Good Morning,

The euro and the US dollar are at parity for the first time in 20 years, Twitter sued Musk, the White House warned that today's CPI will run hot, S&P 500 companies paid out record-high dividends, Google is slowing hiring for the rest of the year, Croatia will adopt the euro common currency, and British lawmakers approved a 25% windfall tax on oil & gas producers in the North Sea.

Quick reminder that we've got a dope referral program where you can earn free merch by referring friends, family, and colleagues to our newsletter, which is read by over 150k investors from C-suite execs to junior analysts on Wall Street. You can find your unique code at the bottom of every email!

Let's dive in.

Before The Bell

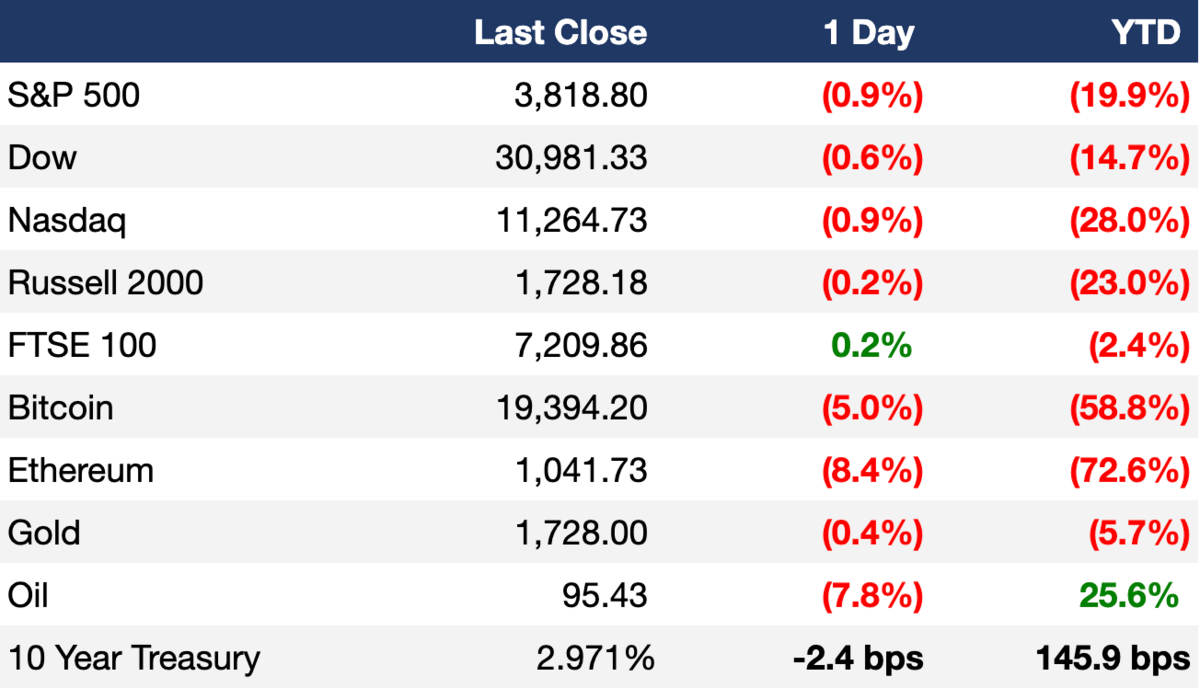

As of 7/12/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks fell as fears of a recession grow and investors predict bad news from June’s inflation report

The S&P 500 fell for its third consecutive session

Oil dropped nearly 8% to its lowest price since April

The Bureau of Labor Statistic’s June CPI report will be released today at 8:30am EST

Earnings

PepsiCo reported better-than-expected sales and profits for Q2 while raising its revenue outlook for the rest of the year (CNBC)

What we’re watching this week:

Today: Delta Air Lines

Thursday: JPMorgan Chase, Morgan Stanley, TSMC

Friday: UnitedHealth Group, WellsFargo, Citibank, Progressive, BlackRock

Full calendar here

Headline Roundup

The euro slid below the US dollar on Tuesday for the first time in 20 years (CNBC)

Twitter sued Elon Musk over his attempt to walk away from his $44B takeover bid (WSJ)

Musk's debt bankers would avoid steep losses if the Twitter deal fails (BBG)

The White House warned that today's CPI inflation number release will be high and not reflect the recent fall in energy prices (AX)

Goldman Sachs hired Alphabet tech incubator CEO Jared Cohen to lead a new innovation group (CNBC)

S&P 500 companies paid out a record-high $140.6B in dividends in Q2 (WSJ)

Netflix is seeking to renegotiate with major entertainment studios to display their programs on an ad-supported version of the streaming platform (WSJ)

Union organizing efforts in the US rose to their highest level in six years during the first half of 2022 (WSJ)

At least ten Chinese firms announced Swiss IPO plans in the past four months, as they attempt to capitalize on the region's political stability (BBG)

The EU accepted Croatia to become their 20th eurozone/euro common currency member (RT)

British lawmakers approved a 25% windfall tax on oil and gas producers in the British North Sea (RT)

Peloton will outsource all of its manufacturing as part of its turnaround efforts (CNBC)

Delivery startup GoPuff laid off 10% of its ~15k member global workforce and closed 76 US warehouses as it attempts to gain profitability (CNBC)

Lego will close its business in Russia indefinitely (RT)

A Message From Masterworks

Investing Lessons of the “Crypto Corporate Raiders”

“And another one gone. Another one bites the dust…” so goes the Queen classic, and pretty much every crypto related headline nowadays. This latest “winter” is more like an Ice Age. So far it's claimed $2.05 trillion in market value, more than 2130 jobs, and at least 4 major firms. Ah, music to the ears… well, at least to some.

Like “crypto white knight” Sam Bankman-Fried, whose FTX stands to acquire BlockFi at a 95% discount. Or Goldman Sachs, who is reportedly putting together an investment group to acquire $2 billion of distressed assets from crypto-lender Celsius.

Eat your heart out, Carl Icahn.

Here’s the takeaway:

Be ready to respond to changing market conditions

Don't put all your eggs in one basket

That's why I’ve been diversifying my portfolio with real assets like fine art. It's been a great hedge – appreciating over 33% annually the last time inflation was this high – outpacing gold and stocks. And as the S&P crumbled 21% in 1H 2022, the art market was up 25%.

The best part is you no longer have to rock a contrast collar and button suspenders to get into this market. Masterworks is the blue-chip art investment platform that's delivered an average 26.7% net IRR across 5 sales.

If you’re interested in diversifying into art, you need to check out Masterworks. ExecSum readers can use this special link to get VIP access.

See important Regulation A disclosures.

Deal Flow

M&A / Investments

Australia & New Zealand Banking Group is in advanced talks to buy accounting software business MYOB Group from KKR at a $2.7B+ valuation (BBG)

PE firm CBC Group is considering taking cosmetic pharmaceutical company Hugel private; the company currently has a market cap of ~$1.1B (BBG)

Abu Dhabi's state-owned wealth fund Mubadala is in talks to acquire asset management firm Fortress from Japanese financial group SoftBank at a $1B+ valuation (BBG)

Telecommunications company Spark New Zealand is selling a 70% stake in its mobile phone tower business TowerCo to Canadian pension fund Ontario Teachers’ Pension Plan Board in a ~$550M deal (BBG)

Norwegian state-owned oil & gas producer Equinor will acquire US-based battery storage developer East Point Energy (CNBC)

AI software company SymphonyAI agreed to buy defense and aerospace company BAE Systems' financial crime detection business NetReveal (BBG)

Spotify will acquire music recognition and Wordle-inspired trivia game Heardle (CNBC)

VC

European insurance tech startup Wefox raised a $400M Series D at a $4.5B valuation led by Mubadala Investment Company (TC)

LianLian DigiTech, a payment service provider in China rivaling Jack Ma's Ant Group, is in talks to raise as much as $223M at a $3B valuation ahead of a planned Hong Kong IPO next year (BBG)

SingleStore, a provider of databases for cloud and on-premises apps and analytical systems, raised a $116M Series F extension led by Goldman Sachs (TC)

Digital asset management platform Gnosis Safe raised $100M in a funding round led by 1kx (CN)

XPENG Robotics, the affiliate company of Chinese EV maker XPeng, raised a $100M Series A led by IDG Capital (BW)

Tecton, a feature platform for machine learning, raised a $100M Series C led by Kleiner Perkins (TC)

AI21 Labs, an AI platform that understands and generates text, raised a $64M Series B led by Ahren Innovation Capital Fund (TC)

Scale Computing, an edge computing computer management platform, raised a $55M funding round led by Morgan Stanley Expansion Capital (TC)

Circ, an apparel recycling startup, raised a $30M Series B led by Breakthrough Energy Ventures (AX)

May Mobility, an autonomous ride-hail and shuttle startup, raised a $28M Series C extension from SoftBank, State Farm Ventures, and others (TC)

FORT Robotics, a communications platform for smart machines, raised a $25M Series B led by Tiger Global (PRN)

Milk Moovement, a cloud-based dairy supply chain software company, raised a $20M Series A led by VMG Catalyst (PRN)

Arist, a workflow-focused behavioral-changing educational platform, raised a $12M Series A led by PeakSpan Capital (Arist)

Intellect, a mental health startup, raised a $10M Series A extension led by Tiger Global (TC)

WeMoney, a personal finance management app, raised a $7M Series A led by BetterLabs Ventures and Full Circle Ventures (SN)

Cloudprinter.com, a global print API platform, raised a $7M seed round led by Capital Mills (PRN)

Posterity Health, a digital platform that offers guidance to address male fertility needs, raised a $6M seed round led by Distributed Ventures (TC)

Quicklly, a marketplace for South Asian groceries and meal delivery, raised a $4M seed round led by JAM Fund, Great North Ventures, and others (PRN)

VECKTA Corporation, an online energy marketplace that connects commercial and industrial energy users with services and equipment suppliers, raised a $3.3M seed round led by VoLo Earth Ventures (PRN)

IPO / Direct Listings / Issuances / Block Trades

Bangkok-based insurance firm Thai Life Insurance raised ~$1B in the largest IPO for a Thai firm in over a year (BBG)

SPAC

Entertainment development firm Falcon's Beyond agreed to merge with Fast Acquisition Corp. II in a ~$1B deal (RT)

Bankruptcy / Restructuring

Liquidators kicked off a sale process for the owner of 250-year-old British luxury menswear retailer Gieves & Hawkes (BBG)

Fundraising

Technology-focused buyout firm Francisco Partners raised nearly $17B for two new funds: $13.5B for Francisco Partners VII LP, and $3.3B for Francisco Partners Agility III LP, which targets smaller investments (WSJ)

Lightspeed Venture Partners raised $7B+ across early and growth-stage funds - $1.98B for Fund XIV, $2.26B for Select Fund V, $2.36B for Opportunity Fund II and $500M for LSIP Fund IV (BW)

Real estate PE firm SANTÉ Realty Investments raised $570M in capital formation for its Ground Lease Fund (PRN)

Crypto Corner

Embattled crypto lender Celsius fully paid off its debt to DeFi protocol Aave and moved $418M 'stETH' stack to an unknown wallet (CD)

California is investigating several US-based crypto lenders that have suspended customer withdrawals and transfers to see if they violated their laws (CD)

Founders of bankrupt crypto hedge fund Three Arrows Capital are missing and are supposedly on the run from creditors (CNBC)

Russia's central bank said there is no place for stablecoins in the Russian economy and is only open to a digital ruble (CN)

Exec's Picks

NASA’s James Webb Space Telescope delivered the deepest and sharpest infrared image of the distant universe so far. Really wild stuff, check it out here

M1 Finance recently released its "Owner's Rewards Card" which is giving up to 10% cash back on purchases and subscriptions to companies such as Netflix, Spotify, Lululemon, Tesla, and more. You can check it out and apply here

With the anticipation of a hot inflation reading, it's looking like a recession is around the corner. You can at least ride it out fashionably with this "Recession Indicator" dad hat lmaoo

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.