Together with

Good Morning,

Rent inflation is cooling, Twitter partnered with eToro to let users trade stocks and crypto, Chinese exports surged in March, Amazon is facing 18 shareholder proposals this year, Apple tripled iPhone production in India, Sweden’s largest pension fund fired its CEO, and Bernard Arnault is now worth $210B+.

Looking to diversify your portfolio with private credit? Check out today’s sponsor, Percent.

Let’s dive in.

Before The Bell

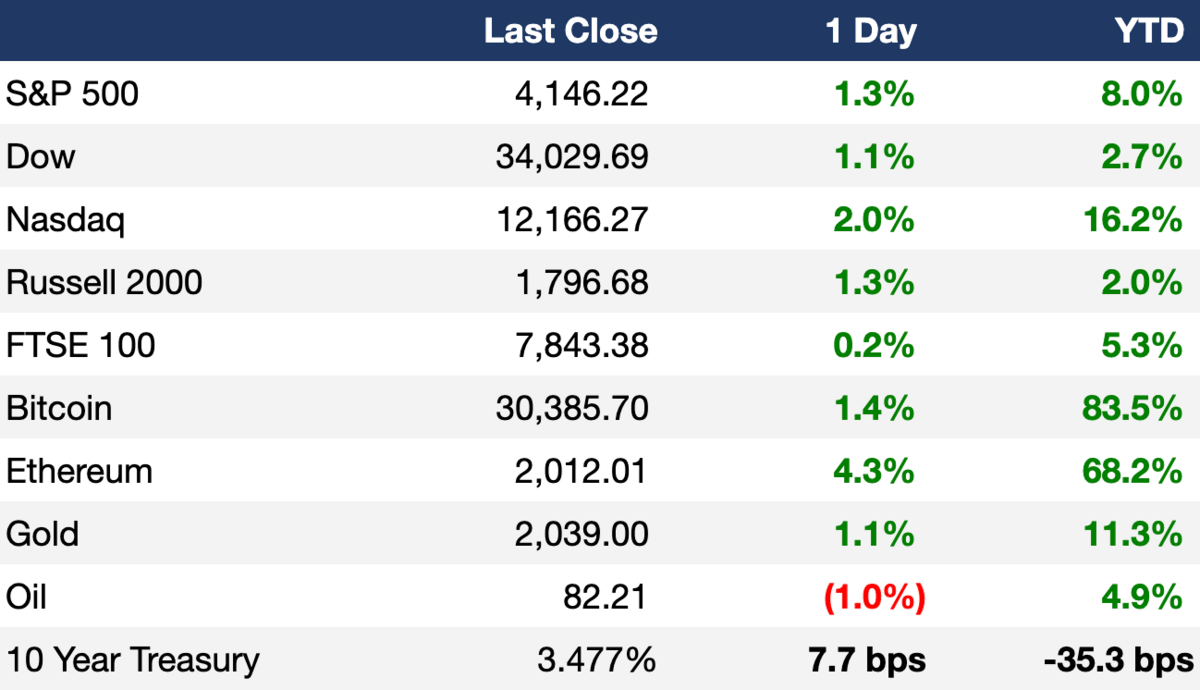

As of 4/13/2023 market close.

Markets

US stocks rallied yesterday on more signs of rapidly cooling inflation and a loosening labor market

Gold hit its highest level of the year

Dollar index fell to a two-month low, and a one-year low against the euro

Earnings

Headline Roundup

US PPI slowed to 2.7% YoY in March for biggest drop in three years (WSJ)

ECB policymakers are converging on a 25 bps rate hike in May (RT)

Rent inflation is cooling (AX)

China's exports unexpectedly surged in March (RT)

Hedge funds boosted exposure to financial stocks by 5.5% amid banking turmoil (RT)

Global debtors and creditors agreed on steps to jumpstart debt restructurings (RT)

Amazon is facing a record 18 shareholder proposals this year (RT)

JPMorgan cut dozens of base metals clients after nickel crisis (BBG)

Amazon announced new AI offerings as it joins Big Tech AI race (WSJ)

Apple tripled iPhone production in India to $7B (BBG)

JPMorgan internally flagged Epstein’s withdrawals years before his 2008 conviction (WSJ)

Exxon CEO's pay rose 52% in 2022 (RT)

Amazon awarded CEO Andy Jassy no new stock in 2022 (RT)

Sweden’s biggest pension fund Alecta fired its CEO after losing $2B on failed SVB/Signature bets (FT)

Tech exec Nima Momeni was arrested for the stabbing/murder of Cash App founder Bob Lee (RT)

Bernard Arnault's wealth soared to $210B (BBG)

Outcome Health founder Rishi Shah was convicted of fraud (AX)

A Message From Percent

The alternative asset you probably haven't yet considered: Private credit.

Private credit is an asset class of non-bank loans and could bring significant advantages to a portfolio. These assets tend to be:

Shorter duration, potentially reducing price volatility due to interest rate fluctuations and lessening the risk of an adverse credit event during the tenor of the transaction, given the limited holding period.

Secured, providing some downside credit protection and a more attractive risk-return profile.

Less correlated with traditional asset classes like stocks and bonds, improving portfolio diversification and the prospect for returns.

With persistent inflation wiping the gains off traditional stock-bond portfolio mix, leading investors to consider diversifying into less-correlated assets.

Meet Percent, the only platform exclusively dedicated to private credit. Percent provides accredited investors access to a wide variety of high yield, short duration (9-month average) offerings. Invest as little as $500 and unlock yields up to 20% APY.

Exec Sum readers can earn up to $500 on your first investment. Sign up today.

Deal Flow

M&A / Investments

A group led by billionaire Apollo co-founder Josh Harris agreed to buy the NFL’s Washington Commanders for $6B (BBG)

French energy company TotalEnergies is considering a bid for oil and gas explorer Neptune Energy at a potential $5B+ valuation (BBG)

PE firm Bridgepoint is preparing to sell its majority stake in French insurance broker Kereis at a potential $2.21B valuation (RT)

A PE consortium led by CVC Capital Partners is in talks to buy Middle Eastern credit card processor Network International, which has a market value of $2B (BBG)

Pharmaceutical company Merck is seeking to revive the sale of its pigments division, Surface Solutions, that could be worth ~$1B (RT)

Canadian miner Hudbay Minerals agreed to buy peer Copper Mountain Mining in a $439M deal (RT)

Consumer brand owner WHP Global and retailer Express agreed to buy the menswear line Bonobos from Walmart for $75M (BBG)

German insurer Frankfurter Leben-Gruppe is nearing a deal to buy Italian insurer Assicurazioni General’s German unit Deutschland Pensionskasse (BBG)

Property investment firm Cain International agreed to buy a minority stake in luxury hotel brand Delano (BBG)

CVC Capital Partners is considering selling its 21% stake in fast food franchise operator QSR Brands (RT)

VC

BioTherapeutics, a biopharma company focused on developing new biologics for cancer treatment, raised a $158M Series B led by Goldman Sachs Asset Management (VCN)

Context Labs, a data provider that helps companies track carbon emissions, hired Barclays to help raise up to $150M at an over $1B valuation (RT)

Satellite telecommunications company Kepler Communications raised a $92M Series C led by IA Ventures (TC)

Biopharmaceutical company Aer Therapeutics raised a $36M Series A from investors including Canaan, OrbiMed, and Hatteras Venture Partners (VCN)

ThayerMahan, an autonomous maritime surveillance solutions provider, raised a $30M Series C led by MC2 Security Fund (VCN)

Consumer benefits administration platform Elevate raised $28M in a funding round led by Anthemis (TC)

Tradier, a global retail brokerage firm, raised a $24.6M Series B led by PEAK6 Strategic Capital (VCN)

Online learning management system LMS365 raised a $20M funding round (TC)

Government-technology focused AI SaaS solution provider Cardinality.ai raised a $12.5M Series B led by Boathouse Capital (VCN)

Otterize, which aims to allow developers to securely connect different software services to each other, raised $11.5M in a seed funding round led by Index Ventures (TC)

Ampersand, a startup that helps SaaS companies build user-facing integrations into their products, raised a $4.7M seed round led by Matrix Partners (TC)

E-bike subscription platform for last-mile delivery drivers Whizz raised a $3.4M seed round from investors including Joint Journey and TMT Investments (VCN)

IPO / Direct Listings / Issuances / Block Trades

Italian gambling company Lottomatica is seeking to raise $467M in a Milan IPO (BBG)

Debt

BBVA, Santander and Bank of America together plan to fund Mexico's $6B deal to purchase power plants from Spanish utility Iberdrola (BBG)

Software maker Adobe is looking to tap debt markets to finance its acquisition of UI design tool maker Figma, which could include replacing its $3.5B DDTL and $1.5B of bonds maturing in 2025 (BBG)

Santander Consumo Peru, the Peruvian car loan business of Santander, plans to sell up to $53M worth of short-term bonds in local markets (LF)

Credit Suisse hired BlackRock to help sell a portfolio of structured bonds (BBG)

Bankruptcy / Restructuring

Movie-theater advertising giant National CineMedia filed for Chapter 11 bankruptcy protection (RT)

Fundraising

Swiss asset manager Edmond de Rothschild raised $2.8B for its fifth ESG-focused BRIDGE infrastructure debt fund (FE)

Warren Equity Partners raised $1.4B for its flagship fourth fund (BW)

Lux Capital raised $1.15B for its largest fund to date, Lux Ventures VIII, to invest in science and deep technologies (BBG)

Crypto Corner

Exec’s Picks

Eight Sleep is a high-tech smart bed system that has taken Silicon Valley by storm. With a built-in heating and cooling system, multiple foam layers to deliver comfort, and analytics tracking to help you optimize your sleep and recovery, Eight Sleep is the complete package. Upgrade your mattress game here, and use code "LIT" at checkout for a great discount!

The Information published an interesting read on the issues that Google and Meta are having with their internal performance reviews.

Amazon CEO Andy Jassy shared his 2022 annual letter to shareholders.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Want to chat social media growth, newsletter strategy, angel investing, Wall Street careers, or something else? Book a call with Litquidity here.

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.