Together with

Good Morning,

NYSE is extending trading nearly around the clock, PE and credit folks saw a mega jump in pay, investors are looking to India for US election safety, the China rally seems to have fizzled, and STEM PhDs are replacing MBA traders in numbers.

Automate your complicated business spend and expense allocation process with one of the fastest growing fintech softwares in the alternative asset management space, StavPay.

Let's dive in.

Before The Bell

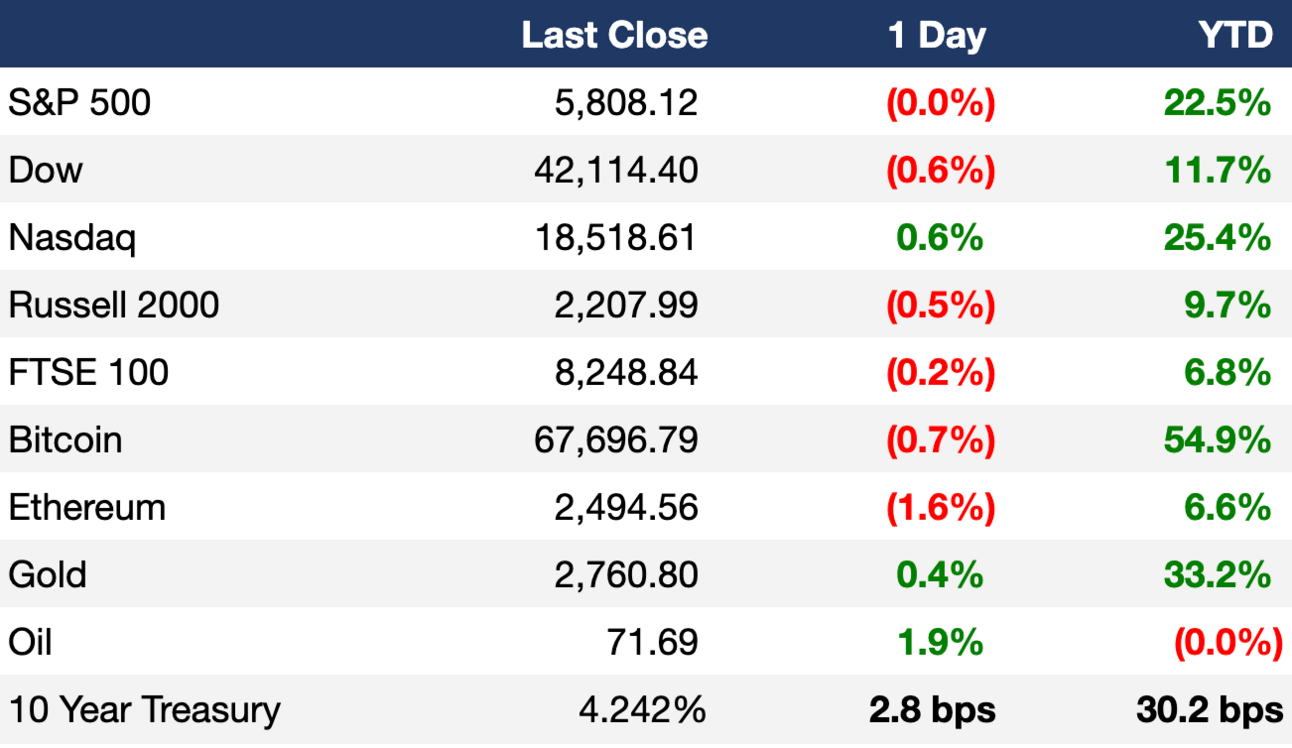

As of 10/25/2024 market close.

Markets

US stocks closed mixed as investors positioned for further corporate earnings

Nasdaq rose for a seventh-straight week to hit an ATH ahead of crucial Big Tech earnings

S&P and Dow snapped six-week wins streaks

Canada's TSX fell for a fifth-straight day in its worst streak since April

US bonds are coming off their worst selloff in six months

Yen fell to its lowest in three months on surprise Japan election results

Earnings

What we're watching this week:

Today: Ford

Tuesday: Alphabet, AMD, Reddit, McDonald’s, Chipotle, Visa, PayPal, Pfizer

Wednesday: Microsoft, Meta, Coinbase, Eli Lilly

Thursday: Apple, Amazon, Intel, Uber

Friday: ExxonMobil, Chevron

Full calendar here

🇺🇸 Election Forecast

Trump's lead holds steady on Kalshi with just one week left to go!

Get $20 to trade the election when you deposit $100 or more. See live odds and bet now.

Headline Roundup

NYSE will extend trading to 22 hours a day (CNBC)

Pay for alternative investment pros rose to $1.4M (WSJ)

US stocks are seeing increased volatility this Q3 earnings (FT)

Hedge funds cut most China stock purchases since the September rally (RT)

European stocks hit by 'Trump effect' as odds favor Republicans (FT)

Money funds continued to draw inflows on election caution (RT)

Investors look to India as US election jitters pick up (BBG)

Catastrophe bond funds suffered virtually no losses from Milton (BBG)

Swedish PE giant EQT is eying M&A in push to expand PE reach (FT)

Bank execs warned EU governments to not interfere with bank M&A (RT)

Nvidia briefly overtook Apple as world's most valuable company (RT)

Accel filed with SEC to tap thriving secondaries market (BBG)

General Atlantic opened a Saudi office (BBG)

EY rolls out future-focused ads and slogan after failed breakup (WSJ)

Google is developing an AI that can control computers (BBG)

TSMC faces severe challenges as free trade falters (BBG)

Delta sued CrowdStrike for $500M over its global IT outage (CNBC)

Alibaba will settle a shareholder monopoly lawsuit for $433M (RT)

PhDs take on MBAs in credit investing as quants jump in (BBG)

Israel conducted its largest-ever strike on Iran (WSJ)

A Message From StavPay

StavPay was built for Alternative Asset Managers to automate the business spend and expense allocation process.

More than 90 managers with over $2.2T of AUM collectively use StavPay to manage their vendors, contracts, invoices, expense allocations, budgets, services, 1099 filings, inter-entity reimbursements, and payments.

Learn more at www.stavpay.com and schedule a demo today.

We promise you, it's an hour well spent.

Deal Flow

M&A / Investments

Blackstone is in advanced talks to acquire minority stakes in US natural gas pipelines owned by EQT for ~$3.5B

Infrastructure investor DigitalBridge is exploring a sale of Brazil's Scala Data Centers, which could fetch over $2B

$1.9B-listed marketing data firm Integral Ad Science is exploring a sale after receiving takeover interest

PE firm Permira agreed to take a 40% stake in jacket maker K-Way from brand manager BasicNet at a $546M valuation

Boeing is weighing options for its troubled space program which includes Starliner and the NASA space station

Japanese franchise operator Watami will buy Subway's Japan operations

KKR-owned Swiss vending machine operator Selecta is exploring a sale to deal with upcoming $1.2B debt maturities

VC

Self-driving tech firm Waymo raised a $5.6B Series C led by Alphabet, with a16z, Tiger Global, Silver Lake, and others participating

Self-driving EV truck startup Outrider raised a $62M Series D led by KDT and NEA

EV charging startup MobilityPlus raised a $44M round led by Suma Capital

Innovative solar panel startup Merlin Solar raised a $31M Series B led by Fifth Wall

Arcade AI, an AI jewelry designing platform, raised $16M from Sound Ventures, Reid Hoffman, and others

Spanish cleantech startup Matteco raised a $15M Series A backed by Grupo ASV, Napali, and Zubi

Twitter-rival Bluesky raised a $15M Series A led by Blockchain Capital

Pharos, a data extraction platform for electronic medical records, raised a $5M seed round led by Felicis

IPO / Direct Listings / Issuances / Block Trades

Indian food delivery giant Swiggy again lowered its $1.4B IPO valuation to $11.3B

Chinese self-driving firm WeRide rose 7% in its trading debut after its $441M IPO

Debt

Ares and a group of banks will provide a $1.6B debt package to fund KKR’s $3.2B acquisition of a 25% stake in Eni unit Enilive

Brookfield-owned insurer American National is seeking to sell $1.5B of private credit stakes

Ares acquired $491M of private credit LP stakes from an unnamed investor

Bankruptcy / Restructuring / Distressed

Nexus Capital secured $765M of financing to acquire discount retailer Big Lots out of bankruptcy

Defaulted Indonesian clothes maker Pan Brothers proposed a restructuring plan to creditors

Evergrande liquidators ceased discussions for a stake sale of its EV unit

Fundraising

SFW Mubadala raised $3.1B for its fourth MM PE fund

MM PE firm Nautic Partners raises $4.5B for its eleventh fund

Crypto Corner

Exec’s Picks

BlueFlame AI discussed crucial GenAI insights for Private Equity with Bain, Apax, and Anthropic. Their recap reveals how AI reshapes knowledge management, due diligence, implementation, agentic capabilities, process redesign, and Anthropic's innovations. Stay ahead in PE - read now!

Goldman recently published a high-profile long-term forecast for the US stock market, but some experts were quick to push back. Here's Sam Ro summarizing the dangers of forecasting decade-long returns.

WSJ published an incredible piece on the advantages of going beyond bland 'networking.'

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what’s up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.