Together with

Good Morning,

Trump surprised markets with his Fed chair pick, Musk is pivoting Tesla to physical AI, US released its final tranche of the Epstein Files, the metals rally ended in spectacular fashion, the US government partially shutdown, and Sandisk blew past earnings to extend its YoY rally to 1,500%.

W.M. Gibson restocked their dealmaker-favorite OG Horsebit Loafer for the new year – with a limited-time 50% discount for the Exec Sum community. Elevate your office shoe game. Snag a pair.

Let's dive in.

Before The Bell

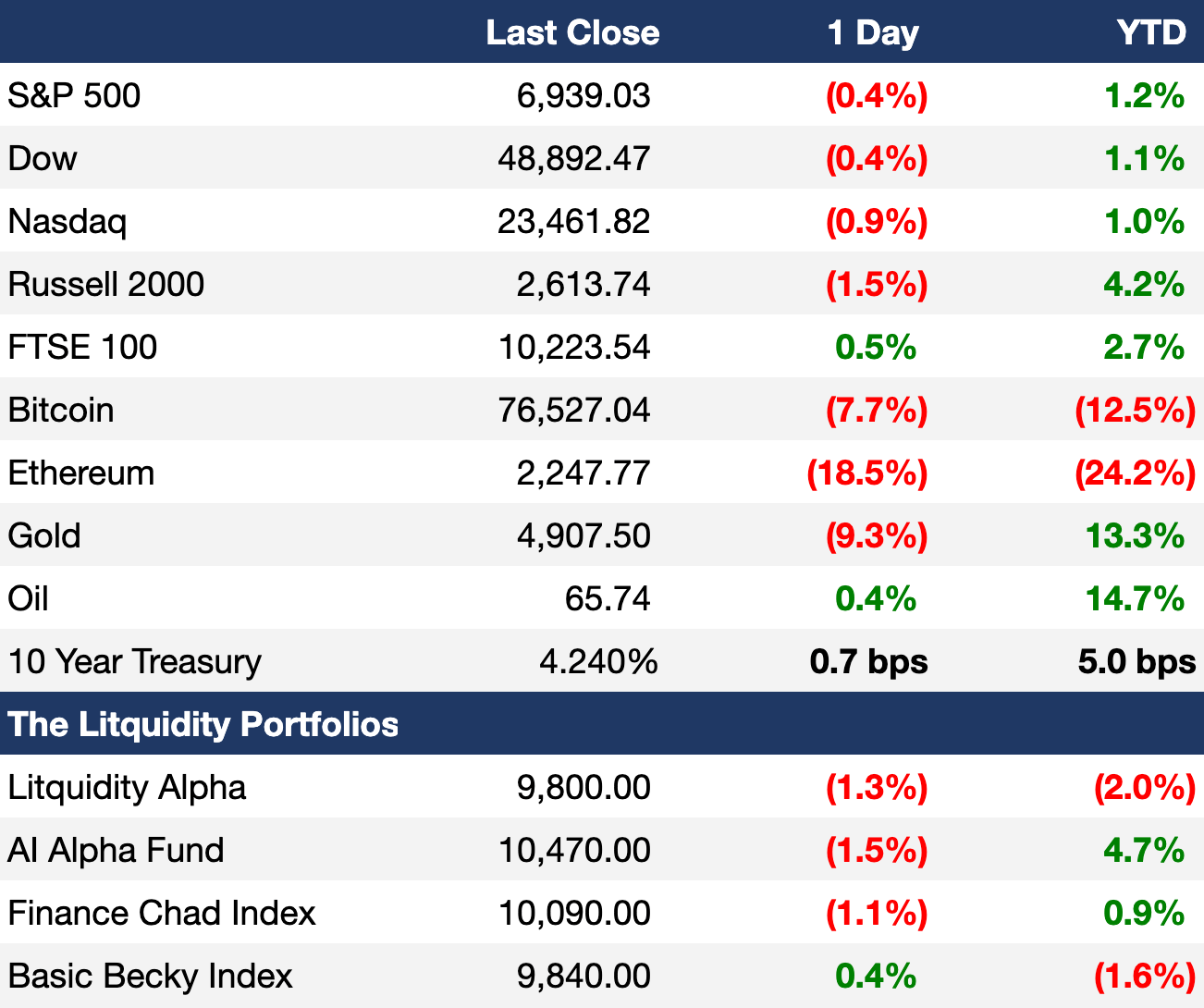

As of 1/30/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks slid on Friday as investors digested Trump's surprise Fed chair pick and a slate of mixed earnings

PE stocks posted their worst January in over a decade on private credit woes

Canada's TSX index fell 3.3% in its worst day since last April’s 'Liberation Day' on a metals crash

Saudi's Tadawul index dropped 1.9% in its worst day since April

South Africa's JSE index fell 4.2% in its worst day since April as the worst-performing stock index on Friday

EM assets are roaring this year on a weak dollar

Turkey, Brazil, South Africa, Chile, Mexico, and Taiwan indexes are up over 10% YTD and Colombia and Korea up over 20% YTD in dollar terms

Brazil, Mexico, Chile, and South Africa FX are up ~6% YTD as the world's best performing major currencies

India stock market volatility rose from record lows ahead of their annual budget

China 30Y yield fell for a second week towards last year's record low on recovering bank demand and a cooling stock rally

Gold and silver crashed 11% and 30% respectively in their worst day since 1980

Gold and silver erased over $5T in value while other precious metals also plunged

Dollar climbed 1% in its best day since May

Bitcoin fell below $80k for the first time since April

Bitcoin posted its longest monthly losing streak since 2018

Earnings

Sandisk absolutely crushed Q2 estimates and forecasts on booming data center memory chip demand; the stock is up 1,500% YoY (CNBC)

Deutsche Bank reported its largest FY profit since 2007 on strong IB performance amid a money laundering probe (RT)

American Express beat Q4 revenue estimates but missed on earnings as higher expenses tied to its Platinum card refresh offset strong spending from high-income customers (WSJ)

Verizon beat Q4 earnings and revenue estimates on strong subscriber gains and its largest combined mobile and broadband additions since 2019 (WSJ)

Chevron issued a Q4 beat-and-raise on record output and upside potential from expanded operations, including the ability to ramp Venezuela production by 50% over the next two years (CNBC)

ExxonMobil beat Q4 earnings and revenue estimates despite lower oil prices, delivering its highest FY net production in over 40 years at 4.7M bpd (CNBC)

What we're watching this week:

Today: Walt Disney, Palantir

Tuesday: AMD, Supermicro, PepsiCo, PayPal, Chipotle, Merck

Wednesday: Alphabet, UBS, Uber, Eli Lilly, Novo Nordisk

Thursday: Amazon, Shell, Reddit, Roblox

Friday: Toyota

Full calendar here

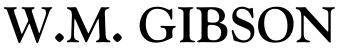

Prediction Markets

US entered a partial government shutdown with a crucial House vote expected Tuesday.

Trade your predictions on Polymarket.

Headline Roundup

Trump nominated Kevin Warsh for new Fed Chair (CNBC)

Trump's surprise Fed chair pick leaves Wall Street guessing (WSJ)

US government partially shut down (WSJ)

Crowded Wall Street trades buckle all at once in 2026 warning (BBG)

Stock market volatility takes back seat to commodity and FX swings (BBG)

Hedge fund correlations with stocks sparks fears over lack of hedging (FT)

Hedge funds slashed bullish silver wagers to a two-year low (BBG)

BlackRock and PIMCO see inflation risks in contrarian market view (BBG)

Xi Jinping called for yuan to attain global reserve currency status (FT)

AI boom is triggering a loan meltdown for software companies (BBG)

China is running record budget deficit as welfare spending soars (BBG)

Hong Kong economy grew by most since 2021 on trade and IPOs (BBG)

Hong Kong regulator ramped up warnings over poor IPO filings (BBG)

UK pensions are piling into PE (BBG)

Danish pensions come under pressure to reduce US exposure (FT)

India seeks diaspora capital as foreign funds pull out of local stocks (BBG)

HSBC targets Hong Kong IPOs after missing out on listings boom (FT)

Apollo reaped 18% returns for individual investors last year (BBG)

Delta Electronics surge made it Taiwan's second-biggest stock (BBG)

Tesla will end Model S production as Musk reshapes his $3T+ empire (WSJ)

SpaceX is seeking regulatory approval to build data centers in space (BBG)

Disney CEO Bob Iger plans to step down early (WSJ)

Trafigura won its $500M nickel fraud case against Prateek Gupta (FT)

AI researchers hit by flood of 'slop' (FT)

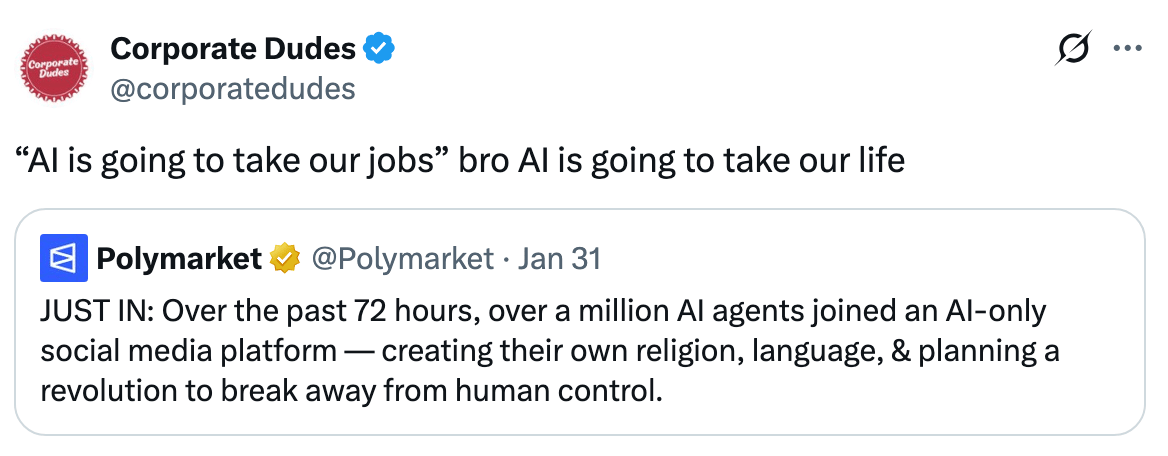

US released final tranche of Epstein files (WSJ)

A Message from W.M. Gibson

Back by popular demand (and restocked for the New Year)

After selling out our most popular sizes during the holidays, we've restocked the OG Horsebit Loafer – the dress shoe 2,000+ finance professionals actually want to wear during long days and even longer nights.

W.M. Gibson makes premium leather loafers minus the luxury brand markup. Made from full-grain calf leather with a soft, broken-in feel from day one, they're designed for all-day wear without feeling like traditional dress shoes.

Appropriate for deal closings, client meetings, date nights (looking at you, V-day), and everywhere in between. Comfortable enough that you'll forget about your feet. Sharp enough for MD approval. Available in brown and black.

Take 50% with code LIT50.

Deal Flow

M&A / Strategic

$26B-listed French IT company Capgemini will sell its US subsidiary Capgemini Government Solutions

A consortium led by KKR is nearing a deal to buy a Singapore-based global data center firm ST Telemedia Global Data Centers at an over $10B valuation

Investment firm Architect Capital is in talks to acquire a majority stake in creator platform OnlyFans at a $3.5B valuation

UK PE firm Permira agreed to buy a significant minority stake in European asset management platform Carne at a $1.7B valuation

A consortium including Hong Kong businessman Ng Wing Fai is in talks to acquire businessman Daniel Levy's ~30% stake in UK soccer club Tottenham Hotspur for $1.4B

Bain Capital finalized plans to acquire Japanese personal-care company FineToday for $1.3B from CVC

Global building materials giants CRH and Heidelberg are in advanced talks to acquire Nordic construction firm NCC's industry business at an over $800M valuation

Apax Partners offered to take-private UK automotive service provider Pinewood Technologies in a $792M deal at a 30% premium

France blocked European PE firm EQT's $656M purchase of French satellite company Eutelsat's ground-based antenna assets

Bolt Ventures, Main Street Advisors, and IKON Capital will acquire MotoGP team Red Bull KTM Tech3 for $50M

Ford and Chinese tech giant Xiaomi are in talk to form a JV to manufacture EVs in US

State Street-backed Indian asset management firms Groww and Edelweiss placed bids for PGIM India Asset Management

VC

Nvidia paused plans to invest in OpenAI's $100B round on unresolved doubts about the deal; Nvidia's investment in OpenAI may be its largest ever

Alphabet's autonomous driving unit Waymo is seeking to raise $16B at a $110B valuation from Alphabet, Sequoia, DST Global, Dragoneer, and Mubadala

Redwood Materials, a lithium-ion battery recycling and materials remanufacturing startup, raised a $425M Series E led by Capricorn and Goldman Sachs Alternatives

VulcanForms, a 3D printing metal parts maker, raised a $220M round led by Eclipse and 1789 Capital

Asian stablecoin and payments platform OSL Group raised a $200M round from undisclosed investors

Privacy-centric blockchain startup ZKP raised a $100M funding round from unnamed investors

Indian aerospace components manufacturer JJG Aero raised a $30 million Series B from Norwest

heyData, a European security-compliance platform, raised a $16.5M Series A round led by Riverside Acceleration Capital

Mantis Biotech, the infrastructure powering human-in-computer models, raised a $6.3M seed round led by Decibel Partners

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

China-listed energy drink maker Eastroc Beverage raised $1.3B at a $21B market cap in a Hong Kong listing priced at the highest number possible

Precision components maker Indo-MIM is preparing to raise $700M at a reduced $2.5B valuation in an India IPO

Power engineering firm Solv is seeing to raise $512M at a $5B valuation in an IPO

Austrian energy solutions company Asta humped 45% after raising $225M in a Germany IPO

Fidelity-backed advertising technology company Moloco is considering an IPO; the firm was last valued at $2B in 2023

National Stock Exchange of India received regulatory clearance to begin preparations for an IPO after a decade-long wait

Debt

India plans to issue a record $187B of bonds this year

China plans to sell $29B of special government bonds to recapitalize state-owned insurance giants including China Life Insurance, People's Insurance Co., and China Taiping Insurance

Banks including JPMorgan began selling $20B of debt backing PIF, Silver Lake, and Affinity Partners' record $55B LBO of Electronic Arts

Indian conglomerate Adani Group is seeking to raise $10B in local-currency debt as it pivots to domestic capital markets

A group of lenders led by Deutsche Bank are at risk of $1.2B of hung bank debt tied to Thoma Bravo-backed Conga's acquisition of PROS Holdings' B2B unit

Banks including JPMorgan and Wells Fargo are preparing to sell $7.9B of debt to finance PE firm CD&R's $10.3B LBO of packaging firm Sealed Air

Blackstone-backed sandwich chain Jersey Mike's Subs sold $760M of bonds and retained rights to repay half the principal early with proceeds from a planned $1B IPO

Manhattan's One High Line luxury condo project raised $525M for refinancing from lenders including Ares and JPMorgan

RedBirdCapital-owned Italian soccer club AC Milan struck a deal for $700M of new debt that will refinance a vendor loan provided by Elliott

Bankruptcy / Restructuring / Distressed

Bankrupt auto parts supplier First Brands, senior lenders, and unsecured creditors began mediation with the bankruptcy judge to resolve disputes over collateral and ownership, with 13k jobs at risk if talks fail

Regulators estimate that Banco de Brasilia's transactions with failed Banco Master created a ~$1B hole in its balance sheet

Dutch home-improvement retailer Maxeda reached a restructuring deal with creditors to slash debt by $165M, extend maturities, and raise $60M in new equity from GoldenTree Asset Management

Ryan Reynolds-backed Welsh soccer club Wrexham AFC had $6.3M frozen in the collapse of UK FX broker Argentex, which went insolvent in July over soured FX trades

Funds / Secondaries

France's La Banque Postale and Dutch insurance firm Aegon's LBP Asset Management JV raised $595M for its infra debt climate impact fund

French SME investor LT Capital raised over $170M for its fourth fund

Members-only startup community South Park Commons is raising $500M for its largest-ever 'anti-accelerator' fund

VC FOF TrueBridge Capital raised $230M for its debut VC secondaries fund

Crypto Sum Snapshot

Insider trading case against Marc Andreessen and Coinbase execs will proceed

Dimon clashed with Coinbase CEO Brian Armstrong in ugly WEF conversation

Abu Dhabi royal bought $500M stake in Trump family's crypto venture days before Trump's inauguration

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

The market's moving, are you? No matter what the market is doing, tastytrade advanced charts, in-feed news, and smart tools help you stay up-to-date and quickly adapt your strategy when the market shifts. Manage your entire portfolio on one platform with tastytrade.

FT published an interesting piece on how elite college finance clubs have been paving the way to Wall Street. Read it here.

The final Epstein files release exposes highly damning timelines of some of the most powerful people in the world. But some interactions are another kind of ironic. Here's Apollo co-founder Leon Black asking Epstein for advice on how to restructure Caesars in 2012.

Here's Apollo co-founder Marc Rowan doing something similar.

tastytrade, Inc. and Litquidity are separate and unaffiliated companies that are not responsible for each other's products, services, or policies.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.