Together with

Good Morning,

Hedge funds are reviving appraisal arbitrage, US trade deficit narrowed to a five-year low, biotech hedge funds are on an absolute tear, foreign investors are dumping Asia stocks, exchanges are planning to launch derivatives for private markets, and Larry Ellison's net worth plunged $25B after Oracle slumped.

Finance folks, get a head start on next year's planning budgets with Planful's Annual Planning Survival Kit: your step-by-step guide to stable, strategic planning.

Let's dive in.

Before The Bell

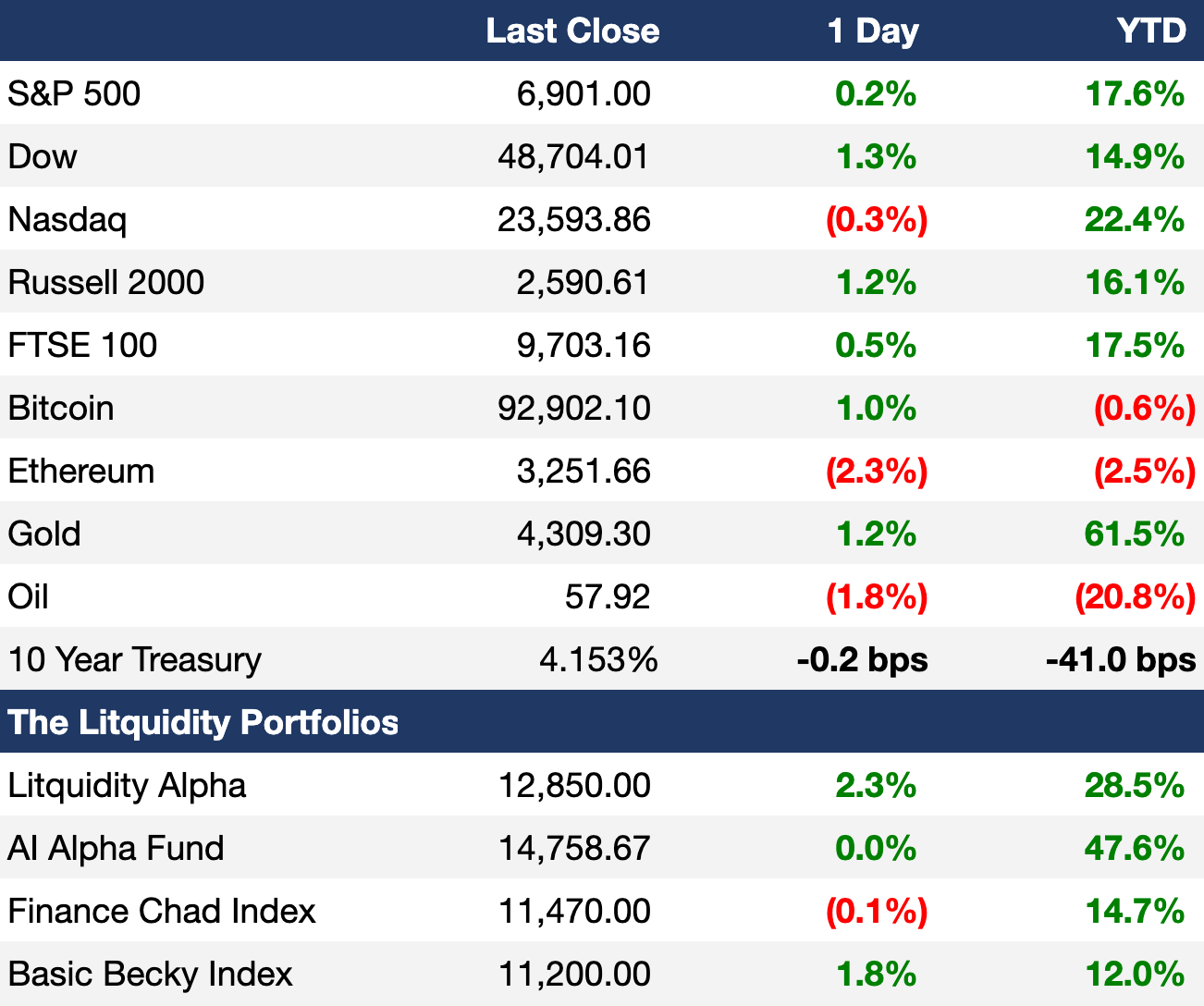

As of 12/11/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose yesterday as investors digested the Fed rate cut and growing angst over AI spending

S&P and Dow closed at fresh ATHs

Dow had its best day since January relative to S&P

Oracle CDSs rose further to 2008 levels

MSCI World index hit a fresh ATH on track for its best year since 2019

Thailand's SET index is down 10% YTD as Asia's worst index amid a capital flight

Oil settled at a three-month low

Indian rupee fell to a fresh record low

Earnings

Broadcom issued a Q4 beat-and-raise on surging AI demand, with the firm expecting AI chip sales to double in Q1 (CNBC)

Costco beat Q1 earnings and revenue estimates thanks to strong member growth among younger shoppers, rising digital sales, new location openings, and fee increases (CNBC)

lululemon issued a Q3 beat-and-raise but fired its CEO amid years of struggles from intense competition and weak demand (CNBC)

Full calendar here

Prediction Markets

Risk-free you say??

Trade the 2028 US presidential election on Polymarket

Headline Roundup

Hottest IB jobs for college grads is in private capital advisory (EFC)

US trade deficit narrowed to a five-year low (RT)

US jobless claims surged by the most since Covid (RT)

US plans to boost tax break for corporations (BBG)

Bessent emphasizes economic growth in bid to ease regulations (BBG)

Fed reappointed regional chiefs early to shield from Trump politics (FT)

BOJ says economy has weathered US tariffs (FT)

Switzerland held rates steady at 0% (CNBC)

Top exchanges set sights on derivatives for private markets (BBG)

Hedge funds revive 'appraisal arbitrage' play after years of decline (BBG)

Asia stocks see biggest foreign outflows in six years on AI valuation fears (RT)

Retail investors load up on Netflix after $40B selloff (BBG)

Investors say SpaceX will be 'craziest IPO' ever (RT)

Biotech rally sees biotech hedge fund gains touch 100% YTD (FT)

VC fundraising is set for its worst year since 2017 (INC)

Emerging manager hedge fund debuts boom in UAE (BBG)

EM private credit surged to a record $18B (FT)

London's IPO fortunes brighten after Q4 deals rebound (BBG)

KKR sees European credit renaissance fueled by ABS boom (BBG)

CPPIB CEO warned against rushing into private credit deals (FT)

Apollo sees echoes of SVB in US insurance's shift to Caymans (BBG)

Deutsche Bank is most exposed European bank to shadow banks (BBG)

BofA promoted 394 to MD (RT)

Tesla US sales hit a four-year low (RT)

OpenAI launched GPT-5.2 after 'code red' response to Google (RT)

Larry Ellison's net worth plunged $25B on Oracle slump (BBG)

A Message from Planful

Strengthen Portfolio Planning with a Survival Kit Built for Your Teams

Planning season can pull you in every direction, but you have what it takes to lead with clarity. When budgets freeze, targets shift, and decisions stack up, the right tools help you move from reacting to steering the process.

The Annual Planning Survival Kit gives you practical resources to stay in control: a checklist to pressure-test your approach, guidance for staying flexible under pressure, a real CFO story to spark new thinking, and short demos that show how to modernize without adding complexity. It's designed to help you cut through noise, stay confident, and keep your plan on track.

Download the kit to steady your process and lead planning season forward.

Deal Flow

M&A / Investments

SoftBank is weighing an acquisition of DigitalBridge-backed data center operator Switch at an over $50B valuation, including debt; SoftBank is also in talks to acquire DigitalBridge

Singapore state-owned development company Sembcorp Industries will acquire Australia's Alinta Energy for $4.3B as it expands overseas

Apollo is exploring a sale or IPO of golf and membership clubs operator Invited at a $3B valuation, including debt

General Atlantic and Canada's CPPIB agreed to acquire recreational boat online marketplace Boats Group from UK PE firm Permira for over $2B

The Wyckoff family acquired winery-owner Ste. Michelle Wine Estates from PE firm Sycamore, which saw Sycamore and lenders take a loss

Blackstone and EQT-backed Dutch payments firm Mollie will acquire UK fintech GoCardless in a $1.2B mostly-stock deal

Singapore's Keppel REIT will acquire an additional one-third stake in Singapore's Marina Bay Financial Centre Tower 3 from Sageland for $725M

German technology group Freudenberg offered to acquire Lego family-backed industrial vacuum cleaners maker Nilfisk for $595M

Blackstone will acquire a portfolio of grocery-anchored retail properties in Texas for $440M

Carnelian Energy Capital is seeking to sell six of its North American O&G production investments

European financial services giants Natixis and Generali ended talks for a $3T asset management JV

Blackstone will acquire a portfolio grocery-anchored retail properties in Texas for $440M

The asset management arm of crypto firm Blockstream will acquire event-driven hedge fund Corbiere Capital

Crypto firm Nexo will acquire Argentina trading platform Buenbit

VC

OpenAI raised a $1B strategic investment from Disney

AI-powered IT support startup Serval raised a $75M Series B at a $1B valuation led by Sequoia

Large-satellite startup K2 Space raised a $250M Series C led by Redpoint

AI DevOps platform Harness raised a $240M Series E round at a $5.5B valuation led by Goldman Sachs

Port, an AI-agent orchestration and developer portal startup, raised a $100M Series C at an $800M valuation led by General Atlantic

Medra, a physical AI scientist platform for drug discovery, raised a $52M Series A led by Human Capital

GenAI developer tools startup Runware raised a $50M Series A led by Dawn Capital

AI behavioral-health software startup Ritten raised a $35M Series B led by Five Elms Capital

Outset, an AI-moderated research platform, raised a $30M Series B round led by Radical Ventures

Cascade, a DeFi neo-brokerage for 24/7 perpetual futures, raised a $15M seed round co-led by Polychain and Variant

Subsense, a non-surgical BCI startup, raised a $10M round from Golden Falcon Capital

AI wildlife-monitoring startup Spoor raised a $9.3M Series A led by SET Ventures

Cynch AI, an AI-native tax automation startup, raised a $9M round led by TGV

AI strategic intelligence startup Trendtracker raised a $7M Series A round led by Armilar

AI credit-intelligence startup AIR raised a $6.1M Seed round co-led by Work-Bench Ventures and Lerer Hippeau

Get real-time updates on any startup, VC, or sector. Try Fundable.

IPO / Direct Listings / Issuances / Block Trades

Indian asset management JV ICICI Prudential Asset Management began taking orders for its India IPO that could raise $1.2B at a $12B valuation

PE firm TPG is considering a stake sale or IPO of jeweler APM Monaco at a $2B valuation

Debt

EU is set to extend its freeze on Russian assets to allow for a $105B loan to Ukraine

India's central bank RBI bought $5.5B of bonds

Dutch lender ABN Amro Bank completed a SRT with Blackstone in its first loss protection on a $2.3B portfolio of corporate loans

Chipmaker STMicroelectronics opened a $1.2B credit line with EIB

Mariner Wealth Advisors is set to raise $1.2B in high-yield debt for a refinancing

Argentina raised $1B in its first domestic dollar bond sale since a 2020 restructuring as it plots a return to global markets

Bankruptcy / Restructuring / Distressed

Bankrupt auto parts supplier First Brands' $1.1B DIP loan plummeted further to 30¢ after Marathon and Redwood sold

Distressed assets investor Flacks Group offered to revive Italy's struggling ILVA steel plant ahead of an auction deadline, which would include eventually acquiring Italy's 40% stake for $600M-$1.1B

Grand Slam Track League filed for bankruptcy

Fundraising / Secondaries

$180B Hermes-linked family office Krefeld created new asset manager Breithorn Holding to acquire assets outside luxury fashion, with investments already in French insurer Albingia and KKR-backed Anjac Health & Beauty

Ilex Capital Partners, the UK hedge fund that debuted with $1.8B in 2022, raised another $2B in Q3 to bring AUM to $7B; the fund is up 9% YTD

CAPZA, the private markets arm of BNP Paribas' asset manager AXA, raised $1.3B for a senior loan fund

Integrity Growth Partners raised $220M for a debut fund

Crypto Sum Snapshot

JPMorgan arranged a short-term bond for Galaxy on the Solana blockchain

Coinbase is set to launch prediction markets and tokenized stocks

SEC gave DTCC approval to tokenize stocks in move to blockchain

Norway's Norges Bank paused CBDC plans

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Bloomberg published a deep dive on Berkshire's new CEO Greg Abel and the challenges that lie ahead.

Jacob Miller published a blog post for the CFA Institute on how AI is impacting VC.

WSJ published an interesting summary of the raging accounting debate on depreciation practices of AI chips.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.