Together with

Good Morning,

Retail traders seemingly beat out institutional investors in the April turmoil, at a time where names like Berkshire Hathaway avoided the dip and Michael Burry sold his entire stocks portfolio.

Accelerate and streamline your M&A workflows like never before with SS&C Intralinks. Learn more below!

Let's dive in.

Before The Bell

As of 5/15/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks gained yesterday as traders continued to digest trade talks optimism

S&P rose for a fourth-straight day

Canada's TSX index hit a new ATH after rising for an eight-straight day

India's Nifty 50 index hit a seven-month high

Russian ruble hit a two-year high amid Ukraine peace talks

Correlation between the dollar and G10 currencies fell to a seven-year low

Earnings

Alibaba missed Q4 earnings and revenue estimates, despite 18% growth in cloud revenue as macro headwinds and lingering US-China trade tensions continued to weigh on consumer sentiment (CNBC)

Applied Materials missed Q2 revenue estimates due to weaker sales in its largest segment and ongoing export control uncertainties, though it beat on earnings as strong investment in advanced chips partially offset a slowdown in ICAPS (RT)

Cava beat Q1 earnings and revenue estimates as same-store sales jumped 11% on 7.5% traffic growth, outperforming peers amid broader consumer pullback, while maintaining its FY same-store sales forecast (CNBC)

Walmart beat Q1 earnings estimates but narrowly missed on sales and warned of imminent tariff-driven price hikes; the retailer also reported its first-ever quarterly profit for global e-commerce amid growth in online ads and its third-party marketplace (CNBC)

John Deere beat Q2 earnings and revenue estimates on cost cuts and inventory management, but trimmed its FY profit forecast amid softer equipment demand from farmers and ongoing tariff-related cost pressures (RT)

Take-Two Interactive beat Q1 earnings and revenue estimates on strong performance in NBA 2K25, GTA Online, Red Dead Redemption 2, and others, but issued weak FY bookings guidance amid delays to GTA VI (BBG)

Full calendar here

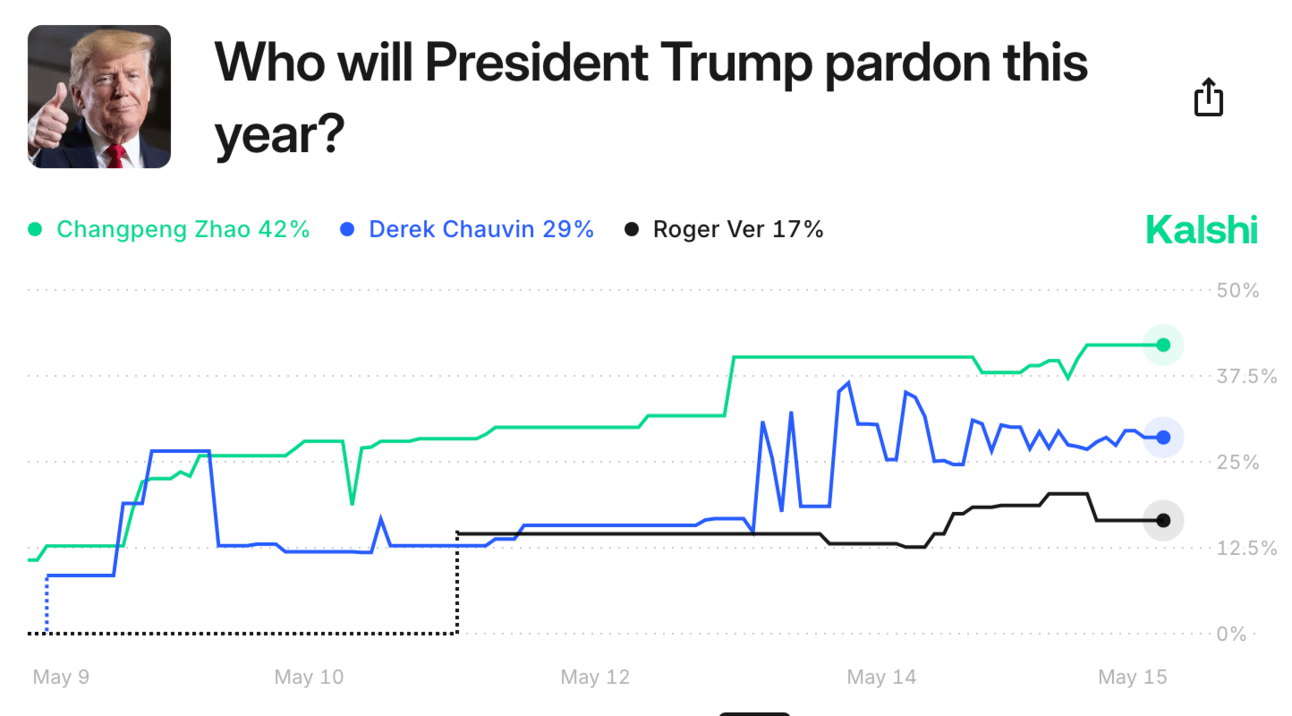

Prediction Markets

Surely, these won't create any controversy.

Headline Roundup

Retail traders beat out institutional investors in April turmoil (BBG)

US PPI inflation slowed to 2.4% YoY in biggest drop in five years (BBG)

J Pow signaled changes to Fed policy framework set in 2020 (BBG)

Jamie Dimon still sees possibility of US recession (BBG)

Japan economy shrank in Q1 for first time in a year (WSJ)

US IPOs come off the sidelines as tariff shock eases (BBG)

Europe is bracing for wave of IPOs in coming weeks (BBG)

Legal advisers are optimistic about Chinese M&A recovery (FT)

Berkshire Hathaway did not buy the dip in April (BBG)

Michael Burry sold virtually all stocks from portfolio (BBG)

Quant traders are rushing into Saudi Arabia (BBG)

Falling rate drive best month for Brazil hedge funds since 2007 (BBG)

Partners Group will lobby Trump to bless PE in 401(k)s (BBG)

EY delayed start dates for consulting recruits for third-straight year (FT)

BlackRock won vote for CEO's $30M pay despite proxy opposition (RT)

StanChart builds financial sponsors group in US IB push (RT)

Jamie Dimon reiterated demand for work-from-office (BBG)

UAE pledged to invest $200B in US (RT)

Shein lowered US prices amid US-China trade deal (BBG)

Russia oil-export revenue fell to its lowest since June 2023 (BBG)

Trump agenda hit a speed bump in Congress (RT)

US homebuilder sentiment fell to the lowest since 2023 (BBG)

Harvard paid top endowment execs a combined $26M in 2023 (P&I)

Corporate America is leaving more jobs unfilled (WSJ)

A Message from SS&C Intralinks

In M&A, complexity comes with the territory. How you navigate it sets you apart.

SS&C Intralinks DealCentre AI brings everything into one place — from prep to close — so your team can move quickly, securely and decisively.

Built around our industry-leading VDR, DealCentre AI is more than a data room. It's where AI intelligence and human expertise move as one, accelerating workflows without sacrificing control. It’s a fully connected environment that automates and scales repetitive tasks, delivers insights from past transactions and provides real-time visibility of your pipeline — with the speed and flexibility today's deal teams require.

Bring greater confidence to every decision — and a clear advantage to every deal.

In a competitive market, DealCentre AI helps top performers stay ahead.

Deal Flow

M&A / Investments

Ares' credit arm entered exclusive talks to acquire a 20% stake in Italian energy giant Eni's renewables unit Plenitude, valued at over ~$13.5B, including debt

Khosla Ventures-founder Vinod Khosla, Bessemer Venture Partners, and ICONIQ Growth agreed to acquire a 6% stake in NFL's San Francisco 49ers at a record $8.5B valuation

Strathcona Resources will sell shale oil assets in Western Canada in three separate deals totaling $2B

Sports goods retailer DICK'S Sporting Goods agreed to acquire footwear retailer Foot Locker for $2.4B cash at an 87% premium

Electric utility Vistra agreed to acquire seven natural gas-fired power plants for $1.9B to meet growing AI demand

Irish food manufacturer Greencore agreed to acquire UK grocery supplier Bakkavor Group in a $1.6B cash and stock deal

36 indigenous groups in BC, Canada agreed to buy a 12.5% stake in pipeline giant Enbridge's Westcoast pipeline system

VC

Whalar Group, an influencer marketing agency representing 300+ TikTok, Instagram, and YouTube creators, raised funding at a $400M valuation from Marc Benioff, Neal H. Moritz, and Shopify

Entrata, an OS for multifamily communities, raised a $200M minority investment at a $4.3B valuation from Blackstone

Sprinter Health, a mobile healthcare provider, raised a $55M Series B led by General Catalyst

Zeno Power, a startup developing nuclear batteries, raised a $50M Series B led by Hanaco Ventures

Cognichip, an AI model to speed up chip manufacturing processes, raised a $33M seed round led by Lux Capital and Mayfield

AI video generator startup Hedra raised a $32M Series A at a $200M valuation led by a16z

Contract development and manufacturing organization Kincell Bio raised $22M in funding led by NewSpring Capital

Wi-Charge, an Israeli startup specializing in long-range wireless power, raised a $20M Series C led by Standard Investments

Fiber optic sensing startup Optics11 raised a $19M round from FORWARD.one, SET Ventures, Join Capital, and Value Creation Capital

Solestial, a solar energy company for space, raised a $17M Series A led by AE Ventures

Virtual try-on startup Doji raised a $14M seed round led by Thrive Capital

Defense tech startup Adyton raised $11M in funding led by Venrock

Row Zero, an enterprise spreadsheet built for big data and security, raised a $10M seed round led by IA Ventures

Indian ice cream brand Hocco raised a $10M Series B led by Chona Family Office and Sauce VC

Metafoodx, an AI food operations company, raised $9.4M in funding led by Trustbridge Partners

KYD Labs, a blockchain-based ticketing platform, raised a $7M seed round led by a16z crypto

TaleMonster Games, an Turkish studio bringing depth and creativity to casual puzzle games, raised a $7M seed round led by General Catalyst

French carbon credits startup Riverse raised a $5.6M seed round led by Alven and Racine

akeno, a German AI-driven software startup for real-time adaptive production planning, raised a $5M seed round led by Cusp Capital

Microbe-based sensor startup Fieldstone Bio raised a $5M seed round led by Ubiquity Ventures

CarbonSix, a robotics startup specializing in AI-powered manipulation, raised a $4M seed round led by Foothill Ventures and Storm Ventures

Plakar, a French open-source backup and restore platform, raised a $3M pre-seed round led by Seedcamp

IPO / Direct Listings / Issuances / Block Trades

Thoma Bravo sold its remaining 7% stake in Nasdaq for ~$3.4B

Chinese drugmaker Jiangsu Hengrui Pharmaceuticals is seeking to raise up to ~$1.3B in a Hong Kong listing

A unit of Singapore Telecommunications offered to sell shares in Indian wireless carrier Bharti Airtel to raise $1B

Arabian Construction is planning to raise several hundred million dollars in a UAE IPO this year

Chinese cancer biotech BlissBio is considering a Hong Kong IPO

Debt

Ontario plans to borrow $42.7B to fund a larger budget deficit and infrastructure spending, with an increased portion expected from FX bond sales

Distressed Hong Kong developer Parkview raised a $38M private credit loan from Asian investment firm PAG

Bankruptcy / Restructuring / Distressed

FTX bankruptcy advisers will distribute $5B to creditors/customers in a second payment round which will see creditors received 54%-120% of their claims

LG-unit LG Chemical is seeking to raise $1B in exchangeable bonds of LG Energy Solution to refinance a previous issuance

South African state-owned Land & Agricultural Development Bank is in talks to raise up to $1B to aid its recovery from a default five years ago

CVS Pharmacy, Walgreens, Albertsons, Kroger, Giant Eagle, and others will acquire pharmacy assets from over 1k Rite Aid store locations in separate transactions as Rite Aid moves forward with bankruptcy sales

Fundraising / Secondaries

European PE firm Inflexion raised $3B for its first multi-asset continuation fund for four PortCos led by Carlyle AlpInvest, HarbourVest Partners, and Lexington Partners in the largest such fund in Europe

Mark Cuban-led Harbinger Sports Partners launched as a $750M PE fund focused on professional sports

Elham Credit Partners, the private credit arm of Asian PE firm Hillhouse, is set to raise $750M for a debut private credit fund

PX3 Partners, UK PE firm founded by ex-Rhone Group execs in 2021, raised $560M for its debut fund

European boutique asset manager Unigestion raised $308M for a targeted $450M third EM PE FOF

Crypto Sum Snapshot

Coinbase experienced major hack one day after S&P 500 inclusion

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

PE folks, the days of pulling all-nighters and sacrificing weekends to build LBO models are over. Mosaic's digital deal modeling platform takes care of mundane mechanical calculations and incorporates unparalleled accuracy for you to build comprehensive LBO models in minutes. It's no surprise that Mosaic is already trusted by top PE funds on the street.

Bitcoin 2025 hits Las Vegas on May 27-29! Join 30,000+ for top speakers like JD Vance and Ross Ulbricht, unmatched networking, and epic nightly after-parties. Get 30% off with code Litquidity. Grab your pass here!

Callie Cox wrote an insightful piece on how Warren Buffett fans often ignore the most important part of his playbook.

On more Warren Buffet, Barry Ritholtz reminds investors that our greatest investing strengths are really just ourselves.

Analyst Opportunity – VC / Growth Equity 💼

We are working with an anonymous VC / growth equity firm based in Los Angeles to help hire an analyst

The analyst will support the investment team throughout full deal lifecycles, including sourcing, screening, due diligence, and investment committee preparation

The ideal candidate has one year of investment banking or consulting and a passion for tech / software. Learn more and apply at Litney Partners

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.