Together with

Good Morning,

A coup started (and ended) in Russia over the weekend, SpaceX is selling insider shares at a $150B valuation, Ozempic-like pills are coming, companies are trying a new strategy called “siloing” to stay in China, the UK wants to tame greedflation, Goldman is cutting 125 MDs, and Litquidity got a front page feature in the Financial Times!

Looking for a resilient asset class to diversify your portfolio? You can invest directly in farmland through today’s sponsor, AcreTrader.

Let’s dive in.

Before The Bell

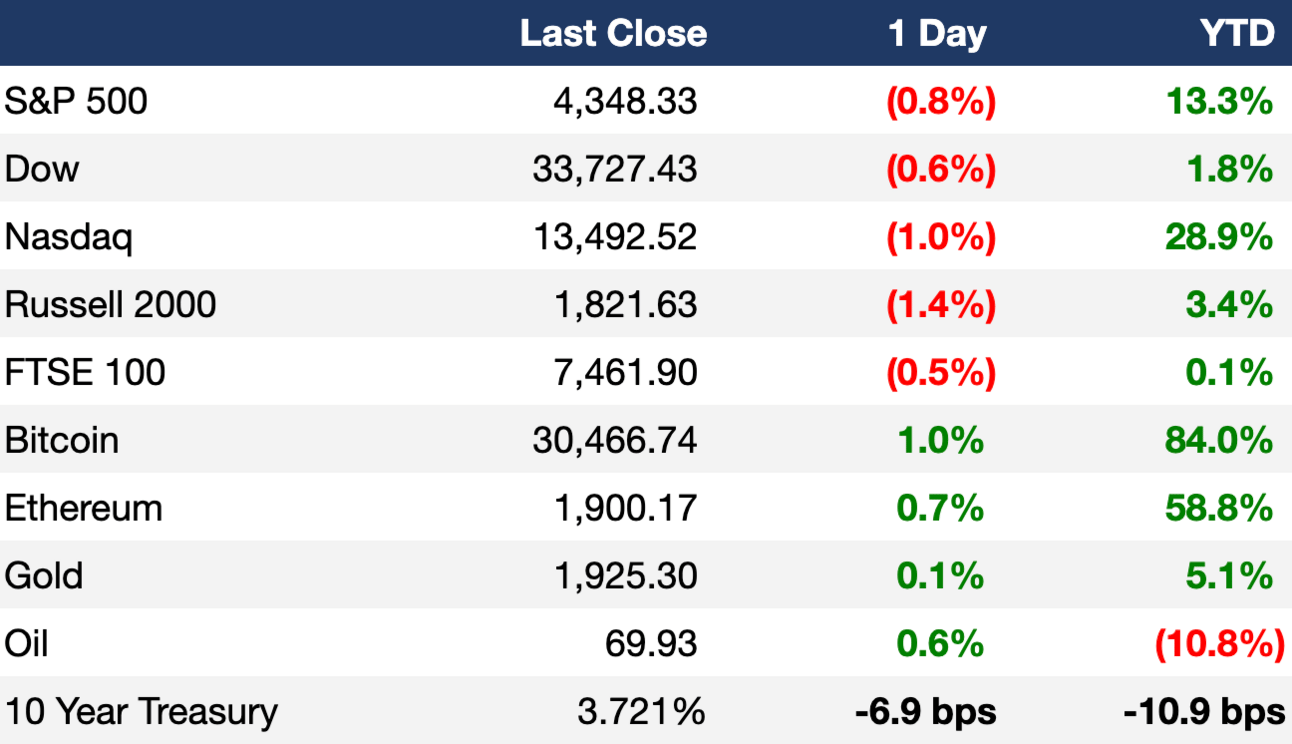

As of 6/23/2023 market close.

Markets

All three major averages closed lower on Friday in a broad sell-off that marked the end of a recent rally

The Dow, S&P and Nasdaq snapped three, five, and eight-week win streaks, respectively

UK swaps markets now imply BoE rates to peak at 6.25%

Yen swaps positions suggest BOJ’s negative-rate policy will stay this year

Bitcoin hit 1-year high amid BlackRock ETF excitement

On Friday, we’ll receive the PCE index, the Fed’s preferred inflation gauge

Earnings

CarMax beat Q1 expectations with reduced SG&A costs driven by proceeds from a legal settlement and active cost management, their stock was up 10% (IBD)

What we're watching this week:

Today: Carnival

Tuesday: Walgreens, Manchester United, Jefferies

Wednesday: Micron, General Mills, BlackBerry

Thursday: Nike, Paychex, Simply Good Foods

Friday: Constellation Brands

Full calendar here

Headline Roundup

Prigozhin turns forces back in deal with Kremlin to drop charges (BBG)

US business activity fell to a three-month low (RT)

Corporate bankruptcies and defaults are surging (CNBC)

Bond traders are heeding Powell's pledge to stay on Volcker path (BBG)

World economy at critical juncture in inflation fight, central-bank body warns (RT)

BOJ member called for early revision to YCC (RT)

PE exits are slower than during the global financial crisis (PB)

UK to tame inflation with greedflation and public pay crackdown (BBG)

Elite law firms flock to dealmaking Saudi Arabia amid global M&A drought (FT)

Companies try new strategy to stay in China: siloing (WSJ)

Hong Kong will fine-tune mortgage limits for first-time homebuyers (RT)

BNY Mellon pushes ahead with diversity funds despite backlash (FT)

YouTube is testing an online-games offering (WSJ)

Starbucks workers, citing pride decorations, strike at some stores (WSJ)

Citi will hold employees 'accountable' for office attendance (RT)

Goldman Sachs is cutting ~125 MDs globally (BBG)

JPMorgan cut nearly 40 investment bankers in US (RT)

BlackRock announced fresh layoffs, impacting < 1%(RT)

Pill versions of Ozempic-like drugs are coming (WSJ)

US retailers targeted with bomb threats, seeking bitcoin and gift cards (RT)

A Message From AcreTrader

Sow some land into your investment portfolio.

Farmland produces the food, fiber, and fuel we rely on daily, and when prices rise, generally so do farmland values. When you invest in farmland, you invest in American agriculture and the enterprising farmers who support it.

Join investors from across the U.S. in diversifying your portfolio with AcreTrader.

*AcreTrader Financial, LLC, member FINRA/SIPC. Farmland investing is speculative and involves high degree of risk, including complete loss of principal and not suitable for all investors. Past performance does not guarantee future results and there is no guarantee this trend will continue.

Deal Flow

M&A / Investments

Japanese semiconductor equipment maker JSR Corp. is considering being acquired by state-backed Japan Investment Corp for ~$7B (RT)

$5B life sciences firm Abcam is exploring strategic options including a potential sale; it has received multiple takeover offers including some from the largest US suppliers of life-science tools (BBG)

IBM is nearing a deal to acquire software company Apptio for ~$5B in a push to expand into automation technology (WSJ)

Italian energy company Eni and Eni-controlled Norwegian producer Var Energi are jointly acquiring explorer Neptune Energy Group for $4.9B (BBG)

The Qatar Investment Authority is buying a 5% stake in Monumental Sports & Entertainment, the parent company of the NBA team Washington Wizards and NHL team Washington Capitals, in a deal that values the company at $4.1B (RT)

Blackstone is considering the sale of an unsecured Spanish loan portfolio worth $2.2B (RT)

Brookfield Asset Management is in discussions to acquire Swedish real estate company SBB’s remaining 51% stake in its education subsidiary EduCO; Brookfield bought its 49% stake of EduCo for $858M cash (RT)

Elon Musk’s SpaceX is offering to sell $750M of insider shares at a $150B valuation (BBG)

Goldman Sachs will likely take a large writedown for fintech lender GreenSky that it acquired for $2.2B in 2021, which it is looking to divest for around $300M-$500M (RT)

Mitsubishi UFJ Financial Group is buying Indonesian automobile lender Mandala Finance for $467M (BBG)

Troubled French supermarket chain Casino completed the sale of its remaining 11.7% stake in Brazilian retailer Assai, receiving $355M cash after tax (RT)

PE firm Allegro Funds is buying PwC Australia’s government practice, which has been damaged by a conflict of interest scandal, for 67¢ (RT)

