Together with

Good morning,

Jerome Powell hit everyone with the fattest "I'M NOT F*CKIN LEAVIN" straight out of Wolf of Wall Street after Joe Biden announced he would be renominating J Pow for a second term.

Thx all for your contributions to our survey the past few days. We'll be sifting through the list and reaching out to the most active accredited members of the Litquidity x Exec Sum fam for some special opportunities shortly. 🤝 #BIGTHINGS

Let's dive in.

Before The Bell

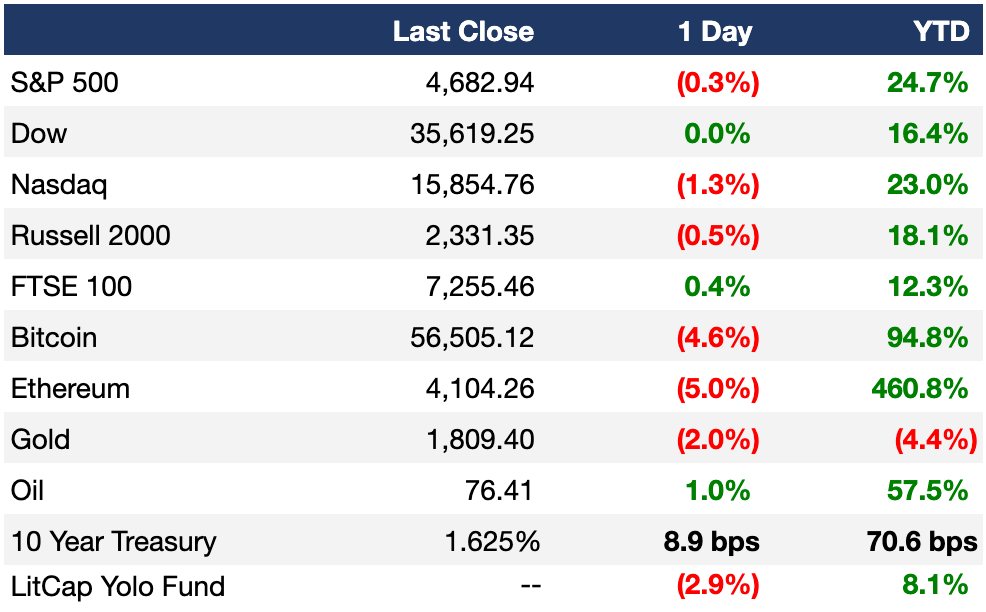

As of 11/22/21 market close.

To see the LitCap Yolo Fund's portfolio holdings, download the Iris Social Stock app here and give Litquidity a follow. If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

The big news today was that Biden would renominate J Pow as Fed Chair, causing some slight movement in the market

The Dow edged positive, but the J Pow news and resulting rising Treasury yields sent the S&P 500 and tech-heavy Nasdaq into the red for the day

Also, news of America’s recent Covid spike has sparked some worry for investors

Earnings

Zoom beat analyst estimates on both quarterly revenue and EPS, also issuing better-than-expected guidance even though the company is expecting a revenue slowdown post-pandemic (CNBC)

Urban Outfitters shares plunged 10%+ AH even after the company beat on both profit and sales since high growth in digital sales was overshadowed by a decline in comparable retail store sales (MW)

What we’re watching today: American Eagle, Dell, Dick’s Sporting Goods, Dollar Tree, Nordstrom

Full calendar here

Headline Roundup

Five dead in Wisconsin after vehicle sped into Christmas parade (WSJ)

US existing-home sales rose unexpectedly to a nine-month high (BBG)

Treasury yields rise after Biden taps Powell for second term (WSJ)

Jeff Bezos donates $100M to Obama Foundation (WSJ)

American Medical Association warns halting Biden Covid vaccine mandate will cause severe and irreparable harm (CNBC)

Comcast weighs pulling some content from Hulu in effort to boost Peacock (WSJ)

A Message From Masterworks

The Unexpected Way Millionaires Invest in Alternatives (And How You Can Too)

The Power Law dictates that 1% of the world’s population holds more than 45% of the wealth— and they’re only getting richer.

The one thing they’re doing that we’re not? They allocate 30%, on average, to alternative investments like Contemporary Art.

It makes sense: inflation just hit a 30-year high, and every top equity firm from Goldman to Vanguard is projecting returns of less than 5% until 2035.

Numbers you should know:

Contemporary Art prices outperformed the S&P 500 by 174% from 1995–2020

The global value of art expected to grow by 53% by 2026

86% of wealth managers recommend offering art to clients

No wonder the Wall Street Journal reported that art is one of “the hottest markets on Earth.”

