Together with

Good Morning,

Key clients are ditching PwC China, ratings agencies are cautious on private credit loans, blacklisted Chinese firms are rebranding as American, a European fintech blamed regulations for slow growth, and a top quant fund’s key bet is a curve steepener.

Let’s dive in.

Before The Bell

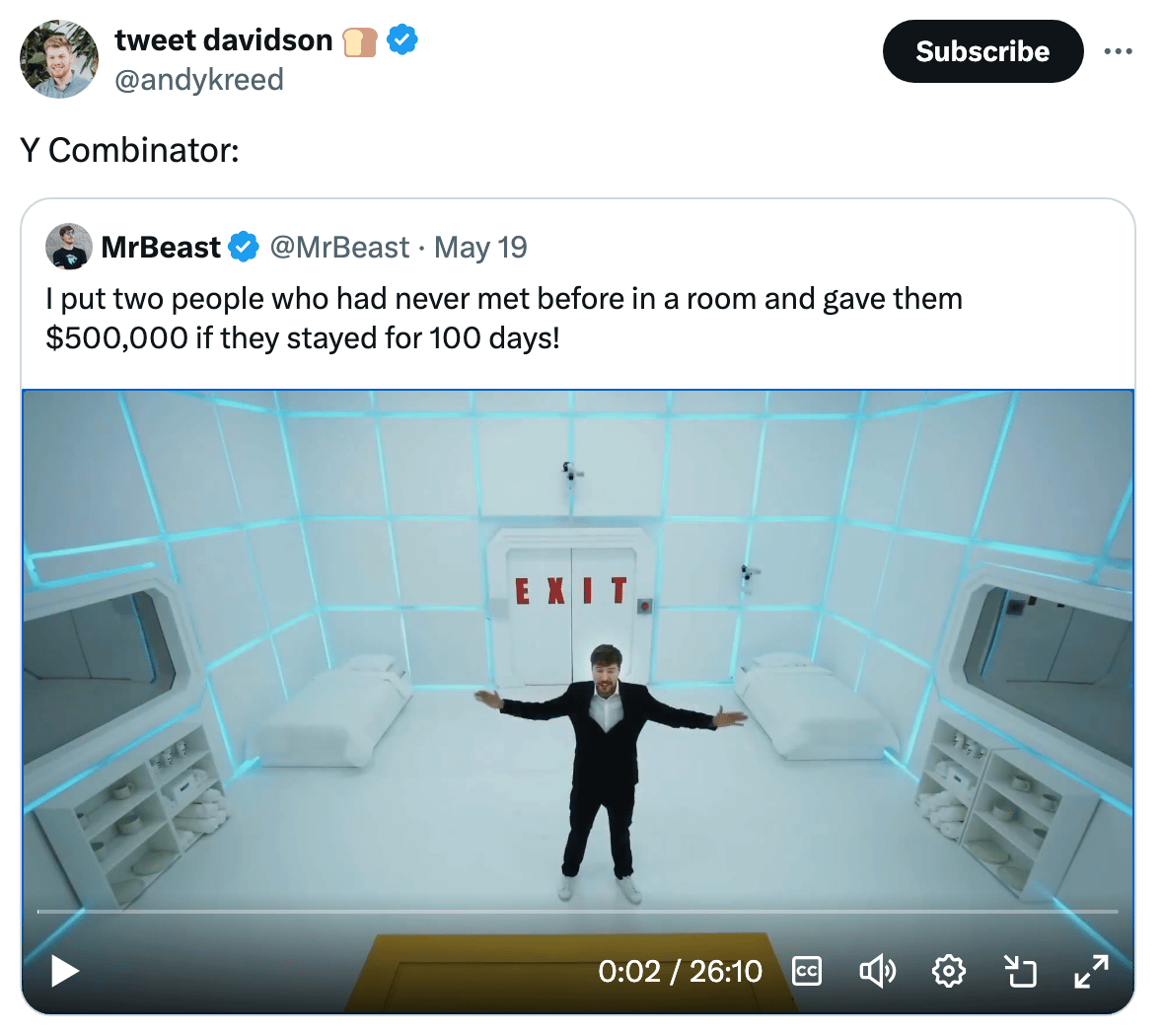

As of 05/28/2024 market close.

Markets

US stocks closed mixed yesterday as investors weighed rate cut doubts against Nvidia-driven AI hype

The Nasdaq closed above 17,000 at an ATH

US yields spiked after weak US 5Y and 2Y Treasury auctions

Crude rose for a fourth day to a four-week high

Earnings

Headline Roundup

Wall Street shifts to faster settlements; bumps seen ahead (RT)

Catalyst quant fund shorts US 10Y as key macro bet (BBG)

Rating firms stay cautious in ratifying private credit loans (RT)

Key clients desert PwC China as Big Four rivals circle (FT)

Blacklisted Chinese firms rebrand as American to dodge crackdown (WSJ)

China financial firms unusually cash-rich as savers pile in (BBG)

UBS was Europe’s worst-selling fund house in April (FT)

European fintech N26 says regulations cost it billions in growth (FT)

Japan external assets hit record high to remain world's top creditor (RT)

US consumer confidence unexpectedly improved in May (RT)

IMF upgraded China's 2024/25 GDP forecasts after 'strong' Q1 (RT)

Mongolia defends plan to tap mining riches for new SWF (BBG)

Exxon's CEO lashed out at CalPERS for stoking shareholder revolt (FT)

Activist Elliott disclosed a $2.5B stake in Texas Instruments (RT)

UK fund manager Nick Train apologized for poor investment performance (FT)

Major proxy firms recommended voting against Toyota chairman (RT)

Robinhood launched a maiden $1B stock buyback (RT)

Chicago to offer most generous subsidies to save downtown (WSJ)

A Message From Plaid

Want A Glimpse At The Future Of Finance?

Then you need to register for Plaid Effects right here.

This June 18th customer conference is bringing together leading industry executives and the top brass from Plaid to teach you how to scale fast, utilize fintech, and build for the future.

Whether you’re a startup founder, a senior executive, or a mid-level developer, Plaid Effects will cover what’s important to your success – from onboarding, to payments, to fraud prevention, to good old fashioned revenue growth.

June 18th. 9AM PST. Oh, and did we mention it’s totally free?

Deal Flow

M&A / Investments

Hess shareholders approved Chevron's $53B takeover despite a dispute with ExxonMobil over a key asset (BBG)

Google-parent Alphabet is considering an all-stock bid for $32.5B marketing software firm HubSpot (CNBC)

T-Mobile agreed to acquire almost all of US Cellular's wireless operations in a $4.4B deal (RT)

Canada's OMERS is exploring selling a stake in Leeward Renewable Energy that may value the company at ~$3.5B, including debt (BBG)

Midstream energy company Energy Transfer agreed to acquire WTG Midstream Holdings in a ~$3.25B cash-and-stock deal (RT)

PE firm Energy Capital Partners will acquire Atlantica Sustainable Infrastructure for $2.6B cash (RT)

Prague-based defense firm Czechoslovak Group will acquire Vista Outdoor’s sporting products business for ~$2B (RT)

Johnson & Johnson agreed to acquire rights to a drug from privately held Numab Therapeutics for ~$1.3B (RT)

Pharma giant Merck is nearing a $1.3B cash deal for eye-drug company EyeBio (WSJ)

Japanese industrial group Asahi Kasei will acquire Swedish biotech Calliditas Therapeutics for ~$1.1B (BBG)

A consortium of KKR and Singtel are frontrunners to buy a $1B minority stake in STT Telemedia Global Data Centres (RT)

Bitcoin mining firm Riot Platforms offered to acquire all outstanding shares of smaller peer Bitfarms for ~$950M (RT)

Precision engineering company Nordson agreed to acquire medical device maker Atrion for ~$800M (BW)

KKR will acquire Canadian energy firm Emera's indirect minority stake in the Labrador Island Link clean energy transmission project for $872M (RT)

Dutch bank ABN Amro will acquire German private bank Hauck Aufhäuser Lampe from China’s Fosun International for $730M (RT)

Aerospace components maker TransDigm will acquire test manufacturer Raptor Scientific from PE firm L Squared Capital Partners for $655M (PRN)

The parent of Brazilian airline Gol started potential merger talks with rival Azul (RT)

Blue Owl Capital and Lunate Capital acquired a minority stake in healthcare PE firm Linden Capital Partners (BBG)

VC

German climate technology startup Cloover raised a $114M seed round led by Lowercarbon Capital (RT)

Transcend, a next-gen data privacy platform, raised a $40M Series B led by StepStone (BW)

Supervizor, a plug and play QA platform for finance teams, raised a $22M funding round led by Orange Ventures (BW)

Grubtech, a SaaS integration and unified commerce platform, raised $15M in funding led by Jahez Group (FN)

Realtime Robotics, a collision-free autonomous motion planning startup for industrial robots, raised a $30M Series B led by Mitsubishi Electric (BW)

Switchboard, a customizable oracle network for users to plug into the on-chain economy, raised a $7.5M Series A led by Tribe Capital and RockawayX (FN)

Sagetap, an AI-driven marketplace matching SaaS buyers and sellers, raised $6.8M in funding from NFX, Uncorrelated Ventures, and more (PRN)

OpenSocial Protocol, a composable infrastructure layer for building social applications, raised a $5M seed round led by Portal Ventures and SNZ Capital (PRN)

Braavo Capital, a startup providing financing for consumer subscription apps, raised a $5M Series B led by existing insiders (PRN)

NodeOps, a provider of a blockchain node orchestration platform, raised a $5M seed round led by L1D (FN)

Revolv Space, a space tech startup, raised a $2.8M round led by Primo Ventures (FN)

Coinflow Labs, an instant settlement payment provider, raised a $2.3M seed round led by CMT Digital (FN)

IPO / Direct Listings / Issuances / Block Trades

India’s Adani Enterprises secured board approval to raise up to $2B (BBG)

Health-care payments software maker Waystar is seeking to raise up to $1.04B at a $3.8B valuation in a US IPO (RT)

Aluminum producer Novelis is seeking to raise up to $945M at a $12.6B valuation in a US IPO (BBG)

Abu Dhabi-based edtech Alef Education is seeking to raise $515M in Abu Dhabi’s first IPO of 2024 (BBG)

German wheelchair maker Sunrise Medical is seeking to raise $261M in a Frankfurt IPO (BBG)

Debt

Sandwich chain Subway is selling $3.35B of ABS's to help fund its LBO, the largest securitization of its kind (BBG)

Lenovo plans to sell $2B worth of zero-coupon convertibles to Saudi Arabia's PIF (BBG)

Blackstone acquired a $1B mortgage portfolio from German real estate lender Deutsche Pfandbriefbank (BBG)

Construction firm Owens Corning is testing investor appetite for bonds to refinance a portion of its $3.9B acquisition of doormaker Masonite International (BBG)

Bankruptcy / Restructuring / Distressed

Fundraising

Crypto Corner

Exec’s Picks

With the Credit Card Competition Act gaining major bipartisan traction in Congress, the travel and credit cards experts at The Points Guy explain why this may come at the cost of YOUR credit card points and rewards. Check out why the CCCA is a recipe for fewer points, higher fees, and fewer rewards and what you can do to Protect Your Points.

An ex-OpenAI board member shared her first detailed account of Sam Altman’s dramatic ouster.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter