Together with

Good Morning,

Bill Gross thinks treasuries are overvalued, BlackRock is bullish on equities in 2024, Nvidia rallied to a record high on news of new AI-related components, Wall Street is trying to time the Fed’s QT taper, United and Alaska Airlines found loose parts on some Boeing 737 MAX 9 jets, and Michigan won the college football national championship.

Looking to diversify your portfolio outside of just stocks and bonds? Today’s sponsor, Percent, helps accredited investors access exclusive private credit deals.

Let’s dive in.

Before The Bell

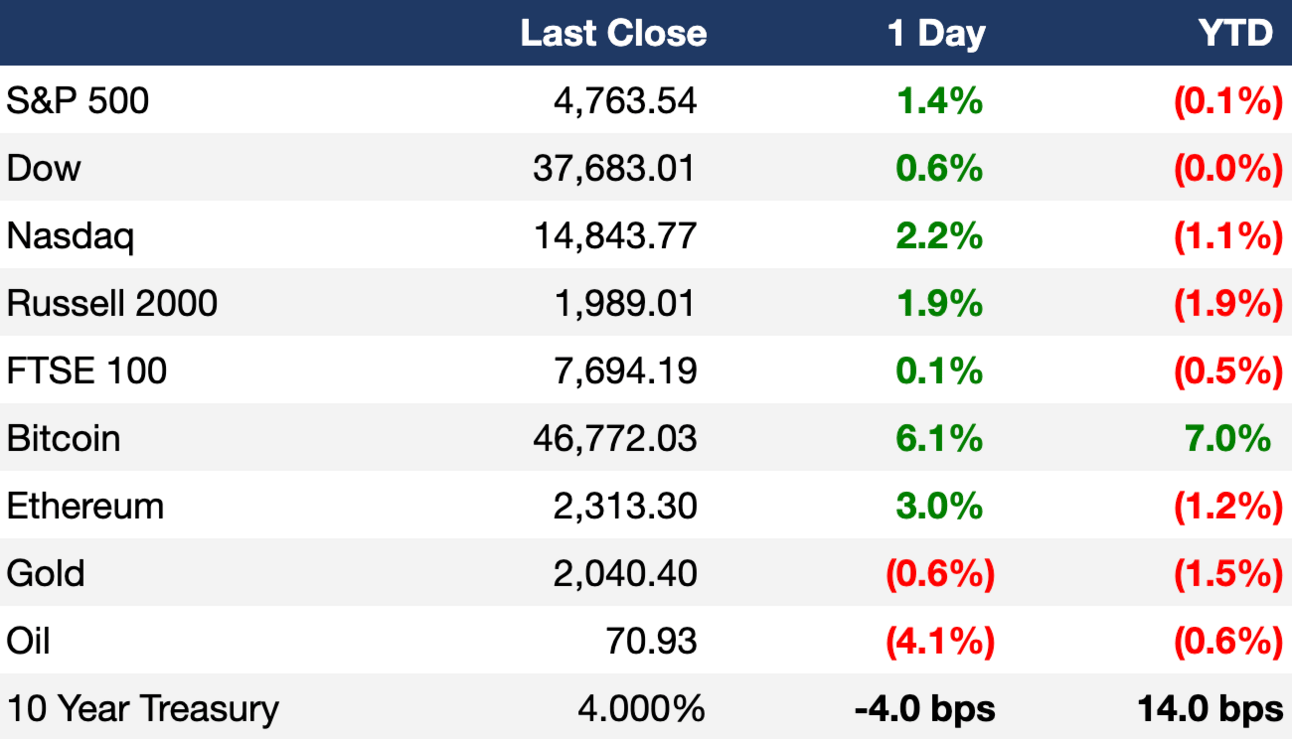

As of 1/8/2024 market close.

Markets

US stocks rallied, boosted by tech, ahead of this week’s CPI report and big bank earnings

The Nasdaq led indices with a 2.2% gain, its best day since November 14

European stocks rose, shaking off negative sentiment seen at the start of trading in 2024

Earnings

Jefferies Q4 profit and revenue fell as the investment bank continued to grapple with a deal slump (BBG)

What we're watching this week:

Today: Albertsons, Tilray

Thursday: Infosys

Friday: JPMorgan Chase, Bank of America, Citigroup, Wells Fargo, United Health, BlackRock, Delta Air Lines

Full calendar here

Headline Roundup

Bill Gross casts shade on treasuries, sees 10Y ‘overvalued’ at 4% (BBG)

BlackRock says last year’s risk rally has legs ‘well into 2024’ (BBG)

China central bank hints at reserve ratio among tools to boost credit (BBG)

Nvidia rallies to record high as chipmaker announces AI-related components (RT)

Wall Street is trying to nail down timing of Fed’s QT taper (BBG)

Chinese city official spent $21B on ‘vanity projects’ (BBG)

More young bosses want a raise to work from the office (BBG)

JetBlue CEO to step down in February (CNBC)

Oil tankers continue Red Sea movements despite Houthi attacks (RT)

Buying home and auto insurance is becoming impossible (WSJ)

United, Alaska find loose parts on some Boeing 737 MAX 9 jets (WSJ)

Russian billionaire and Sotheby’s fight over ‘the lost Leonardo’ painting (BBG)

A $32B rout may not be end of Tencent’s woes (BBG)

Mike Johnson faces same test as ousted speaker Kevin McCarthy (WSJ)

Tiger Woods and Nike split up after 27 years (WSJ)

Michigan defeats Washington to win national championship (WSJ)

A Message From Percent

Increase resiliency for 2024 investments with a 40/30/30 portfolio

As investors make their investment plans for the new year, there’s a lot more to consider than stocks and bonds.

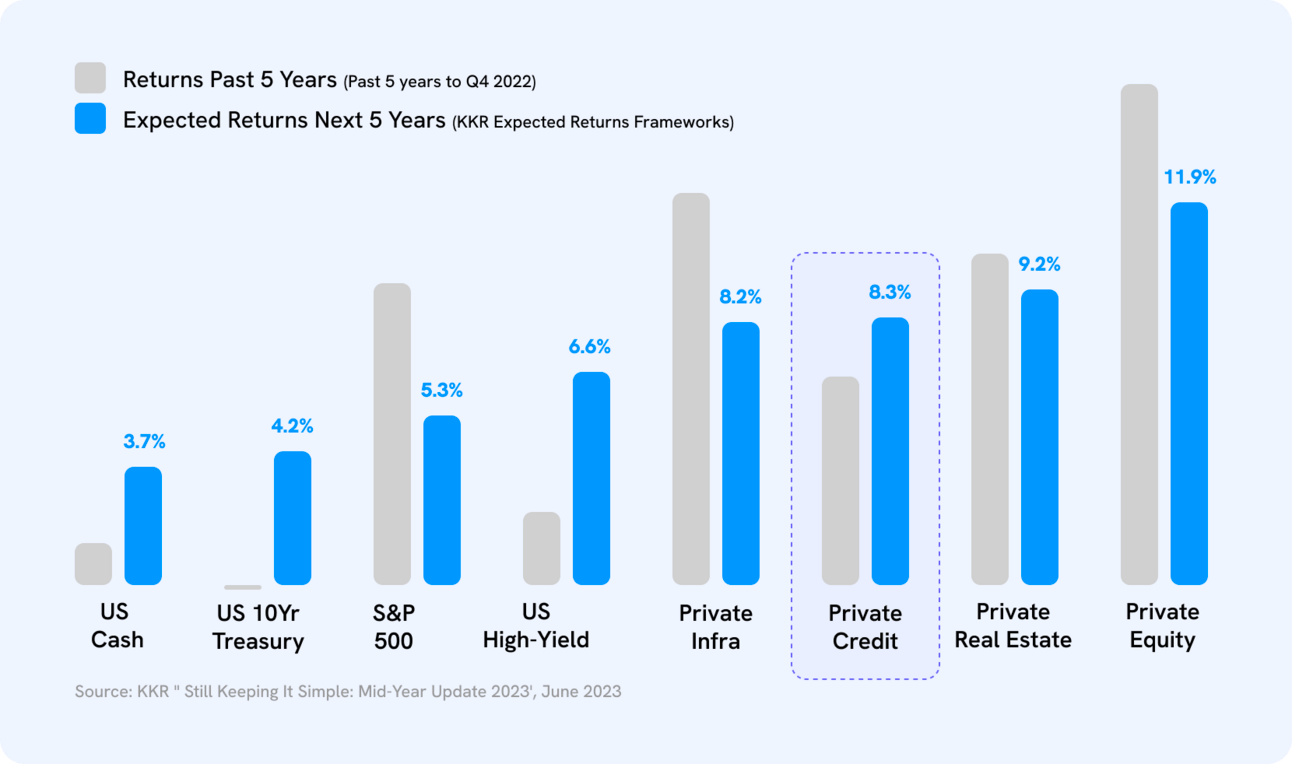

Research shows that alternative investment strategies such as private credit may outperform the S&P 500, as well as other traditional investments like bonds and treasuries, in the next five years. Additionally, 40/30/30 portfolios—in which 30% are alternative investments—are predicted to not only deliver better returns, but involve less risk in macroeconomic environments.

A popular alternative investment is private credit: Non-bank lending to businesses in search of capital. Often associated with higher yields, shorter-term durations, and earned income from contractual return, private credit is a top choice for diversifying institutional portfolios. Now, with Percent, accredited investors can access exclusive private credit deals too.

By investing as little as $500, the everyday accredited investors can access:

Yields up to 20% APY

The ability to regularly re-evaluate and re-calibrate shorter-term investments to meet portfolio needs

A wide range of deals, from small business lending in Latin America to real estate in Europe

Learn more and get a $500 bonus on your first investment with Percent.

Deal Flow

M&A / Investments

Cloud services provider Hewlett Packard Enterprise is in advanced talks to buy Juniper Networks for ~$13B (WSJ)

Swiss drugmaker Novartis is in advanced talks to acquire Cytokinetics in a deal that could value drug developer at well over $10B (RT)

Sony Group is planning to call off $10B merger between its India unit with Zee Entertainment Enterprises (BBG)

Medical solutions company Boston Scientific will acquire Axonics, a maker of devices to treat urinary and bowel dysfunction, in a $3.7B transaction (BBG)

Johnson & Johnson will acquire Ambrx Biopharma, a developer of a cancer drug known as antibody-drug conjugates, for $2B cash (CNBC)

Merck will acquire cancer drug developer Harpoon Therapeutics for ~$680M to reinforce its oncology portfolio with immunotherapies (RT)

Deutsche Lufthansa offered concessions to EU merger watchdogs in an attempt to resolve competition concerns regarding its $356M investment in ailing Italian carrier ITA Airways (BBG)

The Italian government will raise its stake in the country’s largest steelmaker, Acciaierie d’Italia from 38% to 66% with a $351M capital injection (BBG)

PE firm Altamont Capital Partners acquired a controlling interest in Mini Melts USA, one of the fastest-growing ice-cream brands in the country (WSJ)

VC

Game development studio Second Dinner raised a $100M Series B led by Griffin Gaming Partners (BW)

Claris Bio, a late-stage biotech company focused on corneal healing, raised a $57M round led by Novo Holdings, RA Capital, and Mass General Brigham Ventures (FN)

Vortexa, a real-time global analytics platform for energy and freight markets, raised a $34M Series C led by Morgan Stanley Expansion Capital (BW)

Contents.com, an Italian startup that helps businesses create multilingual content using AI, raised an $18M Series B led by Alkemia Capital (FN)

Data intelligence startup SynMax raised a $13M round at a $50M valuation led by energy trader Bill Perkins (BW)

Oncology biotech company Cumulus Oncology raised an $11.5M seed round led by Eos Advisory and the Scottish National Investment Bank (FN)

Data-driven patient navigation startup Care Continuity raised a $10M Series A-3 led by Empactful Capital and Viewside Capital Partners (PRN)

Women’s health startup Health in Her HUE raised a $3M seed round led by Seae Ventures (TC)

CharacterX, a provider of a decentralized AI social network, raised a $2.8M seed round at a $30M valuation led by Lightspeed Venture Partners, INCE Capital, and Spark Digital Capital (FN)

QuantHealth, an AI-powered clinical trial design platform, received a $2M strategic investment from Accenture Ventures; bringing its total Series A to $17M (BW)

African fintech startup Cleva raised a $1.5M pre-seed round led by 1984 Ventures (TC)

Rincell Corporation, an advanced chemistry battery cell manufacturer, raised a $1.2M seed round led by NextGen Battery Chem Ventures (PRN)

Midel Photonics, a laser tech startup, raised a $1.1M seed round from High-Tech Gründerfonds and others (FN)

IPO / Direct Listings / Issuances / Block Trades

Fundraising

Crypto Corner

Exec’s Picks

ICYMI: Litquidity published his 2023 year-end letter over the weekend. Give it a read to see what’s going on behind the scenes with the Exec Sum team.

Byrne Hobart investigated why companies own their own headquarters.

Ben Thompson published a good piece on whether or not The New York Times has a strong case against OpenAI.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter