Together with

Good Morning,

Investors are poising for an end-of-year stock market rally, Goldman and Morgan Stanley have divergent rate-cut predictions, Biden and Xi are gearing up for a high-stakes meeting, Boeing is closing in on a major deal with Emirates, and ‘The Marvels’ disappointed in the box office.

Are you looking for a banking solution that allows you to handle all of your bills in one place? Check out today’s sponsor, Onyx.

Let’s dive in.

Before The Bell

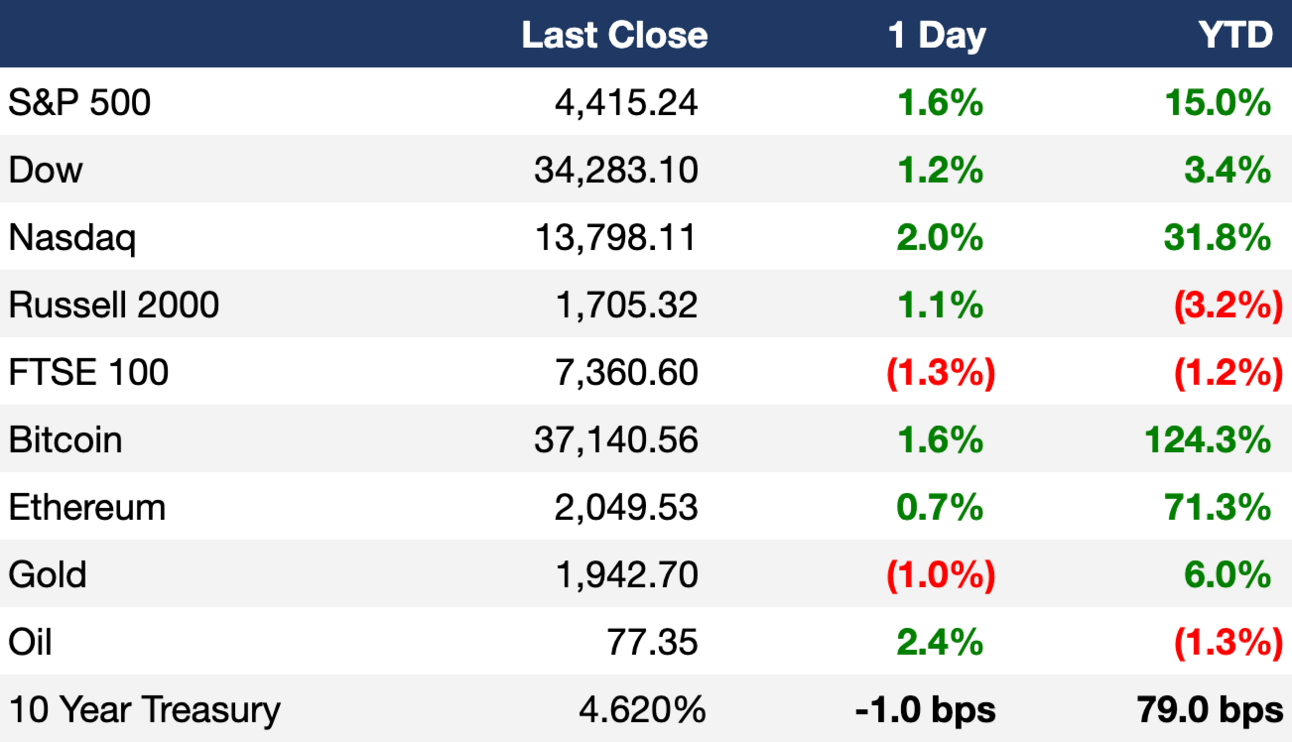

As of 11/10/2023 market close.

Markets

US stocks jumped as Treasury yields stabilized

The Nasdaq led indices with a 2.05% gain

European stocks fell on Friday, led by the FTSE, after the UK economy reported no growth in Q3

Earnings

What we're watching this week:

Today: Tyson Foods

Tuesday: Home Depot, Sea Limited

Wednesday: Target, Palo Alto Networks, Cisco, JD.com,

Thursday: Walmart, Alibaba, Applied Materials, Macy’s

Friday: BJ’s

Full calendar here

Headline Roundup

Investors are embracing stocks and eyeing a year-end rally in markets (WSJ)

Oil prices fall on worries of waning demand in US and China (RT)

Goldman Sachs, Morgan Stanley diverge on Fed rate-cut forecasts (BBG)

As Biden and Xi gear up for a high-stakes meeting, experts have low expectations (CNBC)

Boeing closes in on major deal with Emirates for its 777X jets (BBG)

Indian students flock to US colleges, offsetting drop from China (BBG)

Australia struggles to restart port operations after cyberattack (BBG)

‘The Marvels’ disappoints at box office, showcasing Disney’s studio challenge (WSJ)

Apple’s top iPhone supplier goes to outer space with new satellites (BBG)

Chinese chipmaker YMTC sues Micron alleging patent infringement (RT)

Japan’s wholesale inflation slows sharply in sign of waning cost pressures (RT)

A $20B week marks reopening of market for EM borrowers (BBG)

Payments app Zelle begins refunds for imposter scams after Washington pressure (RT)

Tens of thousands protest across Spain at proposed Catalan amnesty (RT)

Hopes of a US nuclear renaissance sink with NuScale (BBG)

Taylor Swift’s postponed Argentina show prompts airline to waive flight-change fees (CNBC)

A Message From Onyx

Discover the Ultimate Banking Experience!

Looking for the best banking app? Look no further! Onyx Private is here to redefine your banking journey. Instantly add funds to your account via your external debit card and simplify your life by managing your bills and payments directly from our app with our native solution. Plus, enjoy 1% cashback on credit card bill payments.

Join us with the exclusive LIT010 code and receive a generous 10% discount on the premium membership.

Deal Flow

M&A / Investments

Hungary is working with French infrastructure giant Vinci in a plan to purchase Budapest Airport; an earlier acquisition attempt valued the airport at $4.7B (BBG)

AstraZeneca paid $185M upfront and up to an additional $1.8B to license an anti-obesity experimental pill from China's Eccogene (RT)

Japanese state-backed fund INCJ sold almost all of its stake in semiconductor manufacturer Renesas Electronics worth $1.8B (RT)

Private healthcare operator Columbia Asia Healthcare will acquire Ramsay Sime Darby Health Care from Australia’s Ramsay Health Care and Malaysian conglomerate Sime Darby for $1.2B (BBG)

German state-lender KfW acquired a 25% stake in local utility EnBW's TransnetBW for ~$1.1B (RT)

Walgreens Boots Alliance cut its stake in Cencora through a share sale worth ~$674M; it now owns a 15% stake in the drug wholesale company (RT)

Lombard Investments is considering selling a stake in Hasfarm Holdings in a deal that could value the floricultural firm at ~$600M, including debt (BBG)

Swedish truckmaker Volvo won an auction for the battery business of troubled Proterra in the United States for $210M (RT)

TotalEnergies is nearing a deal to buy a fleet of natural gas-fired power plants in Texas from independent power producer TexGen Power (BBG)

Bohai Leasing, a listed arm of failed Chinese conglomerate HNA Group, is studying potential asset sales, including a 70% stake in Avolon, the world’s fourth-largest plane lessor, after struggling to refinance some of its debt (BBG)

Societe Generale is exploring a sale of its German consumer finance business Hanseatic Bank (BBG)

Mining company Vale will sell a 14% stake in its Indonesian nickel miner Vale Indonesia (RT)

Sydell Group is exploring a sale of its NoMad Hotels brand and is gauging potential interest from buyers including Hilton Worldwide Holdings and other major operators (BBG)

VC

Databricks, a data and AI startup, raised an undisclosed amount in a Series I at a $43B valuation led by Amazon Web Services, CapitalG, and Microsoft (FN)

Firefly Aerospace, an end-to-end space transportation company, raised $300M in funding at a $1.5B valuation led by AE Industrial Partners (PRN)

Technique Solaire, a French solar energy distributor, raised a $213.7M funding round from Bpifrance and Crédit Agricole (EU)

Roller, a Melbourne-based provider of cloud-based venue management software, raised $50M in growth funding led by Insight Partners (FN)

Virtual cardiometabolic care services startup Vida Health raised a $28.5M round led by General Atlantic, Ally Bridge, and more (BW)

DeepInfra, a startup providing a scalable infrastructure for running AI models through an API, raised an $8M seed round led by A.Capital and Felicis Ventures (FN)

Ridepanda, a provider of a micro-mobility-as-a-benefit platform, raised $7.5M in debt and equity led by Blackhorn Ventures and Yamaha Motor Ventures (FN)

Surglasses, a Taiwan-based company advancing AR-augmented reality surgical navigation systems, raised a $6.5M pre-Series A round led by Taiwania Capital (FN)

Singapore-based fintech startup EduFi raised a $6.1M pre-seed round led by Zayn VC (TC)

PostgresML, a startup allowing developers to prototype and deploy AI applications on PostgreSQL, raised a $4.7M seed round led by Amplify Partners (FN)

Octarine Bio, a Copenhagen-based synthetic biology platform company, raised $4.6M in funding led by Óskare Capital, Unconventional Ventures, and The Footprint Firm (FN)

LiveKid, a provider of a management application for kindergartens and nurseries, raised $3.4M in funding led by Inovo VC (FN)

AI-powered wealth management platform Era raised a $3.1M seed round led by Northzone (FN)

IPO / Direct Listings / Issuances / Block Trades

Futures and options broker Marex Group is preparing for an IPO in New York two years after it pulled plans to list in London (BBG)

Debt

Bankruptcy / Restructuring

China's embattled property developer Country Garden aims to have a plan to restructure its offshore debt by the end of this year (RT)

Fundraising

Singapore firm Everstone Capital Asia is seeking to raise $1B for its latest PE fund, which will invest in Southeast Asia and India (BBG)

Crypto Corner

Exec’s Picks

While US stocks have trounced international markets for the past 15 years, it might be time to add some foreign exposure to your portfolio, according to The Wall Street Journal.

Money market funds have been hot in 2023 as interest rates continued to climb. Ben Carlson discussed what might happen to these funds once rates come back down.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter