Together with

Good Morning,

Yesterday was wild, to say the least. Elon Musk is acquiring Twitter, NFT holders lost millions after the BAYC Instagram got hacked, DeSantis signed the bill to strip Disney of self-governing status, GM's Corvette is going electric, and Trump has no plans to return to Twitter.

Oh, and most importantly: you can now add "Investor Relations Professionals" to the Litquidity brand, because we partnered with RCI Hospitality to host their next earnings call on Twitter Spaces 😤

Let's dive in.

Before The Bell

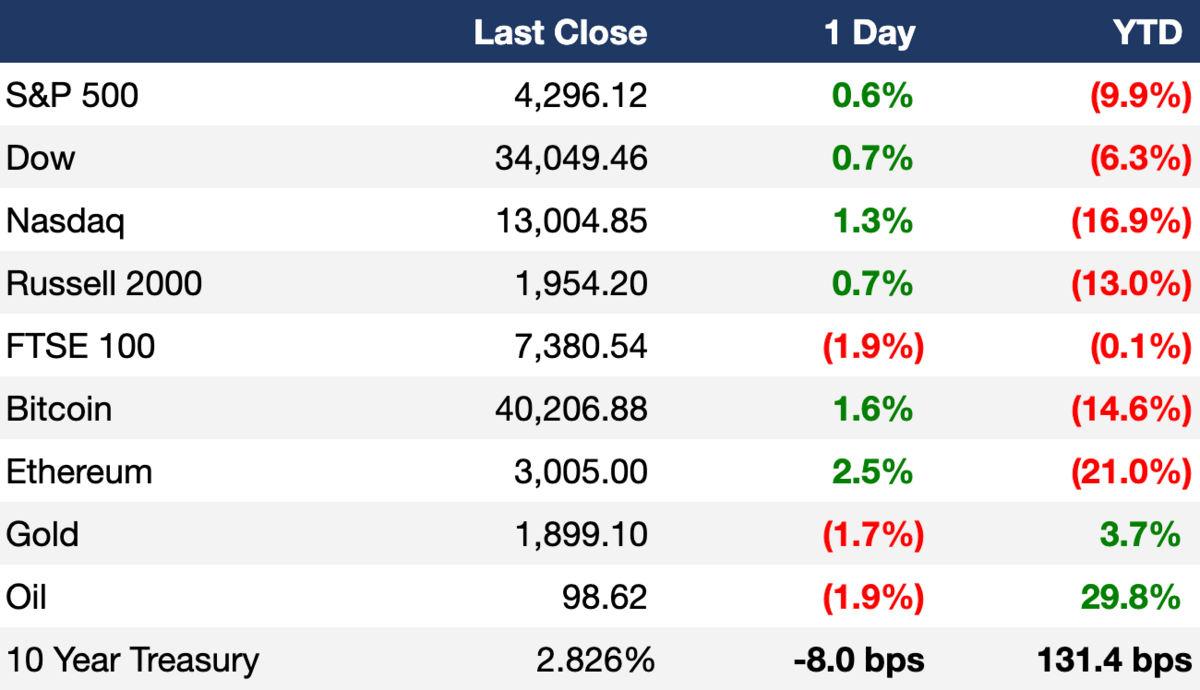

As of 4/25/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks made a huge comeback in the afternoon yesterday to close in the green, with the S&P, Dow, and Nasdaq gaining 0.6%, 0.7%, and 1.3%, respectively

Big tech names helped rally markets due to falling interest rates, with the 10-Yr yield dropping back to 2.8%

Investors will continue to watch important earnings announcements throughout the week, as ~160 companies in the S&P are expected to report

Earnings

Coca-Cola posted better-than-expected sales numbers for the quarter as demand held up amid price increases, helping offset surging input costs (WSJ)

Activision Blizzard missed Q1 sales estimates due to low demand from its latest ‘Call of Duty: Vanguard’ and weaker ‘Call of Duty: Warzone’ engagement (CNBC)

What we’re watching today: UPS, PepsiCo, JetBlue, GE, Microsoft, GM, Alphabet, Visa, Chipotle

Full calendar here

Headline Roundup

Litquidity to kick off IR business with Twitter Spaces earnings call pilot with RCI Hospitality (Benzinga)

Blast at illegal Nigeria oil refinery claims more than 100 lives (BBG)

GM’s Corvette is going electric (BBG)

Hedge fund Verition moves its New York office in a major expansion (BBG)

US, allies lobby to get Ukraine to G-20 summit alongside Putin (BBG)

Florida governor signs bill stripping Disney of self-governing authority (RT)

GE hoping to 3D print concrete components for wind turbines so it can save on transportation costs (CNBC)

Tesla sinks after CEO Musk agrees to buy Twitter in $44B deal (BBG)

New York MTA misses its fare revenue target by $170M (BBG)

Donald Trump says he won’t return to Twitter if Elon Musk reverses ban (CNBC)

A Message From Shift4

Shift4 (NYSE: FOUR) is boldly redefining commerce by simplifying complex payments ecosystems across the world. As the leader in integrated payments and commerce technology, Shift4 powers billions of transactions annually for hundreds of thousands of businesses in virtually every industry – including hotels, restaurants, stadiums, casinos, retail, nonprofit, ecommerce and more.

The company recently expanded into the cryptocurrency space with the acquisition of The Giving Block, the leading crypto donation platform. To celebrate, Shift4 launched “Caring with Crypto” – a $20 million fundraising campaign for nonprofits on the platform, with Shift4’s CEO matching $10M in donations. You can visit thegivingblock.com/caringwithcrypto for more information about this initiative or to donate.

Learn more about Shift4 at shift4.com.

Deal Flow

M&A / Investments

Elon Musk agreed to buy social networking platform Twitter in a $44B deal, a 38% premium to the company’s April 1st valuation (BBG)

Blackstone agreed to buy industrial and office property owner PS Business Parks for ~$7.6B (BBG)

TPG Capital agreed to buy Change Healthcare’s claims editing business for $2.2B (RT)

Shell is nearing a deal to buy Indian renewable energy producer Sprng Energy for ~$1.8B (BBG)

Buyout firms including CVC Capital Partners and KKR are considering bids for Japanese conglomerate Toshiba (BBG)

Snack company Mondelez agreed to buy Ricolino, Mexico’s leading confectionery company, for $1.3B (BBG)

Investment Corp. of Dubai, the country’s sovereign wealth fund, is exploring a potential sale of British software services company SmartStream Technologies that could be worth ~$1B (BBG)

Singaporean sovereign wealth fund GIC agreed to buy a 75% stake in London’s Paddington Central office campus for $888M (BBG)

Spanish lender BBVA raised the price that it’s offering to shareholders of its Turkish unit following calls from some investors that the previous bid was too low (BBG)

PE firms including Blackstone and KKR are showing interest in a potential buyout of French video game publisher Ubisoft (BBG)

Suitors including Cerberus Capital and SPAC Tailwind Acquisition Corp have expressed interest in buying Bed Bath & Beyond’s Buybuy Baby business after the company received activist pressure to sell the unit (RT)

PE firm Najafi Companies agreed to buy ‘FBoy Island’ and ‘Bad Moms’ producer STX Entertainment for $173M (TBI)

Dubai-based ride sharing startup Swvl agreed to buy Turkish transportation-as-a-service operator Volt Lines in a $40M deal, with an additional $25M in funding committed to grow in the region (BBG)

Gaming equipment company Turtle Beach is exploring strategic alternatives including a possible sale (RT)

VC

SF-based satellite imagery specialist Capella Space raised $97M through a mix of equity and debt in a round led by NightDragon (CNBC)

Sustainable fertilizer startup Anuvia Plant Nutrients raised a $65.5M Series D co-led by Riverstone Holdings and Piva Capital (PRN)

Renter and landlord fintech company TheGuarantors raised a $50M Series C led by Portage Ventures (PRN)

Hour One, an AI video generation startup, raised a $20M Series A led by Insight Partners (PRN)

Social connection platform Wisq raised a $20M Series A led by Norwest Venture Partners (PRN)

Leasecake, a cloud-based operating system for lease management, raised a $12M Series A led by PeakSpan Capital (BW)

Cloud-based traffic analytics startup GridMatrix raised a $3.5M seed round led by 8VC and Cota Capital (PRN)

IPO / Direct Listings / Issuances / Block Trades

Marina owner and operator Suntex Marinas hired Bank of America as lead underwriter for its IPO at a potential $3B valuation (BBG)

Fundraising

Crypto Corner

Exec's Picks

Here - Returns on vacation rentals average nearly 129% more than any other class of real estate investment. Here enables anyone to buy fractional shares of vacation rentals and earn passive income from the highest-yielding asset class in real estate without ever lifting a finger. Get started with as little as $100. Get early access to the future of real estate investing here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to list a job here on Exec Sum or on our board, click this link.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast, presented by CoinFLEX.US, on Spotify and Apple Music 🤝