Czech billionaire Daniel Kretinsky is interested in acquiring a stake in Thyssenkrupp's steel business, which is also looking for a buyer or co-owner (RT)

Logistics group Shift agreed to buy the brand and IP of British delivery brand Tuffnells Parcel Express, which collapsed this month (BBG)

Defense company Anduril Industries is acquiring rocket-engine business Adranos (WSJ)

VC

Metatime, the creators of a blockchain network called MetaChain, raised a $25M seed round led by Yildiz Tekno Venture Capital Investment Trust, Yildiz Technical University Technopark, and others (BW)

EvaluAgent, a startup building software to help companies evaluate call center agents, raised a $20M Series A led by PeakSpan (TC)

Hungry, a DC-based food tech marketplace, raised a $10M Series C-1 at a $270M valuation from Anfernee Simons, Bobby Wagner, Roquon Smith, Laremy Tunsil, and others (FN)

Duos, a digital health startup focused on the needs of older adults, raised a $10M round led by Primetime Partners, SJF Ventures, and the Castellan Group's Aging Innovation Fund (FN)

TreaTech, a Swiss engineering company focused on circular waste treatment, raised a $10M Series A led by Engie New Venture and Montrose Environmental Group (FN)

Hyf, a startup transforming food by processing wastewater into feedstocks for biomanufacturing and clean water, raised $9M in funding led by Synthesis Capital (FN)

Carbonwave, a developer of ultra-regenerative advanced biomaterials made from seaweed, received a $6M investment from Pegasus Capital Advisors and the Global Fund for Coral Reefs (PRN)

Hypar, a cloud-based design automation platform for buildings, raised a $5.5M Series A led by Brick & Mortar Ventures (FN)

AvoMD, a no-code platform enabling clinicians and hospitals to easily make their own apps, raised a $5M seed round led by AlleyCorp (PRN)

IPO / Direct Listings / Issuances / Block Trades

Thyssenkrupp and Industrie De Nora are looking to raise $617M in a $2.94B IPO of their hydrogen joint venture Nucera, which is below the forecasted $3B+ valuation (RT)

SPAC

Italian-American restaurant chain with bowling and bocce Pinstripes is merging with Banyan Acquisition Corp at an EV of $520M (BBG)

Debt

Nasdaq will sell debt worth $5.1B to fund its acquisition of Thoma Bravo-owned software company Adenza (RT)

Indonesia's state energy company Pertamina is raising $3.1B to upgrade its Balikpapan refinery through a financing deal with South Korean, American, and Italian export credit agencies and 22 commercial banks (RT)

A group of investors led by Apollo is making a $1B-$2B debt investment into chipmaker Wolfspeed (RT)

Brazil’s state energy firm Petrobras is expected to offer up to $1.5B in its first dollar bond sale since 2021 (BBG)

Indian private lender Yes Bank is raising ~$305M through debt securities (RT)

Chinese real estate firm Leading Holdings Group failed to pay the entire $119.4M of principal plus interest due on a dollar bond issued as part of a debt swap (BBG)

Central China Real Estate didn’t pay interest on a note before the end of a grace period and will suspend payments on all offshore debt (BBG)

Bankruptcy / Restructuring

A consortium led by Fortress Investment Group will buy Vice Media after a bankruptcy court approved Fortress’ $350M bid (RT)

Cargo airline Western Global Airlines is weighing options including filing for bankruptcy as it faces dwindling liquidity (BBG)

Membership-driven private jet service provider Wheels Up is consulting with restructuring advisors to try to avoid bankruptcy (WSJ)

Fundraising

Crypto Corner

Binance has been ordered to halt all digital currency services in Belgium (RT)

SCOTUS agreed to halt customers’ lawsuits against crypto exchange Coinbase while it pursues appeals to move disputes into private arbitration (RT)

Fed governor Michelle Bowman called for clear regulatory framework for novel technologies including digital assets, as uncertainty left institutions in a ‘supervisory void’ (CT)

Exec’s Picks

Madison Darbyshire published a banger profile of Litquidity in the Financial Times.

Noah Smith pushed back against the idea that “the West is failing” in his latest newsletter.

Litney Partners - Financial Recruiting 💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter