Together with

Good Morning,

Sam Altman was fired, almost rehired, then not rehired over the weekend, Wall Street is tired of ESG, Shakira is on trial for alleged tax fraud, Argentina has a new president, Bob Iger has had a roller coaster year at Disney, and former first lady Rosalynn Carter passed away.

Tired of receiving 20 spam calls per day? Get your personal data off the internet with today’s sponsor, Incogni.

Before The Bell

As of 11/17/2023 market close.

Markets

US stocks edged slightly upward to close out a third straight winning week

The S&P led indices with a 0.13% gain

European stocks rose thanks to a eurozone October inflation report showing decelerating inflation

Earnings

What we're watching this week:

Today: Zoom

Tuesday: Nvidia, HP, Lowe’s, Autodesk, Medtronic, Abercrombie & Fitch, Best Buy, Nordstrom,

Wednesday: Deere

Thursday: Royal Bank of Canada

Full calendar here

Headline Roundup

OpenAI CEO Sam Altman discusses possible return, mulls new AI venture (RT)

Wall Street’s ESG craze is fading (WSJ)

Huawei is giving Apple stiff competition in China (CNBC)

Tesla beat lawsuit claiming it monopolizes repairs, parts (RT)

Apple’s in-house technologies team still has plenty of work to do (BBG)

Inside Bob Iger’s roller coaster year at Disney (WSJ)

Shakira stands trial in Spain for alleged tax fraud (RT)

Ruble bends to Putin’s will in nod to wartime election economics (BBG)

OPEC+ to consider whether more oil cuts needed (RT)

Former first lady Rosalynn Carter died at 96 (WSJ)

GM’s Cruise CEO offers apology, will allow share sales (RT)

Bayer ordered to pay $1.56B in latest US trial loss over Roundup weedkiller (RT)

Argentina votes for new president to confront economic crisis (WSJ)

India seen keeping rice export bans into 2024, holding up global prices (BBG)

F1, the NBA and a Super Bowl: Las Vegas makes its play as America’s sports capital (WSJ)

Israel, Hamas close in on hostage deal amid mounting scrutiny of Gaza death toll (WSJ)

A Message From Incogni

While you're getting ready to shop great deals this week, data brokers are looking to acquire your personal information from all that online shopping.

These companies specialize in collecting personal information and selling it in bulk to marketers (and sometimes scammers). The good news is that you can avoid the Black Friday spam madness before it hits by signing up with Incogni!

Incogni automatically removes your info from the web so that spammers and scammers can't get access to it.

Use code EXEC60 today to get an exclusive 60% discount for Exec Sum readers and get your data removed from 180+ sites automatically with Incogni.

Worried you won’t see the results? There’s no better time to test it out than during the marketing frenzy that is Black Friday. If you don’t find peace from spam within 30 days they offer a full refund.

Deal Flow

M&A / Investments

British billionaire Jim Ratcliffe is nearing a deal to acquire a 25% stake in Manchester United from the Glazer Family that would value the Premier League team at $5.4B (FT)

Spanish utility Iberdrola is planning to make an offer for Electricity North West that could value the British power distribution network at up to $4.3B (RT)

North and South Carolina hospital network Novant Health will acquire three hospitals and their related operations in South Carolina from Tenet Healthcare for $2.4B cash, which Tenet will use to reduce debt (RT)

The Barclay family made a fresh offer, which is backed by media and sports investment group RedBird IMI, to reclaim the Telegraph newspaper from Lloyds Banking Group; RedBird would lend money to Barclay family, allowing them to repay their $1.4B of debt owed (BBG)

OneLife Fitness is exploring a sale that could value the US operator of health and fitness clubs at ~$700M (RT)

Chinese billionaire Li Shufu’s Zhejiang Geely Holding Group sold a $350M stake in Volvo Car (BBG)

Italian fashion house Missoni is exploring a potential sale of the family-owned company (RT)

Panasonic Holdings agreed to sell part of its automotive systems unit and will potentially seek a public listing of the business (BBG)

Petal Card, a credit card company backed by Peter Thiel’s Valar Ventures, is exploring options including a possible sale or additional funding (BBG)

Indonesian state miner PT Mineral Industri Indonesia agreed to acquire a 14% stake in Vale Canada’s and Japan's Sumitomo Metal Mining’s Indonesian nickel mining unit (RT)

Abris Capital Partners is considering a sale of private healthcare provider Scanmed Group; Polish cardiovascular care company American Heart of Poland is the most likely buyer (RT)

Barclays is exploring a potential acquisition of Tesco’s banking operations (RT)

Norway's competition watchdog may block Norwegian Air's bid for domestic rival Wideroe, as it may cause fewer and more expensive flights (RT)

VC

Sustainable aviation fuel startup SkyNRG raised a $190.9M round led by Macquarie Asset Management (EU)

Forward, a startup using sensors, mobile, and AI to improve healthcare, raised a $100M growth round led by Khosla Ventures, Founders Fund, and more (FN)

Smart glass startup Halio raised a $70M round led by SKC (FN)

X-Bow Systems, a low-cost hypersonics provider, raised $64M in funding from Lockheed Martin Ventures (PRN)

RNA and protein manufacturing startup Nature’s Toolbox raised a $47.5M Series B led by RA Capital Management (FN)

Project management software startup Ingenious.Build raised a $37M Series A led by Morpheus Ventures and Navitas Capital (FN)

Route 92 Medical, a medical technology company, raised a $31M Series F led by U.S. Venture Partners, Norwest Venture Partners, InnovaHealth Partners, and The Vertical Group (FN)

Cumulus Coffee Company, a startup advancing a solution for making cold brew at home, raised a $20.3M seed round led by Valor Siren Ventures and Valor Equity Partners (FN)

Leap, a platform for generating value from distributed energy resources, raised $16M in funding from Presidio Ventures (VC)

Inclusively, a workforce inclusion platform, raised a $13M Series A led by Firework Ventures (FN)

Workshop, an email platform for internal communications, raised a $12M Series A led by McCarthy Capital (PRN)

Every.io, a provider of a ‘back office stack’ for startups, raised a $9.5M seed round led by Base10 (FN)

Climate tech startup Kind Designs raised a $5M seed round led by Mark Cuban and Anthropocene Ventures (BW)

Sleek, a Web3 social network, raised a $5M seed round from Binance Labs, Shima Capital, and more (FN)

Blockchain-based game studio Bazooka Tango raised a $5M round led by BITKRAFT Ventures (FN)

AireXpert, a Buffalo, NY-based provider of aerospace and aviation collaboration and automation solutions, raised $3M in funding led by Reformation Partners (FN)

Glencoco, an NYC-based marketplace that connects companies with business development consultants, raised a $3M round led by Felicis and Crossbeam (FN)

AI startup Artisan AI raised a $2.3M pre-seed round from Y Combinator, Bayhouse Capital, and Oliver Jung (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Blackstone is the frontrunner to win a ~$17B portfolio of commercial-property loans from the FDIC’s sale of Signature Bank debt (BBG)

Veritiv sold $1.3B of debt to support Clayton Dubilier & Rice’s leveraged buyout of the packaging supplier (BBG)

Banco BPM is selling $327M worth of euro-denominated additional Tier 1 bonds (BBG)

Bankruptcy / Restructuring

Fundraising

Bain Capital raised $7.1B for its latest Asia-Pacific buyout fund (BBG)

The renewable investing arm of British energy company Octopus Energy launched a dedicated fund with Japan's Tokyo Gas to invest $3.7B in offshore wind projects by 2030 (RT)

LG Technology Ventures, LG Group’s VC arm, created a $309M fund to back startups in AI, batteries, and mobility (BBG)

Cybersecurity VC Ballistic Ventures is seeking to raise as much as $300M for its second fund (TC)

Crypto Corner

Exec’s Picks

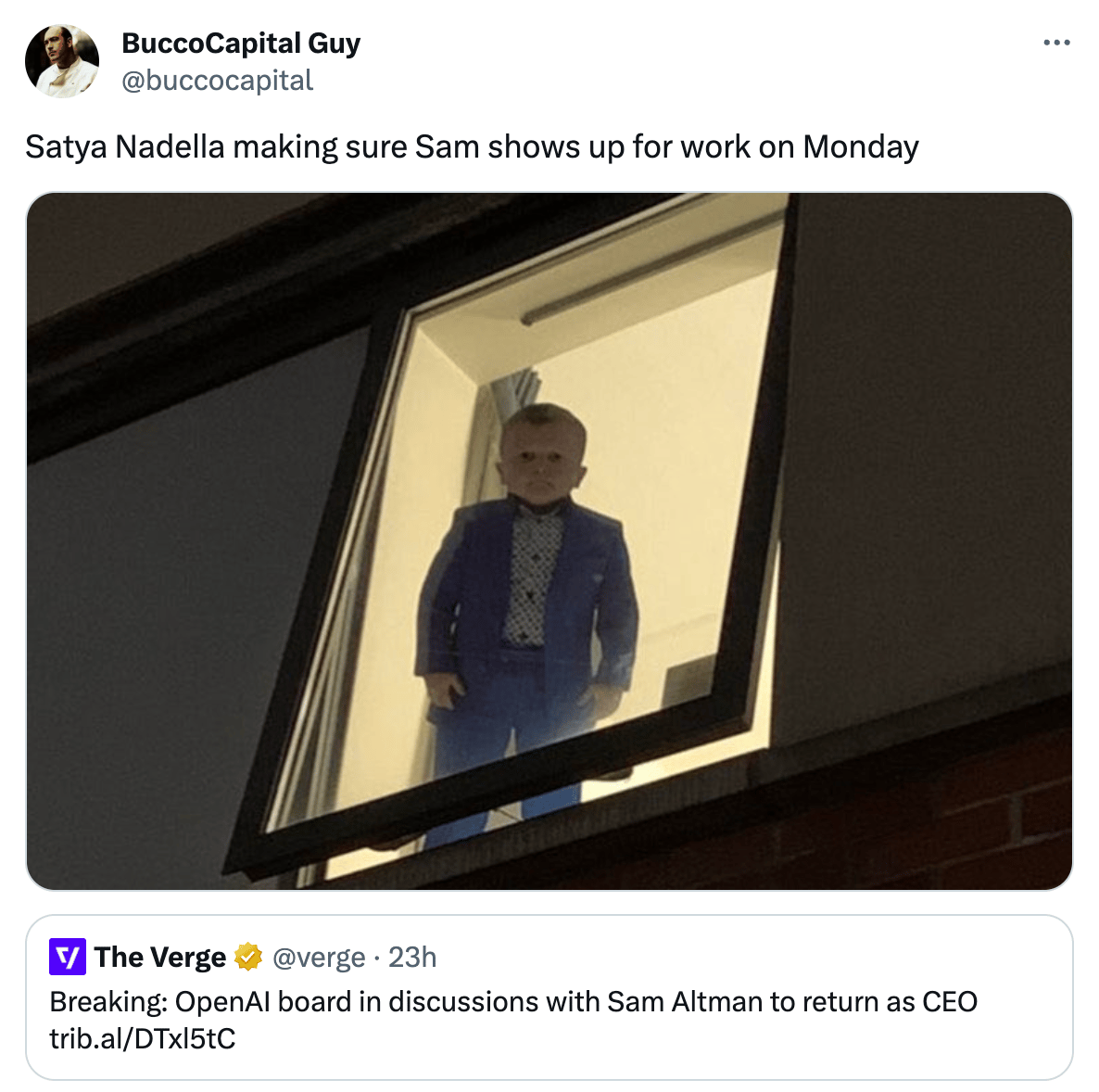

It was a busy weekend in the AI world as OpenAI fired, then tried and failed to rehire Sam Altman as its CEO. We have linked articles below to help you keep up with the latest OpenAI news:

Axios published a summary of the situation as of November 18th.

Negotiations between OpenAI’s board and Sam Altman have hit a snag due to disagreements over the board’s role, according to Bloomberg.

Before his removal from OpenAI, Altman was reportedly looking to raise billions for a new chip venture, according to Bloomberg.

Microsoft is one of the key players pushing to reinstall Altman, according to Forbes.

Disagreements between Altman and other OpenAI employees on ‘AI safety’ created a rift that likely contributed to Altman’s dismissal, according to The Information.

Altman ultimately decided not to return to his role of CEO at OpenAI as of midnight Sunday night, per The Information.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter