Together with

Good Morning,

There’s a new dominant e-commerce giant in China, Milei warns that economic shock is unavoidable, Ethiopia is about to become Africa’s next debt defaulter, the US is reloading the strategic reserve, Rakuten is launching a proprietary AI model, Tucker Carlson is launching his own streaming service, and renters are getting concessions from landlords again.

Are you worried about spammers getting access to your email while you’re doing holiday shopping online? Get your data off the internet with today’s sponsor, Incogni.

Before The Bell

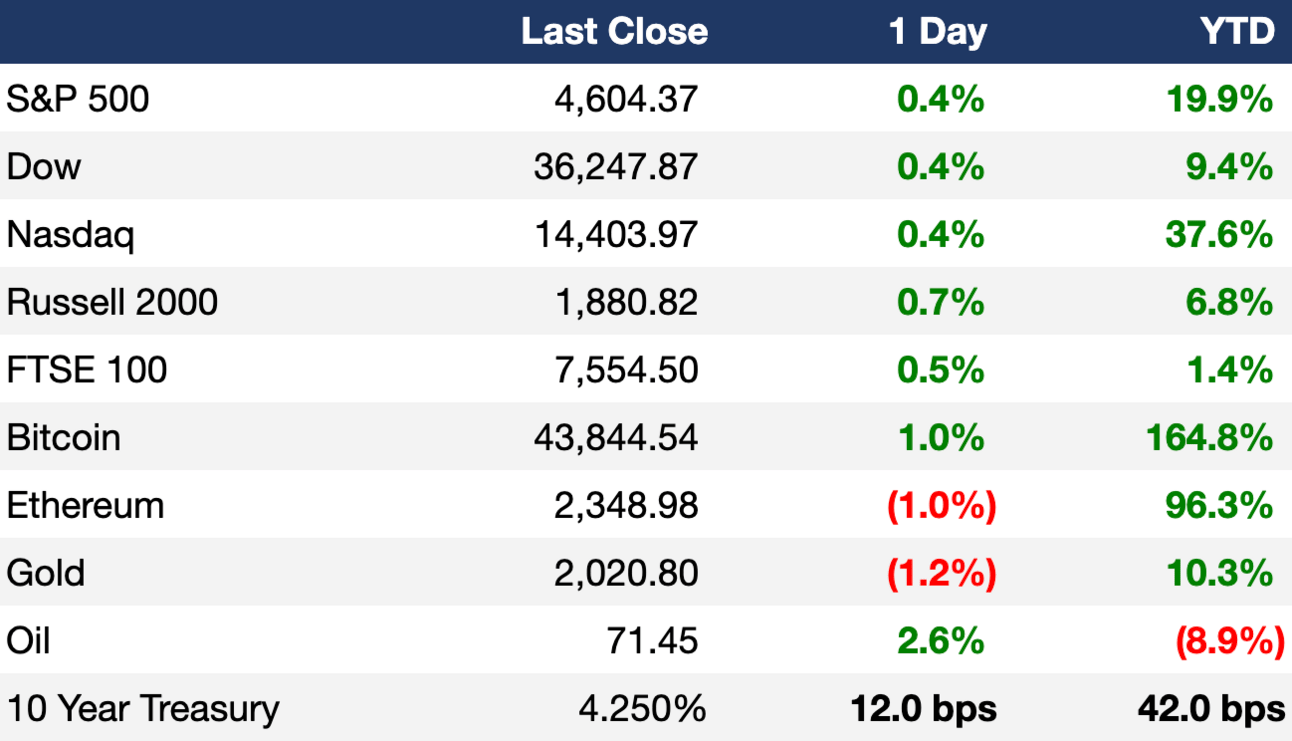

As of 12/8/2023 market close.

Markets

US stocks rose to hit a new high for the year after the November jobs report signaled a resilient economy and cooling inflation

The Nasdaq led indices with a 0.45% gain

European stocks briefly hit their highest level since February 2022 as traders bet that central banks were finished with rate hikes

Earnings

What we're watching this week:

Today: Oracle

Wednesday: Adobe

Thursday: Costco

Friday: Darden Restaurants

Full calendar here

Headline Roundup

Jack Ma’s biggest e-commerce rival is coming for Amazon (BBG)

Argentine President Milei warns economic shock unavoidable in maiden speech (RT)

US seeks to buy up to 3M barrels of oil for Strategic Petroleum Reserve (RT)

Ethiopia is about to become Africa’s next debt defaulter (BBG)

Why treasury auctions have Wall Street on edge (WSJ)

Japanese tech giant Rakuten plans to launch proprietary AI model within next two months (CNBC)

Tucker Carlson is launching his own streaming service (WSJ)

NYC’s financial district gets luxury apartments in former office tower (BBG)

Azerbaijan says it’s on track to double gas exports to Europe (BBG)

Serbia, Bulgaria complete gas pipe to reduce reliance on Russia (BBG)

Many car dealers are getting nervous about EV push (WSJ)

Arm CEO fears humans could lose control of AI (BBG)

Wharton board calls for leadership change at Penn amid furor over campus antisemitism (WSJ)

Renters are starting to get concessions from landlords again (WSJ)

Renaissance Technologies names longtime employee Lippe as Co-CEO (BBG)

Shohei Ohtani to sign $700M deal with Los Angeles Dodgers (WSJ)

A Message From Incogni

While you are surfing the web for holiday gift deals, data brokers are looking to acquire your personal information from all that online shopping.

These companies specialize in collecting personal information and selling it in bulk to marketers (and sometimes scammers). The good news is that you can avoid the holiday season spam madness before it hits by signing up with Incogni!

Incogni automatically removes your info from the web so that spammers and scammers can't get access to it.

Use code EXEC60 today to get an exclusive 60% discount for Exec Sum readers and get your data removed from 180+ sites automatically with Incogni.

Worried you won’t see the results? There’s no better time to test it out than during the marketing frenzy this December. If you don’t find peace from spam within 30 days, they offer a full refund.

Deal Flow

M&A / Investments

US health insurer Cigna abandoned its attempt to negotiate an acquisition of rival Humana to create a $140B+ insurer; Cigna will buy back an additional $10B worth of shares instead (RT)

FTC is seeking more information on Chevron’s $53B acquisition of energy company Hess (RT)

Endeavor Energy Partners is exploring a sale that could value the largest privately held oil and gas producer in the Permian basin at $25B-$30B (RT)

Macy’s received a $5.8B buyout offer from Arkhouse Management and Brigade Capital Management (BBG)

US industrial firm Honeywell will acquire air conditioner maker Carrier's security unit for $5B cash to bulk up its building safety business (RT)

PE firms including Bain Capital and Blackstone are considering bids for Japanese pharmacy chain Tsuruha Holdings, which has a market value of ~$4.1B (BBG)

Saudi Arabia’s PIF is seeking to gain majority control of London’s Heathrow Airport, as several shareholders consider the sale of their interests; a 25% stake in the airport recently sold for $3B (BBG)

TikTok will take a controlling stake in an e-commerce unit of Indonesia’s biggest tech firm, PT GoTo Gojek Tokopedia, for $1.5B (RT)

Chemical maker INEOS Oxide will acquire LyondellBasell’s ethylene oxide unit in Bayport, Texas for $700M (RT)

China Southern Power Grid, the country’s second-largest electricity supplier, is considering a bid for the stakes held by Canadian pension funds in Transelec, Chile’s biggest power-transmission company (BBG)

Germany’s Näder family plans to buy back the remaining 20% stake in prosthesis firm Ottobock from EQT (BBG)

VC

Pragmatic Semiconductor, a Cambridge, UK-based manufacturer of flexible integrated circuits, raised a $228.4M Series D led by Catalyst and UK Infrastructure Bank (FN)

Cortex, a startup developing an integrated mapping and ablation solution suite for the treatment of atrial fibrillation, raised a $90M round led by KKR and Hellman & Friedman (VC)

Igloo, a Singapore-based regional provider of insurtech solutions for companies, raised a $36M pre-Series C led by Eurazeo (FN)

Qortex, an NYC-based intelligent video analytics company, raised a $10M round led by GFT Ventures (FN)

Customer insights platform Yogi raised a $10M Series A led by Blueprint Equity (FN)

Travel platform service for overseas tourists in Japan WAmazing raised a $9.6M Series C from the Hyogo Chiiki Kasseika Fund, Chugin infinity fund NO.2, and ACT (BW)

OurSky, a developer platform for space data applications, raised a $9.5M seed round led by Upfront Ventures and Venrex Investment Management (FN)

Helix, a generative AI assistant for the private markets industry, raised a $6M seed+ round led by FINTOP Capital (VC)

Jiant, a ready-to-drink alcohol brand, raised a $6M Series A led by Natureza Growth Partners (VC)

Japanese revenue-based finance startup Yoii raised a $5.5M Series A led by Emellience Partners (BW)

Gacha Monsters, a Tokyo-based entertainment and gaming company, raised a $3M seed round led by Animoca Brands, Infinity Ventures Crypto, FBG, and Big Time Games (FN)

IPO / Direct Listings / Issuances / Block Trades

UK commodities broker, Marex Group, is seeking an IPO in New York at a valuation above $1.8B (BBG)

Debt

Petroleos Mexicanos refinanced ~$8.3B worth of debt from banks including Banco Bilbao Vizcaya Argentaria, JPMorgan Chase, Citigroup amid a cash crunch (BBG)

Lender Golub Capital Partners is leading a group of lenders to provide a debt package of over $2B to refinance all the existing debt of software firm Aptean (BBG)

Blackstone is leading a $1B private loan package for Permira’s buyout of German insurance broker Gossler, Gobert & Wolters from Hg (BBG)

Bankruptcy / Restructuring

SmileDirectClub, an orthodontics startup once valued at $8.9B, will wind down global operations after failing to find a buyer (WSJ)

Crypto Corner

Exec’s Picks

Ben Cohen covered Jensen Huang’s turbulent path to creating a trillion-dollar chip giant, and why the entrepreneur wouldn’t do it again.

Stripe Press republished Poor Charlie’s Almanack for free.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter