Together with

Good Morning,

The SEC is suing Binance and its founder Changpeng Zhao, Apple revealed its new VR headset, UBS expects its Credit Debit Suisse acquisition to close as early as next week, CMBS delinquencies saw a large spike, Walmart topped the Fortune 500 list, and Mike Pence is running for president.

Looking for a resilient asset class to diversify your portfolio? You can invest directly in farmland through today’s sponsor, AcreTrader.

Let’s dive in.

Before The Bell

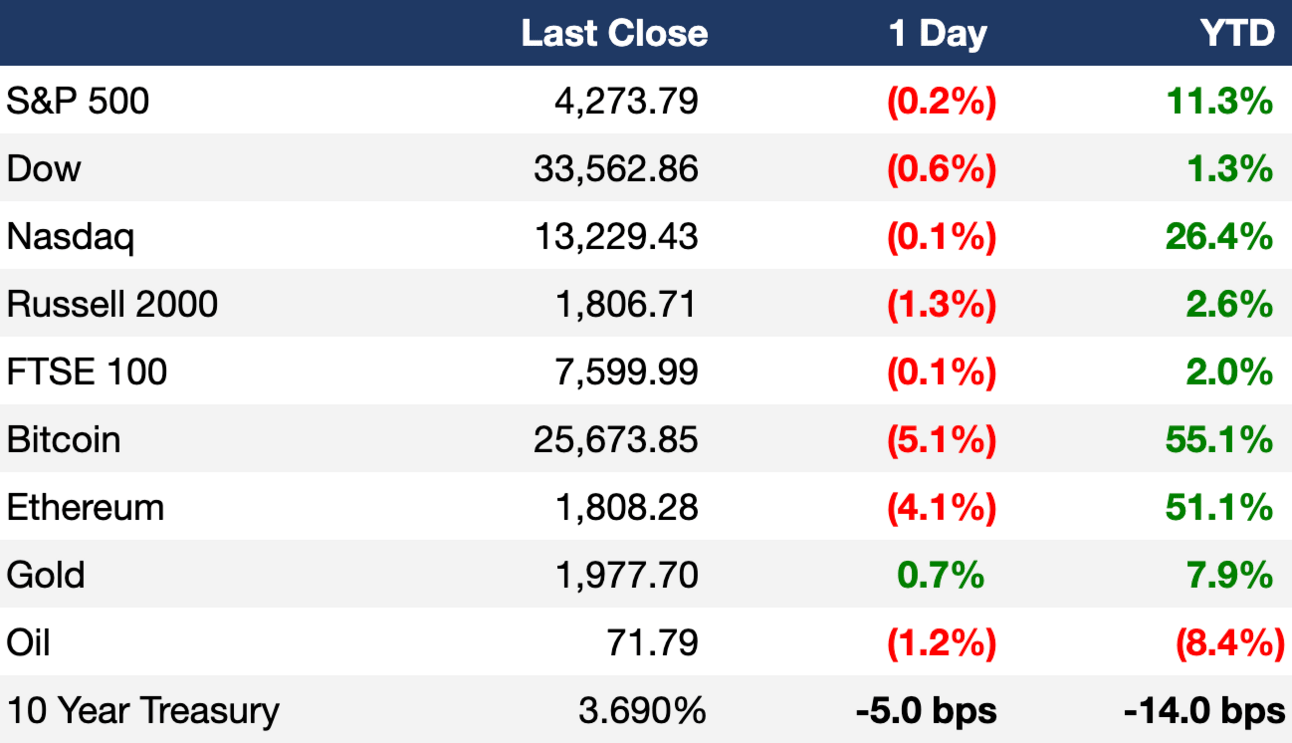

As of 6/5/2023 market close.

Markets

US stocks closed lower Monday, giving back early morning gains in a lackluster information day

The S&P briefly touched its highest level in nine months

The US 2Y yield fell to 4.48% while the 30Y traded up to 3.89%

Traders priced in an 80% chance of no Fed rate change in June

Derivatives markets now expect the Fed’s target rate to sit at 5% at year-end, up 100 bps from last month

Earnings

Gitlab beat Q1 expectations as customers look to the company’s AI-powered platform to drive efficiencies and increase productivity; the stock surged 18% (MW)

Science Applications beat Q1 profit expectations and raised its FY outlook after expanding several existing contracts (MW)

What we're watching this week:

Tuesday: Ferguson, J.M. Smucker

Wednesday: GameStop, Campbell Soup

Thursday: DocuSign, Vail Resorts

Friday: NIO

Full calendar here

Headline Roundup

US factory orders rose for a fourth month in five in April (MW)

CMBS delinquencies saw their biggest spike since 2020 (AX)

US banks prepare for losses in rush for commercial property exit (FT)

UK's Pension Protection Fund slashed equity allocation from 9% to 6% (FT)

UBS expects its $3.4B acquisition of Credit Suisse to be completed as early as June 12th (RT)

Women continue to make up over 10% of Fortune 500 CEOs (FRT)

Walmart topped Fortune 500 list for 11th consecutive year (AX)

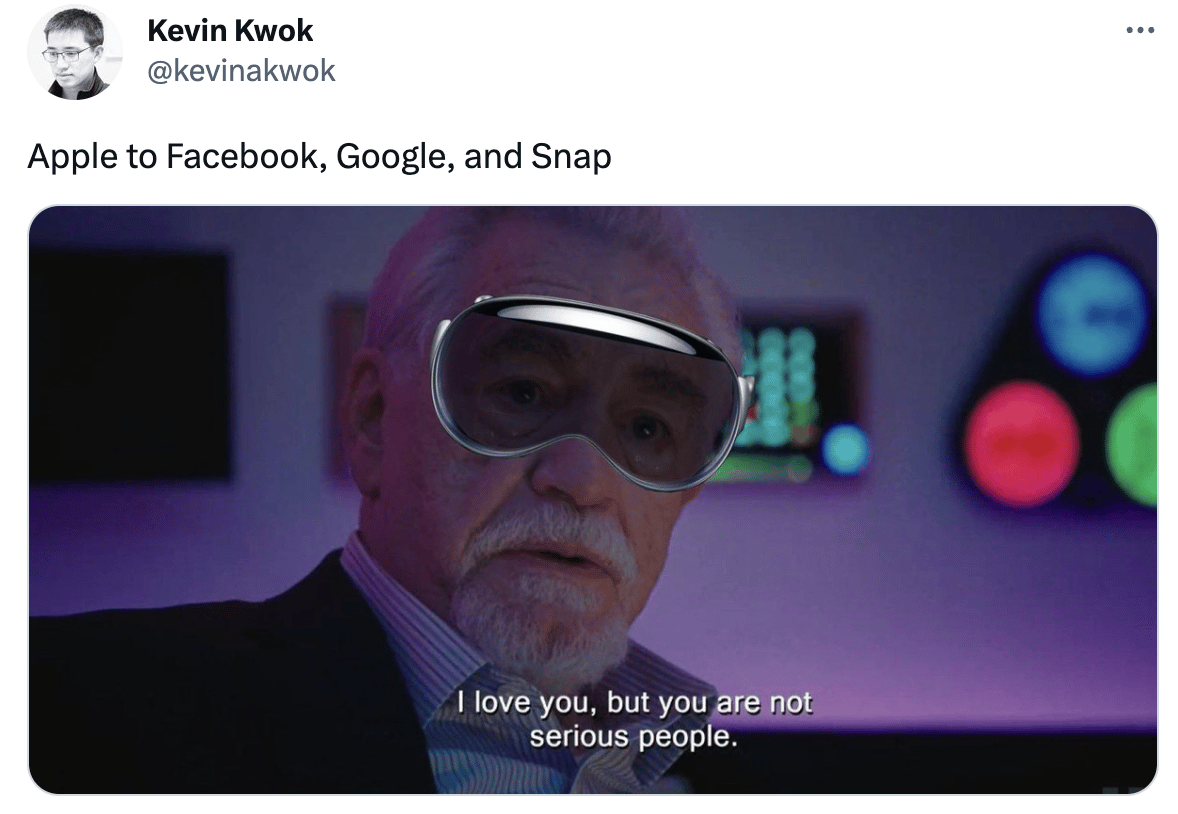

Apple to sell Vision Pro AR headset for triple Meta's top-line price (RT)

JPMorgan flags some signs of emerging de-dollarisation (RT)

Markets brace for deluge of T-Bill supply after US debt deal (YF)

Canadian pensions pull back on China investments (AX)

Musk's Neuralink is reportedly worth ~$5B based on private stock trades (RT)

Former ByteDance exec claims CCP accessed TikTok’s Hong Kong user data (WSJ)

Spotify to lay off 200 workers in podcast division (RT)

Elon Musk says China will initiate AI regulations (RT)

Times Square’s small businesses fight to keep the lights on (WSJ)

US banks could face 20% capital hike under new global rules (RT)

Global airlines more than double 2023 profit outlook (RT)

France rolls out the red carpet for EV battery factories (RT)

Mike Pence is running for president (AX)

A Message From AcreTrader

Ground Your Portfolio with Farmland Investing

You don’t have to be a farmer to invest in farmland. AcreTrader allows you to own shares in a farm — without having to run it.

Diversify your portfolio with a tangible alternative asset class that’s shown historically consistent positive returns for the past 30 years.*

*AcreTrader Financial, LLC, member FINRA/SIPC. Farmland investing is speculative and involves high degree of risk, including complete loss of principal and not suitable for all investors. Past performance does not guarantee future results and there is no guarantee this trend will continue.

Deal Flow

M&A / Investments

Saudi PIF-owned jet lessor AviLease is in advanced talks to buy Standard Chartered's aviation finance business in a $3.8B deal (RT)

UnitedHealth Group gave an unsolicited $3.3B cash offer to acquire home health care services company Amedisys (RT)

Canadian insurer Fairfax Financial Partners is buying $2.3B worth of the real estate loans that had been sold by PacWest Bancorp to property investment firm Kennedy-Wilson Holdings (RT)

GE is selling an over $2B stake in its spinoff GE HealthCare Technologies (RT)

KKR is taking machinery maker Circor private in a $1.6B deal (RT)

Intel is selling a ~$1.5B stake in autonomous driving spinoff Mobileye Global (RT)

Singapore utilities firm Sembcorp Industries signed a $1.4B deal with a PT Medco Energi Internasional subsidiary to import natural gas from Indonesia (RT)

French rocket and aircraft engine manufacturer Safran is in advanced talks to acquire Raytheon’s flight control unit for ~$1B (BBG)

Ryman Hospitality Properties agreed to buy JW Marriott San Antonio Hill Country Resort & Spa from Blackstone for $800M in what would be the second largest single-asset hotel deal in post-pandemic US (WSJ)

Goldman Sachs Asset Management gave a $599M cash offer to acquire Norwegian aquaculture service group Froy (RT)

German flavor and fragrance maker Symrise made a $544M cash offer to acquire pet healthcare company Swedencare (RT)

Zurich Insurance Group and BNP Paribas’ Cardif unit are among potential bidders for PT Astra International’s life insurance arm worth ~$500M (BBG)

Danish drug developer Novo Nordisk is in talks to acquire an over 45% stake in French medical device designer Biocorp from main shareholder Bio Jag, valuing the company at $165M (RT)

Saudi Arabia's sovereign wealth fund PIF is taking 75% stakes in four of the kingdom’s top soccer clubs, including Cristiano Ronaldo’s Al-Nassr (RT)

Retail investment firm Go Global Retail is in talks to acquire Buy Buy Baby from the bankrupt Bed Bath & Beyond (WSJ)

Online retailer Overstock is in talks to purchase Bed Bath & Beyond’s intellectual property (WSJ)

VC

Beyond Music, a global music investment firm based in South Korea, raised $170M in funding led by Praxis Capital (BW)

Fintech company focused on improving the consumer payment experience PayNearMe raised a $45M Series D led by Queensland Investment Corporation (FN)

Medical device company Conformal Medical raised a $35M Series D led by SPRIG Equity (PRN)

African healthcare SaaS startup Helium Health raised a $30M Series B from AXA IM Alts, Capria Ventures, and more (TC)

Impact Analytics, a provider of SaaS solutions for supply chain and merchandise planning, raised $21.5M in funding from Vistara Growth (PRN)

Nest Egg, an investment advice platform for customers of banks and credit unions, raised a $12.7M funding round led by OceanFirst Bank and Republic Bancorp (BW)

PLOT Communications, a SaaS management platform for construction job sites, raised $2M in funding led by GroundBreak Ventures (PRN)

IPO / Direct Listings / Issuances / Block Trades

Rubrik, a cloud data management company backed by Microsoft last valued at $4B in 2021, could IPO in 2024 and raise more than $750M (RT)

Mediterranean fast-casual restaurant chain Cava is aiming to raise $274M in a $2.1B IPO (RT)

Australian chemical distribution firm Redox is looking to IPO at an $850M-$930M valuation and raise $280M for shareholders (BBG)

Brookfield India REIT is planning a ~$400M equity raise (RT)

Indian education company Byju’s is targeting a 2024 IPO of its tutoring unit Aakash Education Services (RT)

Surf Air Mobility filed publicly for a direct listing (BBG)

SPAC

Montana Technologies, a company looking to revolutionize the HVAC industry with its sustainable product AirJoule, will merge with Power & Digital Infrastructure Acquisition II Corp in a $500M deal (BZ)

Immunotherapy developer CERo Therapeutics and Phoenix Biotech Acquisition are combining in a $145M deal (MW)

Debt

India’s Adani Group completed a $2.7B deleveraging program involving a $700M debt prepayment and a secondary $1.9B transaction with GQG Partners (RT)

Bankruptcy / Restructuring

Data-center operator Cyxtera Technologies filed for US bankruptcy protection (RT)

Fundraising

Eduardo Saverin’s B Capital Group is in talks to raise $500M for its third Ascent Fund to invest in early-stage companies (BBG)

UK-based deep tech VC IQ Capital raised $400M for two funds: a $200M venture fund and a $200M growth fund (TC)

UK-based European VC backer Isomer Capital raised ~$268M for a new fund of funds (SFT)

Crypto Corner

A senior Binance executive reportedly had control over Binance.US accounts, contradicting Binance’s claims that its US exchange is independently operated (RT)

SEC is suing Binance and its CEO Changpeng Zhao for violating numerous securities laws (BBG)

Richard Teng emerged as the frontrunner to take over as CEO of Binance if Changpeng Zhao were to step down (BBG)

Exec’s Picks

Jens Nordvig wrote about the ebbs and flows of “dollar hatred” over the last two decades.

Litney Partners - Financial Recruiting 💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter