Together with

Good Morning,

Labor force participation for working-age Americans hit its highest level since 2002, hedge funds are competing for battered commercial real estate, Twitter is rebranding as ‘X,’ Taylor Swift’s tour is stimulating the economy, ‘Barbenheimer’ had a blowout weekend, Alibaba is not joining Ant Group’s share buyback, and Spotify might raise its premium prices.

ICYMI: Yesterday we published a deep dive highlighting one of the hottest new platforms for investing in alternative assets: Gridline. Check out the article here.

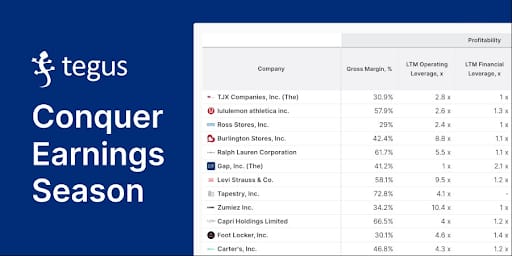

Breakthrough the research noise faster. Tegus has 60k+ expert interview transcripts, and the most robust benchmarking, charting and comps tooling. You can trial the platform right now, for free!

Let’s dive in.

Before The Bell

As of 7/21/2023 market close.

Markets

Stocks ended the week with mixed results as investors assessed the latest round of corporate earnings

The S&P and Dow posted their second-straight winning week

The Dow stretched its winning streak to 10 sessions, a feat not seen since August 2017

Investors are preparing for a special rebalancing of the Nasdaq 100 index today to account for an over-concentration of the index’s top holdings

Oil prices rose for a fourth-straight week

We’ll receive the Fed’s, ECB’s and BOJ’s latest rate policy decisions and US inflation data this week, alongside a slew of corporate earnings

Earnings

American Express met Q2 expectations but disappointed analysts with its cautious forecast as credit card spend on travel and entertainment is moderating from unsustainably high rates in 2022; their stock declined 4% (RT)

What we're watching this week:

Today: Domino’s Pizza

Tuesday: Alphabet, Microsoft, Visa, Verizon, General Electric, General Motors, Texas Instruments

Wednesday: Meta, Coca-Cola, Boeing, AT&T, Chipotle

Thursday: Intel, Mastercard, McDonald’s, Comcast, Ford

Friday: ExxonMobil, Chevron, P&G

Full calendar here

Headline Roundup

Labor force participation rate for 25 to 54 y/o rose to the highest level since 2002 (WSJ)

Russian central bank surprises with sharper-than-expected rate hike to 8.5% (RT)

Global equity funds see first weekly outflow in four weeks (RT)

Hedge fund industry lures $3.6B in fresh money in Q2 (RT)

Hedge funds brawl over battered commercial real estate (WSJ)

Turkey raises interest rates in effort to save economy (WSJ)

Twitter will rebrand as ‘X’ (RT)

‘Barbenheimer’ delivers blowout weekend at the box office (WSJ)

Taylor Swift is stimulating the economy (WSJ)

China sounds out foreign PE groups over boosting inward investment (FT)

China to be center of Mercedes-Benz 2025 EV sales drive (RT)

Work dries up for US consultancies in China after national security raids (FT)

IMF expects deal with Argentina in the coming days (RT)

China's Alibaba says it will not join Ant Group share buyback (RT)

JPMorgan will expand Chase to EU nations (RT)

Chevron CEO to stay past retirement age, CFO to depart in 2024 (RT)

Spotify will raise price of Premium Plan in US for the first time (WSJ)

EY hired corporate crisis adviser Lord David Gold to examine failed break-up plan (FT)

Gender pay gap is now the narrowest on record (AX)

A Message From Tegus

Earnings season doesn’t have to mean late nights and frantic model updates—Tegus gives investors the most accurate company models and industry-specific dashboards with custom KPIs.

So instead of spending time sourcing and aggregating SEC data or manually updating your models with the newest data every quarter during earnings, Tegus’s team of sector-focused financial analysts does all that work for you, ensuring accuracy and speed you won’t find anywhere else.

If you want to thrive and not just survive this earnings season, click here to learn more about Tegus.

Deal Flow

M&A / Investments

An ADQ-led consortium of Abu Dhabi funds called off a $2.5B deal to buy a controlling stake in Israeli financial services firm Phoenix Holdings from US private investment firms Centerbridge Partners and Gallatin Point Capital (RT)

French aviation company Safran will acquire the actuation and flight-control business from Raython Technologies’ Collins Aerospace unit in a cash deal worth $1.8B, including debt (WSJ)

KKR will buy chemicals maker Chase in a $1.3B all-cash deal, including debt (RT)

Financial services provider Evertec is acquiring Brazilian software solutions provider Sinqia for $601M cash (BW)

TUA Assicurazioni, a motor, home, and health insurer and $335M subsidiary of Italian multinational insurer Generali, has takeover interest from multiple international groups (RT)

Home test and health supplement provider Thorne HealthTech, which has a market cap of $320M, put itself up for sale (RT)

Dalian Wanda Group sold a stake in one of its entertainment units for $314M, which allows it to repay a maturing dollar bond due on July 24 (BBG)

Bain Capital will buy a 90% stake in Adani Capital and Adani Housing from the Adani family (RT)

SBB ended talks with Brookfield Asset Management over the sale of its remaining 51% stake in a portfolio of school buildings (BBG)

Australia barred the takeover of financially stricken lithium miner Alita Resources by China-linked Austroid Corporation (RT)

Europe's biggest hotel group Accor entered exclusive negotiations with Andera Partners and partner investors to acquire a 63% stake in luxury caterer Potel & Chabot (RT)

VC

Mynd, an Oakland, CA-based real estate investing company, raised $30M in a financing round led by Invesco Real Estate (FN)

Wooptix, a company that specializes in semiconductor metrology equipment, raised an $11.1M Series B round led by Bullnet Capital and Danobatgroup (FN)

Uplift, an NYC-based behavioral health company, raised a $10.7M Series A round led by Ballast Point Ventures with participation from Kapor Capital (FN)

Pittsburgh-based digital comics platform GlobalComix raised $6.5M in Series A funding led by Point72 Ventures (FN)

Frigade, a San Francisco, CA-based provider of a platform for developers to build product onboarding and education, raised a $3M in seed funding led by Craft Ventures (FN)

Hello Neighbour, a London, UK property renting and management company closed a $2.8M Series A funding round led by Surebind (FN)

Gushwork.ai, a New York-based, AI-powered global platform designed for enterprises to outsource complex operational workflows, raised $2.1M led by Lightspeed (FN)

Magic, a London, UK-based fitness tech startup, raised $2.1M in a round led by Fasnara Capital (FN)

SquadTrip, a Tulsa, OK-based provider of an automated payment solution for large and small group trips, raised $1.5M in funding led by Atento Capital, with participation from Forum Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

Chinese chipmaker Hua Hong Semiconductor is looking to raise $3B in its listing in Shanghai (RT)

Troubled Swedish landlord SBB is selling $228M worth of shares of a subsidiary to Morgan Stanley (BBG)

The board of Italian pencilmaker F.I.L.A.’s Indian unit Doms approved an IPO to sell $100M worth of shares (RT)

The Brazilian unit of China Three Gorges Corp. withdrew its Brazilian IPO (RT)

SPAC

Taiwan Color Optics, a consumer optics supplier, will go public in a $380M merger with Chenghe Acquisition Co. (MS)

Debt

Morgan Stanley sold $6.75B of debt, with its 11-year note yielding a 167 bps premium to treasuries (BBG)

Bankruptcy / Restructuring

Crypto Corner

Exec’s Picks

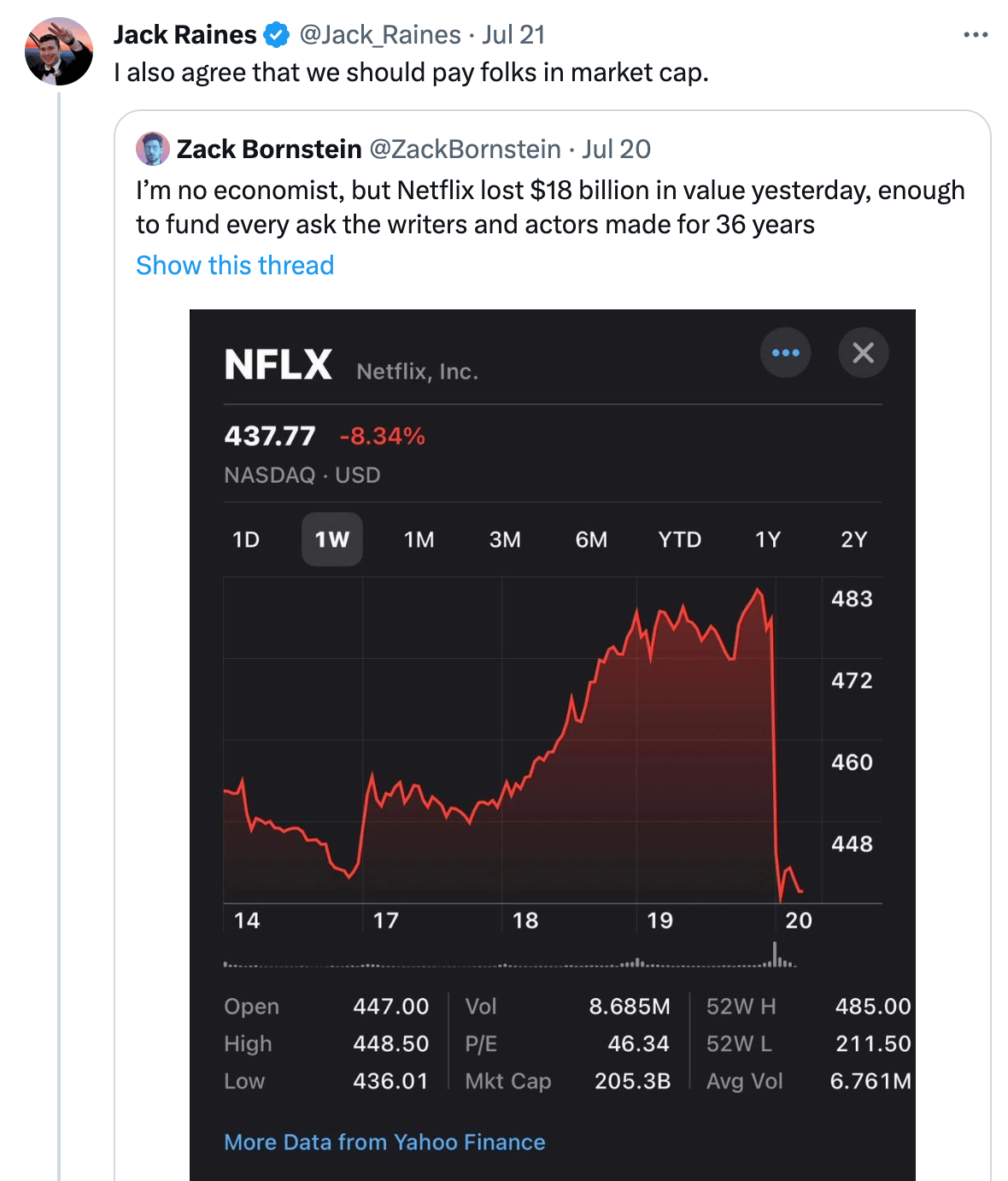

Jack Raines (Exec Sum’s Editor) joined Josh Brown and Michael Batnick to discuss AI and the market, the meme economy, Nvidia’s rollercoaster of a year, the newsletter business, and more on this episode of The Compound.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter