Together with

Good Morning,

Liz Truss set the record for shortest UK PM tenure, Musk plans to layoff 75% of Twitter's staff, China is scrambling to deal with chip sanctions, Snap's stock fell 25% on a poor earnings report, home sales keep declining, college enrollment is down for the third straight year, Turkey slashed interest rates despite high inflation, and Biden said he would refill the US's strategic oil reserves when oil prices fall below $72.

🛢 Speaking of oil, if you're looking to get direct access into private market oil & gas deals, check out today's sponsor EnergyFunders. More info below.

Let's dive in.

Before The Bell

Markets

Stocks fell yesterday, with all three major averages closing down as investors digested key earnings reports and climbing Treasury yields

The 10Y Treasury topped 4.2% for first time since 2008

The pan-European Stoxx 600 closed up 0.3% on news of Liz Truss's resignation

Japanese yen hit 150 against the dollar, its weakest level since 1990

Earnings

Blackstone beat Q3 earnings estimates but still reported a 16% YoY drop on the same metric amid a sharp drop in asset prices, while also marking down the value of its investment portfolio; their stock fell ~4.5% yesterday (RT)

Snap Inc. shares plummeted 25%+ AH after reporting weaker-than-expected Q3 revenue numbers and its plan to cut 20% of staff as part of a major restructuring (CNBC)

Full calendar here

Headline Roundup

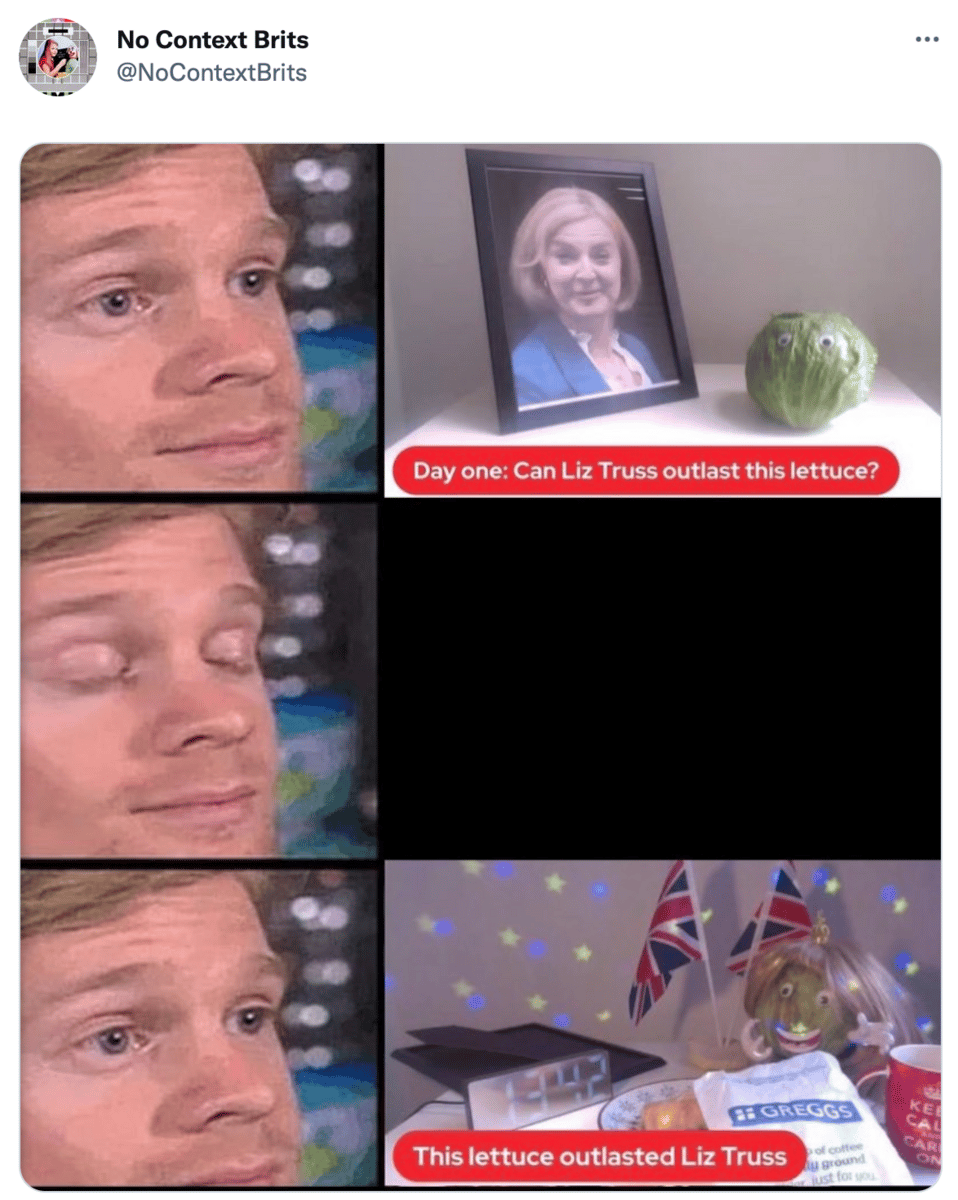

UK PM Liz Truss resigned after 45 days, becoming the shortest-serving PM in British history (AX)

US weekly jobless claims unexpectedly fell to a seasonally adjusted 214k last week (RT)

Existing home sales fell to a 10-year low in September (CNBC)

Turkey slashed interest rates by 1.5% points despite 83% inflation (CNBC)

China is holding emergency talks with chip firms amid recent US curbs (RT)

Canadian home prices tumbled in September in largest monthly decline on record (RT)

Musk plans to cut Twitter workforce by 75% (BBG)

Chip maker TSMC is weighing expansion in Japan to reduce geopolitical risk (WSJ)

Credit Suisse is scrambling to finalize revamp as deadline looms (RT)

Small businesses are getting squeezed out amid push for warehouse space (WSJ)

Texas sued Google alleging biometric data-related privacy violations (WSJ)

Ex-Bezos wife MacKenzie Scott’s donated $84.5M to Girl Scouts (CNBC)

US college enrollment fell for a third straight year (AX)

Financial services firm MoneyGram will be Haas F1 team's new title sponsor (F1)

Philip Morris agreed to pay US cigarette maker Altria $2.7B for the exclusive rights to sell IQOS heated tobacco products in the US (RT)

A Message From EnergyFunders

Invest in Private Market Oil & Gas Deals

At a time when stocks, bonds, real estate, and alternative assets like gold have sustained losses, oil & gas investments have provided a rare opportunity for positive returns in 2022.

But energy stocks remain vulnerable to market volatility. Plus, after the recent outperformance, valuations for many public energy stocks have increased, creating risk for today’s investors.

EnergyFunders offers private market investment vehicles that bypass these risks. Get direct access to investments in oil and gas wells, managed by a team of veteran geologists and engineers. Take advantage of today’s unique economics for private market deals, which one Wall Street Journal article described as “almost too good to be true.”

In today’s market, large public energy companies are focusing capital budgets on share buybacks and dividends instead of drilling new wells. As Dan Pickering of Pickering Energy Partners explained earlier this year:

“The real winners right now are the private companies… Prices are high, and the little guys are quickly adding production to take advantage.”

That’s how EnergyFunders is finding opportunities like the Parker #10 - which repaid 100% of its principal investment within 90 days.

Eligible investors can earn deductions on their current year's tax bill by investing before December 31, 2022.

Learn how you can take advantage of this opportunity today by clicking here!

Deal Flow

M&A / Investments

Swiss tobacco company Philip Morris raised its bid for Swedish nicotine pouch maker Swedish Match to ~$15.8B, calling it the final offer (BBG)

Kushner Cos, Jared Kushner's family real-estate company, is making an unsolicited bid for Veris Residential, an owner primarily of NJ rental apartments, in a deal that would value Veris at ~$4.3B including debt (WSJ)

Morgan Stanley’s infrastructure investment arm is weighing a sale of a 40% stake in German wind and solar project developer PNE that could be worth $552M+ (RT)

Par Pacific agreed to buy Exxon’s Montana oil refinery in a $310M deal (RT)

Brazilian meatpacker Minerva Foods agreed to buy Australian Lamb Company for ~$260M (RT)

Microsoft is in advanced talks to increase its investment in AI company OpenAI. Microsoft invested $1B into the business back in 2019 (WSJ)

Activist investor Starboard Value disclosed a 7.4% stake in Veritiv, a supplier of equipment and services food data centers, and believes the company is undervalued (BBG)

Merchant bank BDT agreed to merge with Michael Dell’s investment firm MSD Partners (BBG)

Australian fund manager Link Administration is exploring a sale of its UK-based unit Link Fund Solutions (BBG)

VC

BeReal, a viral photo-sharing app, raised a $60M Series B at a $600M valuation earlier this year (TC)

Banyan, a startup using product purchase data to automate expense management, raised a $43M Series A ($28M in equity & $15M in debt) at a mid-$100M valuation led by Fin Capital and M13 (TC)

Sensat, a platform helping companies create a digital twin of their physical infrastructure, raised a $20.5M Series B led by National Grid Partners (TC)

GlobalFair, a B2B startup simplifying the process of procuring “ready-to-install” materials for the construction industry, raised a $20M Series A ($12M in equity & $8M in debt) led by Lightspeed (TC)

AI research company Generally Intelligent emerged from stealth with $20M in funding from former OpenAI employees Tom Brown / Jonas Schneider, Dropbox co-founders Drew Houston / Arash Ferdowsi, and the Astera Institute (TC)

Tellius, an AI-driven decision intelligence platform, raised a $16M Series B led by Baird Capital (BW)

Workforce management platform Voil raised a $10M Series A led by Walter Ventures and Desjardins Capital (BW)

Data security platform Velotix raised a $10M seed round led by Capri Ventures (PRN)

Burger-making robotics startup RoboBurger raised a $10M seed-2 round from Promethean Investments (PRN)

Kudos, a smart wallet startup, raised a $7M seed round led by Patron (PRN)

TuMeke, a computer vision platform that automatically assesses injury risk in manufacturing facilities, raised a $2.5M seed round led by GSR Ventures (PRN)

IPO / Direct Listings / Issuances / Block Trades

Biotech firm Prime Medicine notched a ~$1.8B valuation in its Nasdaq debut yesterday (RT)

Indonesia’s largest tech company GoTo is in talks with its major owners, including Alibaba and SoftBank, for a controlled sale of ~$1B of their stakes, aiming to avoid a potential stock crash when a lock-up on their holdings ends next month (BBG)

Australian parking garage operator Best in Parking is planning to seek $979M+ in a potential IPO (BBG)

Bulgarian race-car maker Sin Cars is seeking to raise $100M+ in a potential 2024 Amsterdam IPO (BBG)

State oil firm ADNOC invited banks to pitch for roles in an IPO of its marine services and logistics unit (RT)

Debt

Achieve, a digital personal finance company, raised a $225M debt facility led by O’Connor Capital Solutions (PRN)

Fundraising

Propeller, a climate-tech investor focused on startups involved with the ocean, raised a $100M seed fund (TC)

Crypto Corner

Exec's Picks

Bloomberg put out a super interesting piece about the rise and fall of Covid billionaires' net worths last week. Check it out here.

If you're looking for high quality tech / VC reporting beyond TechCrunch and The Verge, I highly recommend signing up for The Information, where they get a lot of exclusives on major VC fundraises, startup funding rounds, and layoffs. They also have detailed company org charts for those who are looking to breakdown major tech firm corporate structures. Sign up here.

CNBC recently published an item-by-item breakdown of inflation rates across the country for September. Check it out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.