Together with

Good Morning,

Bloomberg is projecting a 100% chance of a recession in the next 12 months, China delayed its Q3 GDP data, Goldman is reorganizing its business, WWE is outperforming the market, Uber Eats partnered with Leafly to deliver cannabis products, Pelosi's husband took a huge L on Nvidia and Micron options, and new UK finance minister Jeremy Hunt is reversing 'almost all' of the UK tax cut plan.

Tired of ESG ETFs with ridiculous management fees? The BAD ETF might be just what you're looking for. Check it out here.

Let's dive in.

Before The Bell

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

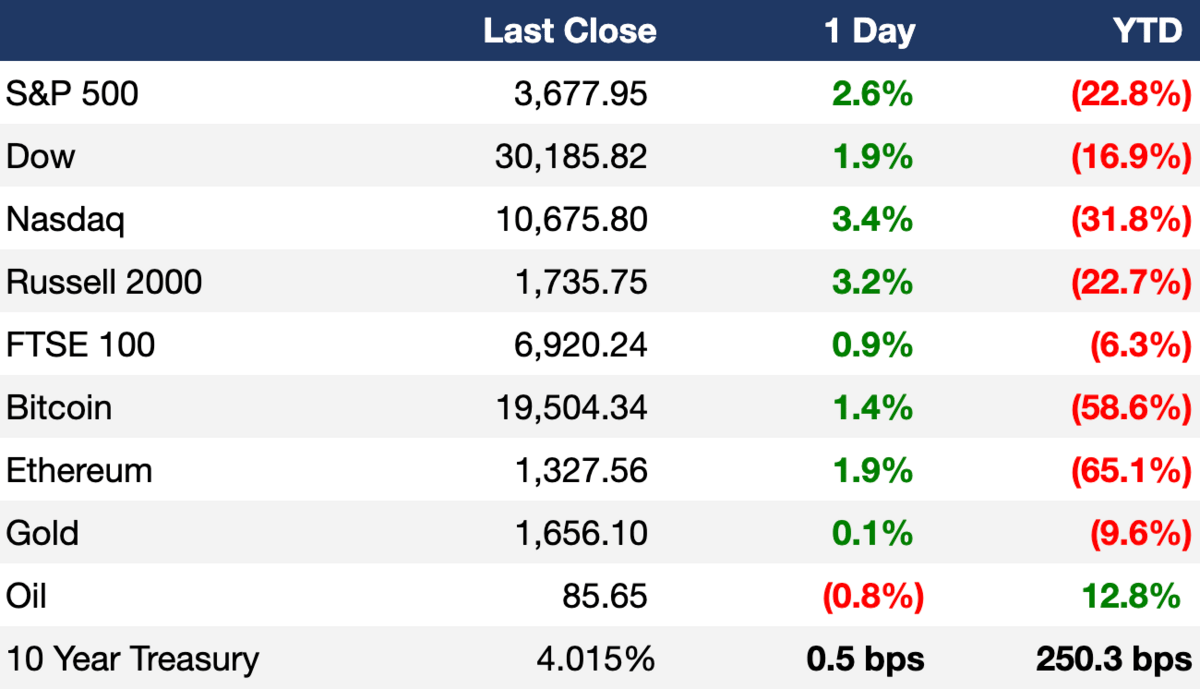

Markets

Stocks rose sharply on Monday as strong bank earnings boosted a volatile market

Nasdaq had its best day since July as oversold tech stocks rallied

The dollar dipped against a basket of major currencies, with the pound rallying on UK's tax plan reversal

European natural-gas prices slid as EU considers a price cap

Earnings

Bank of America beat Q3 profit and revenue expectations on strong US consumer spending levels and a 12% YoY growth in loans; their shares rose ~6% (CNBC)

What we're watching this week:

Today: Goldman Sachs, Netflix

Wednesday: Tesla, IBM, Procter & Gamble, Nasdaq

Thursday: Blackstone, Snap Inc.

Full calendar here

Headline Roundup

New UK finance minister Jeremy Hunt plans to reverse 'almost all' of UK tax cut plan (AX)

Forecast for US recession within year hits 100% in blow to Biden (BBG)

China abruptly delayed its Q3 GDP data release one day before scheduled date (WSJ)

Exxon exited Russia empty-handed with oil project 'unilaterally terminated' (RT)

WWE is defying market trends with its stock up over 50% YTD (CNBC)

Credit Suisse agreed to pay $495M to settle a case related to mortgage-linked investments in the US (RT)

Credit Suisse's investment banking chief to exit in revamp of the business (BBG)

Apple froze plans to use China's YMTC chips (RT)

Uber Eats partnered with Leafly to deliver cannabis to customers (AX)

FTC is investigating whether Visa and Mastercard's security tokens restrict debit-card routing competition on online payments (WSJ)

Nancy Pelosi's husband sold Nvidia and Micron options at a $750k+ loss (RT)

Solomon Partner sets up industrial practice with Greenhill hire (BBG)

Vodafone plans $7B German fiber venture with Altice (BBG)

Goldman plans major reorganization, combining investment banking & trading and merging asset and wealth management into another (RT)

CEO of anti-woke bank startup GloriFi resigns (WSJ)

A Message From The BAD Investment Company

Tired of ESG Bullsh*t?

Fortunately, there's a money manager that decided that B-A-D might be the better acronym for investors.The BAD ETF (NYSE: BAD) launched last December and is taking a different stance in this green washed world focusing on 3 industries for which the ticker represents – B-A-D.

Betting – Casinos, gaming, and online gaming operations – 33%

Alcohol – Alcoholic beverage manufacturing and distribution – 23%

Drugs – Pharmaceutical and biotechnology product development and manufacturing – 33%

Cannabis cultivators & distributors - 10%

The case for these BAD industries remains strong for a simple yet important reason – they have historically offered attractive risk-adjusted returns. In addition to these industries overcoming government scrutiny, these industries have shown resilience during economic downturns because people tend to indulge in their vices, or what some call hobbies.

As a result, we believe these asset classes are typically underappreciated and therefore under-valued but the reality is that people will continue to consume alcohol, gamble, and need medicine in good times, and in BAD.

In regards to the betting and cannabis aspects, as these industries become more widely accepted socially and legally, they may offer investors additional growth as more states look to legalize those industries for additional tax revenues.

Learn more about the BAD ETF fund details and sign up for our mailing list to get the latest fund insights and information.

Deal Flow

M&A / Investments

Harold Hamm, the founder of US shale oil producer Continental Resources, agreed to buy the company, taking it private at a $27B valuation (RT)

PE firm EQT completed the acquisition of HK-based Baring Private Equity Asia. The $6.7B cash/stock deal was originally announced in March (BBG)

BP agreed to buy biogas producer Archaea Energy for ~$4.1B, the latest step in the energy giant's expansion into lower-carbon fuels (BBG)

Norwegian energy company Equinor is considering buying British oil field assets from China’s CNOOC for $1.9B-$2.8B (RT)

Chinese conglomerate Jiangsu Shagang agreed to buy Fosun International’s stake in Nanjing Iron & Steel for $2.1B (BBG)

Credit Suisse launched a sale of its US asset management arm CSAM (RT)

Qatar Investment Authority and Matthew Moulding, the co-founder of British online shopping firm THG, agreed to buy SoftBank’s stake in the company (BBG)

Kanye West agreed to buy right wing social media platform Parler (AX)

VC

Indian edtech startup Byju’s raised a $250M round led by Qatar Investment Authority (TC)

Stability AI, a startup using AI to generate music and images, raised a $101M seed round at a $1B valuation led by Coatue and Lightspeed Venture Partners (TC)

Inversago Pharma, a clinical-stage biotech company developing CB1 inverse agonists, raised a $70M Series C led by NEA (BW)

Ambi Robotics, a startup developing supply chain management hardware, raised $32M in funding led by Tiger Global and Bow Capital (TC)

Intraoperative immunotherapy developer SURGE Therapeutics raised a $26M Series A led by Camford Capital (BW)

Cyberdontics, a robotic dental startup, raised a $15M Series A led by Pacific Dental Services (TC)

Greenzie, an autonomous software startup for commercial lawn mowers and outdoor power equipment, raised an $8M round led by Atlanta Ventures (PRN)

Nigerian banking as a service platform Maplerad raised a $6M seed round led by Valar Ventures (TC)

IPO / Direct Listings / Issuances / Block Trades

Intel is now eyeing an up to $20B valuation in the IPO of its self-driving car unit Mobileye, down from ~$50B (WSJ)

Fundraising

Alley Robotics Ventures launched a $30M fund focused on robotics and automation (PRN)

Crypto Corner

Exec's Picks

Obesity is a known problem in the US, but the rate at which obesity has exploded over the last 40 years is wild. Check out the time-lapsed graph of US obesity on this Reddit post.

Meta's big bet on the Metaverse hasn't been smooth sailing. Check out this WSJ piece detailing the issues with Zuck's newest project.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.