Together with

Good Morning,

Bank of America will sponsor the 2026 FIFA WC, money-market assets rose to a new record, Dalio Family Office's CIO unexpectedly resigned, EY and KPMG are picking up PwC's China scraps, and Starbucks' new CEO is living the dream.

Thousands of stock pay dividends quarterly, but only 79 pay out monthly. Check out the list and see why this matters below.

Let’s dive in.

Before The Bell

As of 08/15/2024 market close.

Markets

US stocks rallied as encouraging consumer data eased recession fears

S&P and Nasdaq rose for a sixth-straight day

Traders reduced bets for a 50 bps Fed rate cut to 24%

VVIX continues to trade above 100 despite VIX retreat

Europe's Stoxx 600 rose 1.2%

US corporate bond spreads tightened to pre-August levels

Dollar is down almost 15% versus yen since early July

Norwegian krone is trading near record lows versus dollar and euro

Earnings

Walmart shares rose 7% after a Q2 beat-and-raise thanks to steady consumer health though FY forecasts fell short of estimates (CNBC)

Alibaba missed quarterly earnings and revenue estimates due to rising competition and cautious Chinese consumers (CNBC)

Applied Materials issued a Q3 beat-and-raise on a surge in AI-fueled demand for its chip-making equipment (RT)

Full calendar here

Headline Roundup

US consumer spending held up better than expected in July (CNBC)

Quant funds unwound stock positions by the most since Covid (BBG)

Money-market allocation rose to a new record (BBG)

Dealer Treasury holdings jumped to a record after market shakeup (BBG)

Japanese margin trading dropped sharply after market rout (RT)

Citadel, D.E.Shaw sold Nvidia while RenTech bought before market rout (FT)

JPMorgan says buying corporate debt on dips pays off 70% of time (BBG)

EY and KPMG emerge as winners from PwC's China woes (RT)

BDO sinks to bottom of US audit quality rankings (FT)

UBS will liquidate a $2B CRE fund of Credit Suisse (RT)

New Starbucks CEO awarded $100M pay-package plus WFH (FT)

Dalio Family Office's CIO will depart after less than a year (II)

Kroger will cut prices by $1B to win Albertsons merger approval (BBG)

US negotiated $6B in Medicare drug cost savings (CNBC)

SoftBank scrapped its AI chips tie-up plan with Intel (FT)

China home-price slump deepens to nine-year low despite stimulus (RT)

Toyota bets big on hybrid-only as EV demand slows (RT)

Bank of America will sponsor the 2026 FIFA World Cup (RT)

Columbia's president resigned after just one year (NYT)

A Message From Sure Dividend

The Only 79 Dividend Stocks That Pay Every Month

Thousands of publicly traded companies have a dividend – that means they pay you just for owning their stock.

However, only a select few pay out dividends monthly instead of quarterly.

Sure Dividend put together a list of all 79 individual stocks that pay dividends every month.

Monthly dividend payments matter because they give investors cash every month instead of quarterly

Monthly dividend payments show a company prioritizes paying shareholders

Monthly dividends allow for faster reinvesting of dividends

You can instantly get your free list of all 79 monthly paying dividend stocks, by clicking the link below:

Deal Flow

M&A / Investments

Seagram's Edgar Bronfman Jr. is close to making an offer for $8B Paramount Global, which would set off a potential bidding war (BBG)

A KKR-led consortium began the sale of its stake in Philippines' largest private hospital Metro Pacific Hospitals at a ~$3B valuation (WSJ)

PE firm Lone Star Funds will acquire Carrier Global’s commercial and residential fire business for $3B (RT)

Logistics firm XPO revived a sale of its European transportation business that could fetch a $2B valuation (BBG)

Software services firm Roper will acquire campus payments company Transact Campus for $1.5B (RT)

LPG shipper BW LPG will acquire Avance Gas' VLGC fleet for $1B (BBG)

Red Bull and German investment company KW 25 are exploring a $550M sale of WRC Promoter (RT)

Lockheed Martin will acquire satellite products maker Terran Orbital in a $450M cash deal (RT)

Australian lithium miner Pilbara Minerals will buy rival Latin Resources in a $370M all-stock deal (BBG)

Single-family landlord AMH is in advanced talks to acquire a portfolio of ~1.7k US rental homes from hedge fund Man Group (BBG)

Blackstone will acquire a majority stake in hospitality accounting software M3 (BW)

VC

Fei-Fei Li's AI startup World Labs raised a $100M round at a $1B+ valuation led by NEA (TC)

Quantum Circuits, a superconducting quantum computers startup, raised a $60M Series B led by ARCH Venture Partners, Sequoia, and more (PRN)

Chaos Labs, a startup building on-chain risk management tools, raised a $55M Series A led by Haun Ventures (PRN)

Vanilla, an estate planning software company, raised $30M in funding led by Insight Partners (BW)

Black Forest Labs, a GenAI for images/videos, raised a $31M seed round led by a16z (TC)

Amount, a digital origination and decisioning SaaS platform, raised $30M from Curql (BW)

AI code review startup CodeRabbit raised a $16M Series A led by CRV (TC)

Intramotev, a startup developing autonomous EV trains, raised a $14M Series A led by Flybridge Capital Partners and Alpaca VC (FN)

Consensus, an AI-powered search engine for scientific research, raised an $11.5M Series A led by Union Square Ventures (FN)

Boosted.ai, a workflow automation startup for institutional investors, raised a $10M growth round from CIBC Innovation Banking (BW)

Goodfire, a startup developing tools to debug AI, raised a $7M seed round led by Lightspeed Venture Partners (BW)

Software sales platform trumpet raised a $6.4M seed round led by AlbionVC (EU)

IPO / Direct Listings / Issuances / Block Trades

Debt

Bankruptcy / Restructuring / Distressed

Crypto Corner

Exec’s Picks

Last week, Roger Federer debuted his RF Collection by Wilson. The RF 01 racquet is an instant classic and the rest of the collection is incredibly sleek. Shop the collection here.

WSJ wrote a piece on the hottest six figure-pay tech job…one that doesn't require a college degree.

Financial Services Recruiting 💼

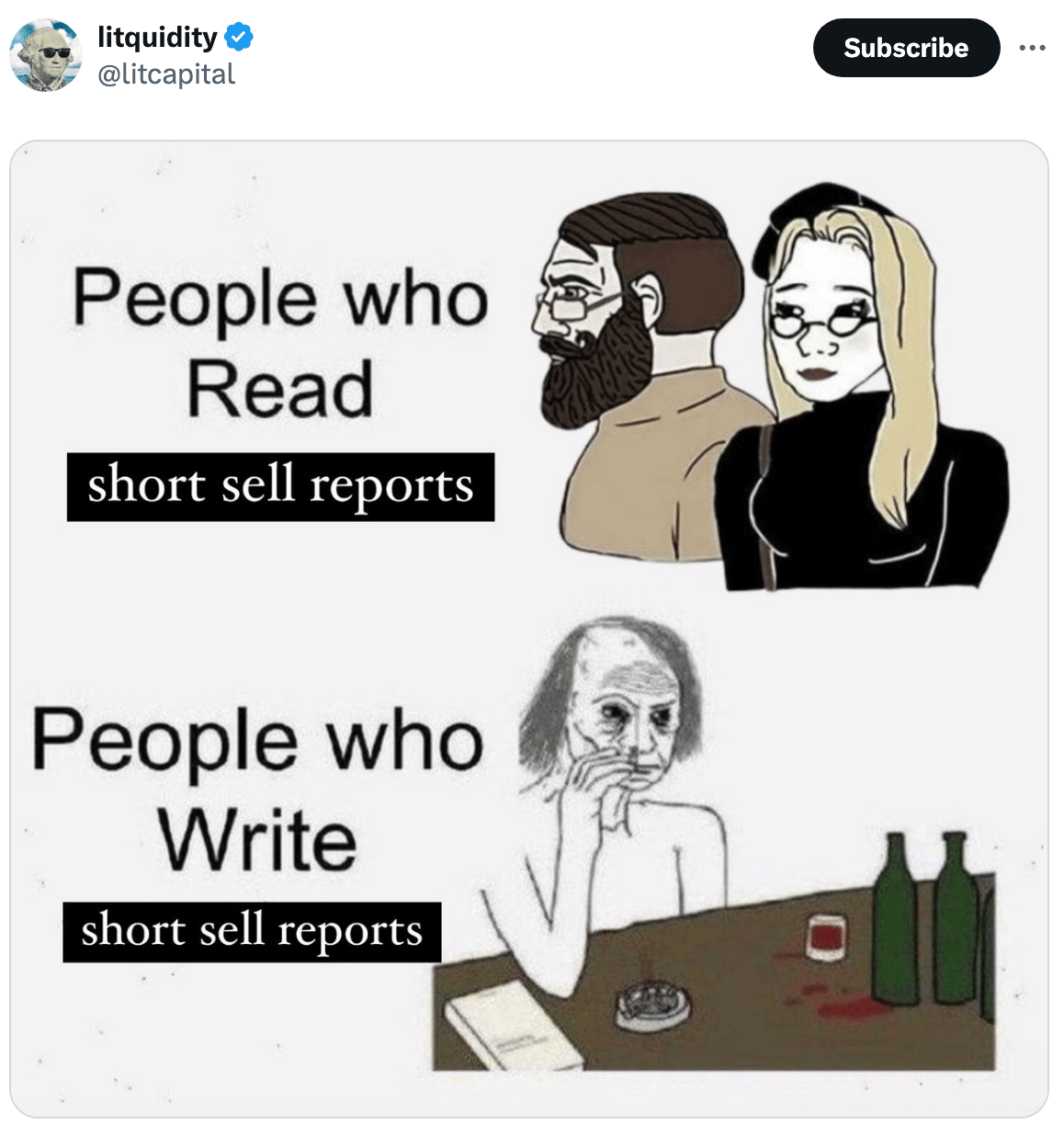

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or consider new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

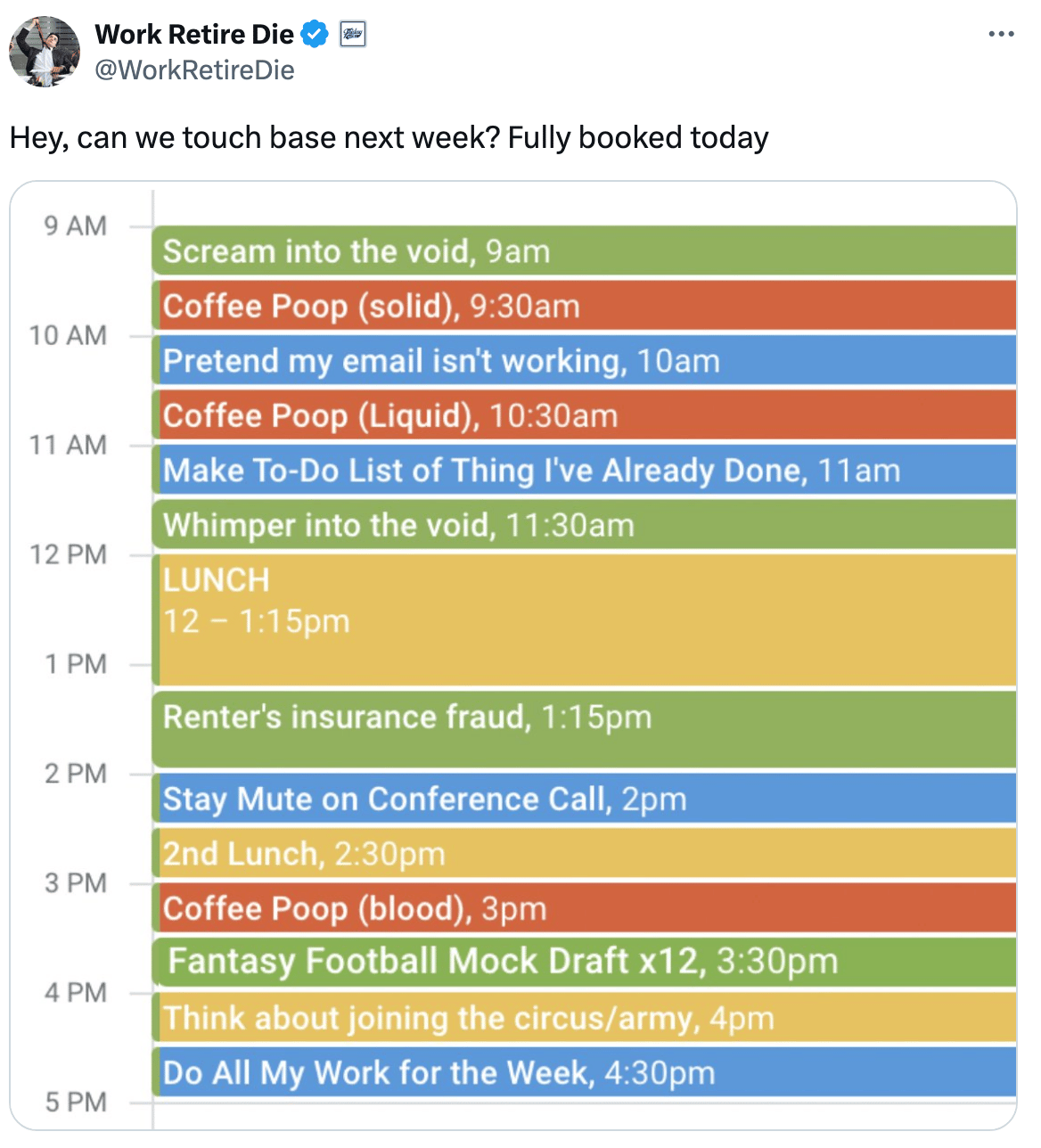

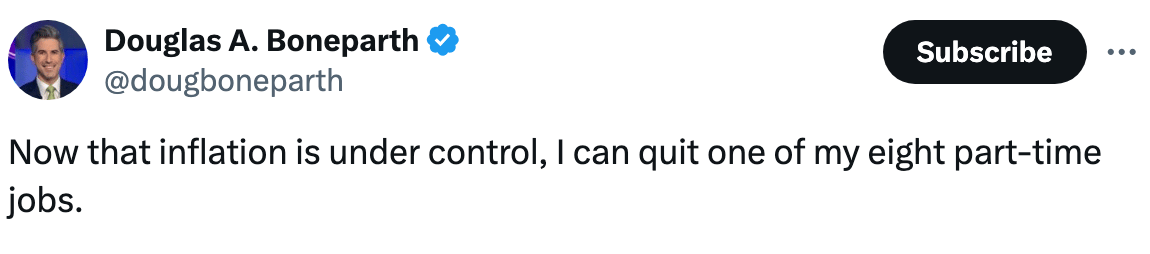

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter