Together with

Good Morning,

Stocks rebounded after the Fed announced a 75 bps rate hike, the European Central Bank wants to tackle Eurozone fragmentation, Euro-Dollar parity may be reached within a month, mortgage demand is down 50% YoY, crypto SPAC deals are in limbo, SoftBank's executives took pay cuts, and global oil demand is expected to stay high through 2023.

Looks like that whole "transitory inflation" thing didn't play out so well.

Speaking of inflation: real estate tends to be a good hedge against it and today's sponsor, Cadre, is changing up the way institutions and individual investors can access and invest in commercial properties. Check em out.

Let's dive in.

Before The Bell

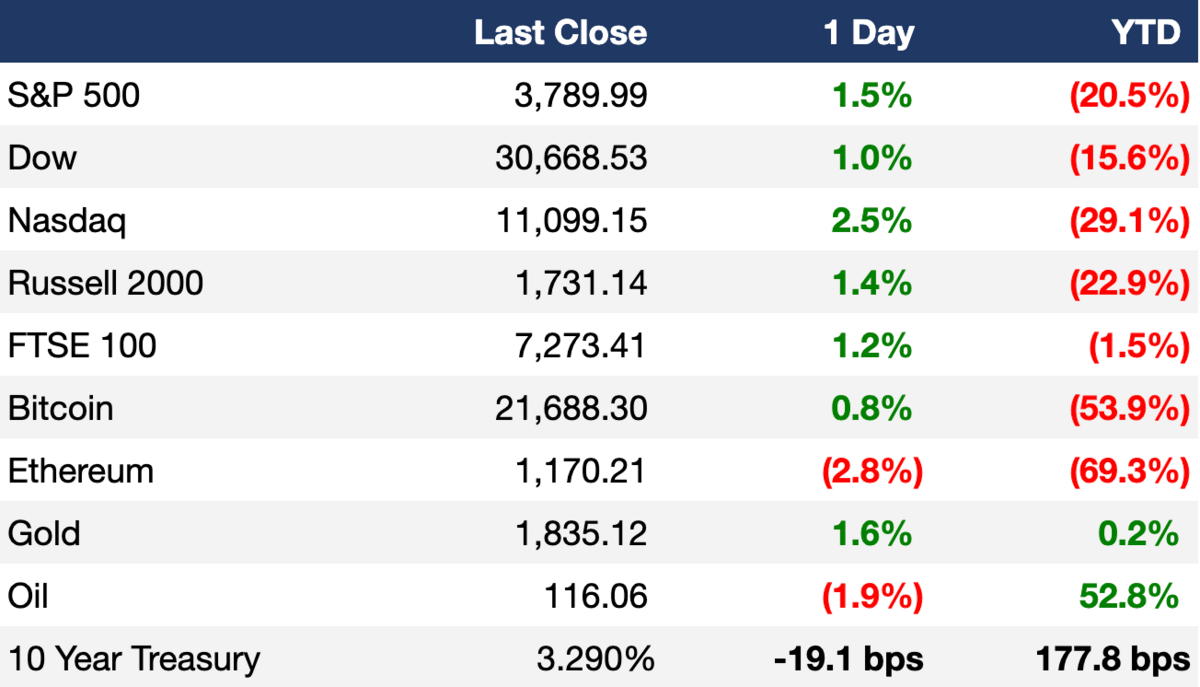

As of 6/15/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks soared across the board after the Fed approved a 75 bps interest rate increase, the largest single hike since 1994

Jerome Powell called the move an “unusually large one” and predicted either a 50 bps or 75 bps increase in July

European markets rose as well after the ECB outlined a bond-purchase program to address financial imbalances in the region

Earnings

What we’re watching today: Kroger, Adobe

Full calendar here

Headline Roundup

The European Central Bank plans to create a new tool to deter risk of Eurozone fragmentation and ease bond market turmoil (CNBC)

Current trends suggest Euro-Dollar parity to be achieved within a month (BBG)

FDA advisers endorsed Pfizer and Moderna COVID-19 vaccines for children 6 months and over (WSJ)

Mortgage demand is more than 50% lower than what it was exactly one year ago (CNBC)

Elon Musk expected to reiterate desire to own Twitter in meeting Thursday (RT)

SoftBank’s top executives saw steep paycheck cuts after its Vision Fund unit suffered historic losses (BBG)

Lego announced plans to spend $1B on a new factory in Virginia, creating more than 1,700 jobs (WSJ)

Biden announced $1B in military aid to Ukraine on Wednesday (AXIOS)

Global demand for oil is expected to exceed supply in 2023, pushing oil prices even higher (WSJ)

Fast-delivery startup Jokr cuts back US operations to focus on LatAm (BBG)

A Message From Cadre

Traditional real estate investing has been beckoning for a revolution...

Cadre uses their proprietary technology to decrease overall costs for investors, bring clarity to a traditionally murky experience, and open participation for a historically opaque and illiquid asset class.

Why choose Cadre to diversify your portfolio?

Potential for liquidity - option to pull capital out of deals in secondary windows

Transparency - Insight into the why on each investment with quarterly updates and ongoing reporting

With low correlation to the stock market, commercial real estate is a vital part of a long term portfolio to grow wealth.

Cadre is the vehicle to access commercial real estate.

Get access to Cadre’s real estate investments here

Diversification does not guarantee a profit or protect against a loss in a declining market. It is a method used to help manage investment risk.

Private placements are high risk and illiquid investments. As with other investments, you can lose some or all of your investment. Nothing here should be interpreted to state or imply that past results are an indication of future performance nor should it be interpreted that FINRA, the SEC or any other securities regulator approves of any of these securities. Additionally, there are no warranties expressed or implied as to accuracy, completeness, or results obtained from any information provided here. Investing in private securities transactions bears risk, in part due to the following factors: there is no secondary market for the securities; there is credit risk; where there is collateral as security for the investment, its value may be impaired if it is sold. Please see the Private Placement Memorandum (PPM) for a more detailed explanation of expenses and risks.

Interests are being offered only to persons who qualify as Accredited Investors under the Securities Act, and a Qualified Purchaser as defined in Section 2(a)(51)(A) under the Company Act or an eligible employee of the management company. This presentation does not constitute an offer to sell or a solicitation of an offer to buy Interests in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. There will not be any public market for the Interests.

Deal Flow

M&A / Investments

British Petroleum Company acquired a 40.5% stake in the Asian Renewable Energy Hub, a ~$36B green hydrogen project in Australia (BBG)

Chinese search engine giant Baidu is in talks to sell its controlling stake in China's Netflix rival iQIYI at a ~$7B valuation (RT)

Australia's Federal Court approved Blackstone's $6.3B buyout of Crown Resorts (MW)

Minority investors of Chinese state-owned ABC Life Insurance are looking to sell their 49% stake in the company at a $4B valuation (BBG)

US defense contractor L3Harris is in talks to buy Israeli spyware firm NSO Group (RT)

MSC Mediterranean Shipping is looking to buy a controlling stake in Global Ports Holding, the world’s largest cruise port operator (BBG)

Abu Dhabi's Aldar Properties is considering buying a majority stake in Egyptian developer Medinet Nasr Housing (BBG)

Used car marketplace Carro bought a 50% stake in car financing and rental company MPM Rent for $54M (BBG)

VC

Biotech startup MegaRobo Technologies raised a ~$300M Series C led by Goldman Sachs, GGV Capital and Asia Investment Capital (BBG)

Business intel search engine AlphaSense raised a $225M Series D co-led by Goldman Sachs Asset Management and Viking Global Investors (TC)

Zoovu, an AI-powered sales analytics platform for e-commerce, raised a $169M Series C led by FTV Capital (BW)

AI-powered parking platform Metropolis raised a $167M Series B co-led by 3L Capital and Assembly Ventures (TC)

PayCargo, a fintech payment platform for shipping businesses, raised a $130M Series C from Blackstone Growth (TC)

DataStax, a real-time data management company, secured a $115M investment led by Goldman Sachs Asset Management (BW)

Automated recruitment platform Fountain raised a $100M Series C led by Capital Group (TC)

SMS marketing company PostScript raised a $65M Series C led by 01 Advisors (TC)

Health insurance provider for small and medium sized-businesses Sana raised a $60M Series B co-led by Trust Ventures and Gigafund (TC)

Narmi, a digital banking platform for financial institutions, raised a $35M Series B co-led by Greycroft, NEA and Picus Capital (TC)

Cube, a financial planning startup for businesses, raised a $30M Series B led by Battery Ventures (TC)

Open distributed cloud service provider Platform9 closed a $26M funding round led by Celesta Capital (TC)

General Radar, a developer of high-resolution 3D radar systems, raised a $22M Series A led by Octave Ventures (BW)

DeFi services platform Skolem Technologies raised a $20M Series A led by Galaxy Digital (PRN)

Tabnine, a startup creating an “AI-powered assistant” for software developers, closed a $15.5M funding round co-led by Qualcomm Ventures, OurCrowd and Samsung NEXT Venture (TC)

Cybersecurity startup GreyNoise raised a $15M Series A led by Radian Capital (TC)

XENDEE, a distributed energy resources planning and operation software, raised a $12M Series A led by Anzu Partners (BW)

Altrio, a real-estate software company, raised an $8M Series A led by Whitecap Venture Partners (BW)

Web3 entertainment tech company Kaleidoco raised $7M in seed funding from Animoca Brands, GameFi Ventures, Gemini, and others (BW)

IPO / Direct Listings / Issuances / Block Trades

Blank check company Feutune Light Acquisition will IPO today at an $85M valuation (PRN)

Oman's sovereign wealth fund is considering an IPO of two units of state energy company OQ SAOC and a manufacturing firm (BBG)

SoftBank is planning to list some of its stake in chip designer Arm on the London Stock Exchange (BBG)

SPAC

Nasdaq-listed 26 Capital will pursue a $2.5B SPAC merger with the Philippines' biggest integrated casino-resort, Okada Manila (RT)

Fundraising

Ex-Morgan Stanley and Felicis Ventures alums raised a $450M debut fund to launch their VC firm PFV (BBG)

Crypto Corner

Bill Gates slams cryptocurrencies and NFTs as a sham, says they are "100% based on greater fool theory" (MW)

Crypto-SPAC deals stuck in SEC limbo as demand plunges (BBG)

Cryptocurrency exchanges Binance and Kraken, along with Layer 2 sidechain Polygon, are among three companies looking to accelerate their hiring amid industry-wide job cuts (CD)

Crypto hedge fund Three Arrows faces possible insolvency after unforeseen liquidations (CD)

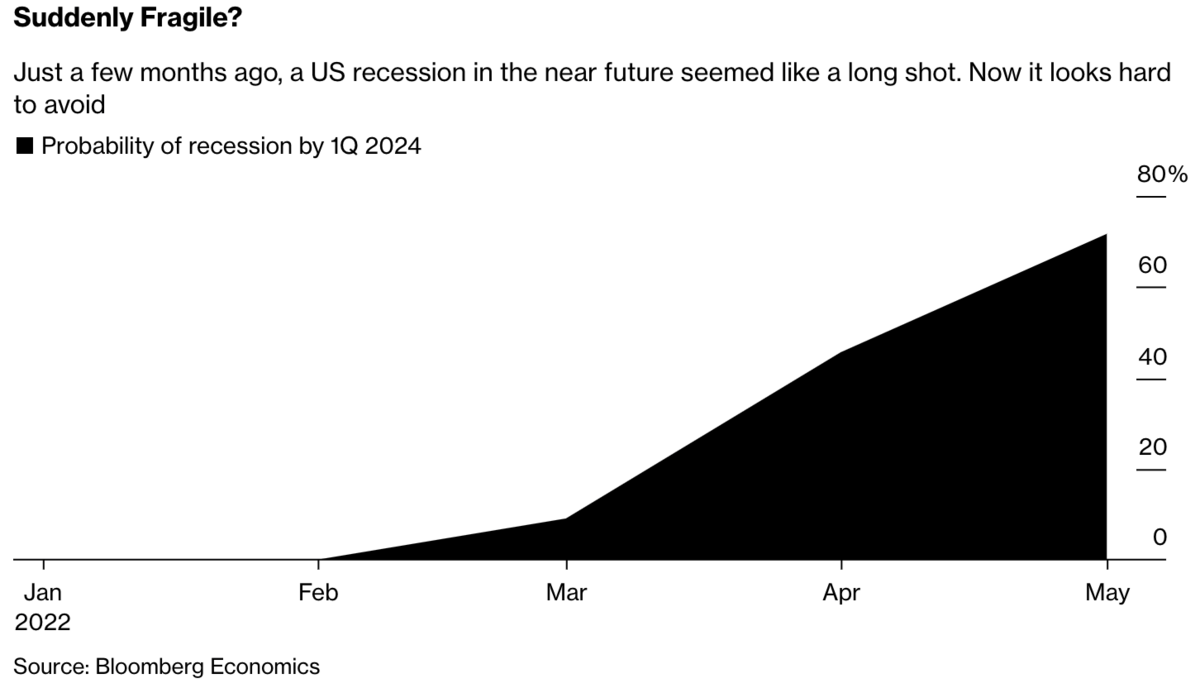

Chart of the Day

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We've got 40+ jobs spanning IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

💼 Today's highlighted job 💼

Liquidibee, a capital provider for businesses of all sizes, ranging from startups to established companies, is hiring an underwriting analyst. Responsibilities for this role include the analysis of financial documents such as credit reports and bank statements, detailed financial analysis to determine credit worthiness, and communication with ISOs, sales managers, and merchants. Think you're the perfect candidate? Apply here through our job board!

Meme Cleanser

Catch the latest episode of our Big Swinging Decks podcast, presented by CoinFLEX.US, on Spotify, Apple, and YouTube 🤝