Markets

Not a good look for Trump's agenda.

Headline Roundup

Mamdani will meet with NYC finance leaders (BBG)

Wall Street bonuses are set to rise to the highest since 2021 (BBG)

US Treasury will increase reliance on short-term debt to fund deficits (BBG)

SCOTUS appears skeptical of legality of US 'reciprocal' global tariffs (WSJ)

US private payrolls rose in October (BBG)

Private credit earnings ease concerns over asset class's health (WSJ)

PE megafunds are forecasting an industry consolidation (CNBC)

Global PE funds consider return to China as investors pivot from US (RT)

UBS chair warns of 'looming systemic risk' from private credit ratings (FT)

Corporate bond markets are set to get first daily closing auction (BBG)

Big AI firms are reviving a crisis-era tool (BRN)

Investors are split on AI bubble fears with billions invested (RT)

OpenAI CFO says market needs more AI 'exuberance' (BBG)

Jensen Huang says 'China is going to win the AI race' (FT)

BofA held its first investor day in over a decade (WSJ)

Deutsche Bank is hedging data center exposure as AI lending booms (FT)

Wells Fargo CEO expects bank's workforce to shrink further (RT)

China's green bond market races ahead of global peers (FT)

Apple is nearing a $1B deal with Google to power Siri with AI (BBG)

Norway SWF opposition complicates Musk's path to $1T pay deal (RT)

JPMorgan will adopt Detroit investment model for other cities (RT)

An ex-Barings exec accused the firm of mismanaging funds (BBG)

Ken Griffin says NYC deserves better than Mamdani's talking points (RT)

Russia may start nuclear weapons tests in response to US (FT)

US consumer delinquencies climbed to the highest since Covid (BBG)

A Message from Vanta

State of Trust: Knowledge Gaps = Security Gaps

AI is moving faster than security teams can keep up – 59% say AI risks outpace their expertise. This is according to Vanta's new State of Trust report, which surveyed 3,500 business and IT leaders across the globe. Download the report to learn how organizations are navigating this gap, and what early adopters are doing to stay ahead.

Deal Flow

M&A / Investments

Qatari Diar, the real estate unit of Qatar's SWF QIA, will invest $30B in an Egypt Mediterranean luxury resort project

Pharma giant Pfizer matched Novo Nordisk's $10B offer for weight-loss drug startup Metsera

Mexico's airport operator ASUR emerged as the lead bidder to buy Brazilian infrastructure manager Motiva's airport portfolio for $925M, excluding debt

Charles Schwab is nearing a deal to acquire private share exchange Forge Global for $600M

Top VC picks by Fundable

Tharimmune, a startup building a blockchain network for financial markets, raised $540M in funding from DRW, Liberty City Ventures, and more

Crypto fintech Ripple raised a $500M round at a $40B valuation led by Citadel Securities and Fortress Investment Group

Beacon Software, an AI-driven software for various industries, raised a $250M Series B led by General Catalyst, Lightspeed Venture Partners, and D1 Capital

Hippocratic AI, a startup building safe GenAI for healthcare, raised a $126M Series C at a $3.5B valuation led by Avenir Growth

EV maker Rivian raised a $115M seed round for its industrial AI and robotics spinoff Mind Robotics

Aerial robotics startup Infravision raised a $91M Series B led by GIC

Reevo, an AI-native GTM platform, raised an $80M round led by Khosla Ventures and Kleiner Perkins

AI video startup Video Rebirth raised a $50M round

Threat exposure management startup Flare raised a $15M Series B led by Inovia Capital

AI software startup Procurement Sciences raised a $30M Series B led by Catalyst Investors

Teleskope, an agentic data security platform, raised a $25M Series A led by M13

Wabi, a startup allowing users to create and share mini apps, raised a $20M pre-seed round from Naval Ravikant, Garry Tan, Sarah Guo, and other accomplished angels

Sunflower Labs, an autonomous aerial security tech startup, raised a $16M Series B led by Sequoia Capital

Sandbar, a smart ring that can take voice notes and control music, raised a $13M round from True Ventures, Upfront Ventures, and Betaworks

French observability platform Tsuga raised a $10M seed round led by General Catalyst

Portal26, a GenAI adoption management platform, raised a $9M Series A led by Shasta Ventures

Billd, a financial solutions for commercial sub-contractors, raised a $7.3M round led by MissionOG

LambdaVision, a biotech startup aiming to restore sight for the blind, raised a $7M seed round led by Seven Seven Six and Aurelia Foundry Fund

Cactus, an AI copilot to automate calls and bookings for home service businesses, raised a $7M seed round led by Wellington Management and Y Combinator

Kabilio, a startup using AI to automate accounting and tax processes, raised a $4.6M pre-seed round led by Visionaries Club and Picus Capital

Flux XII, a startup developing materials for aqueous flow batteries, raised a $4M seed round led by the Grantham Foundation

Get real-time updates on any and every startup, VC, or sector ever. Try Fundable.

IPO / Direct Listings / Issuances / Block Trades

OpenAI is not working on an IPO yet but would like a US government backstop for data center investments; the startup is valued at $500B

Qatar Airways sold its remaining 9.6% stake in Hong Kong's Cathay Pacific Airways for $857M

South Africa mobile network operator Cell C is seeking to raise $413M in a South Africa IPO

Mexican airline Grupo Aeromexico's $235M IPO is over 10x oversubscribed, giving the once bankrupt airline a ~$3B market cap

'Baby Shark' creator Pinkfong raised $53M in its South Korea IPO

French payments firm Worldline is exploring raising several hundred million euros in a share sale to raise capital

Oman India Fertiliser picked banks for an India IPO

Crypto fintech Ripple has no plans to IPO

Debt

Nigeria raised $2.25B in a benchmark dollar debt sale

Apollo-owned LNG carrier operator Energos Infrastructure shelved its $1.5B junk-bond sale amid low investor demand

Media data analytics firm Nielsen sold $1.2B of senior secured bonds

Dezer Development secured a $630M construction loan from Madison Realty Capital for a Bentley-branded condo tower near Miami

US infrastructure investor Stonepeak plans to launch a redeemable infrastructure-backed debt security in Australia after securing $195M in cornerstone commitments

Bankruptcy / Restructuring / Distressed

JPMorgan said Argentina may not need a bank loan

Spirit Airlines will cut 150 salaried jobs as it seeks to exit its second bankruptcy in less than a year

Fundraising / Secondaries

Investment firm Cerberus is seeking to raise $3B for its seventh opportunistic real estate fund

UK PE firm Aspirity raised $1B for its debut fund

Brazilian investment firm Patria Investments is set to raise over $500M for its first secondaries fund it launched since acquiring UK asset manager Aberdeen's European PE business

Lower MM PE firm Teleo raised $350M for its sophomore fund

Portuguese VC Armilar raised $138M for its fourth fund to back disruptive technologies in Iberia and the rest of Europe

Crypto VC CMT Digital raised $136M for a fourth oversubscribed crypto VC fund

Crypto Sum Snapshot

Crypto lending climbed hit an ATH

Big-money crypto backers get hit hard as crypto hoarder stock premiums plunge

Crypto firms and banks battle over future of digital finance rules

Bitwise CIO says Bitcoin retail investors are at 'max desperation' but crypto winter not coming

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Ben Carlson wrote a great piece on the greatest bull market no one ever talks about.

Dan Lefkovitz published an interesting analysis on which 'Trump trades' paid off – and which ones missed the mark.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

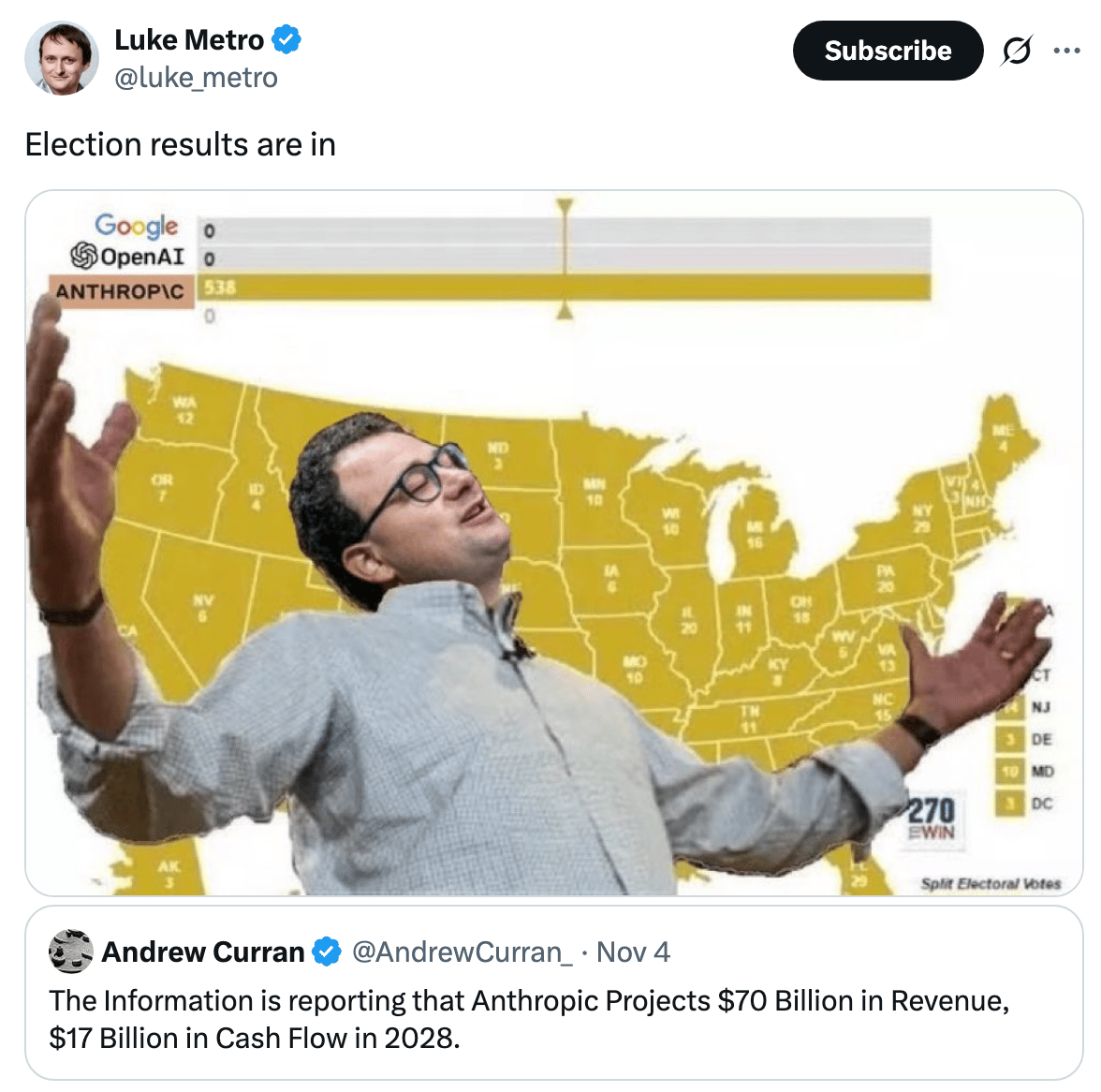

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.