Together with

Good Morning,

Pelosi is flying to Taiwan (watch for some semiconductor stock purchases), global M&A activity is slowing, home prices are cooling, Musk countersued Twitter, the DoJ sued to block a book publisher merger, Dude Perfect will call some Thursday Night Football alternative streams, and Nikola is buying Romeo Power in some former SPAC on former SPAC action.

If anyone is interested in a new number-crunching platform to replace Excel, check out today's sponsor: Causal. More details below.

Let's dive in.

Before The Bell

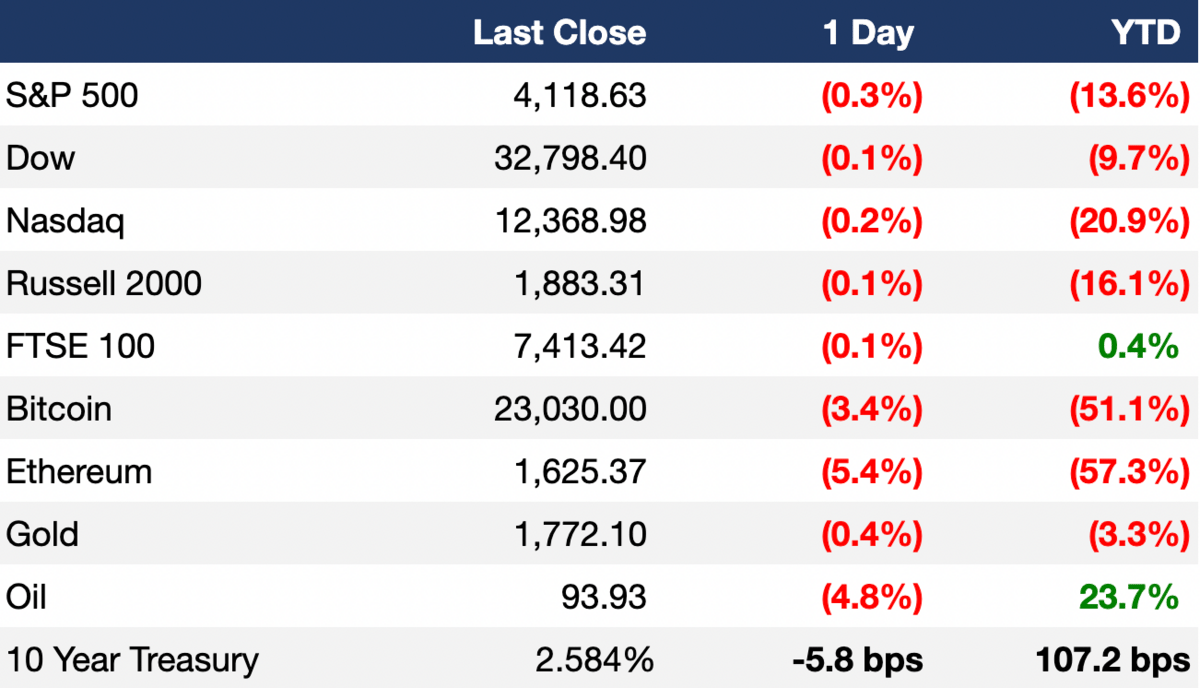

As of 8/1/2022 market close.

Markets

Stocks fell on the first trading day in August after July saw the market’s best month since 2020

The dollar fell for the fourth consecutive session, losing 0.4%, according to the WSJ Dollar Index

After last week’s interest rate increase of 75 bps, investors are forecasting lower future hikes for the rest of the year

Earnings

Activision Blizzard beat analyst expectations on revenue but fell short on the bottom line as the gaming industry contends with a slowdown from its pandemic-era highs (YHOO)

Pinterest rose 21.5% after releasing their Q2 earnings after hours; the company missed earnings and revenue expectations but reported better than expected user numbers (CNBC)

Diamondback Energy exceeded expectations for both earnings and revenue but shares of the shale producer fell 0.4% after hours as crude oil prices fell on the day (IBD)

What we're watching this week:

Today: AMD, Airbnb, PayPal, JetBlue, Starbucks, Uber, Ferrari, Caterpillar

Wednesday: Under Armour, Moderna, CVS Health, Robinhood

Thursday: Alibaba, AMC Entertainment, Kellogg’s, Paramount, WWE

Friday: DraftKings, Cinemark

Full calendar here

Headline Roundup

Ukraine dispatched its first grain shipment since the start of Russia’s invasion under a deal aimed at easing global food shortages (WSJ)

Global M&A activity dropped 30% YoY amidst economic and market uncertainty (WSJ)

Home prices cooled at record pace in June as the annual price appreciation rate fell from 19.3% to 17.3% (CNBC)

Elon Musk countersued Twitter on Friday (RT)

Twitter subpoenaed Morgan Stanley and Bank of America over their Twitter financing agreements with Elon Musk (BBG)

Several of Asia's most well known startup unicorns are trading 40% cheaper in private markets (BBG)

Consumers are shopping at discount stores more often, as average spending on grocery products at discount chains increased 71% from October 2021 to June 2022 (WSJ)

US factory activity slowed in July to its lowest level in two years, as orders declined (WSJ)

The DOJ sued to block book publishers Penguin Random House and Simon & Schuster's $2.2B merger (RT)

Amazon looks to differentiate itself in the first year of owning the rights to Thursday Night Football broadcasts, bringing on trick-shot group Dude Perfect to call some of the games through alternative streams (WSJ)

Over 100 of West Virginia's local governments reached a $400M settlement with drug distributors McKesson, AmerisourceBergen and Cardinal Health (RT)

Biotech company Amgen is fighting the IRS over $10.7B in owed back taxes and penalties (WSJ)

Nancy Pelosi will visit Taiwan later this week despite warnings from China (WSJ)

A Message From Causal

Finance leaders - Stop using Excel. A better spreadsheet exists

Many of us rely on Excel/G-Sheets, and we couldn’t imagine a world without them. The ability to quickly crunch numbers, build financial forecasts or model out scenarios allows us to make informed decisions.

But today’s spreadsheets come with significant (and annoying) challenges: manual data dumps, #REFs, untraceable errors and a lack of data protection creates a constant stream of manual work, stress and a lack of confidence in the work you just did — and that’s where Causal comes in.

Causal is a better way for working with numbers. It's like Excel minus the arcane formulas (no more Sheet1!$E$4 or VLOOKUPs), plus effortless modeling, live data integrations (accounting systems, CRMs, etc), and beautiful interactive dashboards.

Whether you’re a startup CEO focused on fundraising and cash runway, a finance leader building forecasts and financial reporting or an investor evaluating outcomes, Causal can help you plan with more confidence so you can make better decisions, faster.

Try Causal for free to level up the way you work with numbers

Deal Flow

M&A / Investments

Citigroup'’s Mexican unit Banamex will likely attract offers up to $8B as the bidding field narrows to local buyers (BBG)

Fintech payment firm Global Payments will buy smaller peer Evo Payments for ~$4B, including debt (RT)

New York-based cosmetics company Estée Lauder is in talks to buy luxury fashion brand Tom Ford in a potential $3B+ deal (WSJ)

State-owned oil giant Saudi Aramco will buy petrochemical maker Valvoline’s downstream unit for $2.65B in cash (RT)

New Mountain Capital agreed to buy three of life science firm PerkinElmer's businesses for up to $2.45B in cash (RT)

An investment group led by Apollo Global Management is in advanced talks to buy air-freight company Atlas Air Worldwide, which has a current market cap of ~$2.3B (CNBC)

Atlanta-based logistics firm Terra Worldwide is exploring a potential $1B sale of the company (BBG)

Telecommunications company Avatel Telecom is close to acquiring Spanish fiber-optic broadband operator Lyntia Access in a $1B deal (BBG)

PepsiCo will acquire an 8.5% stake and drink distribution rights in energy drink company Celsius for $550M (BBG)

Commodities broker Marex Group will buy rival ED&F Man Capital Holdings at a $220M valuation (RT)

EV maker Nikola will acquire battery supplier Romeo Power for $144M (~11% of the battery maker’s $1.3B 2020 SPAC valuation) (BBG)

World's 2nd largest crude contractor Baker Hugh will sell its oilfield services unit in Russia to its local management team for an undisclosed price (BBG)

Semiconductor maker Semtech is in advanced talks to buy Canadian peer Sierra Wireless (BBG)

South Korean auto manufacturer Hyundai Motor is considering increasing its 20.4% stake in or fully acquiring local lidar-free autonomous mobility platform 42dot (TC)

Global media conglomerate GoDigital Media Group acquired media company NGL Collective (PRN)

VC

Jidu Auto, an autonomous EV startup JV between Baidu and China's Zhejiang Geely Holding Group, is seeking up to $400M in fresh funds at a potential ~$3.5B valuation (BBG)

OriCell Therapeutics, a biotech company developing immunotherapies to satisfy globally unmet clinical needs, raised a $120M Series B co-led by Qiming Venture Partners and Quan Capital (PRN)

Boatsetter, a boat rental community, raised a $38M Series B led by Level Equity Management (CB)

GluBio Therapeutics, a biotech company developing targeted protein degradation drugs, raised a $22M Series A+ led by Qiming Venture Partners (PRN)

OneLoad, a Pakistani fintech which targets micro-retailers, raised an $11M Series A led by Sarmayacar and Shorooq Partners (BBG)

UnoAsia, an AI-based digital bank provider in the Philippines, raised an $11M seed round led by Creador (DSA)

Aurora Hydrogen, a company developing emission-free, hydrogen production technology, raised a $10M Series A led by Energy Innovation Capital (PRN)

Peech, an Israel-based provider of a platform that transforms raw video footage into branded edited videos, raised an $8.3M seed round led by Ibex Investors (FSMS)

Smarter Holding, a circular commerce data company, raised a $7M funding round extension from Regeneration.VC (PRN)

Differentiated Therapeutics, a biotech company focused on computationally predicting and optimizing targeted protein degraders, raised a $5M seed round led by Curie.Bio (FSMS)

Concert Bio, a microbiome company focusing on hydroponic agriculture, raised a $1.7M pre-seed round led by The Venture Collective (TC)

SPAC

Blockchain infrastructure firm W3BCLOUD will merge with Social Leverage Acquisition Corp I in a $1.25B deal (BW)

Debt

Tom Brady-backed bakery Hero Bread is in talks to raise a convertible note at either a $400M valuation or a 20% discount to the company’s next funding round (BBG)

Bankruptcy / Restructuring

Space company Masten filed for Chapter 11 bankruptcy protection after struggling to deliver on its NASA moon contract (CNBC)

Fundraising

Bain Capital is raising $5B for its fifth Asia-Pacific fund (BBG)

Fund manager Octopus Investments revealed that it has raised ~$2.45B over the last 12 months to pursue energy transition opportunities, UK growth company investments and other UK private market opportunities: ~$980M is for renewable energy infrastructure and ~$490M for their care home strategy (FE)

Crypto Corner

The SEC charged 11 people in an alleged $300M crypto Ponzi scheme (CNBC)

North Koreans are plagiarizing LinkedIn resumes and lying about their nationality to get jobs at crypto firms to aid their government's illicit money-raising efforts (BBG)

Luxury jeweler Tiffany and Co. unveils $50k CryptoPunk pendant necklaces (CD)

Exec's Picks

The Milk Road interviewed Reid Hoffman about crypto yesterday, and their conversation was fantastic. Check out the interview here.

A Goldman Sachs program-trading duo recently left the bank for an opportunity at a hedge fund after raking in at least $700M the past two years. GS thinks the guys left with sensitive computer code they developed and are now causing a stink. The traders say they didn't take a single line of code with them. Read the article here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.