Together with

Good Morning,

PIMCO has been buying debt left and right, Xi and Putin will join Biden at the G20 Summit, Tesla is increasing FSD prices, BBBY's stock tanked after Cohen sold his stake, and FTX 10x'd its revenue during the crypto craze.

At long last, our highly anticipated Wall Street comp survey is here. Today we're kicking it off with our sell-side report that breaks down comp across investment banking, S&T, and equity research. You can access here.

Lastly, check out our buddies at The Milk Road if you're interested in following the crypto markets.

Let's dive in.

Before The Bell

As of 8/19/2022 market close.

Markets

Stocks fell on Friday to end the week in the red and snap a four-week winning streak for the S&P 500 as investors second-guessed how aggressively the Fed will need to move to tame inflation

The S&P 500, Dow, and Nasdaq fell 1.2%, 0.2%, and 2.6% on the week, respectively

The Fed’s annual Jackson Hole symposium will begin on Thursday. J Pow will address the global central banking conference on Friday, Aug 26th

Investors will be looking for clues about how high US borrowing costs may go and how long they'll need to stay there to bring down inflation

Earnings

John Deere lowered its full-year profit outlook and sold out of large tractors as supply chain issues persisted, but the company still exceeded revenue expectations; its stock rose 0.5% on the day (RT)

What we’re watching this week:

Monday: Zoom

Tuesday: JD.com, Macy’s, Nordstrom, Intuit

Wednesday: Nvidia, Salesforce

Thursday: Peloton, TD Bank

Full calendar here

Headline Roundup

German producer prices surged to a record 37.2% YoY increase in July (RT)

Fund manager PIMCO has spent over $2B buying leveraged debt backing consumer companies that banks had struggled to offload (BBG)

Chinese investment banks are eyeing Germany as a banking base amid US tensions (BBG)

Greece exited the EU's enhanced economy surveillance framework after 12 years (RT)

Xi Jinping and Putin plan to attend the G20 summit along with Biden in November (AX)

10+ Wall Street banks are nearing ~$200M fine settlements each for employees’ use of WhatsApp (WSJ)

Credit Suisse's largest shareholder urged the bank to fix its investment bank or seek options (BBG)

Tesla will increase the price of its full-self driving software by 25% (TV)

Bed Bath & Beyond fell 41% on Friday after billionaire investor Ryan Cohen sold his 10% stake (WSJ)

Russia will shut down the Nord Stream gas pipeline for three days later this month, citing maintenance (WSJ)

Tesla asked the Chinese government to guarantee its suppliers will have sufficient electricity supply amid a power crunch (WSJ)

Footlocker’s CEO will step down and former Ulta Beauty CEO Mary Dillon will take over (WSJ)

A Message From The Milk Road

The Only Crypto Newsletter I Read

I have a love hate relationship with crypto.

I love it when it goes up, and hate it when it goes down.

This year has been rough for crypto, but one bright spot has been this new crypto newsletter I’m reading (The Milk Road).

I heard about it 3-4 times from people I respect on Twitter before I finally subscribed…and I have to say… it’s awesome.

If you like Exec Sum, you’ll like The Milk Road.

It’s got that great mix of smart stuff & jokes. And crypto is changing so fast, it’s great to just read a super quick & simple summary of the big news each day.

It was started by @shaanvp, so it got pretty popular quickly (100k+ subscribers this year).

If you wanna keep up with crypto —> highly recommend checking it out.

Deal Flow

M&A / Investments

Amazon.com, CVS Health, UnitedHealth Group and Option Care Health are among bidders for healthcare company Signify Health, which could be valued at over $8B (RT)

Indian conglomerate Adani Group made a $3.9B open offer for a 26% stake in Indian cement makers Ambuja Cements and ACC (BBG)

Dutch investment firm Prosus will buy food delivery company Just Eat Takeaway.com's 33% stake in LATAM JV iFood for ~$1.8B (BBG)

Adani Group subsidiary Adani Power will buy thermal power plant operator DB Power at an ~$879.1M enterprise value (RT)

PE firm Apollo will acquire a $785M stake in America's biggest gastroenterology practice GI Alliance, which is valued at $2.2B (BBG)

Wealth fund Abu Dhabi Investment Authority is exploring a sale of Miami Beach Edition hotel for ~$580M (BBG)

Gulf e-commerce company Noon will buy fashion e-commerce venture Namshi from Dubai's Emaar Properties at a $332.5M valuation (RT)

Telecom operators American Tower Corp and IHS Holding may bid for Brazilian telecoms firm Oi's 8,000 towers at a minimum $326M price (RT)

Laser products maker Femto Technologies will buy a majority stake and delist laser systems producer Prima Industrie in a ~$131.2M deal (RT)

Battery Ventures will re-buy a 10% stake in European business software provider Forterro at a $1B valuation, five months after exiting its position (BBG)

Media conglomerate Warner Bros. Discovery will sell its stake in British television startup GB News as part of a ~$71M fundraising round (BBG)

Berkshire Hathaway gained approval to buy up to 50% of energy company Occidental Petroleum’s shares (WSJ)

VC

Sunstone, an Indian higher education startup, raised a $35M Series C led by WestBridge Capital (TC)

Artificial General Intelligence 'AGI' startup Keen Technologies raised a $20M round led by Github CEO Nat Friedman and Cue founder Daniel Gross (TC)

Nigerian B2B e-commerce platform Omnibiz raised $15M: $10M in debt and $5M in equity led by Timon Capital (TC)

Safeheron, a startup making private keys safer in crypto wallets, raised a $7M pre-Series A led by Yunqi Partners (TC)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Leading digital medicine company Akili raised over $163M via a merger with Chamath Palihapitiya’s Social Capital Suvretta Holdings Corp. I (BW)

Bankruptcy / Restructuring

World’s second largest cinema chain Cineworld Group is expected to file for chapter 11 bankruptcy (WSJ)

Crypto Corner

Exec's Picks

Annmarie Hordern wrote a wild piece on the extreme measures it takes to get one's family out of Taliban-controlled Afghanistan. Check out her latest here.

Over the weekend, Fast Company's Yasmin Gagne and Max Ufberg dropped a new piece covering Litquidity (meta, no?), giving readers a behind-the-scenes look at the business behind the meme account. Check it out here.

Amberjack created the world's most advanced dress shoes, and they were ranked the #1 best overall dress shoes in 2021 by Rolling Stone. The only downside is they constantly sell out – get yours today before they’re gone (or pre-order to ensure availability).

The classic Litagonia tee is back, baby! We decided to run this fan favorite back in a limited batch so scoop one up before it's gone.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

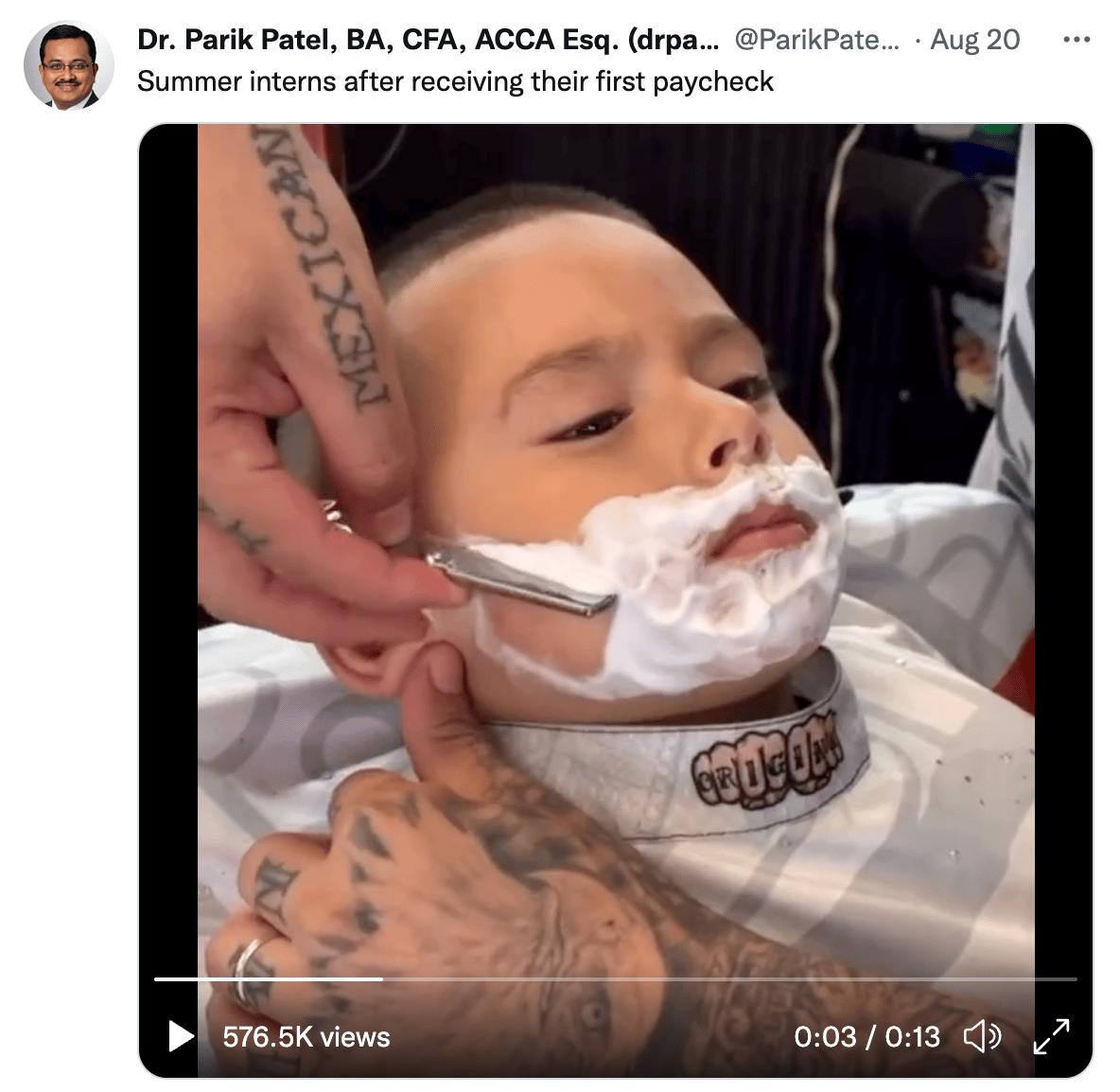

Meme Cleanser

Enjoying the newsletter and want to buy the team a beer? You can do that here!

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.