Together with

Good Morning,

Jensen had heaps of praise for Trump, Nvidia partnered with Palantir amid a wave of deals, activist investors are pushing for bank M&A, Goldman's CEO sees no 'systemic crisis' in credit markets, and Microsoft hit a $4T market cap after agreeing to terms for OpenAI's for-profit restructuring.

Specialized AI tools are emerging as the leaders for investment workflows which is why Blueflame AI is ahead of the curve. See how Blueflame AI can serve your firm's specific needs.

Let's dive in.

Before The Bell

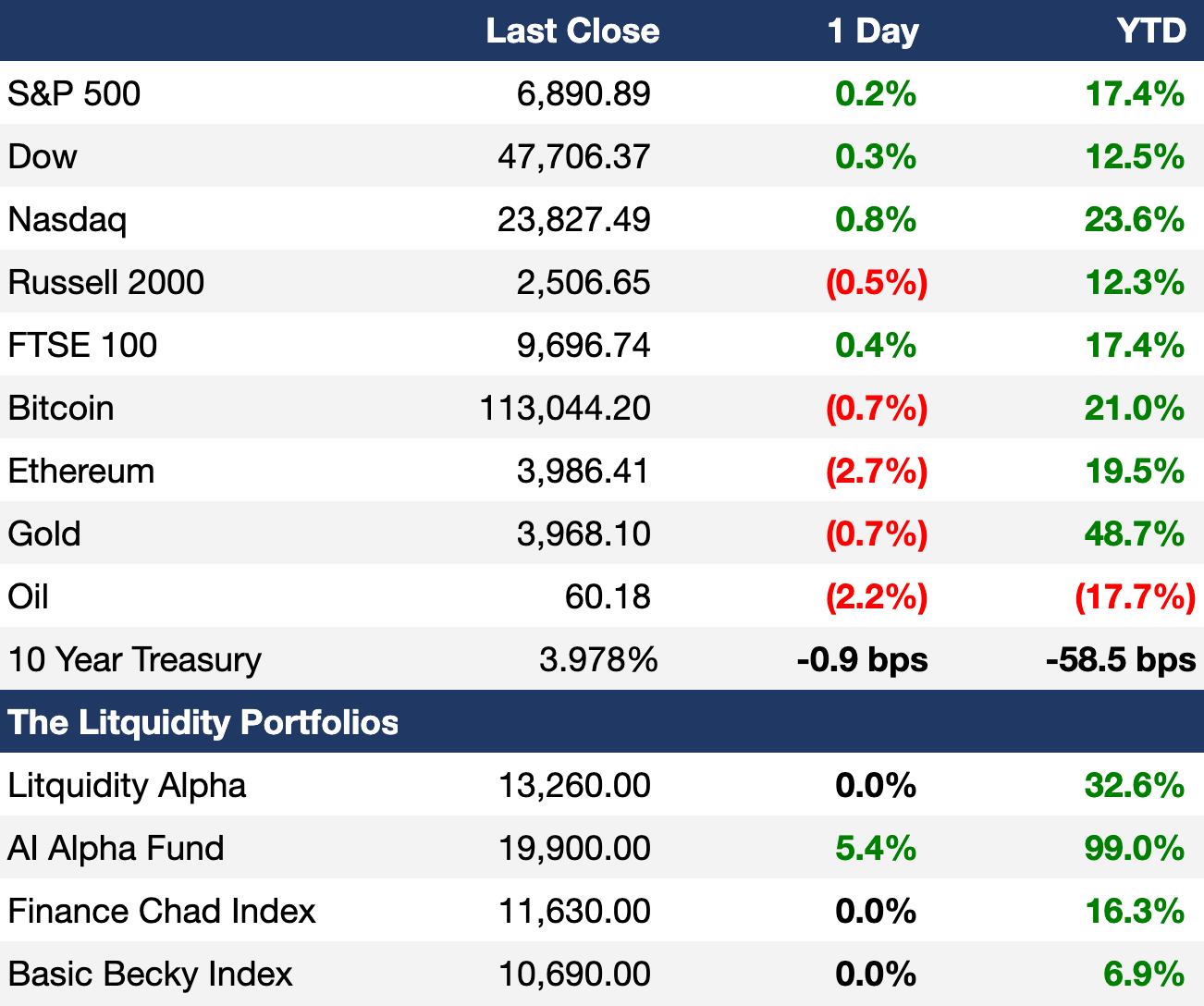

As of 10/28/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks continued to rise yesterday amid a wave of Big Tech AI deals

All three major indexes noticed new ATHs

Apple and Microsoft hit a $4T market cap for the first time

UK's FTSE 100 hit an ATH

South Korea's KOSPI index is up 67% YTD to become this year's best-performing major stock index by far

Shanghai Composite Index touched a ten-year high

US 30Y swap spreads hit their widest in eight months ahead of Fed QT data

Nothing more entertaining to watch than @einsteinofwallst's daily market recap. Especially with everything at ATHs.

Earnings

UnitedHealth Group beat Q3 earnings estimates and raised its FY outlook as medical costs normalized and margins improved (BBG)

PayPal beat Q3 earnings and revenue estimates and raised its FY earnings guidance on rising total payment volume and a partnership with OpenAI, though it warned of slowing US consumer spending (BBG)

UPS beat Q3 earnings and revenue estimates and raised Q4 revenue guidance as cost cuts and a 34k-job reduction drove margins higher; the firm closed 93 facilities under its turnaround plan amid tariff-driven trade disruptions (BBG)

Visa beat Q4 earnings and revenue estimates on strong global consumer spending; the firm reaffirmed its revenue outlook citing momentum in digital payments and AI-driven commerce (BBG)

Electronic Arts missed Q2 earnings and revenue estimates in its last ever public earnings as net bookings fell 13% amid tough comps from last year's College Football 25 launch; the firm is set to go private in a $55B LBO (BN)

Booking Holdings beat Q3 earnings and revenue estimates and gave an optimistic FY outlook as travel demand remains resilient despite concerns of slowing consumer spending and the government shutdown (BBG)

Royal Caribbean missed Q3 earnings and revenue estimates on high expenses but raised its FY guidance as consumers continue to prioritize experiences and meaningful vacations (WSJ)

What we're watching this week:

Today: Alphabet, Meta, Microsoft, Boeing, Starbucks, Verizon, CVS, Chipotle, Caterpillar, Carvana, Kraft Heinz

Thursday: Amazon, Apple, Coinbase, Eli Lilly, Comcast, Reddit, Blue Owl, Roblox

Friday: ExxonMobil, Chevron, AbbVie

Full calendar here

Prediction Markets

Probably one of the most consequential decisions of Trump's presidency.

Headline Roundup

Trump hinted at Bessent as new Fed chair (FT)

Jensen Huang praised Trump in MAGA-themed speech (WSJ)

Jensen Huang rebuts AI bubble fears with wave of deals (BBG)

Blackstone and KKR blasted private credit critics (BBG)

Goldman's CEO sees no 'systemic crisis' in credit markets (BBG)

HSBC warned on wider risks from private credit blow-ups (FT)

Brookfield says private credit is not crowding out PE (BBG)

K&E trains lawyers in communication after PE investor tensions (FT)

Daily $100B stock swings expose 'fragility' beneath Wall Street rally (FT)

Traders in $7T market turn to obscure option to CPI data (BBG)

ADP will release US payroll data weekly (BBG)

Execs expect US to continue dominating global investment flows (RT)

US consumer confidence fell for a third month (BBG)

Global M&A activity rose 10% through September YTD (RT)

Activist investors are juicing up bank M&A campaigns (RT)

Bumper IPO gains shrink in India's record-setting IPO market (BBG)

OpenAI completed its for-profit restructuring (WSJ)

Apple and Microsoft hit $4T market caps for the first time (CNBC)

Nvidia will build AI supercomputers for US (RT)

Nvidia announced partnerships with Palantir, CrowdStrike, and Uber (SHW)

Tesla eyes internal CEO if Musk steps down over $1T pay (BBG)

JPMorgan shuffled execs to lead $1.5T initiative (RT)

BofA shuffled leadership in TMT IB teams (BBG)

A Message from Bluflame

Dare to Discover the Power of Blueflame AI this Halloween

This Halloween, Blueflame AI is here to conjure clarity from the chaos haunting your workflows.

Our agentic AI platform unifies your firm’s internal knowledge with external market intelligence – and applies domain-specific reasoning to help you work faster across sourcing, diligence, and research.

Whether you're reviewing CIMs, prepping for a meeting, or comparing earnings transcripts, Blueflame AI helps you cut through the noise, surface deeper insights, and deliver structured outputs that save hours of manual effort.

Blueflame AI isn't general-purpose AI in disguise. It's agentic intelligence purpose-built for the way private markets firms operate.

No tricks. No hype. Just clarity, speed, and a smarter way to work.

Summon your demo at Blueflame.ai

Deal Flow

M&A / Investments

Microsoft acquired a 27% stake in OpenAI for $135B as part of OpenAI's for-profit restructuring; CEO Sam Altman will not get a stake in the newly restructured entity

PE firm Boyu Capital emerged as the frontrunner for Starbucks' China business, which could fetch a $10B valuation including royalties

Radio-frequency chip supplier Skyworks Solutions agreed to buy smaller rival Qorvo for $9.8B in stock-and-cash at a 14% premium

French media firm Banijay Group agreed to acquire a majority stake in German sports-betting company Tipico from CVC at a $5.4B valuation, including debt

Blackstone agreed to invest $3B in Saudi Arabia's AI company Humain to build data centers alongside its data center portfolio company AirTrunk

Cygnet Energy agreed to acquire Kiwetinohk Energy in an all-cash deal valued at $1B, including debt

Barclays agreed to acquire US D2C personal loan origination platform Best Egg for $800M

US investment firm Long Path agreed to take-private UK software provider Idox in a $438M deal, representing a 28% premium

European defense and aerospace giant Leonardo is selling a minority stake in rocket maker Avio

Eurasian Resources Group is in talks with three different investors interested in its Brazilian iron ore project Bahia Mineracao

Select VC deals

Saudi fintech firm Tabby sold secondary shares at a $4.5B valuation

Sublime Security, an agentic email security platform, raised a $150M Series C led by Georgian

Sweatpals, a community-driven fitness platform, raised a $12M seed round led by Patron, a16z speedrun, and HartBeat Ventures

Spacial, an AI-powered platform for automating residential engineering and permitting, raised a $10M seed round led by TLV Partners

Vesence, a startup using AI to automate the document checking process, raised a $9M seed round led by Emergence Capital

Wild Moose, an AI-powered site reliability engineering platform, raised a $7M seed round led by iAngels

Grasp, a startup automating IB and consulting workflows, raised a $7M Series A led by Octopus Ventures

Real-time data infrastructure startup Crustdata raised a $6M seed round led by Y Combinator and A Capital

UK AI-powered account management platform Trig raised a $6M seed round led by 20VC

Augmented Industries, a German industrial AI company, raised a $5.2M pre-seed round led by b2venture

Bridge, an AI-native OS for private markets, raised a $5.1M seed round led by Thicket Ventures

Identifee, a startup building a single platform for bankers, raised a $5M seed round from Ocean Azul Partners, 10X Capital, and Gaingels

Tempo Labs, a Canadian AI-powered design-engineering platform, raised a $5M seed round from Y Combinator, General Catalyst, Box Group, and more

AccessGrid, a startup building APIs to manage digital key fobs, raised a $4.4M seed round led by Harlem Capital

Insane competition and innovation in the AI applications space. Check out Fundable for the best insights into who's building and who's funding.

IPO / Direct Listings / Issuances / Block Trades

Blackstone, Carlyle and Hellman & Friedman-backed medical supplies maker Medline filed for an IPO to raise $5B at a $50B valuation

Nvidia agreed to acquire a 2.9% stake in Finnish telecom equipment maker Nokia for $1B

Chinese biotech Pollon Life filed confidentially for a Hong Kong IPO that could raise over $300M

Uber plans to invest $100M in Pony AI's upcoming Hong Kong listing and also expressed interest in participating in WeRide's IPO

Debt

Centerbridge Partners and The Vistria Group-backed healthcare services firm Sevita withdrew a $2.5B leveraged loan sale

Indonesian chemicals firm Chandra Asri is in talks with KKR's insurance unit Global Atlantic for a $750M facility to support its $1B acquisition of Esso-branded gas stations in Singapore from ExxonMobil

Kazakh lender ForteBank raised $400M in an AT1 bond sale that received over $1B of bids

Bankruptcy / Restructuring / Distressed

Banco do Brasil threatened to stop making loans to farmers who file for bankruptcy protection

Fortress-backed high-speed rail Brightline avoided a $985M munis buyback after bondholders granted an extension

Fundraising / Secondaries

UK healthcare-focused PE firm GHO Capital Partners raised over $2.9B for its fourth fund fund targeting manufacturing and medical technology companies

Aircraft components supplier FTAI Aviation raised $2B for its inaugural aircraft leasing fund

Sustainable private credit investor Eyre Street Capital is targeting $800M for its second fund

Climate-focused private credit impact investor SAIL Investments is seeking to raise $500M-$700M for its second fund

Crypto Sum Snapshot

Trump Media firm dives into red hot prediction markets in tie-up with Crypto.com

Western Union, the pioneer of the early telegraph, joined the crypto race with stablecoin plans

New crypto ETFs launch in crowded field despite SEC shutdown

Crypto-focused super PACs build $260M war chest ahead of midterms

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

How is AI impacting M&A workflows – what are the shortcomings and what functionality is coming next? Join UpSlide's webinar with Nomura, KPMG, Forvis Mazars, and Model ML on November 5th and learn how AI is transforming M&A. Register today.

Amir Efrati posted a visual of OpenAI's post-restructuring cap table.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting venture between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners places talent at leading firms in PE, hedge funds, VC, growth, credit, IB, and fintech and is currently recruiting for some incredible roles. Head over to our website to drop your resume and we'd love to get in touch!

Next Play

If you're down bad, realizing finance isn't for you, and want to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play will reach out to schedule a 1:1 video call if they think they can help as your own, personal startup matchmaker. They've grown their community to over 50k talented professionals and have deep relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.