Together with

Good Morning,

Adobe’s Figma acquisition collapsed, Nikola founder Trevor Milton is headed to prison, Washington-area office default risk surpassed San Francisco’s, more Americans own stocks than ever before, the EU is targeting Musk’s X in an illegal content probe, and Binance has to pay the CFTC $2.7B.

Finding an affordable financial advisor that you can trust isn’t easy, but today’s sponsor, Money Pickle, will match you with a top financial professional through a process that’s easy, fast, and free. Check them out here.

Let’s dive in.

Before The Bell

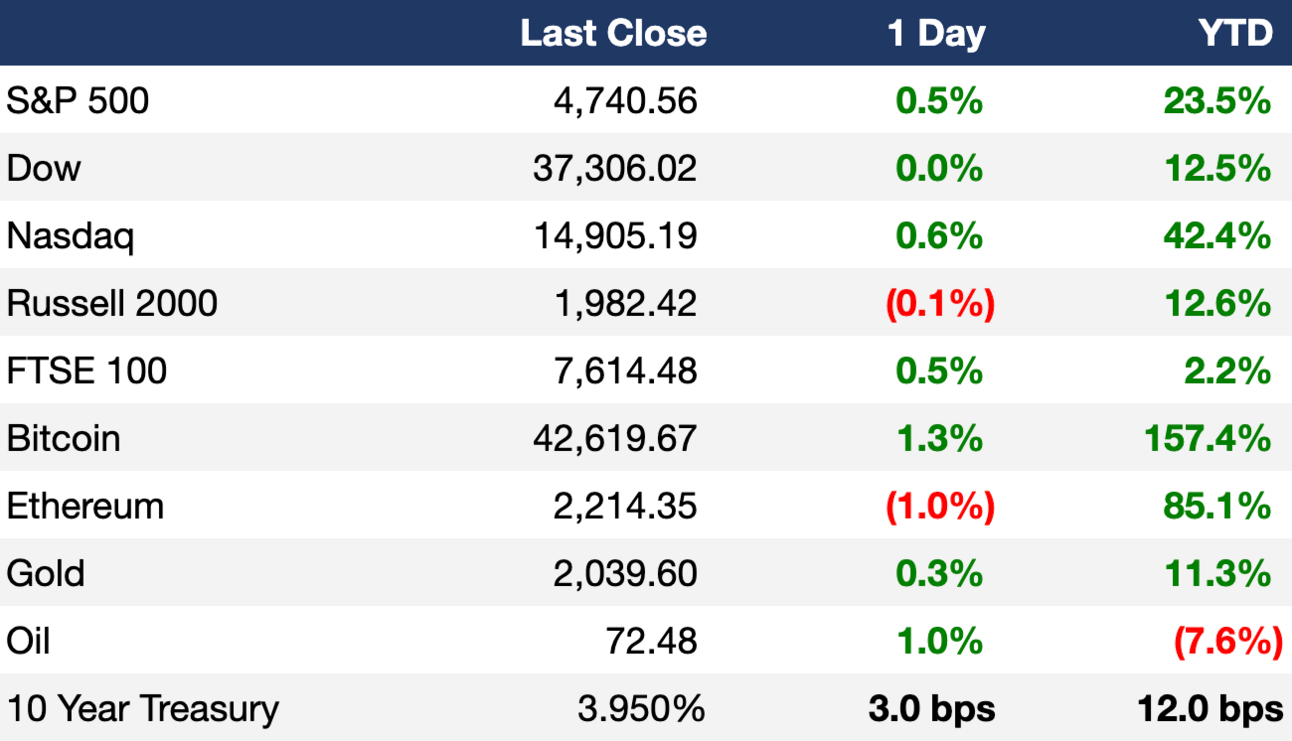

As of 12/18/2023 market close.

Markets

US stocks rose even as Fed officials attempted to rein in expectations for rate cuts

The Nasdaq led indices with a 0.63% gain

Asian stocks mostly fell due to worries about China’s economy

Earnings

What we're watching this week:

Today: FedEx, Accenture

Wednesday: General Mills, Micron, MillerKnoll, BlackBerry

Thursday: Nike, Carnival

Full calendar here

Headline Roundup

Washington-area office default risk surpasses San Francisco’s (BBG)

Nikola founder Trevon Milton sentences to four years in prison for fraud (CNBC)

Apple to halt watch sales as it prepares to comply with US import ban (WSJ)

Adobe has $6B for AI and buybacks after Figma deal collapses (BBG)

Swedes support Tesla mechanics’ strike (RT)

US vows Naval forces to protect ships passing through Suez Canal (WSJ)

Bond managers seek to win back clients sitting on $6T in funds (BBG)

More Americans than ever own stocks (WSJ)

EU targets Musk’s X in first illegal content probe (RT)

Former First Republic workers sue FDIC over withheld retirement pay (RT)

‘Underwater’ car loans signal US consumers slammed by high rates (BBG)

The Great American warehouse building boom is over (WSJ)

Czech Republic set to meet $13B deficit goal, finance chief says (BBG)

Volcano near Iceland’s Grindavik erupts after series of earthquakes (WSJ)

A Message From Money Pickle

Secure Your Wealth The Easy Way 💰

Finding a financial advisor you can trust at a price you can afford isn’t easy. Less than 32% of investors go to a financial advisor. Money Pickle matches you with a top financial professional through a process that’s easy, fast, and free.

Their network of advisors is ready to review your financial situation, offer valuable second opinions, and detail how they can provide further assistance. They can assist you in going over the basics of your investments, estate, or retirement planning, all through a single, convenient video call.

So whether you’re navigating significant life events, working to maintain/grow wealth, or want to explore your many options, let the advisors at Money Pickle help you achieve a better financial life.

Deal Flow

M&A / Investments

Adobe scrapped its $20B acquisition of cloud-based designer platform Figma due to regulatory issues in the UK and EU (BBG)

Abu Dhabi National Oil is preparing to increase its takeover offer for Covestro and offer concessions; the new proposal will value the German plastics and chemicals maker at ~$12.3B (BBG)

Japan’s Nippon Steel will acquire United States Steel for $14.1B to create the world’s second-largest steel company (BBG)

French billionaire Xavier Niel’s telecoms company Iliad proposed merging its Italian operations with Vodafone Italia in a cash-and-stock deal that values Vodafone Italia at $11.4B (FT)

British landlord LondonMetric Property is in talks to merge with London REIT LXI to create an $8.1B property company (FT)

A consortium backed by Clearlake Capital and Insight Partners agreed to acquire software developer Alteryx in a deal that values the company at $4.4B, including debt (BBG)

American conglomerate Koch Industries will acquire chemicals company OCI’s US crop nutrient business for $3.6B (BBG)

Buyout firm EQT will acquire medical device component manufacturer Zeus in an estimated $3.4B deal (BBG)

Door maker Masonite International will acquire PGT Innovations, a manufacturer and supplier of windows and doors, for $3B in a bid to expand its business (RT)

IBM will acquire German tech group Software AG’s Super iPaaS, a business that helps companies integrate applications and data, for $2.3B (FT)

Abu Dhabi-backed fund CYVN Holdings invested $2.2B in China’s Nio for a 20.1% stake in the EV maker (BBG)

Canada's Brookfield is seeking to sell renewable assets worth $1.6B, including debt, owned by its company Saeta Yield (RT)

US restaurant chain Chuck E. Cheese is exploring a sale amid takeover interest; the company could fetch well over $1B in a sale (RT)

PE firm TPG will acquire a 75% stake in a portfolio of warehouse properties around Toronto for $750M from Oxford Properties Group (BBG)

Mitsubishi UFJ Trust and Banking will acquire Australian data manager Link Administration Holdings in a $744M deal (BBG)

New Hope Liuhe, China’s top animal feed maker and leading meat producer, will sell controlling stakes worth $590M in two core operations to raise cash after heavy losses (BBG)

AssetMark Financial Holdings’ Chinese controlling shareholder, Huatai Securities, is exploring options for the business including a potential sale (BBG)

VC

UK power supplier Octopus Energy raised $800M at a $7.8B valuation in an additional funding round led by Origin Energy and Tokyo Gas (BW)

Saudi BNPL platform Tamara raised a $340M Series C at a $1B valuation led by SNB Capital and Sanabil Investments (TC)

Guam digital infrastructure provider GTA received a $200M investment from Stonepeak (BW)

French revenue-based financing platform Unlimitd received a $109.2M investment from Absolute Capital Partners (EU)

Media monitoring startup Meltwater received a $65M investment from Verdane (TC)

4D cardiac imaging and navigation platform LUMA Vision raised a $22M Series A-3 led by EQT Lifesciences, ABV Uni Fund, imec.xpand, and more (BW)

Plant-based materials startup Lingrove raised a $10M Series B led by Lewis & Clark Agrifood and Diamond Edge Ventures (BW)

CurbWaste, a provider of a waste management payments software platform, raised a $10M Series A led by Flourish Ventures (FN)

KAID Health, a medical AI startup, raised $9M in funding led by Activate Venture Partners, Martinson Ventures, and others (FN)

Strike Graph, a TrustOps platform for operating and measuring security and compliance, raised an $8.5M round led by BAMCAP (FN)

Aether Fuels, a climate technology company, raised an $8.5M pre-Series A led by JetBlue Ventures, TechEnergy Ventures, Doral Energy Tech Ventures, and others (FN)

Metagood, a blockchain technology and digital assets company, raised a $5M seed round led by Sora Ventures (FN)

AI-empathy startup Shelpful raised a $3M seed round led by Apollo Projects (VC)

Crowda, an AI-powered platform connecting investors with real estate developers, extended its Pre-Seed funding round to $2M led by Land Services Group (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Morgan Stanley is looking to sell a $350M loan it made to Saudi Arabia’s PIF (BBG)

Bankruptcy / Restructuring

Farfetch secured a lifeline from Korean e-commerce company Coupang, which agreed to lend $500M, buy the assets and delist the troubled fashion platform’s shares (BBG)

Insurance software firm and short seller target Ebix filed for bankruptcy after struggling with higher rates and looming debt payments (BBG)

Amazon is in talks with Diamond Sports Group and some of its creditors to invest in the bankrupt regional-sports broadcaster and start a streaming partnership (BBG)

Fundraising

Merchant bank BDT & MSD Partners raised $3.2B for a new real estate credit fund (BBG)

Saudi PE firm Jadwa Investment is seeking to raise $530M for a new fund to boost dealmaking in fast-growing Middle Eastern oil exporting countries (BBG)

Argonaut Private Equity raised $500M for its Argonaut Private Equity Fund V to back industrial businesses in underserved parts of the US (WSJ)

Tech investor DCVC is raising a $300M venture fund that will focus on Series B climate startups (AX)

Crypto Corner

Exec’s Picks

Josh Brown wrote about five ways investors lost money in 2023.

Axios’s Kate Marino explained how falling yields have Wall Street bracing for a refinancing bonanza.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter