Together with

Good Morning,

Amazon might try to buy Peloton, tensions are still rising in Ukraine, the @NFT Instagram account got banned, Ottawa declares emergency in response to vaccine mandate protests, BuzzFeed doxxed the Bored Ape Yacht Club founders, Spotify removed some Joe Rogan episodes, and Yellen said "I'M NOT F*****G LEAVING".

Before we get into it, we've got two quick announcements:

🗣 1. ICYMI: Karl spent all day Saturday working on a deep dive about one of our favorite asset management disruptors: Titan. This piece also gave us the opportunity to talk about the importance of financial literacy and the retail investing zeitgeist we are experiencing. Check out how Titan is looking to help a new generation of retail investors: Link to Article

🗣 2: We're proud to unveil our second annual 30 Under 30 class! Members of this class work in a variety of fields, including media, private equity, investment banking, entrepreneurship, social media, crypto, and Web3. Keep an eye out for these names, this class is going places. We even have a famous crypto billionaire on the list: Check it out here

Let's dive in.

Before The Bell

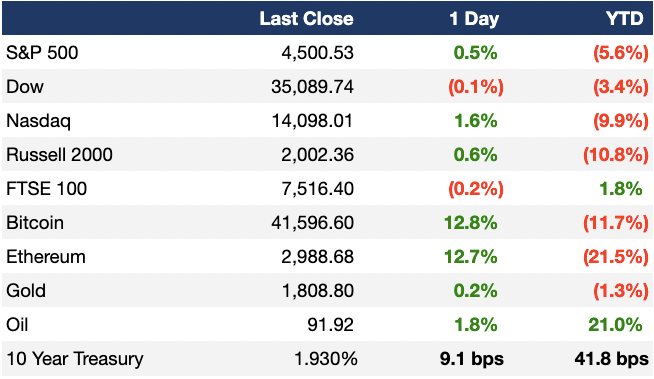

As of 2/4/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

The S&P and Nasdaq both jumped on Friday to close the week in the green, as strong earnings reports from tech giants boosted the indexes

Amazon and Snap jumped 13.5% and 58.8% respectively on Friday, the day after they reported Q4 earnings

Friday’s release of the January jobs report showed a huge beat, with a 467K gain in payrolls vs the Dow Jones expected gain of 150K

Investors will be keeping an eye on the 10-Yr yield, which crossed 1.9% on Friday (the highest level since Dec 2019), and another huge slate of earnings reports this week

Earnings

What we’re watching this week:

Mon: Chegg, Tyson

Tues: Pfizer, Peloton, BP, Chipotle, Lyft

Weds: CVS, Uber, Disney

Thurs: Twitter, Coca-Cola, Affirm

Fri: Under Armour, Apollo

Full calendar here

Headline Roundup

US officials say Russian forces are at 70% of level necessary for full Ukraine invasion (CNBC)

Judges weigh more Biden vaccine-mandate cases after Supreme court rulings (WSJ)

US-led air bridge of weapons to Ukraine seeks to shore up Kyiv’s ability to resist Russia (WSJ)

John Legend and Chrissy Teigen selling NYC home for $18M (CNBC)

Ottawa declares emergency in response to vaccine mandate protests; China imposes lockdown on city of 4M people (BBG)

70 episodes of Joe Rogan's podcast removed from Spotify in response to racial slurs (WP)

Yellen says ‘no plan to leave’ with goals far from accomplished (BBG)

Peloton purchase may pose regulatory ‘headache’ for a tech giant (BBG)

Postal Service says it could buy more EVs if Congress funded it (BBG)

Apollo Co-COO Anthony Civale to retire (BBG)

UK in talks with Macquarie for $13.5B investment (BBG)

SEC to push PE firms for more robust fee disclosures (BBG)

Airbus, Quebec reach $1.2B investment deal for A220 jet program (RT)

Chanel tests purse lovers with $3K price hikes (WSJ)

A Message From LEX Markets

BUILDING STONKS?

BUILDING STONKS! That’s what our intern Karl would've named their app if he were CEO. Instead they named it LEX. ¯\_(ツ)_/¯

The markets going crazy is a nice reminder to sprinkle some diversity into your portfolio. Commercial real estate is a great way to do that, and while you’re diversifying, why not pick up some passive income and tax advantages along the way?

We’re pretty excited about a new investing app that came onto our radar recently. LEX takes buildings public and lets anyone buy shares in the IPOs on their platform. Each IPO is a building. Following the IPO, the building gets a ticker symbol and trades like other stocks. As a shareholder, you get paid dividends flowing from the rent paid by the tenants. Diversify, earn tax advantaged passive income, trade without lockups.

Looking around at other easy ways to invest in real estate, you have REITS and crowdfunding platforms. We think of LEX sort of like a REIT but for a single asset. Or like crowdfunding on steroids since you can trade the shares you bought on LEX’s secondary market.

LEX has a live deal in NYC right now and has a Seattle asset coming next, with more promised soon after.

Sign up for free here and get a $50 bonus on your first deposit.

*See important disclosures

Deal Flow

M&A / Investments

UK private school operator Inspired Education is weighing options including a sale at a potential $4B valuation (BBG)

Singaporean sovereign wealth fund GIC agreed to buy 30 Japanese properties from Seibu in a ~$1.3B deal (RT)

Carlyle is in advanced discussions to buy investment firm CBAM Partners in a potential $750-$850M deal (BBG)

Standard General is in advanced talks to buy television broadcaster Tegna (BBG)

Peloton is attracting interest from potential suitors including Amazon (BBG)

Kohl’s rejected takeover offers it received as too low and has engaged bankers to field interest in the company (BBG)

VC

ACME Capital, a early-stage VC run by Scott Stanford and Hany Nada, raised $300M for its first two funds (TC)

DeFi infrastructure provider Qredo raised an $80M Series A at a $460M valuation led by 10T Holdings, with participation from Coinbase, Avalanche, and Terra through strategic investments (CD)

Data platform startup WEKA raised a $73M round led by Hitachi Ventures (BW)

Artisanal Ventures, a Bay Area VC firm investing in B2B cloud startups, closed its first fund with $62M in capital (TC)

Korean micromobility startup Swing raises $24M Series B led by White Star Capital (TC)

IPO / Direct Listings / Issuances / Block Trades

Var Energy, a Norwegian JV between Eni and HitecVision, is seeking up to $800M in an IPO (BBG)

SPAC

Middle Easter Spotify rival Anghami surged up to 82% in Nasdaq debut after SPAC merger (BBG)

Crypto Corner

Instagram bans popular Mark Cuban-backed @NFT account amid controversy (Decrypt)

BuzzFeed outs Bored Ape Yacht Club Founders: Doxxing or Journalism? (Decrypt)

Tether responds to CoinDesk's intervention in ongoing reserves information case (TBC)

India's crypto tax may curb excessive speculation, bring institutional demand (CD)

Bitcoin tops $40k for the first time in 2 weeks (CD)

Exec's Picks

Mario Gabriele, creator of popular newsletter The Generalist, wrote a great piece of the growing trend of "solo capitalists" in the venture capital industry (with a small Litquidity quote in there). Check out The Future of Solo Capitalists.

The Hiring Block

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast on Spotify and Apple Music 🤝