Together with

Good Morning,

US home prices hit an all-time high, USC and UCLA are joining the Big Ten, economic growth is finally hitting China again, Ketanji Brown Jackson was sworn in to the Supreme Court, and FTX passed on a deal to acquire Celsius.

If you are tired of bad economic "forecasts" and want to see where real traders are placing their bets on everything from interest rates to oil prices, check out our new newsletter, Eight Ball.

Happy 4th of July to the loyal and ever-growing Exec Sum fam. We're gonna be throwing back domestic beers all weekend for 'Murica and will see y'all on Tuesday. 🦅🇺🇸🍻 In case y'all missed your chance and want to cop some epic patriotic gear for next year, check out our Long USA / Short Russia tee here.

Let's dive in.

Before The Bell

As of 6/30/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

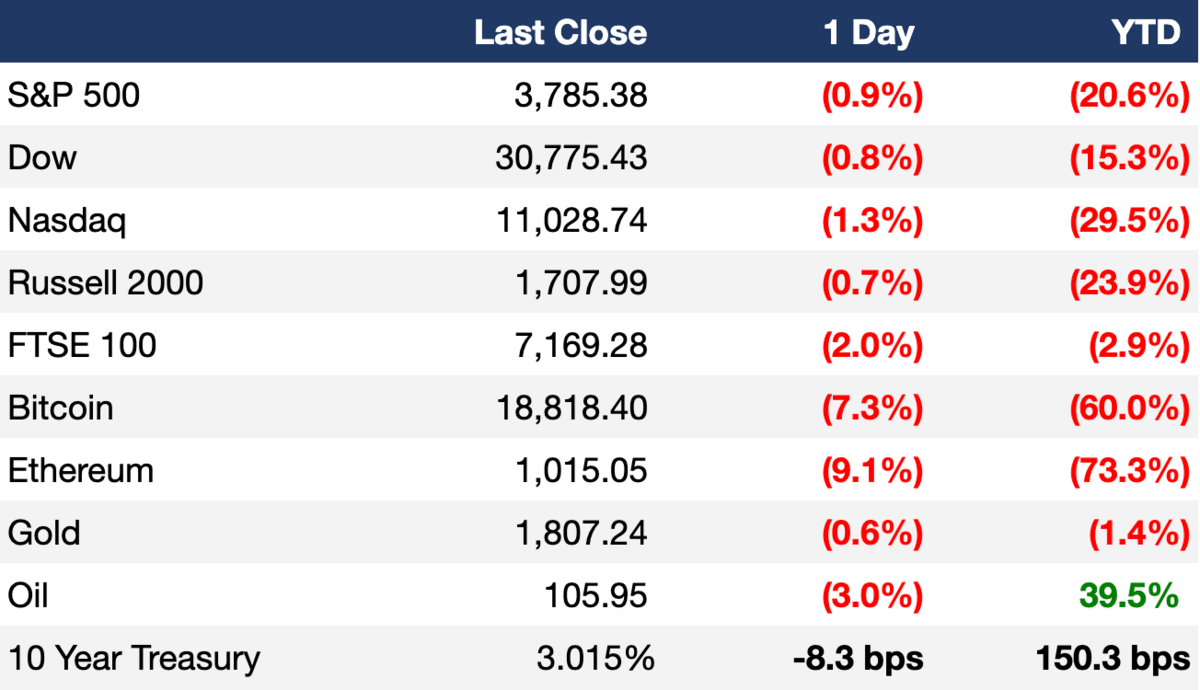

Thursday saw stocks close in the red once again, concluding the S&P 500’s worst first-half performance since 1970

Data released Thursday showed US consumer spending rose at its slowest pace yet this year in May as shoppers struggled with high inflation

Oil prices fell as OPEC confirmed that it would stick with its planned output increases in August

Bitcoin fell below $19k, having lost more than a third of its market value in the past month and 60% year-to-date

Earnings

Walgreens Boots Alliance’s earnings fell more than 73% in Q3 due to a $683M legal settlement, decreased demand for Covid vaccines, and increased internal investment; their stock fell 7.27% on the day (MW)

Micron Technologies reported a strong rise in earnings for its latest quarter but issued revenue projections for the current quarter that were lower than expected, causing the stock to fall 1.32% (WSJ)

Full calendar here

Headline Roundup

The consumer price index showed inflation running at an 8.6% annual rate in May (AX)

A new Federal Reserve gauge showed moderate but rising signs of distress in trading of high-quality corporate bonds (WSJ)

Mortgage rates dropped to 5.70% after three consecutive weeks of increases (WSJ)

The median listing price for US homes hit a record high $450K in June (CNBC)

The FinTech IPO Index is down 42.8% YTD at the end of Q2 (PYMNT)

UBS will pay $25M to settle SEC fraud charges related to a complex options-trading strategy (WSJ)

Economic activity in China expanded in June after three straight months of contraction as Covid-19 restrictions eased (WSJ)

The US Department of Justice sued in federal court to block Booz Allen Hamilton's acquisition of EverWatch over antitrust concerns (RT)

Ketanji Brown Jackson was sworn in as the US Supreme Court's first Black woman (AP)

UK companies that went public via SPAC listings in the past two years have lost an average 61% of their value (FT)

USC and UCLA will leave the Pac-12 Conference and join the Big Ten by 2024 (BR)

A Message From Eight Ball

A Macro Newsletter with Skin in the Game

In Skin in the Game, Nassim Taleb said, "Don’t tell me what you think, tell me what you have in your portfolio."

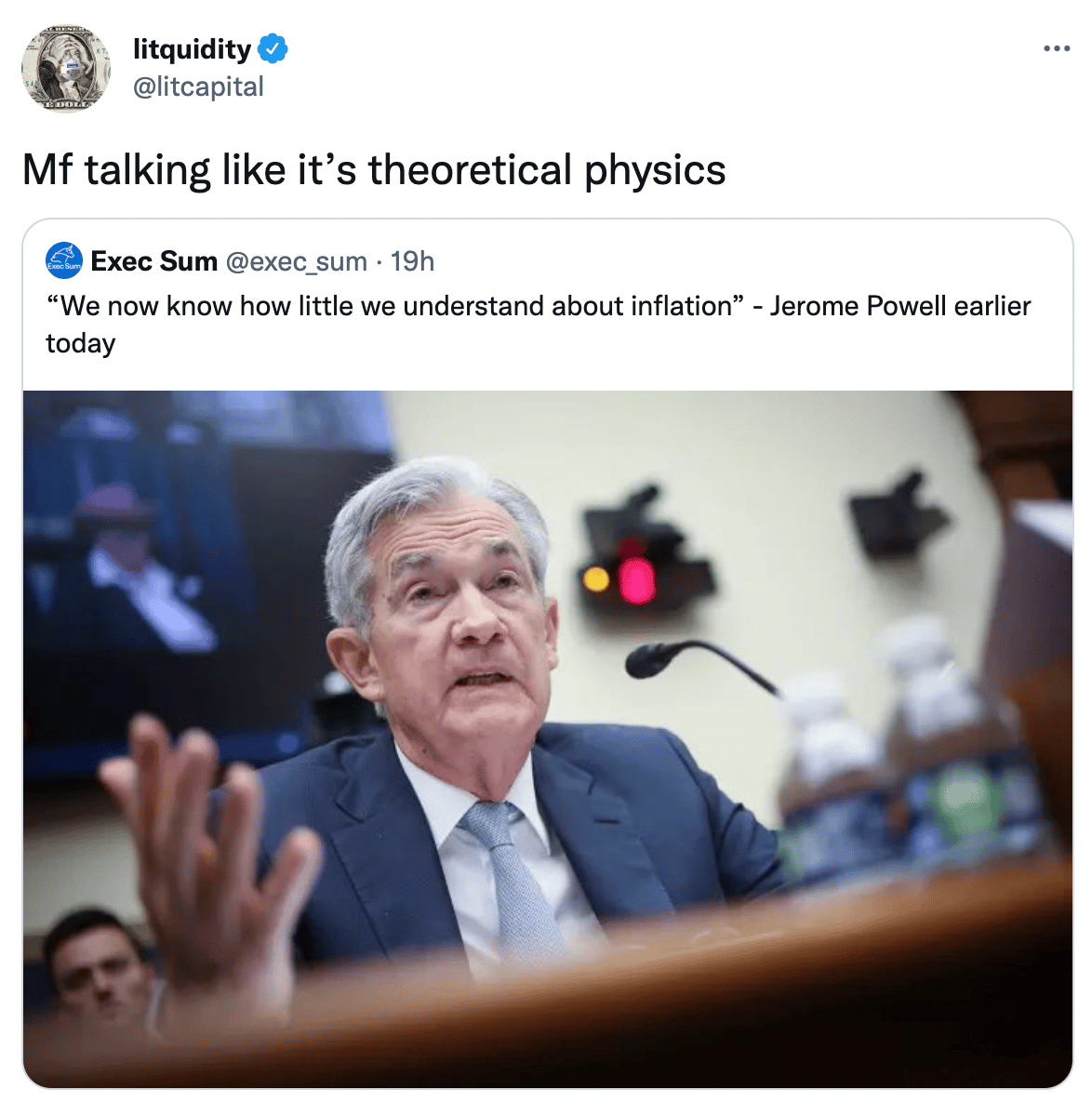

Every day, economists and talking heads give their predictions about the economy, interest rates, and the stock market. "We are going into a recession!" "Oil is going to $150 per barrel!" And every day, most of these predictions are wrong. The problem is that none of these economists put their money where their mouth is, so their accuracy doesn't matter.

We launched Eight Ball to solve this problem. With our new newsletter, Eight Ball, we use data provided by real-time prediction markets to see where investors are forecasting interest rates, oil prices, GDP growth, and more.

Our forecasts are determined by investors who put their real money on the line, not media personalities looking for air time.

If you want economic forecasts that have "skin in the game," subscribe to Eight Ball here!

Deal Flow

M&A / Investments

Philippines telecommunications giant Globe Telecom entered exclusive talks with bidders for its telecommunication tower portfolio in a deal that could be valued at ~$1.5B; a consortium comprised of Stonepeak Partners and local power retailer Manila Electric Co. and a party consisting of buyout firm Partners Group and Aboitiz Group are negotiating for separate parts of the portfolio (BBG)

A consortium led by asset management firm HRL Morrison & Co. agreed to acquire US fiber infrastructure provider FiberLight at a ~$1B valuation (BBG)

PE firm Permira is considering a sale of fund administration platform Alter Domus, which may be valued at "several billion dollars" (BBG)

Indian eyewear retailer Lenskart will buy a majority stake in Japanese online eyewear retailer Owndays at a ~$400M valuation (BBG)

Bank of Ayudhya, the Thai unit of Japanese bank Mitsubishi UFJ, will acquire a 99% stake in Nomura's Thai securities unit for $156M (BBG)

British consumer goods company Unilever sold its Ben & Jerry's ice cream business in Israel to its local licensee for an undisclosed amount (RT)

Cryptocurrency exchange FTX is nearing an agreement to buy troubled crypto trading platform BlockFi for $25M, a 99% discount to its $3B Series D valuation (BBG)

Equity service platform Carta acquired Vauban, an online platform that helps investors back private companies from end to end (TC)

VC

OppZo, an AI-based fintech unlocking access to capital for small and medium-sized businesses, raised over $260M in debt and equity funding led by Arcadia Fund (PRN)

Twelve, a startup transforming carbon into products usually made from fossil fuels, raised a $180M Series B led by DCVC (TC)

Biotech startup Evolved By Nature raised a $120M Series C led by Teachers' Venture Growth and Senator Investment Group (PRN)

Cancer metabolism company Faeth Therapeutics raised a $47M Series A led by S2G Ventures (PRN)

Indian agricommerce company WayCool raised a $40M funding round led by 57 Stars (PRN)

Snowplow, a platform designed to create data for AI and business intelligence applications, raised a $40M Series B led by NEA, Snowplow investors, Atlantic Bridge and MMC (TC)

Brazilian motorcycle rental startup Mottu raised a $40M Series B: $30M in equity funding co-led by Base Partners and Crankstart, and $10M in debt funding from Verde Asset (TC)

Modular, an AI development platform, raised a $30M seed round led by GV (TC)

Personal income tax platform April raised a $30M Series A led by Treasury (PRN)

Retail Rocket, a retention management platform for brands, raised a $24M Series A led by Flintera; they also acquired SailPlay, a startup developing software for retailers (TC)

TaskHuman, a professional development platform focused on coaching, raised a $20M Series B led by Madrona (TC)

Analytical marketing platform Black Swan Data raised an $18.5M funding round led by Oxx (TC)

Fleetzero, a startup seeking to power cargo ships with electricity, raised a $15.5M funding round led by Breakthrough Energy Ventures (TC)

Stake, a startup that provides cash back and banking services to renters, raised a $12M Series A led by RET Ventures ESG Fund (TC)

HomeLister, a digital brokerage and real estate site that gives homeowners a way to list and sell their properties online, raised a $10M Series A co-led by M13 and Homebrew (TC)

Mike Tyson's cannabis brand Tyson 2.0 raised a $9M Series A led by JW Asset Management (PRN)

Cybersecurity company Inspectiv raised an $8.6M Series A led by StepStone Group (PRN)

Foresite Technology Solutions, a technology company that optimizes construction processes for builders, raised $8M in a funding round led by Gallant Capital (PRN)

MoHash, a DeFi protocol providing access to global capital and liquidity, raised a $6M seed round co-led by Sequoia India and Southeast Asia and Quona Capital (TC)

VistaPath, a leading provider of AI-based pathology processing platforms, raised a $4M seed round led by Moxxie Ventures (PRN)

Focal Point, a data management platform, raised a $3M seed round from Susa Ventures, Amplo, GoPoint Ventures, and others (TC)

Sava, a spend-management platform for African businesses, raised a $2M pre-seed round from Quona Capital, Breega, CRE Ventures and others (TC)

IPO / Direct Listings / Issuances / Block Trades

Pharmaceutical company Novartis is leaning towards an IPO to spinoff its $25B generic-drug unit Sandoz amid unfriendly market conditions for LBOs (BBG)

World’s largest travel retailer China Tourism Group Duty Free will relaunch a planned Hong Kong IPO that could raise up to $3B (BBG)

IBS Software, a SaaS solutions provider to the travel industry globally, is considering an IPO that could value it at $2B+ (BBG)

Nano Labs, a chipmaker specializing in integrated circuits for cryptocurrency mining, intends to raise ~$37M in a US IPO (SA)

Short video app Triller filed for an IPO days after ending a $5B merger plan with video advertising software provider SeaChange International (YHOO)

SPAC

Enjoy Technology, a retail startup founded by former Apple executive Ron Johnson, filed for bankruptcy less than a year after going public through a SPAC merger (YHOO)

Fundraising

Venture firm IDG Capital is poised to raise ~$900M for a new fund focusing on investments in China (BBG)

Peterson Ventures, a pre-Series A VC firm that invests across SaaS and digital commerce, raised over $140M in new capital for its Fund IV and Opportunity Fund I (PRN)

MAYA Capital raised a second fund of $100M committed to early-stage Latin American startups (TC)

Crypto Corner

The EU passed landmark legislation to regulate crypto assets and service providers throughout the bloc's 27 member nations (CD)

Crypto exchange platform FTX passed on a deal to acquire cryptocurrency loan company Celsius due to a $2B hole in their balance sheet (TB)

The FBI added ‘Cryptoqueen’ Dr. Ruja Ignatova to its "Ten Most Wanted" fugitives list after an alleged $4B OneCoin fraud (CNBC)

El Salvador purchased 80 BTC at $19k each (TB)

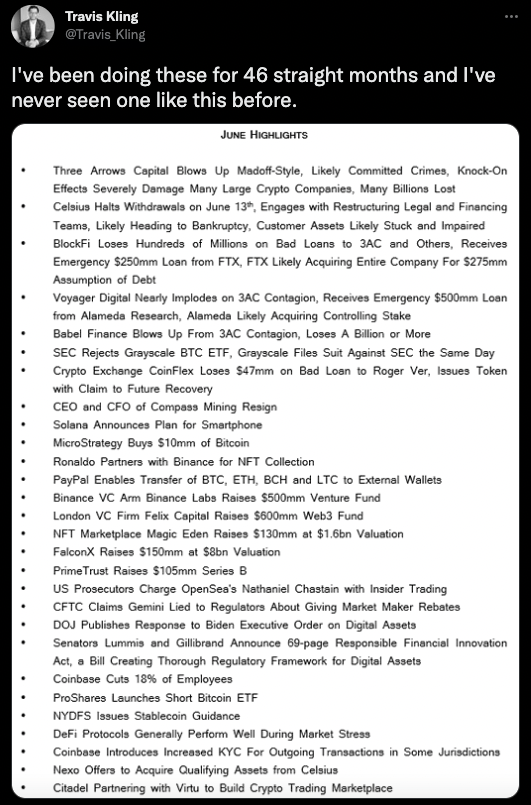

See below for a roundup of a wild June for crypto, compiled by Travis Kling, a former HF PM turned crypto fund manager:

Exec's Picks

If you are active on Twitter, you may have noticed RadioShack's verified Twitter account posting unhinged tweet after unhinged tweet. The reason? RadioShack is now a cryptocurrency platform. Sort of. The New York Post's Brittany Miller explained what's going on with the zombie retailer's Twitter account here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below: