Together with

Good Morning,

Warner Bros. reopened talks with Paramount, Goldman will drop DEI from all board hiring, Mamdani proposed a 10% property tax hike to close NYC's budget gap, PE-backed SaaS firms are releasing earnings early to calm AI fears, and Palantir moved their HQ again from Denver to Miami.

Invest before the IPO. Get access to 20 private companies worth a combined $3.3 trillion that accredited investors can buy today with our sponsor Augment.*

Let's dive in.

Before The Bell

As of 2/17/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed flat yesterday as investors continued to weigh AI software fears ahead of crucial Fed minutes

Egypt's EGX 30 index is up 27% YTD in dollar terms this year, more than double of the MSCI EM index

Bitcoin fell for a fourth-straight week

Earnings

Palo Alto Networks beat Q2 earnings and revenue estimates as AI trends boost cybersecurity demand but disappointed on guidance (CNBC)

eToro beat Q4 earnings and revenue estimates as a 43% rise in stocks, commodities, and FX trading offset a 72% drop in crypto revenue (RT)

Toll Brothers beat Q4 earnings and revenue estimates but fell short on order estimates as buyers hold back over prices and economic uncertainty (BBG)

What we're watching this week:

Today: Carvana, Figma, DoorDash

Thursday: Walmart, Opendoor, John Deere, Klarna, Wayfair

Full calendar here

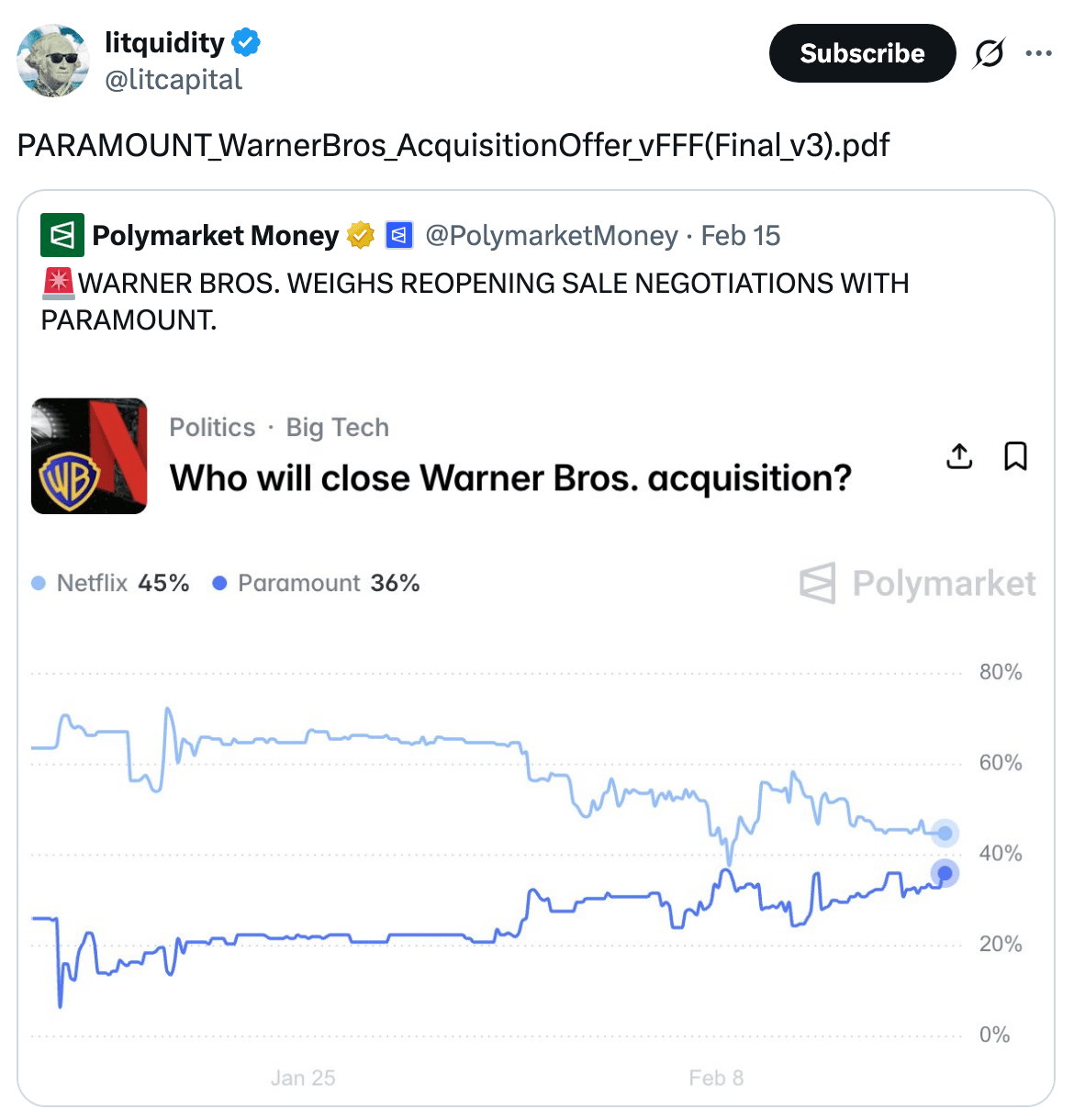

Prediction Markets

US-Iran nuclear talks aren't going too smooth.

Trade event contracts on Polymarket, the world's largest prediction market.

Headline Roundup

Mamdani proposed 10% property tax hike if no tax on wealthy (WSJ)

Goldman Sachs will drop DEI from all board candidate criteria (WSJ)

Two unions are urging SEC to investigate Apollo over Epstein ties (FT)

Palantir moved HQ again from Denver to Miami (CNBC)

Global regulators fret about banks' rising use of SRTs (FT)

EU cross-border bank M&A jumped to the highest since 2008 (FT)

PE megafunds chase India cricket as new investment craze (RT)

Heavy demand for corporate bonds creates record trading volume (BBG)

Private software companies release earnings early to calm AI nerves (BBG)

Bank of Ireland quit US leveraged loan market amid private credit competition (BBG)

Companies boost FX hedging as tariffs spark losses (BBG)

Investor worry over Capex race is at record high (BBG)

AI impact on corporate growth seen as limited to Big Tech (BBG)

Big Oil execs are under pressure to spell out growth plans (FT)

LA to China exports fell to a three-year low (RT)

Soaring gold price force vaults to reduce insurance cover (FT)

SEC chair Paul Atkins called for shrinking exec pay disclosure (RT)

US charged two ex-execs in PE fraud (FT)

A Message from Augment

SpaceX. OpenAI. Stripe. Canva. Databricks.

$3.3 Trillion. 20 Companies. Zero Tickers. You probably use their products. You just can't buy their stock – at least, not on a traditional exchange.

These are some of the most consequential companies in tech, and none of them are public yet. But they do trade — on the secondary market, where accredited investors have been buying and selling private company shares for years.

Augment's Q4 Power 20 Report ranks the top 20 pre-IPO companies by secondary market activity, estimated price movement, and revenue. The combined estimated valuation: $3.3 trillion – a figure that would rival some of the largest publicly traded companies in the world.

Here's what you need to know about the private markets right now:

Secondary deal volume reportedly hit a record $226B in 2025, up 41% YoY

Several Power 20 names are reportedly in active IPO preparation for 2026

Augment is a FINRA-registered broker-dealer built for individual accredited investors looking to access shares in private companies before they list

The window between 'private' and 'public' is where many of these companies have historically experienced significant growth. Public market investors often arrive after that phase is over.

*Inclusion in the Augment Power 20 does not predict future performance and should not be considered investment advice. Investing in private companies in the secondary market carries risks, including potential lack of liquidity and limited financial information. Past activity not indicative of future results. The revenue figures are based on third-party estimates and are subject to limitations in data availability and methodology. For informational purposes only.

Deal Flow

M&A / Strategic

Warner Bros. Discovery rejected Paramount Skydance's sweetened $108B bid but will reengage on a new offer, potentially sparking a bidding war with Netflix

Germany is preparing to buy a potential 25.1% stake in Franco-German tank maker KNDS ahead of its planned $23.7B France and Germany dual IPO

Australian steel firm SGH and US-based Steel Dynamics submitted a sweetened 'best and final' $10.6B offer for Australia's BlueScope Steel

Diagnostics tech maker Danaher agreed to buy medtech Masimo at a $9.9B valuation, including debt, representing a 40% premium

Natural gas firm Ovintiv agreed to sell its Anadarko oil and natural gas assets to an undisclosed buyer for cash proceeds of $3B

Blackstone agreed to acquire HVAC group Champions from Odyssey Investment Partners at a $2.5B valuation

Portland General Electric agreed to buy the wind, natural-gas generation, and distribution assets of Berkshire Hathaway's PacifiCorp unit in Washington for $1.9B amid wildfire damages

Palo Alto Networks will acquire Israeli agentic cybersecurity startup Koi for $400M

Shelby Companies, a vehicle of hedge fund Knighthead Capital Management, will acquire a 97% stake in UK women's soccer club Birmingham City WFC from parent Knighthead

Apollo-backed UK-based The Restaurant Group is exploring a sale of its airport and rail‑hub restaurant division

Canadian apparel and furnishings distributor A.Y.K. International agreed to acquire struggling Canadian apparel firm SRTX

VC

European thermal intelligence startup SatVu raised a $40M round led by the NATO Innovation Fund

AI-powered healthcare payment integrity startup Codoxo raised a $35M Series C led by CVS Health Ventures

Enterprise AI governance consultancy Lightworks raised $12M in financing led by Round13 Capital

Skygen.AI, an autonomous AI platform for enterprise software automation, raised a $7M seed round

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

EQT and Vitruvian Partners-backed cyber insurer CFC is exploring an IPO at a $6.8B valuation

Polish fintech Blik is exploring a Poland IPO at a $2B valuation

Activist Starboard Value built a 9% stake in $1.1B-listed online travel agency Tripadvisor

Robinhood is seeking to raise $1B in an IPO of a closed-end fund holding stakes in SpaceX, OpenAI, Databricks, Stripe, Revolut, and others from Robinhood's retail clients

Activist Jana Partners built a stake in $32B-listed payments processor Fiserv

Blackstone-backed mobile advertising platform Liftoff postponed its $760M IPO

$20B-listed automotive parts retailer Genuine Parts will split into two listed companies following a strategic review of its automotive and industrial business lines amid pressure from activist Elliott

Nvidia unloaded a $140M stake in UK chip firm Arm

Activist Palliser Capital took a stake in Japanese toilet-maker Toto citing an 'undervalued and overlooked' AI play

Berkshire Hathaway sold stakes in Bank of America and Apple and added New York Times in Warren Buffett's final trades as CEO

SPAC / SPV

The Trump family, Israel-based Protego Ventures, developer American Ventures, and others are investing in a $1.5B all-stock merger between Israeli drone maker XTEND and US-listed JFB Construction Holdings in a deal aimed at taking XTEND public

Debt

Theater chain AMC is seeking a $2.5B junk loan to refinance existing debt

Panama is selling $3B of global bonds in its first deal in two years

Auto parts supplier Cooper-Standard is seeking to sell a $1.1B junk bond

Arts-and-crafts retailer Michaels is marketing a $1.7B junk bond

Senegal secured funding in regional debt markets to meet ~$485M in eurobond payments due March

Carlyle, BlackRock, Benefit Street Partners, and Oak Hill Advisors are buying up cheap pools of software debt as they prepare to launch new CLOs

Bankruptcy / Restructuring / Distressed

Vanderbilt Minerals filed for bankruptcy after losses from asbestos lawsuits

Bankrupt luxury retailer Saks Global is fighting mall operator Simon Property to keep two California and New York stores open after the firm moved to take over the locations over unpaid rent before their January bankruptcy filing

Funds / Secondaries

VC Thrive Capital raised over $10B for its tenth and largest fund yet

Private markets FOF HarbourVest Partners raised $1.1B for its debut PE continuation solutions fund to focus on single asset CVs

French investment firm Tikehau Capital raised over $1B for its second private credit secondaries fund

Spain's Mundi Ventures raised $885M for a debut deep tech fund

Seligman Investments, a unit of asset manager Columbia Threadneedle, launched Seligman Ventures with $500M to invest across early-stage to pre-IPO startups focused on AI and cloud infrastructure, cybersecurity, and data center hardware

Crypto Sum Snapshot

Stripe's crypto unit Bridge won initial approval to establish a trust bank

Goldman and NYSE execs will headline Mar-a-Lago crypto forum hosted by Trumps

Gemini top three execs departed months after IPO

Binance kidnap attempt in France despite bear market puts industry on alert

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Equity capital markets are off to a strong start, with IPO activity accelerating after several years of subdued issuance. But as financial sponsors return to the market and a new wave of mega-cap and SMID-cap IPOs line up, is there sufficient demand? Learn more.

On the private markets side, check out these two interesting but antithetical articles on the state of VC:

VC-backed unicorns are losing their horns

2026 may be year of the 'Soonicorn'

Upcoming Events👩💻💆♀️

Litquidity and Ramp's women founder community are getting together for an after-work destress on Tuesday, March 3 at a penthouse on Billionaires' Row. Featuring a self-care 'happy hour' of mini facials, vitamin shots, pop-up wellness brands, and epic views, this is a great excuse to destress and meet other NYC women entrepreneurs! RSVP here.

A special shoutout to Manhattan Laser Med Aesthetics and Chelsea Bizub for contributing to the experience.

Powered by Palm & Park

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.