Together with

Good Morning,

Tiger Global is down 52% YTD, US mortgage rates slipped, the EU approved a partial ban on Russian oil, Biden is canceling student debt for former Corinthian Colleges students, Trevor Milton doesn't want Nikola to sell more shares, and job growth cooled in May.

🚨 New feature dropping tomorrow: Exec Sum is launching a weekly opinion piece covering the most important current events in finance and business. Stay tuned for our first edition 🤝

Let's dive in.

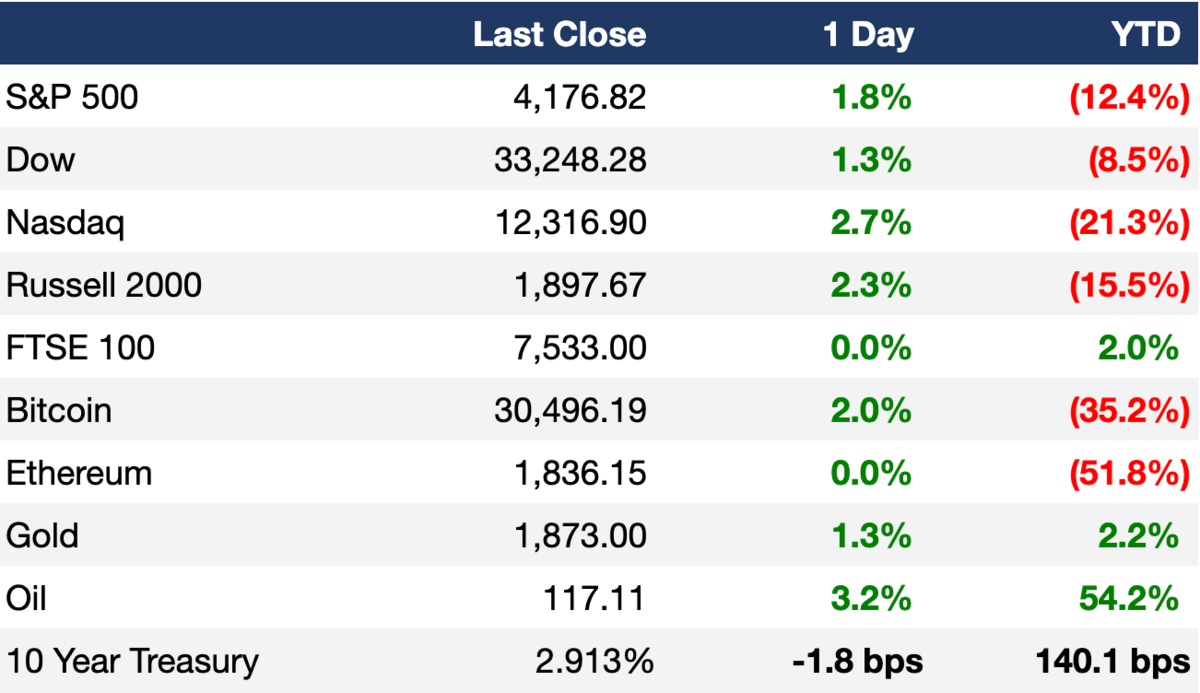

Before The Bell

As of 6/2/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

US stocks rose yesterday, brushing off Microsoft's bleak earnings forecast and comments from Fed Vice Chair Brainard, who suggested they may be aggressive on rate hikes into September

Yesterday’s gains helped all three major indexes snap-two day losing streaks as we approach more jobs data today

This morning we’ll receive the nonfarm payroll report

Economists are expecting 328K jobs added in May, down 100K from April

Initial jobless claims for last week came in lower-than-expected at 200K (vs 210K), a decline of 11K from the previous week

ADP employment data showed the slowest job creation pace of the pandemic-era recovery

Private payrolls increased by 128K in May (well short of the 299K expected)

Earnings

Headline Roundup

US mortgage rates slip as market shows signs of ‘normalizing’ (BBG)

Wall Street banks chip away at $50B of buyout loans sitting on books (BBG)

Tiger Global tumbles 52% YTD, prompting fee cut and redemption plan (BBG)

EU approves partial Russian oil ban, sanctions on Sberbank (BBG)

Ford is investing $3.7B to expand Midwestern auto plants (BBG)

Biden administration will cancel student debt for half a million from Corinthian Colleges (WP)

Private payrolls increased by just 128K in May, the slowest growth of the recovery, ADP says (CNBC)

Citigroup’s fat-finger trade seen costing bank $50M+ (BBG)

Nikola founder Trevor Milton blocks company share sale (BBG)

Oracle wins regulatory approvals for $28B Cerner takeover (BBG)

Social Security fund will be able to pay benefits one year longer than expected, Treasury says (CNBC)

Job growth seen cooling in May but wage increases were still hot (CNBC)

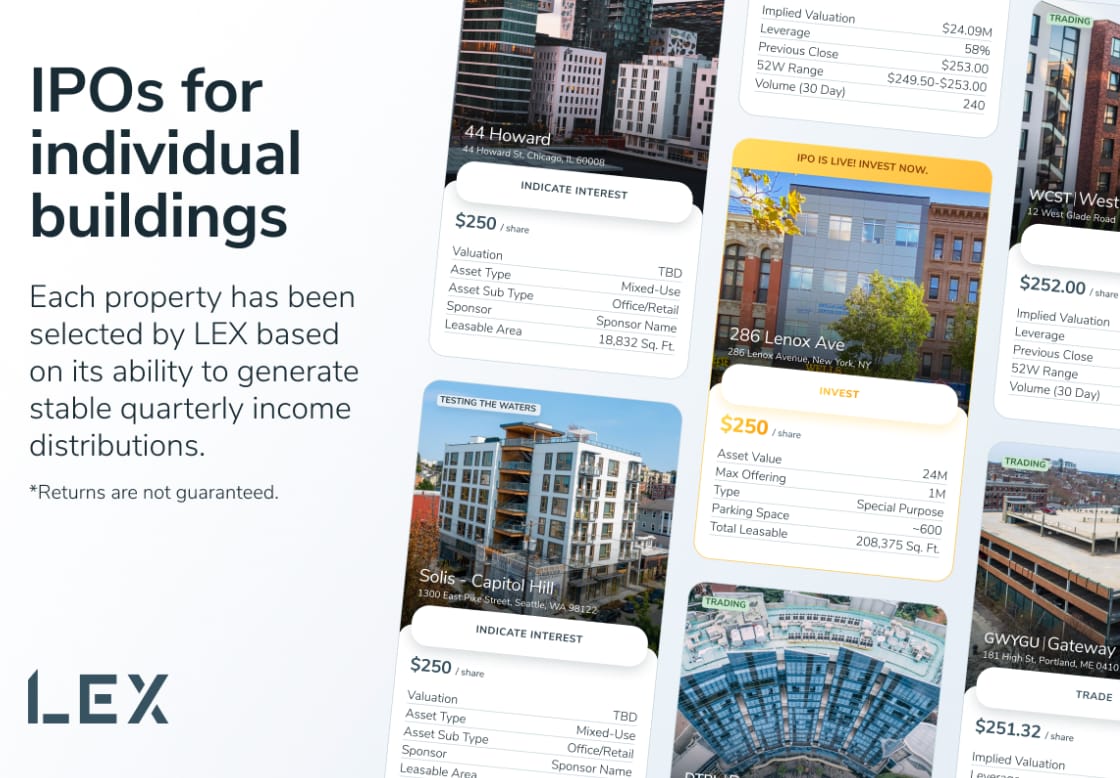

A Message From Lex

JUST BECAUSE THE S&P IS FALLING DOESN’T MEAN YOUR PORTFOLIO SHOULD

War, inflation, interest rates, and a million other variables make stocks volatile. Luckily, a building is still a building. Commercial real estate is your answer to hedging inflation and diversifying your portfolio. That’s why we're excited about LEX.

Truth is, the best deals in real estate are hard to find, unless you shorted Russian stocks all the way to accreditation (legend) and now you have access. Even then, you’ve got scarce deals, crowdfunding, or REITs to pick from…until LEX.

LEX IPOs buildings so you can get in the game.

By taking buildings public, LEX has created a way for you to invest in marquee commercial real estate. Build a portfolio by picking the buildings you want to invest in. Each building gets a ticker and trades like your other stocks.

The best part? As a shareholder, you can get paid dividends flowing from the rent paid by the tenants. You can also earn tax advantaged passive income and trade without lockups.

Check out LEX’s live assets in New York City and upcoming IPO in Seattle.

Deal Flow

M&A / Investments

Sycamore Partners and retail holding company Franchise Group offered to buy department-store chain Kohl’s in separate $7-$8B bids (WSJ)

Allied Irish Banks agreed to buy British lender NatWest’s Irish tracker mortgage book for $5.75B (RT)

Regeneron Pharmaceuticals agreed to buy the immune-oncology drug Libtayo from partner Sanofi for up to $1.1B (BBG)

Localiza Rent a Car is nearing an agreement to sell ~$730M in assets to competitor Ouro Verde (BBG)

Japanese conglomerate Toshiba has received 10 investment proposals, including 8 to go private (RT)

Car-sharing service Turo agreed to buy French competitor OuiCar for an undisclosed sum (BBG)

Billionaire Enrique Razon’s Prime Infra Holdings agreed to buy a controlling stake in the Malampaya deep-water gas-to-power project (BBG)

VC

Upstream Bio, a biotech company focused on inflammation, raised a $200M Series A led by OrbiMed and Maruho (BW)

JupiterOne, a startup helping companies track and secure cyber assets, raised a $70M Series C at a $1B+ valuation led by Tribe Capital (TC)

Indonesian hyperlocal social commerce app Super raised a $70M Series C led by NEA (TC)

Precision immunology startup Endpoint Health raised a $52M equity / debt Series A led by Mayfield, Humboldt Fund, AME Cloud Ventures, and more (BW)

Software supply chain security startup Chainguard raised a $50M Series A led by Sequoia Capital (TC)

Danish cleantech startup ZeroNorth received a $50M investment from PSG Equity as part of its Series B (BW)

Laminar, a public cloud data security provider, raised a $30M Series A extension led by Tiger Global and Salesforce Ventures (BW)

LatchBio, a startup accelerating scientific progress by allowing researchers to store and analyze data without touching code, raised a $28M Series A led by Coatue and Lux Capital (BW)

Upcycling startup Novoloop extended its Series A to $21M with funding led by Hanwha Solutions and Mistletoe (PRN)

Vernal Biosciences, an mRNA manufacturer, raised a $21M round led by Ampersand Capital Partners (PRN)

Bakery chain Lady M is looking to raise ~$20M at a ~$600M valuation in a new funding round to fuel its expansion in Asia (BBG)

Online B2B steel marketplace Felux raised a $19M Series A led by EquipmentShare (BW)

LaunchNotes, a personalized, automated, and secure way to connect teams and users in the product development lifecycle, raised a $15M Series A led by Insight Partners (PRN)

Sanlo, a startup offering gaming / app SMEs fintech services, raised a $10M Series A led by Konvoy (TC)

Prokeep, a startup building a communications and commerce platform for distributors, raised a $9M seed round led by Ironspring Ventures (PRN)

Construction permit startup Pulley raised a $4.4M seed round led by Susa Ventures (TC)

Prisms VR, a math learning platform, raised a $4.25M seed round led by a16z (BW)

HourWork, a SaaS recruitment and retention platform for QSR franchise owners, raised a $2.5M Series A led by MassMutual MM Catalyst Fund (PRN)

Fundraising

Cybersecurity-focused global stage agnostic investment firm Ten Eleven Ventures raised a $600M Fund III (PRN)

Chicago-based real estate development and investment firm CRG raised $300M for its latest industrial real estate fund, USLF II (BW)

Healthcare venture firm Qiming USA raised $260M for its third fund (BW)

Canonical Crypto launches $20M inaugural fund backed by Marc Andreessen, Chris Dixon (CD)

Crypto Corner

Exec's Picks

Lux Capital's recent Q1 2022 letter to investors is a goldmine for insights into the state of the venture capital market, survival for early-stage companies, and what might come next as cash remains tight. Check out Lux's piece here.

SURVEY: We're in discussions with some folks around potential web3 plays later this year and need your help! If you've got 30 more seconds, pls help us in filling out this very brief survey.

As Summer Wedding SZN is kicking off, we wanted to remind you of our exclusive, limited edition suede loafers we made in collaboration with Del Toro. Check out Litquidity's "The Fed" Suede Milano loafers here.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast, presented by CoinFLEX.US, on Spotify, Apple, and YouTube 🤝