Together with

Good Morning,

Oaktree seized control of Inter Milan, PE is eyeing college sports, Fidelity halted European private credit activity, PwC is facing heat in China, DuPont will split into three, and Nvidia pulled off yet another Nvidia.

Summer season means it's time for a wardrobe overhaul. Check out our personal favorite Mizzen+Main for the most comfortable men's dress shirts in the game!

Let’s dive in.

Before The Bell

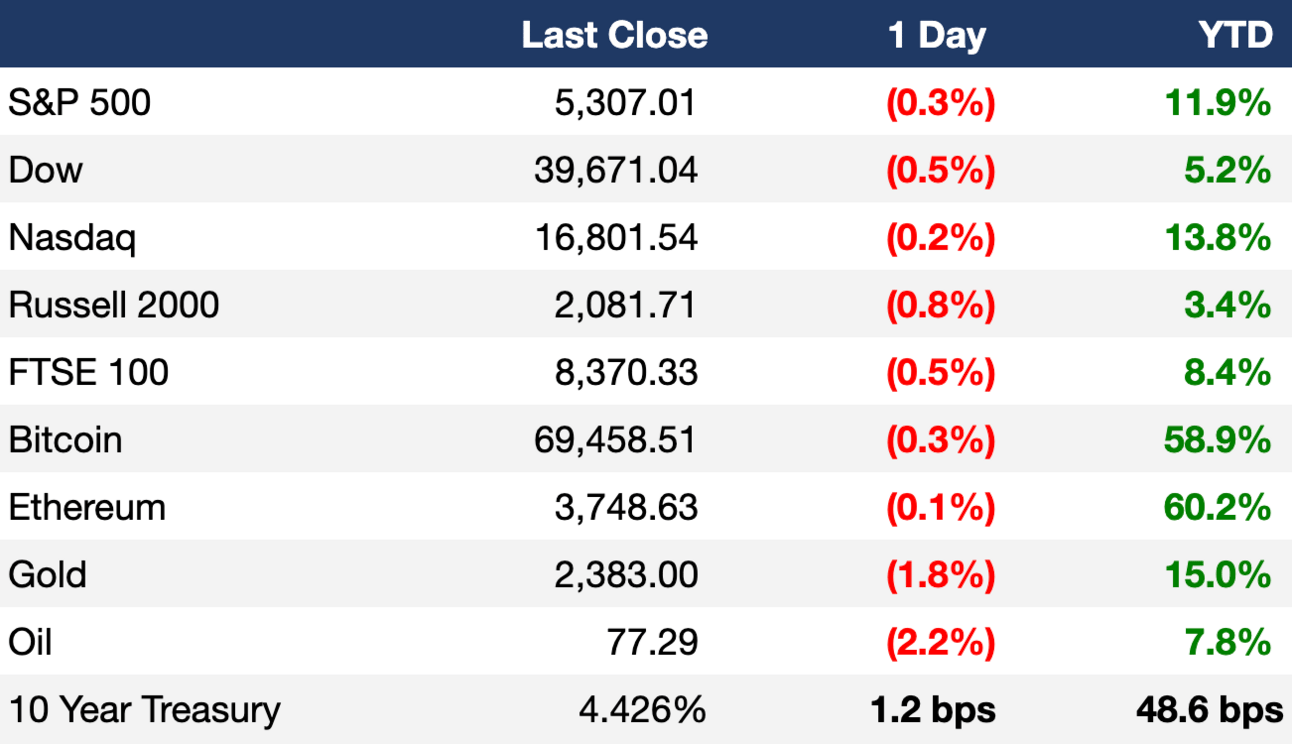

As of 05/22/2024

Markets

US stocks ticked lower yesterday as Fed minutes revealed concerns about persistent inflation

Biotech shares surged as new human bird flu infections emerge

Japan’s 10Y yield topped 1% for first time in 11 years

Earnings

Nvidia rose ~6% after yet another beat-and-raise driven by a 262% YoY jump in sales; they also announced a 10-for-1 stock split (CNBC)

Target plunged ~8% after reporting a YoY sales decline and missing Q1 earnings estimates as customers purchase fewer everyday items (CNBC)

What we're watching this week:

Today: Intuit, Workday, Ralph Lauren

Full calendar here

Headline Roundup

Fed minutes reveal inflation anxiety among officials (BBG)

PE is eying college sports (WSJ)

Junk bond risk premiums are at pre-pandemic lows (WSJ)

Emerging market credit ratings are finally looking up again (RT)

David Solomon says Fed unlikely to cut rates this year (RT)

Fidelity halted European direct lending activities (BBG)

Chinese sovereign bond trading was suspended after frantic retail buying (FT)

Citigroup fined $79M for 'fat-finger' trading error (RT)

South Korea to keep short-sale ban until system developed (BBG)

CPP's exposure to yuan reduced to just 5% (BBG)

PwC faces crisis in China over audit of failed developer Evergrande (FT)

Hedge funds bought Chinese stocks for a fourth-straight week (RT)

Retail giants cut prices as inflation hits shoppers (FT)

TikTok is planning significant layoffs (TI)

BNPL borrowers will get the same protections as credit card users (AX)

Cancer victims sue J&J over 'fraudulent' bankruptcies (RT)

Bridgewater tapped China head as head of new investment unit (RT)

Techstars CEO Maëlle Gavet will depart (TC)

Barclays hired BofA’s David King as global tech M&A head (BBG)

A Message From Mizzen+Main

"I legit love my Mizzen+Main shirts" - Hank, CEO of Litquidity

Summer szn means it’s time to consider a wardrobe overhaul, but it's hard to find a shirt that meets all our needs. Don’t stress, Mizzen+Main has your back.

With their Leeward No Tuck Dress Shirt, you can have all the comfort of your favorite homey t-shirt with the style of that dress shirt you can wear to the office every day. This shirt is made from machine washable performance fabric that's quick drying and wrinkle resistant—so you'll never have to worry about looking your best.

Stop sacrificing comfort for style, because you can have both in your Mizzen+Main's Leeward dress shirt. Use code EXECSUM and take $35 off any order over $125 today!

Deal Flow

M&A / Investments

Miner Anglo American agreed to enter talks with larger rival BHP Group after rejecting a third proposal worth ~$49B (BBG)

German railway Deutsche Bahn received a handful of confirmatory bids for its DB Schenker logistics unit, which could fetch $16B in one of Europe’s largest deals this year (BBG)

Eni is studying a sale of a 20% stake in its biorefining unit Enilive after receiving interest; the whole business is valued at ~$10.8B (BBG)

UK investment platform Hargreaves Lansdown rejected an $5.9B takeover proposal from a consortium comprising CVC Capital and Abu Dhabi's ADIA (FT)

US based Vulcan Materials reportedly rejected Mexico's offer to purchase its Caribbean coast assets for $2Bl (BBG)

Biogen agreed to acquire Human Immunology Biosciences for up to $1.8B, with a $1.15B payment upfront (BBG)

Firefly Aerospace investors are considering a sale at a ~$1.5B valuation (BBG)

Tata Group will acquire Disney’s minority stake in Tata Play in a deal that values the subscription television broadcaster at ~$1B (BBG)

KKR and TPG are exploring options including a buyout of Southeast Asian online real estate platform PropertyGuru (BBG)

VC

Suno, a music creation platform, raised $125M in funding from Lightspeed Venture Partners, Matrix, and more (FN)

Turkish fintech Colendi raised a $65M Series B led by Citi Ventures (EU)

Streaming data lake platform Hydrolix raised a $35M Series B led by S3 Ventures (FN)

Coactive Systems, a startup for users to manage and retrieve visual data, raised a $30M Series B at a $200M valuation led by Emerson Collective and Cherryrock Capital (FN)

Cover Whale, an insurtech startup focused on commercial auto, raised $27.5M in funding from Morgan Stanley Expansion Capital (PRN)

SOCRadar, a threat intelligence and brand protection platform, raised a $25.2M Series B led by PeakSpan Capital (FN)

Aerodome, a DFR tech company, raised a $21.5M Series A led by CRV (FN)

Verse, a startup helping organizations reduce emissions, raised a $20.5M Series A led by GV (PRN)

Majority, a mobile banking and international services platform for migrants in US, raised $20M including $12.5M in equity led by Victor Jacobsson (FN)

Patronus AI, an automated evaluation and security platform, raised a $17M Series A led by Notable Capital (FN)

Hospitality software provider Nory raised a $16M Series A led by Accel (EU)

Max Retail, a marketplace for independent retailers and brands to sell excess inventory, raised a $15M Series A led by Nosara Capital (FN)

Bolster, a multi-channel phishing protection company, raised a $14M Series B led by M12 (PRN)

Amino Health, a digital healthcare navigation company, raised $10M in funding led by Transformation Capital (FN)

WeatherXM, a decentralized physical infrastructure network, raised a $7.7M Series A led by Lightspeed Faction (PRN)

Superlegal, an AI-powered platform for legal contract review for SMBs, raised a $5M seed round led by Aleph and Disruptive AI fund (PRN)

Messaging operations infrastructure platform Volt raised a $3M seed round led by Mercury (FN)

Sinn Studio, an XR studio, raised a $2.5M seed round led by Hartmann Capital (PRN)

IPO / Direct Listings / Issuances / Block Trades

State-owned ADNOC plans to sell a 5.5% stake in its drilling unit ADNOC Drilling for $900M (BBG)

Carlyle sold its minority stake in Brazilian hospital chain Rede D'Or for $427M (RT)

Saudi fintech Rasan Information Technology's $224M local IPO drew $29B in orders (BBG)

Chemicals giant DuPont will split into three listed companies (BBG)

Softbank-backed Indian budget hotel chain Oyo, once valued at $10B, withdrew its IPO application for a second time (TC)

SPAC

Admiral Acquisition will acquire industrial engineering firm Acuren in the largest SPAC deal YTD valued a $1.85B (RT)

Debt

Bankruptcy / Restructuring / Distressed

Fundraising

Permira is seeking $814M for a new debt fund to finance mid market firm (WSJ)

Peter Thiel-founded Valor Ventures raised $300M for its ninth fund (TC)

Investment firm Peterson Partners closed its PE business’ Fund X at $265M to invest in growth-oriented companies (FN)

Temasek’s VC arm will launch its first Japan-focused fund (FT)

Crypto Corner

Exec’s Picks

With the Credit Card Competition Act gaining major bipartisan traction in Congress, the travel and credit cards experts at The Points Guy explain why this may come at the cost of YOUR credit card points and rewards. Check out why the CCCA is a recipe for fewer points, higher fees, and fewer rewards and what you can do to Protect Your Points!

WSJ published an article covering the unlikely stocks that became a hot bet on AI.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter