Together with

Good Morning,

A Colorado court disqualified Trump from its 2024 ballot, Google owes $700M in a Play store settlement, Citi is facing a #MeToo claim, the IRS may be forgiving $1B in taxpayer penalties, Brazil’s credit rating was raised by the S&P, and shippers are avoiding the Red Sea.

Looking to diversify your portfolio outside of stocks and bonds? Today’s sponsor, Yieldstreet, lets investors invest in real estate, art, venture capital, and more, all on one platform. Check them out here.

Let’s dive in.

Before The Bell

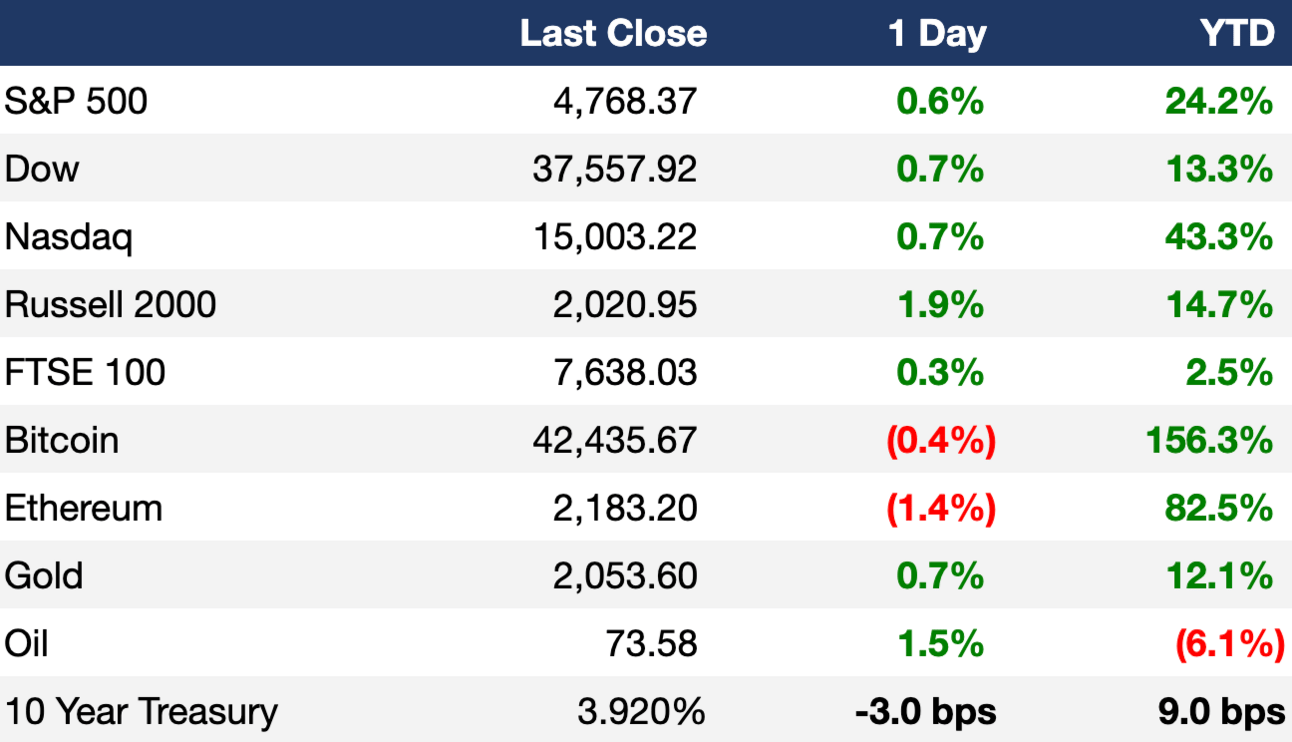

As of 12/19/2023 market close.

Markets

US stocks rose thanks to the Fed’s recent dovish shift on rates

The Dow led indices with a 0.68% gain

European stocks rose after comments from European Central Bank officials and data encouraged optimism for rate cuts

Oil futures continue to climb due to Red Sea shipping risks

Earnings

Headline Roundup

Trump disqualified from 2024 ballot in Colorado, court says (BBG)

Google to pay $700M in Play store settlement (WSJ)

Citi suit raises #MeToo claims at Wall Street’s top levels (BBG)

IRS zaps nearly $1B in penalties for taxpayers (WSJ)

Brazil’s credit rating raised by S&P after overhaul of tax code (BBG)

The office market had it hard in 2023. Next year looks worse (WSJ)

Investment Firm H.I.G. scraps plans for future standalone tech funds (BBG)

Shippers have already diverted about 35B in cargo from the Red Sea amid fears of attacks (CNBC)

Singapore tightens vape enforcement on travelers amid global crackdown (BBG)

Tesla wannabes are running out of road (WSJ)

Tougher French immigration bill passes, Macron’s parliament majority wobbles (RT)

Private shale drillers set to cut spending after boom in 2023 (BBG)

U.S. Bank fined $36M for freezing unemployment debit cards during COVID-19 pandemic (CNBC)

Comcast says data of 36M accounts was compromised in breach (WSJ)

A Message From Yieldstreet

Invest outside of Stocks

The team at Yieldstreet is pulling back the curtain on the investing process. Finally, you can participate in wealth creation opportunities that were typically off-limits to non-institutional investors. Meet the new way to invest beyond the stock market. Find real estate, art, legal finance, venture capital, and more — without needing to take out a new mortgage to afford them. And, all on one platform.

Target annual yields typically range from 3%-18%. Discover why over 350k members have invested over $2B with Yieldstreet.

Deal Flow

M&A / Investments

German national railway company Deutsche Bahn began the sale process for its DB Schenker logistics unit, which could be worth as much as $21.3B (BBG)

Spain will acquire a stake in Telefonica worth as much as $2.2B through its investment vehicle Sepi as Saudi Arabia builds up its own position in the company (BBG)

The State of Berlin will acquire state-owned Swedish national power company Vattenfall’s district heating business in Berlin for $1.8B (RT)

European retailers Intermarche and Auchan Retail will acquire hypermarket and supermarket stores valued at $1.5B from Casino Guichard Perrachon, which needs cash as it undergoes a debt restructuring (BBG)

Carlyle Group and Insight Partners acquired risk-management software and services provider Exiger for ~$1.2B (WSJ)

Gina Rinehart and Chile’s SQM agreed to jointly acquire Western Australian lithium prospect Azure Minerals for $1.1B after Rinehart disrupted an earlier bid for the business in October (FT)

Blackstone will sell its entire $833M 23.6% stake in India's largest real estate investment trust Embassy Office Parks (RT)

Kodiak Gas Services agreed to buy CSI Compressco in an $854M all-stock deal (MW)

Spanish renewable power company Acciona Energias is looking to sell a portfolio of solar and wind power assets in Spain worth as much as $547M (RT)

VC

UK-based consumer lending fintech company Updraft raised a $346M debt / equity deal led by Jefferies and Santander (EU)

Lightmatter, a startup designing photonic chips to speed up computing, raised a $155M Series C-2 at a $1.2B+ valuation led by GV and Viking Global Investors (BW)

3D metal printing startup Seurat Technologies raised a $99M Series C led by NVIDIA (PRN)

Employee-centric healthcare network solution Employer Direct Healthcare raised $92M in a secondary investment at a $1B valuation led by Insight Partners (PRN)

Lassen Therapeutics, a clinical-stage biotech company developing antibody therapeutics for fibrotic diseases, raised an $85M Series B led by Frazier Life Sciences and Longitude Capital (BW)

Cybersecurity training startup SimSpace raised a $45M round led by L2 Point (TC)

NewLeaf Symbiotics, an agricultural biotech startup focused on the discovery, production, and commercialization of products containing microbes, raised a $45M Series D led by Gullspång Re:food (PRN)

Atavistik Bio, a biotech company discovering the next generation of precision allosteric therapeutics inspired by the body’s natural regulators, raised a $40M funding round led by The Column Group, Lux Capital, and Nextech Invest (AB)

Anti-ransomware startup Halcyon raised a $40M Series B led by Bain Capital Ventures (TC)

Unnatural Products, a biotech startup combining AI and chemistry to create targeted therapeutics, raised a $32M Series A led by Merck Global Health Innovation Fund (FN)

Sweetch Energy, a renewable energy company specializing in osmotic energy, raised a $27.5M Series A led by Révolution Environnementale et Solidaire (FN)

Dog cancer treatment startup ImpriMed raised a $23M Series A led by SoftBank Ventures Asia (TC)

Agtonomy, a startup specializing in autonomous and AI solutions for agriculture, raised a $22.5M Series A led by Momenta (FN)

ScaleOps, a startup automating Kubernetes configurations, raised a $21.5M Series A led by Lightspeed Venture Partners (TC)

TuMeke, a computer vision platform that automatically assesses injury risk in manufacturing facilities, raised a $10M Series A led by Intel Capital (PRN)

Salt Labs, a loyalty and payments technology company, raised $8M in funding from Third Prime (PRN)

IPO / Direct Listings / Issuances / Block Trades

Lendbuzz, a US auto loans platform using AI to offer auto loans to customers without credit history, hired investment banks for an IPO that could value the fintech at over $2B (RT)

ServiceTitan, a startup that makes software to help contract workers manage their businesses, revived preparation for an IPO in 2024 (RT)

Debt

Chemicals producer BASF is raising $1.5B through privately-placed debt (BBG)

Engineering firm Robert Bosch is raising $1.2B through a private debt market that caters to blue-chip companies (BBG)

High-end fitness club chain Equinox is looking to raise over $1B through a mix of new debt and preferred equity to refinance $1.5B of debt coming due early next year (WSJ)

India’s Vedanta approved raising as much as $409M in the local bond market (BBG)

Fundraising

Technology-focused middle market PE firm Clearhaven Partners raised over $580M for its Clearhaven Fund II (WSJ)

Partech, a Paris, France-based tech investment firm, launched a $395M venture fund (FN)

Pivotal Life Sciences, a global investment firm dedicated to investing in companies involved in healthcare innovation, closed its Pivotal bioVenture Partners Fund II at $389M (FN)

Turnspire Capital Partners, an NYC-based PE firm, closed its Turnspire Value Fund II at $275M (FN)

Crypto Corner

Exec’s Picks

Padel has taken the sports world by storm over the last few years, and TWOTWO offers some of the best Padel gear on the market. If you’re trying to cop a racket, or other merch like hats, balls, and hoodies, check out TWOTWO here, and get 10% off using code “Litquidity10” at checkout.

Tyler Cowen explained why the French economy may be underrated.

Nick Maggiulli wrote about the problem with course-selling “gurus” who sell the thing without doing the thing.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter