Together with

Good Morning,

The US labor market was on fire in June, US VC funding declined 50% YoY in Q2, high-yield bond deals are back, Threads hit 30M downloads in its first 16 hours, UBS overhauled leadership in its wealth management division, the US is renewing its audit of NY-listed Chinese firms, and Japan’s base salary growth hit a 28-year high.

Are you a non-accredited investor looking to invest some money in venture capital? Check out today's sponsor, Sweater. They're a platform allowing ordinary investors to gain exposure to the VC asset class.

Let’s dive in.

Before The Bell

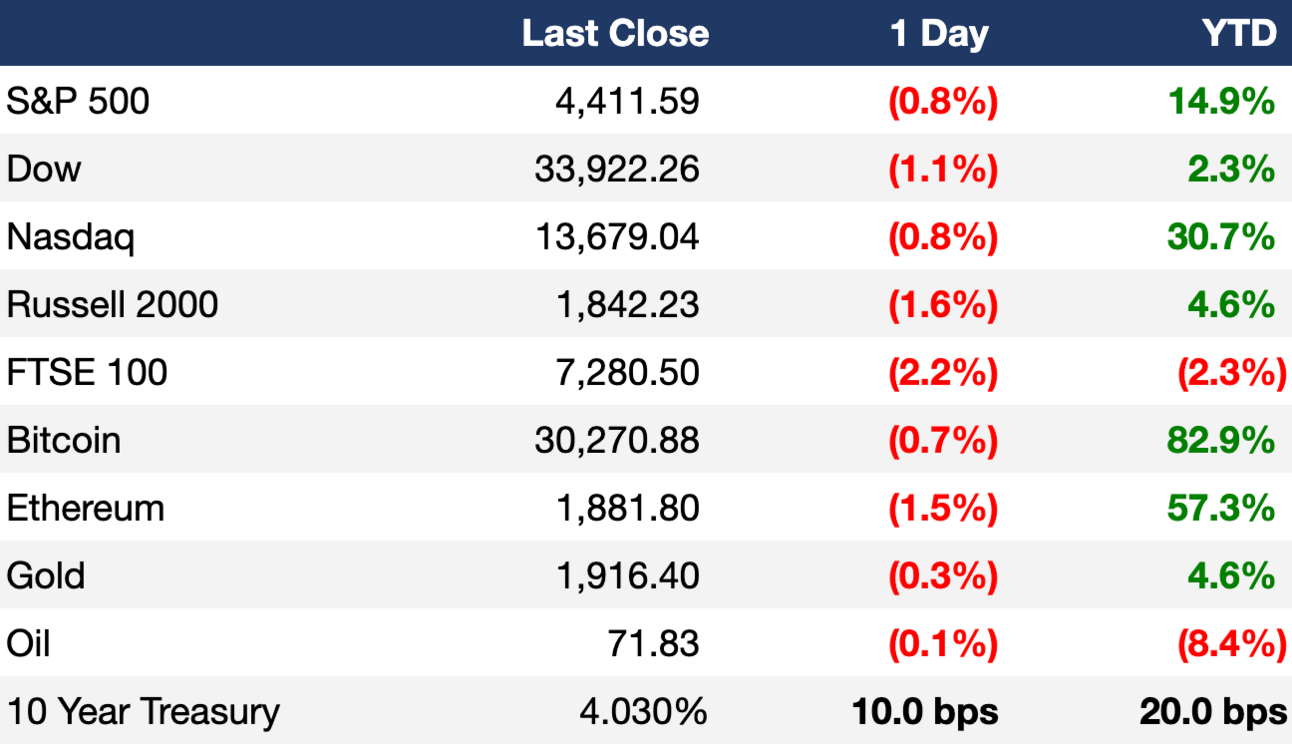

As of 7/6/2023 market close.

Markets

Stocks slid yesterday after better-than-expected jobs data increased investors’ anxiety over the Fed's rate hike path

The Dow and S&P 500 marked their worst daily performances since May

S&P 500 correlation has plunged to near-record lows

The pan-European Stoxx 600 shed 2.3% in its biggest one-day drop since March

Singapore stock benchmark is on track for its lowest close in eight months

US 2Y Treasury yield hit its highest level since 2007 to surpass 5%

Futures markets priced in a 92% chance of a 25 bps Fed rate hike this month

Swaps markets priced in a UK interest rate of 6.5% by next March

Oil is on track for its second straight weekly gain

Bitcoin touched a 13-month high amid growing institutional demand

Earnings

Headline Roundup

US private sector added 497k jobs in June, smashing estimates (CNBC)

US layoffs fell to a seven-month low in June (RT)

Great resignation shows signs of ending (WSJ)

US VC funding fell ~50% YoY in Q2 (BBG)

US EV sales surged 50% in H1, but slower than H1 2022 (WSJ)

AI boom is boosting poor tech industry outlook (WSJ)

High-yield bond deals are back (AX)

Green bonds overtook fossil-fuel debt deals for the first time (BBG)

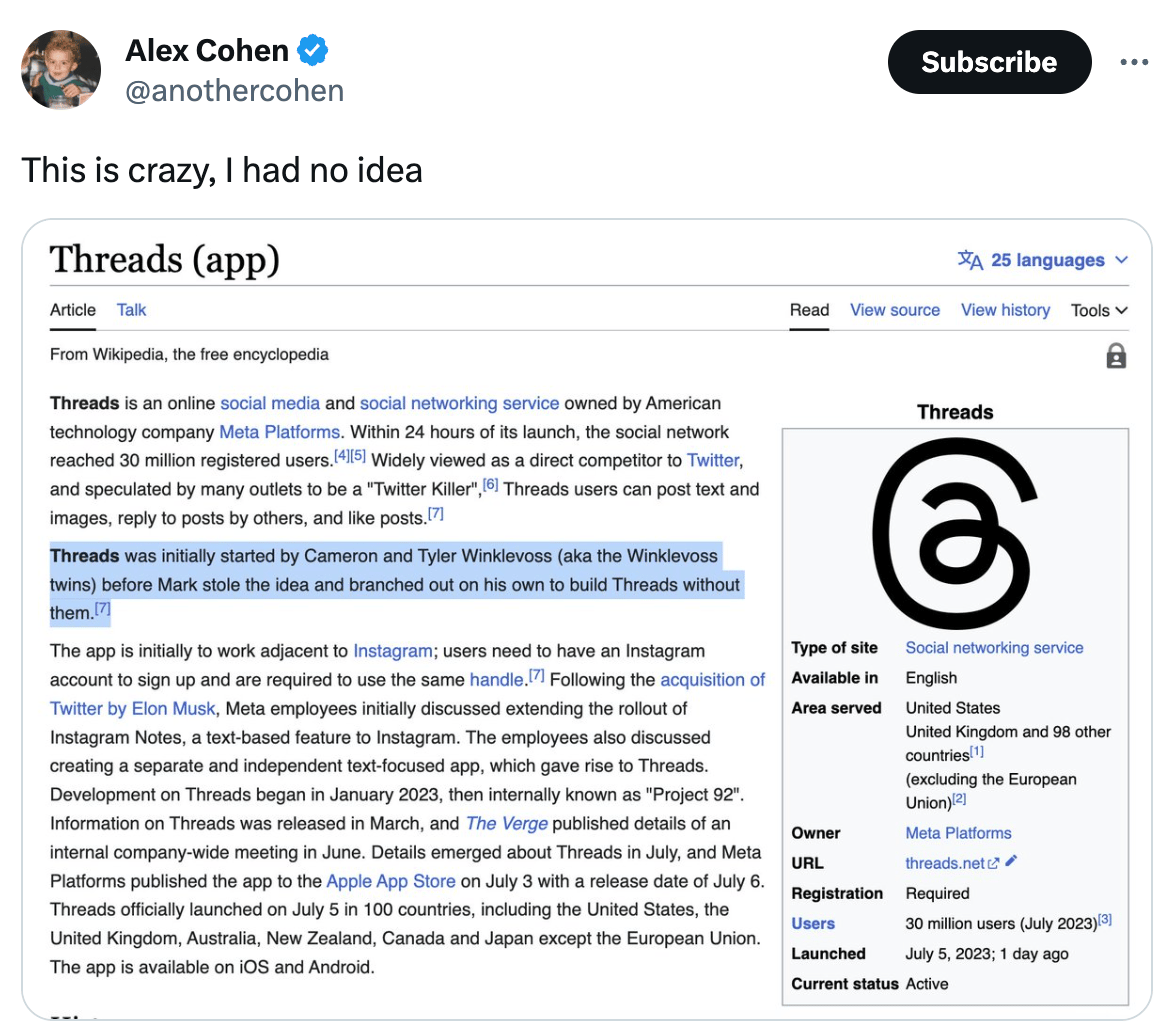

Threads became the most rapidly downloaded app (NYT)

Twitter threatens Threads lawsuit against Meta (RT)

UBS overhauls leadership at wealth management division (RT)

Exxon is struggling to attract traders amid low pay offers (BBG)

China’s sinking markets heap pressure on Xi to deliver stimulus (BBG)

US renewed its audit of NY-listed Chinese firms (BBG)

Goldman says the West needs to invest $25B+ in rare earths to match China (RT)

Japan's base salary growth hit 28-year high in May (RT)

Samsung sales fall most in over a decade as chip slump persists (BBG)

DoorDash, Uber Eats, and Grubhub sue NYC over minimum-wage law (WSJ)

PepsiCo and Mars see business boom in Russia after staying behind (BBG)

Tech layoffs disproportionately affected women (AX)

Lazard fired its co-head of restructuring in North America for inappropriate behavior (BBG)

A Message From Sweater

For the first time, accredited and non-accredited investors alike have the opportunity to support innovative startups through Sweater's groundbreaking app.

Sweater Ventures has set out to democratize the venture capital landscape, enabling investors of all backgrounds to invest in their fully managed fund.

For a limited time, Sweater is allowing anyone to invest in the Sweater Inc fintech platform, where they've already raised $1.5M to date from their community.

Don't wait too long, this opportunity ends on July 31st, 2023.

Deal Flow

M&A / Investments

PE firm GTCR acquired a 55% stake in Worldpay, the merchant services business of Fidelity National Information Services, in a deal that values the unit at $18.5B (RT)

TPG and Blackstone are evaluating competing bids for Standish Management in a deal that could value the US fund administrator at $1.7B (RT)

Italy is in talks with Saudi Arabian, Norwegian, and Singaporean sovereign wealth funds over plans for a $1.1B residential area in Milan (RT)

Scientific instrument maker Thermo Fisher Scientific will acquire healthcare data provider CorEvitas for $913M cash to boost its portfolio of services for pharmaceutical clients (RT)

Cronos Group, an Altria Group-backed Canadian cannabis producer with a market cap of $773M, is exploring potential options, including a sale, after attracting acquisition interest (RT)

Vietnam's Saigon–Hanoi Commercial Joint Stock Bank is in discussions to bring in a strategic partner that would own up to a 20% stake in the lender in a deal that would value the bank at $2B-$2.2B (RT)

London-listed hedge fund Man Group will buy a controlling stake in US middle market private credit manager Varagon Capital Partners for $183M (RT)

Bausch + Lomb acquired Johnson & Johnson's eye & contact drops brand Blink for $107M (RT)

Norwegian Air will buy domestic peer Wideroe for $106M to strengthen its Norwegian position (RT)

Digital marketing company Avenue Z paid $75M for Bevel, a communications firm for tech and VC (BBG)

Emirates Telecommunications Group and France’s Orange SA are evaluating bids for a 45% stake in Ethiopia’s state-controlled telecom operator, Ethio Telecom (BBG)

Italian insurer Generali’s asset management arm will buy Connecticut-based rival Conning Holdings as part of a partnership with Cathay Life, a unit of Taiwan’s Cathay Financial Holding (RT)

VC

Clair, a fintech company aiming to launch the first consumer-friendly on-demand pay solution, raised a $175M round led by Thrive Capital (BW)

Japanese robotics startup Telexistence raised a $170M Series B led by SoftBank (TC)

CADDi, a provider of procurement solutions for the manufacturing industry, raised an $89M Series C from Globis Capital Partners, DCM Ventures, and more (FN)

Qover, a Belgian-based insurtech specializing in embedded insurance orchestration, raised a $30M Series C from Alven, Kreos Capital, and Zurich Global Ventures (FN)

Men's activewear brand Ten Thousand raised a $21.5M Series A led by Provenance (PRN)

Laser fusion startup EX-Fusion raised a ~$13M seed round led by ANRI, Nissay Capital, Delight Ventures, and more (FN)

Numarics, a startup building an ‘OS’ for businesses, raised an $11.1M seed round led by UBS and FiveT Fintech (FN)

nami, a multi-sensing platform and ecosystem enabler for the Internet of Things, raised a $10.5M Series A led by Verizon Ventures, Amavi Capital, INSPiRE, and Aconterra (PRN)

DataGalaxy, a Lyon-based provider of collaborative data governance solutions, raised a $10M seed round led by AV8 Ventures (FN)

Kinnu, a London-based AI-powered learning app, raised a $6.5M seed round led by LocalGlobe and Cavalry Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

L Catterton, the PE firm backed by LVMH, is considering strategic options including an IPO for Birkenstock which could value the German sandal maker at over $6B (BBG)

Renewable energy unit Adani Green plans to raise $1.5B through qualified institutional placement to fund the Adani conglomerate’s coal divestment (BBG)

Chinese AI startup Fourth Paradigm received China’s nod for a Hong Kong IPO (RT)

Debt

A group of banks including JPMorgan and Goldman Sachs will provide $9.4B of debt to back GTCR’s purchase of a majority stake in FIS’s merchants payment unit Worldpay, in what will be the biggest buyout financing in over a year (BBG)

India state-run Power Finance Corporation is looking to raise up to ~$738M through two sets of bond sales (ET)

Bankruptcy / Restructuring

UK believes that distressed water company Thames Water can avoid falling into public ownership, as it is in talks to raise $1.3B from investors (BBG)

Fundraising

Altas Partners raised $4B for its third PE fund (PB)

Enterprise SaaS VC Notion Capital closed its fifth fund at its hard cap of $326M (TC)

Europe’s Sienna VC is raising $250M to invest in Israeli tech startups (CT)

Insight Partners raised $118M for its second 20/20 Vision Capital fund to invest in VC funds led by underrepresented managers (RT)

Climate VC Public Ventures launched a $100M impact fund focused on ‘improving health equity and supporting climate preparedness for underserved communities’ (TC)

Crypto Corner

Exec’s Picks

Twitch co-founder Emmett Shear joined the Logan Bartlett Show for a wild conversation that covered everything from whether or not AI will kill us all to his experience in Y Combinator’s first batch with Sam Altman and Paul Graham. Check it out here.

Speaking of Paul Graham, his newest essay, How to Do Great Work, is must-read material.

Litney Partners - Financial Recruiting 💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter