Together with

Good Morning,

Apollo is planning a trading desk for private credit, hedge funds remained steady amid August's turmoil, foreign investors are fleeing Asian tech stocks, and Goldman is projecting an economic boost from a Harris presidency.

Turbocharge and streamline your M&A deal processes like never before with DealCentre AI.

Let's dive in.

Before The Bell

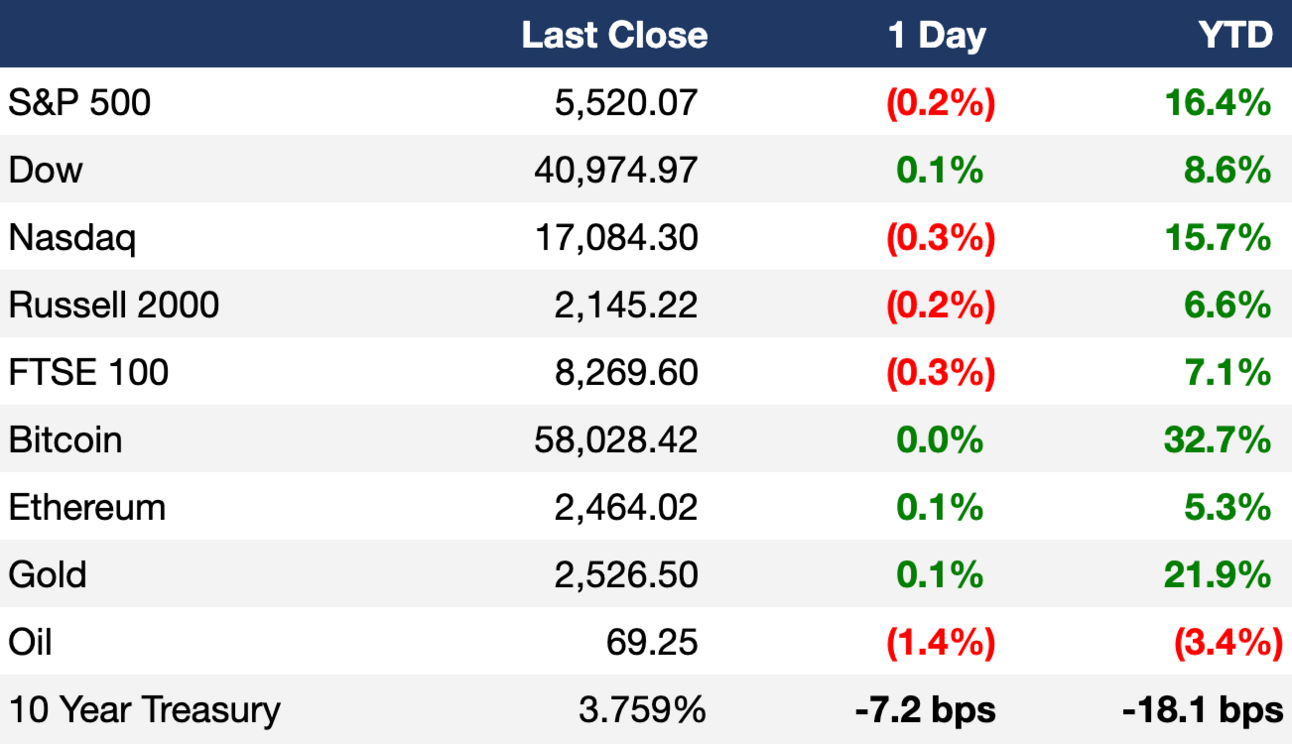

As of 09/04/2024 market close.

Markets

US stocks slipped further yesterday as investors digested fresh jobs data

Rates markets now see a 1:1 odds of a 25 bps and 50 bps Fed rate cut this month

Europe's Stoxx 600 fell to a two-week low

US 2Y-10Y yield curve is close to dis-inverting

Oil turned negative for the year

Yen rallied 1% for a second-straight day

Bitcoin fell to a one-month low

Earnings

Dollar Tree plunged 22% after missing Q2 estimates and cutting its FY outlook due to increasing pressures on customers (CNBC)

Dick's Sporting Goods fell 5% despite blowing past Q2 earnings estimates due to cautious FY guidance on a slowdown in consumer spending (CNBC)

What we're watching this week:

Today: Broadcom, Docusign

Full calendar here

Headline Roundup

Canada cut rates for third-straight time to 4.25% (FT)

Fed's Beige Book shows declining economic activity (BBG)

US job openings dropped to a 3.5-year low (BBG)

Tuesday's record corporate bond sales well absorbed by markets (BBG)

Goldman sees biggest boost to US economy from Harris win (RT)

JPMorgan says reports of dollar's demise are greatly exaggerated (RT)

US O&G M&A is nearing its 2023 record (RT)

Foreign investors aggressively exited Asian tech stocks in August (RT)

Global hedge funds gained in August despite market turmoil (RT)

All of Citadel's strategies are up YTD (RT)

Apollo is building out a trading desk for private credit (BBG)

Nvidia denies receiving US antitrust subpoena (CNBC)

Trafigura extended employee notice periods to six-month minimum (RT)

Volvo scrapped plans to go full EV by 2030 (CNBC)

A Message From SS&C

Ready to turbocharge your M&A process?

SS&C Intralinks DealCentre AI™ is the purpose-built, AI-powered dealmaking platform that incorporates dynamic tools, unmatched intelligence and robust insights across every phase of the M&A lifecycle.

With DealCentre AI, you can accelerate and streamline your deal like never before to gain an edge with:

Increased efficiency: Perform speedier due diligence to promote higher close rates

Greater accuracy: Pinpoint concerns and minimize errors, with less manual work

Deeper insights: Drive sharper, more informed decisions at every step

You can also say goodbye to siloed, fragmented deal processes. A centralized, fully modular platform for all deal-related activities, DealCentre AI allows you to view and manage your entire end-to-end deal lifecycle, giving you clear visibility into your pipeline while maintaining complete deal records — even for past deals.

See how DealCentre AI uses AI-powered intelligence to reimagine dealmaking and completely revolutionize the way deals are done.

Deal Flow

M&A / Investments

$32.2B-listed pipeline company Targa Resources rebuffed informal takeover interest from larger rival Williams (BBG)

Blackstone will acquire Australian data center group AirTrunk at a $16.1B EV (RT)

Verizon is in advanced talks to acquire $9.6B-listed rival Frontier Communications (BBG)

The Nordstrom family is seeking to take its namesake retailer private for $3.8B (BBG)

UK warehouse owner Segro will acquire European warehouse firm Tritax EuroBox in a ~$1.4B all-stock deal, including debt (RT)

$1.4B-listed Sandy Spring Bancorp received takeover interest (BBG)

Malaysia's IHH Healthcare will acquire hospital chain Island Hospital for $901M (RT)

Starwood Capital will acquire UK-based Balanced Commercial Property Trust for $885M (FT)

Irish classifieds group Distilled is exploring a sale at a $663M valuation (RT)

TPG acquired emissions solutions firm Miratech from PE firm BP Energy Partners (WSJ)

Abu Dhabi's ADNOC will acquire a 35% stake in Exxon's planned Texas hydrogen plant (RT)

Centerbridge Partners will acquire Italian specialty finance bank Banca Progetto from Oaktree (RT)

Germany plans to sell an up to 5% stake in $17.2B German lender Commerzbank, which it bailed out in 2008 (BBG)

VC

OpenAI-rival Safe Superintelligence raised $1B at a $5B valuation from NFDG, a16z, Sequoia, and others (TC)

Payroll and HR platform Oyster raised a $59M Series D at a $1.2B valuation led by Silver Lake Waterman (TC)

AI search and productivity platform You.com raised a $50M Series B led by Georgian (TC)

Ghanaian digital lender Fido raised a $30M Series B led by BlueOrchard and FMO (TC)

Revefi, a SaaS platform that automatically troubleshoots data-related issues, raised a $20M Series A led by Icon Ventures (TC)

Re-Leased, a NZ-based CRE management software company, raised $12.5M in funding led by Movac (PRN)

Cognitive Credit, a data and analytics software for corporate credit markets, raised a $10M Series B led by ETFS Capital (BW)

DubClub, a sports betting platform for amateurs, raised a $7.5M Series A led by Renegade Partners (TC)

Palm, a cash management startup for treasuries, raised a $6.1M seed round led by Speedinvest and Target Global (TC)

IPO / Direct Listings / Issuances / Block Trades

Debt

Bankruptcy / Restructuring / Distressed

Fundraising

Crypto Corner

Exec’s Picks

Get the strong technical and modeling skills + big-picture thinking you need as a private equity investor in Wharton Online's Private Equity Certificate Program—built with a best-in-class curriculum designed by Wall Street Prep. September 9th deadline: Save $300 with code LITQUIDITY.

Adam Grossman shared some great insights on why you likely don't need to focus on dividend paying stocks.

Ted Seides of Capital Allocators shared a short excerpt from his forthcoming book…seeking to defend private equity.

Financial Services Recruiting 💼

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter