Together with

Good Morning,

The Fed expects to see its balance sheet contract through 2025, EY canceled plans to split its audit and consulting businesses, China’s consumer inflation hit an 18-month low, Berkshire raised its stakes in Japan’s five largest trading houses, the US is studying possible rules to regulate AI, and office space for rent hit a record high.

Want to learn more about an under-covered stock making waves in the green energy storage sector? Check out this report from today’s sponsor, Energy Sector Report.

Let’s dive in.

Before The Bell

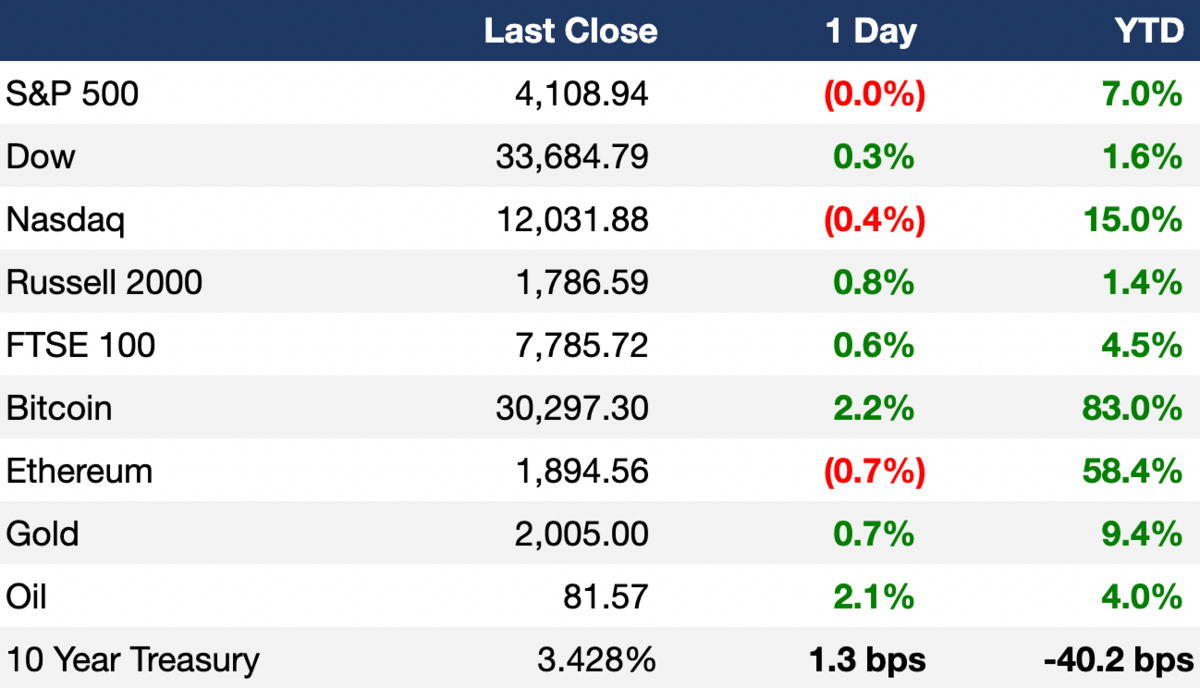

As of 4/11/2023 market close.

Markets

US stocks ended mixed yesterday as investors await crucial inflation data today and brace for gloomy Q1 earnings

Canada's TSX index rose 0.7% to a five-week high

Bitcoin topped $30k for the first time since June

Crypto-related stocks continued to surge alongside Bitcoin's rally

Oil prices rose ~2%

Earnings

What we're watching this week:

Today: LVMH

Thursday: Delta

Friday: JPMorgan, Citi, Wells Fargo, BlackRock

Full calendar here

Headline Roundup

The Fed expects to see its balance sheet contract through 2025 (RT)

EY canceled plans to split its audit and consulting business (FT)

IMF expects bank volatility to slow US economic growth (WSJ)

Russian oil price cap is driving down Russia revenues (AX)

China's consumer inflation hit an 18-month low as demand falters (RT)

Smaller Chinese banks cut deposit rates amid squeezed margins (RT)

Twitter is no longer an independent company after merging with shell firm X Corp. (BBG)

HSBC USA hired dozens of SVB bankers to focus on tech and healthcare (RT)

Berkshire Hathaway raised stakes in Japan's five largest trading houses to 7.4% (RT)

OpenAI will offer users up to $20k for reporting bugs (RT)

US is studying possible rules to regulate AI like ChatGPT (RT)

Switzerland's bankers union called for a freeze on UBS/Credit Suisse job cuts (RT)

Credit Suisse and SEC debated for months over reporting deficiencies (RT)

Citigroup M&A chief Mark Shafir will retire (RT)

World Bank's board will interview US nominee Ajay Banga in early May (RT)

China is negotiating a compromise plan with other major creditors for debt-relief for struggling developing nations (WSJ)

Alibaba will roll out generative AI across its apps (RT)

WhatsApp rolled out its business payment tool in Brazil (RT)

Amazon will charge for some UPS Store returns (TI)

Office space available for rent hit a record high (AX)

Ken Griffin donated $300M more to alma mater Harvard (RT)

Michael Jordan’s signed trainers sold for a record $2.2M (FT)

A Message From Energy Sector Report

#1 Stock Revolutionizing Energy Storage

Elon Musk says a battery shortage is holding back Tesla.

It’s a major problem that every manufacturer is facing right now.

However, there is a small $3 stock right now that is meeting this challenge head-on.

This company is at the forefront of developing cleaner and more efficient lithium-ion batteries and has its focus on next-gen, non-flammable solid-state batteries.

Company insiders are such strong believers that they still own a WHOPPING 62% of the shares.

Wall Street is warming up to the story as well. SeekingAlpha reports that analysts have an average price target that is over 218% higher than current levels.

Click here to learn more about the incredible opportunity while it is still at this level, and see if this stock deserves a place in your portfolio today!

Deal Flow

M&A / Investments

US gold miner Newmont raised its bid for Australian rival Newcrest Mining to $19.5B (BBG)

Indian conglomerate Shapoorji Pallonji Group is weighing asset sales, including a controlling stake in Mumbai-based Afcons Infrastructure, that could raise ~$2B (BBG)

Financial services firm Macquarie Group is considering selling a portfolio of nine highway projects in India at a potential $1.5B+ valuation (BBG)

KKR agreed to buy a 29% stake in communication specialist FGS Global at a $1.43B valuation (BBG)

Natural resources company Vedanta is in talks with Farallon Capital Management to raise at least $1B, though the terms of the capital raise have not been finalized (BBG)

The consortiums looking to acquire Forbes for potentially ~$800M removed Sun Group as lead investor (AX)

Air-conditioning company Carrier is looking to sell or spin off its Fire and Security business segment which accounts for ~17% of its sales (WSJ)

Brookfield Infrastructure agreed to buy French asset manager AXA IM’s stake in French data center firm Data4 (RT)

Bain Capital Tech Opportunities, the tech-focused investment arm of Bain Capital, agreed to buy a stake in enterprise software firm iManage (RT)

French foods group Danone agreed to buy Promedica, a Polish company specializing in care services for patients at home (RT)

Octave Klaba, the founder of French cloud provider OVH Groupe SAS, is seeking to buy search engine Qwant, which prides itself on respecting user privacy (BBG)

Carlyle ended its efforts to buy a stake in healthcare technology firm Cotiviti from Veritas (BBG)

VC

Clear Street, which says it is building “modern infrastructure” for capital markets, raised $270M at a $2B valuation in a Series B extension round led by Prysm Capital (TC)

Market intelligence platform AlphaSense raised $100M at a $1.8B valuation in a funding round backed by CapitalG (RT)

Infogrid, an AI-driven building monitoring tech startup, raised a $90M Series B led by Northzone (TC)

Lithium extraction startup EnergyX will raise a $50M Series B led by General Motors (RT)

Agtech robotics firm Carbon Robotics raised a $30M Series C led by Sozo Ventures (TC)

Trading-focused blockchain Sei raised $30M at an $800M valuation from investors including Jump Crypto, Distributed Global, Multicoin Capital, Asymmetric Capital Partners, Hypersphere Ventures and Bixin Ventures (TC)

Autoleap, which provides a SaaS approach to auto repair operations, raised a $30M Series B led by Advance Venture Partners (TC)

Open source startup NetBox Labs raised a $20M Series A led by Flybridge Capital (TC)

Indonesia-based cloud kitchen brand operator Legit Group raised a $13.7M Series A led by MDI Ventures (TC)

Graneet, which is building an all-in-one SaaS product focused on small construction companies, raised an $8M Series A led by Point Nine and Foundmental (TC)

Debt

Bankruptcy / Restructuring

Cineworld filed a reorganization plan in a Texas bankruptcy court that will effectively wipe out existing shareholders; the plan intends to cut debt by ~$4.53B and raise $2.26B in funds to emerge from bankruptcy (RT)

Fundraising

Blackstone raised $30.4B for its largest global property drawdown fund Blackstone Real Estate Partners X, which will focus on sectors such as rental housing, hospitality, and data centers (BBG)

HPS Investment Partners raised $17B for its HPS Strategic Investment Partners V debt fund (POI)

Apple will double its investment in its carbon removal Restore Fund to $400M (RT)

India-based PE firm Amicus Capital raised up to $100M for its second investment fund (FGA)

Indian MM PE firm Paragon Partners raised $85M for its second fund (DSA)

German VC Blockchain Founders Capital raised $16.3M for its micro VC fund to make early-stage investments in the web3 space (TCH)

Crypto Corner

Bitcoin accounted for 98% of inflows into crypto investment products last week (CT)

Investors are set to gain access to over $33B of ether this week under a planned revamp (RT)

Ex-Deutsche Bank banker Rashawn Russell was charged in US with crypto fraud (RT)

G7 will discuss CBDC standards and crypto regulation (RT)

Exec’s Picks

The New York Times covered the insane story of Russia jailing the WSJ’s Evan Gershkovich for “espionage,” despite no evidence supporting this accusation. A GoFundMe has also been launched to assist Evan’s family in rescue efforts.

The Information published a piece on the slowdown in VC funding for industry newcomers.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.