Thanks to Masterworks.io, New York City’s newest $1B fintech unicorn, you can access this unexpected and potentially lucrative asset class.

They use data to identify key works by artists like Picasso, Banksy, and Basquiat—then securitize and issue shares of those paintings on their revolutionary technology platform. Investing in art has never been easier.

With almost $300M AUM, Masterworks is off to the races.

*See important disclosures

Deal Flow

M&A

Energy drink maker Monster Beverage is exploring a combination with Corona brewer Constellation Brands, the two have market values of $48B and $44B respectfully (BBG)

Bain Capital and Hellman & Friedman agreed to buy health information and technology company Athenahealth in a $17B deal (BBG)

Vivendi, the largest shareholder in Telecom Italia, is unlikely to support KKR’s $12.2B bid for the company (BBG)

Norway’s Telenor and Thai conglomerate CP Group agreed to merge their telecom units in Thailand in an $8.6B deal (RT)

Telecom company Ericsson agreed to buy cloud communications firm Vonage in a $6.2B deal (RT)

Warburg Pincus is exploring a purchase of business services provider Vistra in a potential $4-5B deal (BBG)

CVC Capital Partners and HPS Investment Partners agreed to buy stakes in Authentic Brands, the company behind Brooks Brothers and Eddi Bauer, in a combined ~$3.5B deal at a $12.7B valuation (WSJ)

Spanish privately held call centre operator Grupo Konecta has hired JPM and BNP Paribas to find a buyer for a controlling stake at a potential $1.69B+ valuation (RT)

EU-based retail company Schwarz Group agreed to acquire Israeli security startup XM Cyber for $700M (TC)

Warburg Pincus is in talks to buy a minority stake in China Everbright Bank’s wealth management unit for $300-$400M at a ~$1.5-$2B valuation (BBG)

Netflix agreed to buy visual-effects studio Scanline VFX to build on its in-house production capabilities (BBG)

Canadian software company Enghouse is exploring options including a sale (BBG)

GM acquired a 25% stake in electric boat company Pure Watercraft (TC)

VC

Cloud-based cybersecurity platform Lacework received a $1.3B investment at an $8.3B valuation from Tiger Global, Sutter Hill Ventures, D1 Capital Partners, Altimeter, and more (WSJ)

Crypto-focused fintech startup MoonPay raised a $555M round at a $3.4B valuation led by Tiger Global and Coatue (CNBC)

LTK, a creator-driven marketplace, raised a $300M round at a 2B valuation from SoftBank Vision Fund (TC)

AR game development platform Niantic raised a $300M round at a $9B valuation led by Coatue (TC)

E-commerce fulfillment and tech startup Deliverr raised $250M at a $2B valuation in a round led by Tiger Global (BBG)

Virtual and digital physical therapy provider Sword Health raised a $167M Series D at a $2B valuation led by Sapphire Ventures (BBG)

NFT music rights startup Royal raised a $55M Series A led by a16z Crypto (TC)

Neural search platform Jina.ai raised a $30M Series A led by Canaan Partners (TC)

Vegan cheese startup New Culture raised a $25M seed round led by Ahren Innovation Capital (TC)

Fonoa, an Irish startup helping businesses stay tax compliant while scaling, raised a $20.5M Series A led by OMERS Ventures (TC)

DevOps cloud platform Render raised a $20M Series A led by Addition (TC)

LatAm teen banking app Z1 raised a $10M Series A led by Kaszek (TC)

B2B BNPL startup Slope raised an $8M seed round from Global Founders Capital and more (TC)

Fractional, a startup making real estate ownership more accessible, raised a $5.5M round at a $30B valuation led by CRV (TC)

AI diagnostic visualization platform LifeVoxel raised a $5M seed round (TC)

Cloud-focused startup AutoCloud raised a $4M seed round led by Animo Ventures (TC)

IPO / Direct Listings / Issuances / Block Trades

Paris-based PE firm Ardian has begun preparations for a potential IPO (BBG)

Exec's Picks

Skillful helps top talent launch and accelerate their careers in the tech industry (think: Strategy & Ops, Product, Strategic Finance). Exec Sum readers can secure an exclusive early-bird discount on upcoming programs. Get your code here

The new Federal Reserve Ugly Christmas Sweaters just dropped, following J Pow's renomination

ICYMI: We published a deep dive article breaking down Beehiiv's business model, the newsletter / creator industries, and why Litquidity Capital invested in the seed round

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 100+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Hire Talent" on the top right of the job board.

Candidates: We've also partnered up with Portal Jobs for a more hands-on approach to matching talent with relevant jobs. Fill out the form here and we'll get to work on placing you in a relevant gig 🤝