Together with

Good Morning,

Stocks were red yet again, US regulators are cracking down on crypto and Chinese companies, Russian gas companies printed money in H1 2022, Snap is laying off 20% of its employees (Exec Sum reported it first), Truth Social wasn't approved on Google's app store, and Texas reported the first US monkeypox death.

Let's dive in.

Before The Bell

Markets

The selloff continued yesterday with all three major averages once again sliding deeper into the red, putting them on pace to finish negative in August

This morning we’ll receive ADP employment data, and the August jobs data drops Friday

Oil prices fell more than $7 yesterday, marking the steepest decline in a month, on fears of a weakening global economy and lower worldwide fuel demand

Earnings

Best Buy beat earnings and revenue expectations despite a 13% drop in Q2 sales; their stock closed 1.61% higher as the company reaffirmed its full-year guidance (CNBC)

BMO missed fiscal Q3 earnings expectations and saw a 40% decline in net income on lowered capital markets and investment banking revenue; their stock slid 1.6% on the day (BBG)

HP missed fiscal Q3 earnings and sales estimates with sales declining 4.1% YoY; their stock slid 5%+ in extended trading (YH)

Baidu beat Q2 profit and income estimates reporting ~$521M in net income; their stock slid nearly 7% as US audit risk offset their earnings beat (YH)

Chewy missed Q2 revenue estimates and issued a disappointing full-year sales forecast; their stock tumbled 11%+ in extended trading (BBG)

What we're watching this week:

Thursday: Broadcom, Lululemon, Signet Jewelers

Full calendar here

Headline Roundup

US job openings rose by 199k to 11.2M+ in July, defying expectations and rate hikes (RT)

US regulators will vet Alibaba, among other US-listed Chinese firms, for audit inspections starting in September (RT)

Mikhail Gorbachev, the last Soviet leader, died at 91 (BBC)

US credit scores are flat YoY at a record-high 716 average, but this is the first time that scores didn't improve YoY since the Great Recession (CNBC)

Over 42 SPAC mergers have been canceled this year (BBG)

China will set up firewall between bankers and analysts in IPO deals (RT)

Russian gas giant Gazprom made a record $41.75B in net profit in H1 2022 (RT)

Investors increase bets against Euro as energy crisis intensifies (FT)

Elon Musk sent a second deal termination letter to Twitter, citing whistleblower allegations (AX)

Snap plans to lay off 20% of employees (first reported by Exec Sum on twitter) (TV)

Netflix appoints two Snap execs to lead its advertising push (WSJ)

Trump's Truth Social app was not approved on Google Play Store (RT)

Goldman Sachs will lift Covid-19 protocols (RT)

Facebook will shut down its game streaming app (CNBC)

Royal Caribbean will partner with SpaceX’s Starlink for onboard internet (CNBC)

Taiwan fired warning shots at a Chinese drone (RT)

Texas reported the first US monkeypox death (AX)

Light Street Capital to vote against Zendesk’s $10.2B go-private deal (RT)

A Message From Sundays

Do you want your dog to eat better than you did as an intern?

Sundays air-dried dog food makes it easier for busy dog parents to provide fresh quality nourishment that their pups deserve.Sundays was created by veterinarian Dr. Tory Waxman along with a team of food scientists and pet nutritionists to exceed industry standards. Each recipe uses only the highest quality human-grade ingredients to deliver maximum health and wellbeing for your furry friends.

The nutrient-dense, high-protein recipes contain 90% premium meat, the other 10% is all natural veggies and superfoods. The food is air dried to maintain maximum nutritional value—and you won’t have to store it in the fridge. Finally, you can rest easy knowing your dog eats better than a techie in a well-funded startup’s cafeteria.

The proof is in the product. In a blind taste test against the leading premium dog foods on the market, dogs preferred munching on Sundays 20 - 0.

With healthy & fresh ingredients and the drool-worthy taste , move your furry family from the doghouse to the penthouse.

Get your paws on Sundays now and get 50% off your order with code SUM50 + free shipping!

Deal Flow

M&A / Investments

Oakley Capital agreed to buy a minority stake in British testing and inspection company Phenna Group at a $1.2B+ valuation (BBG)

PE firm PAG agreed to buy Japanese theme park Huis Ten Bosch in a $720M deal (BBG)

Digital infrastructure firms DigitalBridge and Equinix have been shortlisted into final round talks for the data center business of Malaysia's Time Dotcom, which could fetch ~$600M (BBG)

Alternative-asset manager Wafra agreed to buy a minority stake in Oak Hill Capital Partners from Jefferies (BBG)

Pakistani fintech PostEx agreed to buy logistics service provider Call Courier (TC)

VC

Blockchain game company Animoca agreed to raise $100M in a funding round led by Temasek (BBG)

Genomic and data analytics startup MedGenome raised a $50M round led by Novo Holdings (PRN)

Glints, a Singapore-based career development platform, raised a $50M Series D led by DCM Ventures, Lavender Hill Capital, and PERSOL Holdings (TC)

Game developer and publisher Xterio raised a $40M round led by FunPlus, FTX Ventures, XPLA, and Makers Fund (BW)

Blue World Technologies, a Danish startup working on methanol fuel cells, closed a $37M Series B led by Breakthrough Energy Ventures, Vaekstfonden, and DEUTZ AG (PRN)

Recurve, an open-source virtual power plant management platform, raised an $18M Series B led by Calpine Energy Solutions, Quantum Innovation Fund, and Toshiba Energy Systems Solutions (PRN)

Kenyan SME loan provider Pezesha raised an $11M pre-Series A equity/debt round: $6M in equity led by Women’s World Banking Capital Partners II and $5M in debt from Talanton and Verdant Capital Specialist Funds (TC)

Stake, a Dubai-based startup offering retail investors the opportunity to buy fractional rental property in the UAE, raised an $8M pre-Series A round led by Vivium Holdings, BY Ventures, and MEVP (TC)

Electronics marketplace PriceOye raised a $7.9M seed round led by JAM Fund (TC)

Outpost, a startup building reusable satellites, raised a $7.1M seed round led by Moonshots Capital (BW)

Neurofenix, a neurological rehabilitation platform, raised a $7M Series A led by AlbionVC (PRN)

Power, a patient-friendly platform designed to improve access to clinical trials, raised a $7M seed round led by Footwork and CRV (PRN)

tokenproof, a platform allowing users to secure and unlock the value of NFTs, raised a $5M seed round led by Penny Jar Capital (PRN)

Danish biotech startup Bactolife received a $5M investment from the Bill & Melinda Gates Foundation (PRN)

MEDU, a Mexican startup developing reusable PPE, raised a $4M seed round led by MaC Venture Capital (TC)

Healee, a provider of customizable digital health tech, raised a $2M seed round led by NinaCapital (BW)

IPO / Direct Listings / Issuances / Block Trades

SPAC

Life insurance asset managers Abacus Settlements and Longevity Market Assets agreed to a three-way merger with East Resources Acquisition Corp in a ~$618M deal (BBG)

Debt

Instant delivery startup Gopuff is seeking to raise a credit line of up to $300M after delaying their IPO (WSJ)

Fundraising

Crypto Corner

Exec's Picks

Fall wedding szn is around the corner. Don't show up wearing some square toed, thick rubber soled dress shoes you bought 15 years ago. Check out Del Toro's sleek shoes perfect for weddings and even classy nights out.

Jack Raines wrote a great piece breaking down the core issues behind our student debt problem. Check it out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

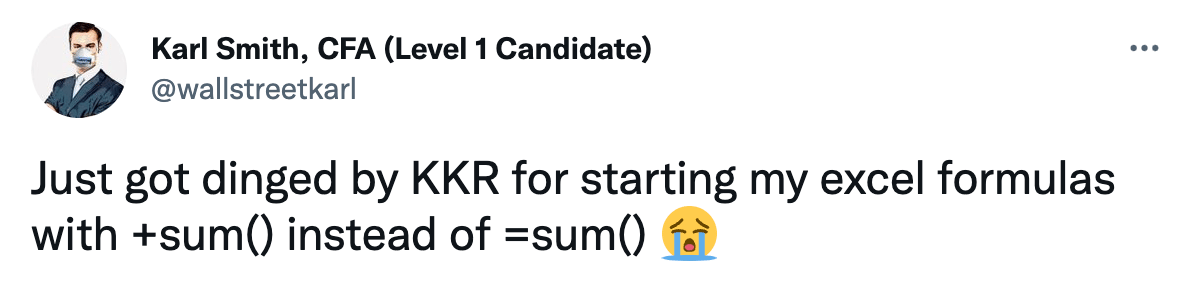

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.