Together with

Good Morning,

US consumer sentiment is improving, the pound keeps losing value vs the dollar, Credit Suisse is considering bringing back the First Boston brand, China raised its US treasury holdings, Bank of America will offer zero-down mortgages to minority first-time homebuyers, India's Gautam Adani is the world's second-richest man, and Biden declared the pandemic "over".

Let's dive in.

Before The Bell

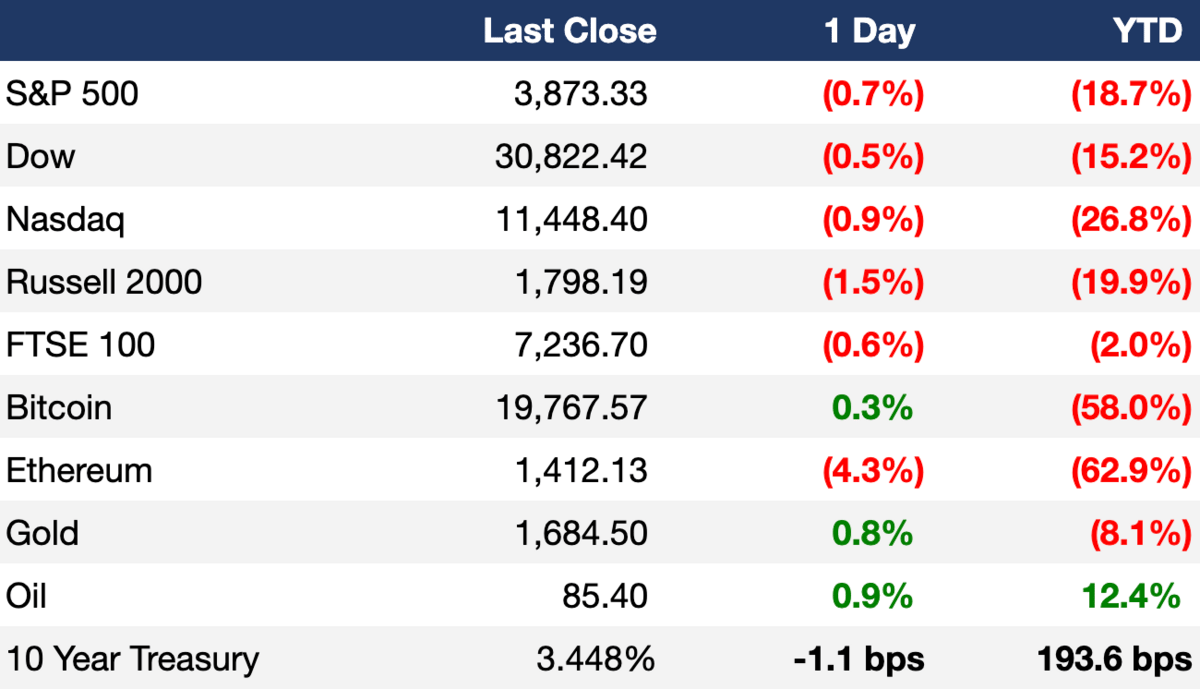

Markets

Markets closed down Friday as investors reacted to the hotter-than-expected inflation report and FedEx’s warning about a “significantly worsened” global economy

On the data front we’ll hear the August housing starts on Tuesday and initial jobless claims on Thursday

Earnings

What we're watching this week:

Wednesday: General Mills, Trip.com

Thursday: Accenture, Costco, FedEx, Manchester United

Full calendar here

Headline Roundup

Biden declared that the pandemic is "over" in his 60 Minutes interview (CBS)

Credit Suisse considers rebranding investment bank First Boston (BBG)

US consumer inflation expectations fell to one-year low in September (RT)

Pound hit a 37-year low against the dollar as UK recession fears mount (FT)

Canadian dollar hit a near 2-year low against the US dollar (RT)

US bank regulators are considering new rules for regional banks in times of crisis (WSJ)

China raised US treasury holdings in July for the first time in eight months, while Japan reduced US debt load (RT)

China will sanction CEOs of Boeing and Raytheon over Taiwan sales (RT)

Credit Suisse settled for $32.5M in a US shareholder lawsuit over risk exposure to clients such as Archegos (RT)

Indian industrialist Gautam Adani is now the world's second-richest person (BBG)

Bank of America will offer zero-down mortgages to minority first-time homebuyers in certain US cities (CNBC)

NY marijuana retail licenses will go first to those convicted of drug crimes (WSJ)

Michael Jordan’s ‘Last Dance’ jersey sold for record-breaking $10.1M (CNBC)

Market downturn sparks logest US tech IPO drought in over 20 years (FT)

A Message From Kalshi

Trade the Future

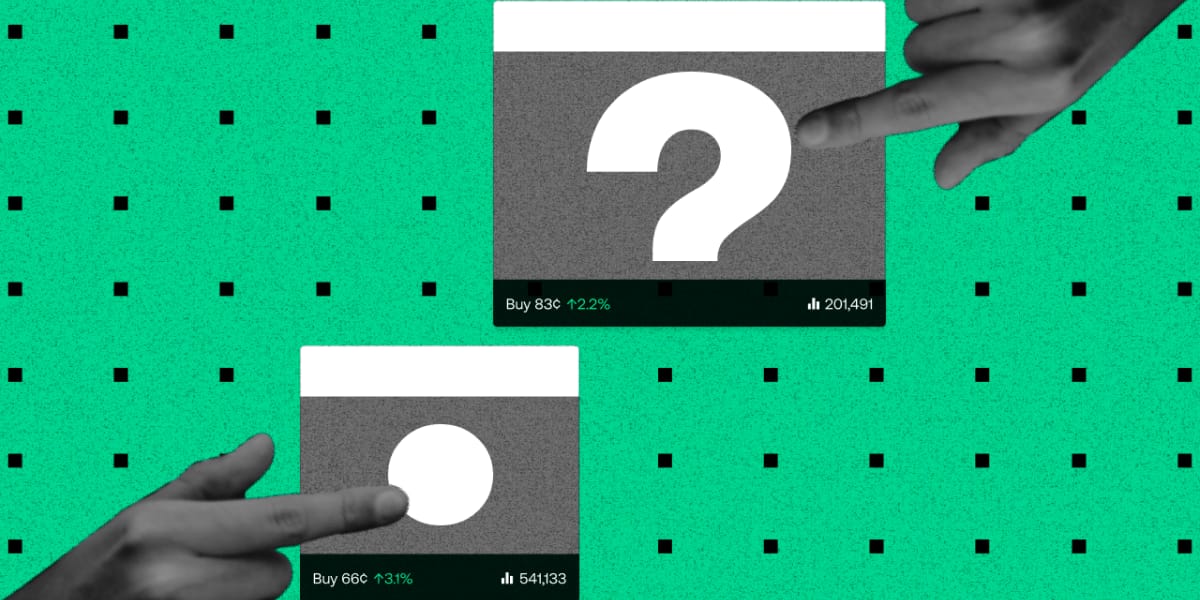

For decades, being an investor meant buying exposure to a broad spectrum of factors outside of your intended investment: the economy, consumer sentiment, regulatory change and more.

Your investments are your decisions, and you should be able to control both completely. That’s why Kalshi built an entirely new asset class — one that Wall Street has never shared – so every American can take back control of their investment decisions.

Event contracts on Kalshi let you trade real world events on the first ever fully CFTC-regulated exchange.

And the decision couldn't be simpler: will something happen, or not?

Traders can buy "Yes" or "No" shares tied to specific future events — like "Has inflation peaked?" As the event becomes more likely to happen, the value of the share appreciates. You can sell the shares any time, or hold until the market resolves.

Will the US go into recession? Will 2022 be the hottest year on record? Will there be a moon landing before 2025? Whatever your view, Kalshi lets you trade it.

Deal Flow

M&A / Investments

BHP Group is considering raising its $5.6B offer for miner OZ Minerals (BBG)

Alternative investment firm Stonepeak agreed to buy telecom company Intrado’s emergency call-routing services unit in a $2.4B deal (RT)

Sports metaverse company LootMogul received a $200M investment commitment from Gem Global Yield (PRN)

VC

Federato, a startup helping insurance customers manage risk, raised a $15M Series A led by Emergence Capital (TC)

Qidi, a Chinese startup building smart glasses, raised a $14.4M angel round led by Joy Capital (PRN)

NebulaGraph, a Chinese startup offering graph databases with open source and enterprise subscription options, raised a ‘low tens of millions’ Series A led by Joy Capital (TC)

Taqtile, an augmented reality-enabled work instruction platform, raised a $5M preferred equity round from Mesmerise and Downer (BW)

KNN3, a startup looking to enable social discovery across decentralized apps, raised a $2.4M seed round led by HashGlobal and former CEO of Chinese conglomerate Fosun International LiangXinjun (TC)

IPO / Direct Listings / Issuances / Block Trades

Bankruptcy

Crypto exchange FTX is the front runner to buy the assets of crypto lending company Voyager Digital, which filed for bankruptcy in July after halting withdrawals, trading and deposits due to liquidity issues (TI)

SPAC

Lunar-focused space company Intuitive Machines agreed to merge with Inflection Point at a ~$1B valuation (CNBC)

Fundraising

Crypto Corner

Exec's Picks

Rally invented fractional investing in alternative assets. Find rare sports memorabilia on Rally and trade equity in rookie cards, championship rings, and more. Invest in more than just a ticker symbol. Real assets with legendary stories await you on Rally.

Bain Capital recently published an interesting report on embedded finance and consumer preferences, check it out here.

Adobe acquired design tool developer Figma for $20B last week. The Information has broken down the biggest VC winners from the sale. Read here.

Silicon Valley exec and angel investor Adam Nash wrote a post about how he met Dylan Field, the founder of Figma. He explained the vision and challenges of building web design tools on the cloud back in 2012, when it was far from obvious and filled with immense challenges. Read here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

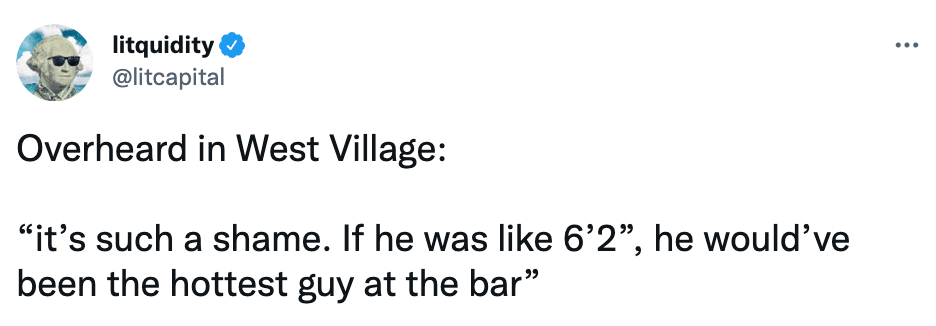

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.