Together with

Good morning,

PPI came in hotter-than-expected with YoY price increases of 9.6% causing stocks to fall.

Congress passed $2.5 trillion debt ceiling increase because, as Joe Biden said last week, "the US always pays its debts". The not-so-fine print being that it does so by printing more money and increasing the amount of debt to pay off the existing debt (although this is nothing new under this administration).

Let's dive in.

Before The Bell

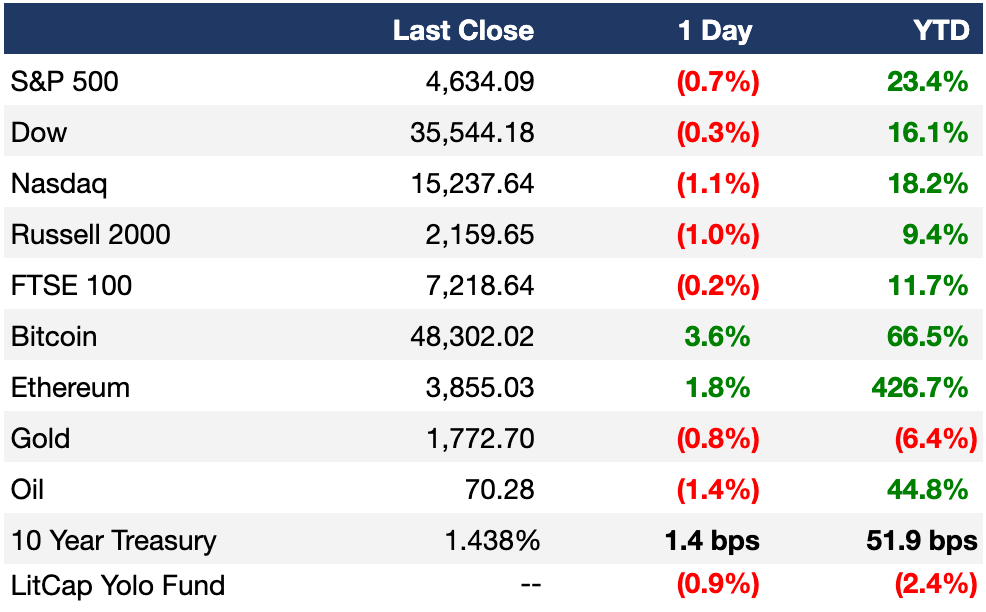

As of 12/14/2021 market close.

To see the LitCap Yolo Fund's portfolio holdings, download the Iris Social Stock app here and give Litquidity a follow. If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

US stocks took a hit yesterday with tech leading the way after the new inflation data showed a continued sharp rise in prices

The producer price index and core PPI hit the highest levels on record, increasing 9.6% and 6.9% YoY, respectively (nice)

Today, the central bank will release a statement with quarterly projections for the economy, inflation, and interest rates

We’re all waiting to see if there’s any commentary from the Fed on potential plans to accelerate bond buyback tapering due to high inflation levels

Tune in at 2pm ET see J Pow speak during his press conference

Earnings

What we’re watching today: HEICO, Progressive

Full calendar here

Headline Roundup

Congress passes $2.5T debt limit increase, sending it to Biden (NYT)

Goldman Sachs and JPMorgan plan to increase bonuses to get edge (BBG)

Pfizer Covid pill stops hospitalization, not milder symptoms (BBG)

Tesla to accept Dogecoin as payment for some products (BBG)

Battery giant LG energy strikes supply deal with recycling firm (BBG)

JPMorgan hires former Paytm president Nayyar for Europe fintech (BBG)

Lilly joins Foghorn in $380M pact for genetic cancer treatments (BBG)

Vontobel to open new Miami office in US wealth push (RT)

Kroger to end some Covid-19 benefits for unvaccinated staff (WSJ)

UAE threatens to pull out of $23B F-35, Drone deal with US (WSJ)

Wholesale prices measure rose 9.6% YoY, the fastest pace on record (CNBC)

United Airlines plans to purchase up to 100 hydrogen-electric engines (CNBC)

Crypto platform FTX will pay Golden State Warriors $10M for global rights (CNBC)

Omicron accounts for 3% of US covid cases (BBG)

Andrew Cuomo has to return $5M book payment, NY ethics panel says (BBG)

DC sues Proud Boys, Oath Keepers over Jan. 6 Capitol riot (BBG)

A Message From Amberjack

Modernizing Men’s Shoes.

Obviously good style. Secretly great comfort.

Amberjack is a modern footwear brand started by former executives from Adidas, Cole Haan, & McKinsey. It’s the world’s most advanced dress shoe, made with proprietary athletic materials that deliver incredible comfort and A-grade leather vertically sourced from one of the world’s leading tanneries.

They’ve been featured in Forbes, Business Insider, and Yahoo, and were just ranked the #1 best overall dress shoes in 2021 by Rolling Stone. Only downside is they constantly sell out – get yours today before they’re gone (or pre-order to ensure availability).

Deal Flow

M&A

Australian biotech company CSL agreed to buy Swiss drugmaker Vifor Pharma in an $11.7B deal (BBG)

3M agreed to separate its food-safety business and combine it with peer Neogen in a $9.3B deal (BBG)

UK pest control company Rentokil agreed to buy US peer Terminix in a $6.7B deal (BBG)

KKR agreed to invest in warehouse-management software maker Koerber at a $1.7B valuation (BBG)

Brookfield Asset Management is in talks to buy a stake in Australian energy metering business Intellihub at a $2.1B valuation (BBG)

Norwegian energy group Equinor is looking to raise $1B+ in a sale of a stake in its Martin Linge oilfield in the North Sea (RT)

Chatham Asset Management agreed to buy printing company RR Donnelley for ~$897M, terminating a previous deal between RR and Atlas Holdings (RT)

UK bus operator National Express agreed to buy rival Stagecoach in a $630M deal (BBG)

Ride-hailing and delivery group Grab agreed to buy Malaysia’s top premium grocery chain Jaya Grocer (BBG)

Silver Lake agreed to buy ~10% of Germany’s Software AG for $388M (BBG)

Shell agreed to buy US-based solar energy storage developer Savion (RT)

General Atlantic agreed to invest $140M at a $500M+ valuation in Restore Hyper Wellness, a provider of IV drip therapy and cryotherapy (BBG)

Robinhood agreed to buy crypto platform Cove Markets (SI)

Italian bank BPER offered to buy an 88.3% stake in rival Banca Carige from Italy’s depositor protection fund FITD for a symbolic amount of 1 euro. If the deal goes through, it will acquire the remaining capital of Carige for 0.8 euros / share (including a 29% premium over the closing price of the bank’s stock on Dec. 13) (RT)

Silver Lake agreed to buy an $100M stake in Australian Professional Leagues, the organization that runs the country’s professional soccer, at a ~$300M valuation (BBG)

VC

Initialized Capital raised $700M that will be deployed across two fund vehicles: its sixth venture fund and an opportunity fund (BBG)

European early-stage VC VentureFriends closed a $112M third fund (TC)

Digital health startup Cadence raised a $100M round at a $1B valuation led by Coatue (BBG)

Growth equity firm Camber Partners closed a $100M debut fund to roll up SaaS startups (TC)

Spatial analysis platform Carto raised a $61M Series C led by Insight Partners (TC)

Pair Eyewear, a glasses company using magnetic frames to allow people to change eyewear styles, raised a $60M Series B from NEA’s Rick Yang, NFL star Christian McCaffery, Olivia Culpo, and more (TC)

Mobility software startup Apex.AI raised a $56.5M Series B led by Orillion that saw German auto parts maker ZF Friedrichshafen acquire a 5% stake in the startup (RT)

Fresh, a business platform for salons, raised a $52.5M Series C extension at a $640M+ valuation led by BECO Capital and Michael Lahyani (TC)

Employee expense management platform Mesh Payments raised a $50M Series B led by Tiger Global (TC)

Supply chain AI company TealBook raised a $50M Series B led by Ten Coves Capital and BDC Capital (VB)

Cybersecurity startup Guardio raised a $47M round led by Tiger Global (TC)

Doctor review service Garner Health raised a $45M Series B led by Redpoint Ventures (TC)

Warehouse robotics startup ForwardX raised a $31M Series C1 led by Taikang Life Insurance (TC)

Superside, a startup which operates a network of freelance creatives which are used by companies for design-based efforts, raised a $30M round led by Prosus Ventures and Lugard Road Capital (TC)

In-person event sound service Mixhalo raised a $24M Series B led by Fortress Investment (TC)

Alternative meat startup jack & annie’s raised a $23M Series B led by Creadev and Desert Bloom (TC)

BHub, a startup looking to become the back office administrator for LatAm companies, raised a $20M Series A from QED Investors, Picus Capital, and Clocktower Technology Ventures (TC)

Staircase, a startup using an API to bring together the various parties in the mortgage origination process, raised an $18M Series A led by Bessemer Ventures (TC)

Global government tenders platform Cube RM raised an $8M Series A led by Runa Capital (TC)

Enquire AI, a newly rebranded AI startup helping businesses find global subject-matter expertise, raised a $5.5M Series A led by Uzabase (TC)

IPO / Direct Listings / Issuances / Block Trades

Asian insurer FWD raised $1.4B in private placements from investors including Apollo’s Athene Holding and Canada Pension Plan ahead of a potential Hong Kong IPO (BBG)

SPAC

Exec's Picks

Gearing up for interviews and still not really sure what Investment Banks and Hedge Funds actually do? Check out Finance|able's best (free) articles in their Analyst Starter Kit

Escaping the New York winter by heading to Tulum or Miami? Need to freshen up your swim shorts game? Check out Meriggi, the premium men's swimwear brand inspired by the Mediterranean lifestyle and aesthetic. Their shorts are clean af.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 100+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're looking to hire candidates and want to post a job, all you have to do is hit "+ Hire Talent" on the top right of the job board. If you want the role to be featured on Exec Sum, check out our "Featured" and "Premium" tiers.

To Candidates: We've also partnered up with Portal Jobs for a more hands-on approach to matching talent with relevant jobs. Fill out the form here and we'll get to work on placing you in a relevant gig 🤝

Meme Cleanser

We just dropped a sticker pack in partnership with our friends over at Bullish Studio. Check it out here