Together with

Good Morning,

An active shooter killed four at Blackstone's Manhattan HQ. A scary day for New Yorkers and friends. We hope everyone is staying safe at this time. Our hearts go out to the victims and their families.

Bitcoin Depot, the biggest Bitcoin ATM network in North America, has its eyes set on global expansion and wants the key retail trader segment to stay involved. Check out their investor insights.

Let's dive in.

Before The Bell

As of 7/28/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed mostly flat yesterday as traders looked past the US-EU trade deal and braced for a big week of economic data, including the Fed's rate decision

S&P hit a sixth-straight ATH

Nasdaq hit a new ATH

Dollar is set for best month YTD

Euro slid by the most in over two months

Earnings

Waste Management beat Q2 earnings and revenue estimates with a 19% YoY revenue increase, but lowered FY guidance below estimates due to weaker recycled commodity prices and weather-related volume impacts (INV)

Whirlpool missed Q2 earnings and revenue estimates and cut FY earnings guidance amid volume and share pressure from a pre-tariff import surge, but expects recovery as higher tariffs take hold (WSJ)

What we're watching this week:

Today: Boeing, Spotify, Starbucks, UnitedHealth Group, Visa, PayPal, UPS, Booking Holdings

Wednesday: Meta, Microsoft, Robinhood, Kraft Heinz, Carvana, Ford, Hershey

Thursday: Apple, Amazon, Coinbase, Reddit, Mastercard, Strategy, CVS Health, Roblox

Friday: ExxonMobil, Chevron

Full calendar here

Prediction Markets

95% chance of no rate cut but 100% chance of a Trump crash out.

Headline Roundup

Gunman killed four at Blackstone's HQ (BBG)

San Francisco is in talks with Vanderbilt for a downtown campus (BBG)

Out-gunned Europe accepts least-worst US trade deal (RT)

Germany and France hit out at US-EU trade deal (FT)

US housing market posted its worst Spring selling season in 13 years (BBG)

Hedge funds sold tech stocks at the fastest pace in 12 months (RT)

Short sellers lost $2.5B in July betting against 50 most shorted US stocks (BBG)

~30% of institutional investors are using AI (BBG)

US paused export controls to bolster China trade deal (FT)

Chinese AI firms formed alliances to build domestic ecosystem (RT)

Oil trader Vitol handed record $10.6B payout to its traders (BBG)

Robinhood CEO calls it 'tragedy' that retail investors can't tap private markets (BBG)

VC Antonio Gracias defends DOGE role after pressure on his fund (FT)

Carlyle named three insiders as co-presidents (RT)

TD Bank named John MacIntyre as chair to steer oversight push (RT)

JPMorgan will charge fintechs access to customer data (FT)

UK is considering a wealth tax on assets over $13M (BBG)

Ireland economy shrank for the first time since 2023 (BBG)

Anthropic capped Claude Code usage (TC)

US is weighing a patent system overhaul to raise revenue (WSJ)

US in investigating Duke University for civil rights violations (BBG)

US gave Russia 10-12 days to agree to ceasefire in Ukraine (BBG)

US blocked Taiwan president Lai from NY stopover amid China talks (FT)

US moved nuclear arms to UK for first time since 2008 (BBG)

20% of NASA employees will depart (RT)

33% of new US CEOs are on an interim basis (AX)

Americans are putting (and pulling) money in 401(k)s at record highs (WSJ)

A Message from Bitcoin Depot

Bitcoin Depot: The Company Putting Bitcoin on the Map

Ever thought about getting into Bitcoin but feel lost? Meet Bitcoin Depot (Nasdaq: BTM), the world's largest Bitcoin ATM operator, with over 8,500 machines.

They're making Bitcoin accessible to everyone, providing a straightforward way to step into the world of digital currencies.

Here's the key info from their Q1 earnings report:

✅Revenue up 19% Year-Over-Year to $164.2M

✅Net Income increased significantly to $12.2M

✅Adjusted EBITDA soared 315% Year-Over-Year to $20.3M

✅Leading market position with 27% of the U.S. market alone

✅Recent stock buys from large asset management firms

Bitcoin Depot provides an access point for everyday users, generating revenue regardless of Bitcoin’s price swings. The nearly $3 billion in transaction volume since 2016 demonstrates the scale of their operation.

The above is for general informational purposes only and is not investment advice nor does it constitute an offer, recommendation or solicitation to buy or sell a particular financial instrument. Bitcoin Depot is not a registered investment adviser under the U.S. Investment Advisers Act of 1940. Nothing contained herein constitutes a solicitation, recommendation, endorsement, or offer by Bitcoin Depot to buy or sell any securities or other financial instruments

Deal Flow

M&A / Investments

Energy technology giant Baker Hughes is nearing a $13.6B all-cash deal to buy Chart Industries, gatecrashing an earlier agreement to merge with rival Flowserve

The private credit units of PIMCO and KKR are in advanced talks to acquire a stake in Harley-Davidson's financing unit and its motorcycle loan portfolio in a $5B deal

PE firms Permira and Warburg Pincus are exploring a sale of UK wealth manager Evelyn Partners which could be valued at over $3.4B

European PE firm EQT agreed to acquire HR software provider Neogov from Warburg Pincus and Carlyle at an over $3B valuation, including debt

PE firms Permira and Nordic Capital agreed to acquire Danish vaccine maker Bavarian Nordic for ~$3B at a 21% premium

TV broadcaster MFE-MediaForEurope raised its takeover bid for German media firm ProSiebenSat.1 to $2.4B, topping a rival offer from Czech investor PPF

Canadian investment firms Brookfield and Birch Hill agreed to acquire Canadian mortgage firm First National Financial for $2.1B

European PE firm Cinven is in exclusive talks to acquire French data and AI consulting firm Artefact for over $1.2B

Thailand's PTT Exploration and Production acquired a 50% stake in offshore Block A-18 in the Malaysia-Thailand Joint Development Area from Chevron for $450M

PE firm Levine Leichtman Capital Partners acquired donut chain Shipley Do-Nuts from Peak Rock Capital at a ~$400M valuation

L Catterton, the PE firm backed by luxury-goods giant LVMH, acquired a majority stake in putter maker L.A.B. Golf at an over $200M valuation

Brazilian bank BTG Pactual will acquire HSBC's Uruguay unit for $175M

McDonald's is selling eight Hong Kong retail properties valued at $153M

UK quant investment firm Qube Research & Technologies agreed to merge its Torus and Prism hedge funds into a single vehicle with over $20B in assets

VC

Quince, the social media-viral affordable luxury brand, is raising a $200M round at an over $4.5B valuation led by ICONIQ

AI data labeling startup Micro1 is finalizing a Series A at a $500M valuation

xLight, a startup building the world's most powerful lasers to revolutionize semiconductor manufacturing, raised a $40M Series B led by Playground Global

Insurtech startup Cover Whale raised $40M in financing from Morgan Stanley Expansion Capital

Apera AI, a provider of 4D vision for industrial robotic automation, raised a $36M Series A led by BDC Capital

E2B, an open-source cloud infrastructure for AI agents, raised a $21M Series A led by Insight Partners

Zodia Markets, a crypto trading firm owned by Standard Chartered, raised an $18.3M Series A led by Pharsalus Capital

Cybersecurity startup Root Evidence raised a $12.5M seed round led by Ballistic Ventures

TakeUp, an AI-powered revenue optimization platform for independent stays, raised an $11M Series A led by 1848 Ventures

German defense tech platform Project Q raised an $8.7M seed round led by Project A, Expeditions Fund, and Superangel

Cybersecurity startup Tonic Security raised a $7M seed round led by Hetz Ventures

DynaRisk, a cyber risk management firm, raised a $4.7M round led by YFM Equity Partners

German fashion lingerie brand Saint Sass raised a $4.9M round led by Infinitas Capital

Credibur, a German fintech building the infrastructure layer for private credit markets, raised a $2.2M pre-seed round led by Redstone

IPO / Direct Listings / Issuances / Block Trades

Design software firm Figma upsized its US IPO offering to $1.2B at an $18.8B valuation, still below the $20B valuation it would've fetched in a planned sale to Adobe that fell apart in 2023

Berkshire Hathaway will sell one-third of its ~$4B stake in $28B-listed domain name registry VeriSign

Lenskart, the Indian eyewear retailer backed by SoftBank, ADIA, KKR, and TPG, plans to file for a $1B IPO; the firm was last valued in June at $5B

Northrop Grumman-backed space startup Firefly Aerospace is seeking to raise $632M at an $5.5B valuation in an IPO

Franco-German defense company KNDS agreed to acquire additional shares in gearbox maker Renk from Triton Partners, raising its stake to 15.8%

Warner Bros. Discovery split into Warner Bros. and Discovery Global where the former will house TV, video-game, movie studios, HBO, and HBO Max and the latter will include CNN, TNT Sports in US, Discovery, and Discovery+

Debt

Mexico completed a $12B debt offering to support state-owned Pemex, the world's most indebted oil major

Brazil is in talks with global investors including TPG and Brookfield to raise $4B for climate-focused projects

Deutsche Bank agreed to lend $1.7B to refinance the redevelopment of London's Olympia exhibition center in one of UK's largest real estate financings ever

Japanese lender SMBC is planning a $1B SRT tied to $8B of subscription line loans to private funds

General Motors raised $698M in a surprise euro debt sale

Germany will provide South Africa with a $580M loan to support the country's efforts in transitioning away from fossil fuels and toward cleaner energy sources

Brown University secured a $500M private loan at a 4.44% interest rate amid 'deep financial challenges'

Urbacon Data Centre Solutions is considering a ~$233M asset‑backed borrowing deal, leveraging a newly constructed Toronto data center as collateral

Bankruptcy / Restructuring / Distressed

3D printer maker Desktop Metal filed for Chapter 11 after accumulating over $100M in unsecured debt, including $30M owed to law firm Quinn Emanuel, which forced the company's merger with Nano Dimension and is now seeking repayment through European asset sales

Fundraising / Secondaries

PE firm Odyssey Investment Partners is seeking to raise a $1B continuation fund to extend ownership of industrial equipment maker Industrial Electric

Australia's Macquarie raised $711M for its debut infrastructure secondaries fund

Healthcare-focused PE firm Heritage Group raised $370M for its fourth fund

Investment firm Tecum Capital raised $325M for its fourth SBIC mezzanine fund, focusing on lower MM debt

Hong Kong-based Flow Capital Partners launched a $125M Asia Credit Master Fund to expand its focus beyond Hong Kong and China, targeting sectors like renewable energy across the region

Israel’s New Era Capital Partners raised $120M for its third fund to focus on early-stage AI startups

Venture debt investor Hercules Capital's investment advisor arm hit a first close on its fourth private credit fund

Crypto Sum Snapshot

ECB warned rise of stablecoins could undermine euro area monetary policy

PayPal will roll out 'pay with crypto' feature for merchants, supporting over 100 cryptocurrencies

Interactive Brokers is considering launching a new stablecoin for customers

FIS Partners is partnering with Circle to offer bank stablecoin payments

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

In the current era of must-see live sporting events, sports leagues and teams are becoming increasingly attractive to private equity investors. Stephen Amdur, Partner at Pillsbury Winthrop Shaw Pittman LLP, discusses the growing appetite for institutional investment in the sports industry.

WSJ published five insightful charts showing signs of a market bubble that investors are tracking.

@Restructuring__ released the Restructuring League Tables for H1, illustrating everything you need to know about which banks, financial advisors, and law firms are dominating the market. Check out the thread here.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out our recruiting firm, Litney Partners. Established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners has placed strong candidates across leading firms spanning private equity, hedge funds, venture capital, growth equity, private credit, investment banking, and fintech. Head over to our website to drop your resume / create your profile and we'd love to get in touch!

We move faster than most firms due to our paralleled reach, decades of industry expertise, and ability to attract top caliber candidates.

Next Play

If you're down bad, realizing finance isn't for you, and/or are curious to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play reviews every submission and will reach out to schedule a 1:1 video call if they think they can be helpful as your own, personal startup matchmaker. They’ve grown their community to over 50k talented individuals and have strong relationships across the tech ecosystem.

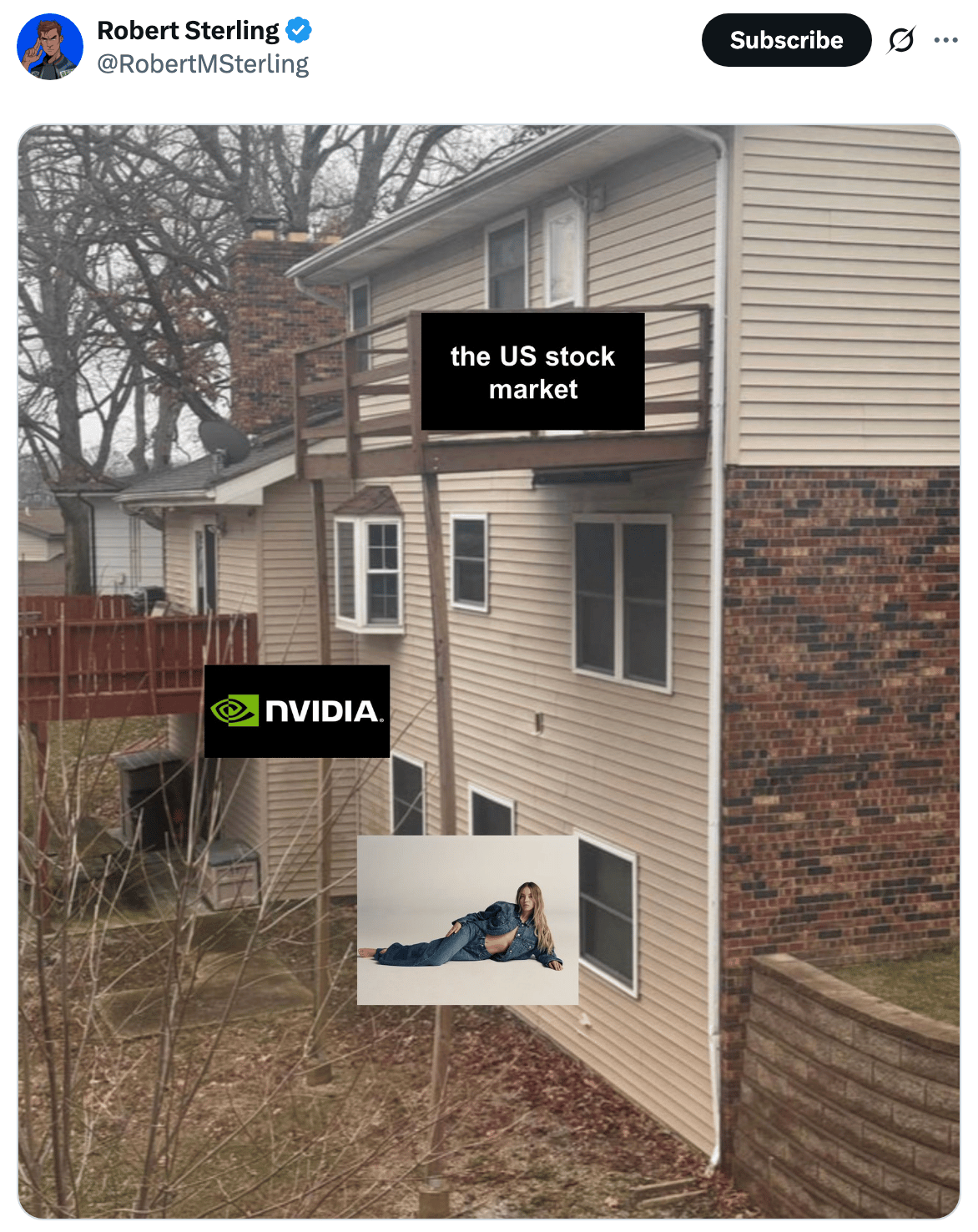

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.