Together with

Good Morning,

AI continues to carry the entire stock market, Bain is pulling back from work in China, US banks hiked Q3 dividends, Amazon is pivoting into an AI company, and the presidential debate became the meme of the weekend.

Earn 12% interest on silver, paid in silver, on the Gold Yield Marketplace®, Monetary Metals.

Let’s dive in.

Before The Bell

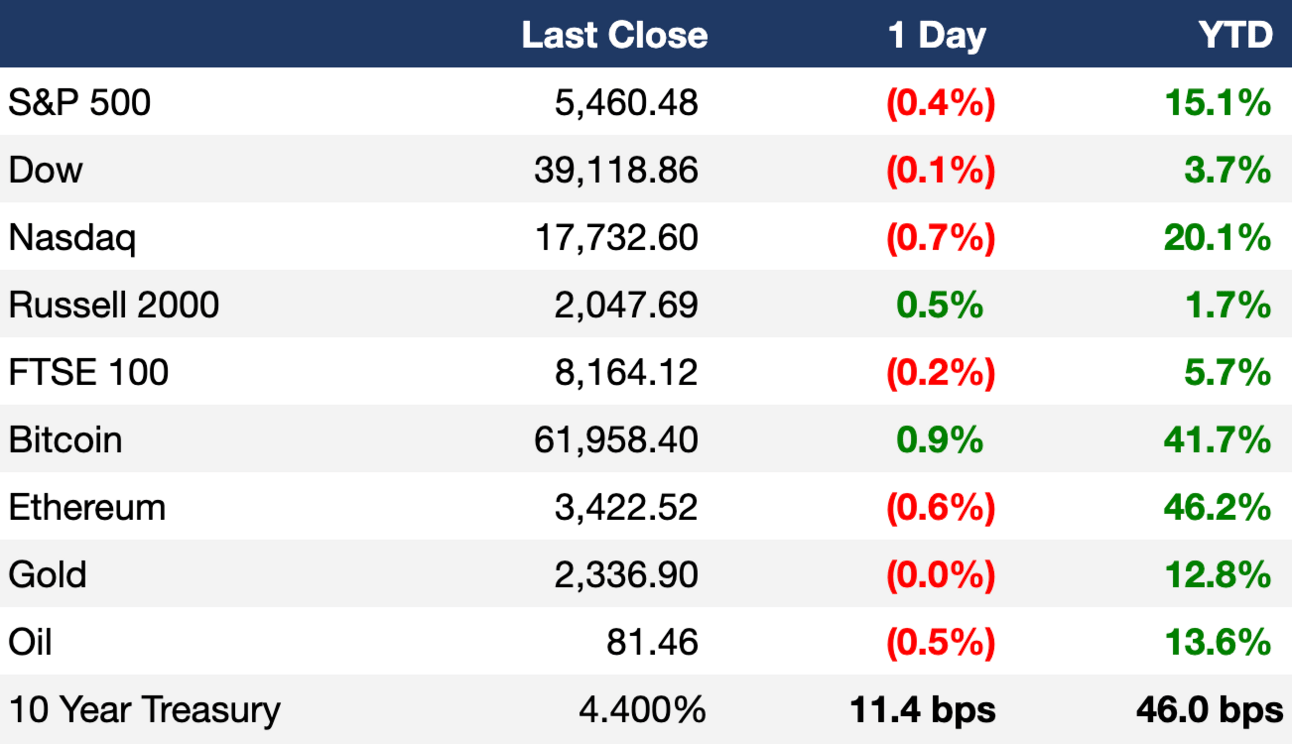

As of 06/28/2024 market close.

Markets

US stocks closed lower on Friday markets digested fresh inflation data and sentiment from the presidential debate

All three major US indexes posted a seventh winning month in eight

S&P 500 and Nasdaq gained 3.9% and 8.3% in Q2 respectively

Nvidia has accounted for 31% of S&P 500's H1 returns

France-Germany 10Y spread hit its highest since the Euro crisis

Lumber futures fell to post-Covid lows as home-building season fails to spark

Yen weakened through 161 vs the dollar to a 38-year low

Earnings

What we're watching this week:

Wednesday: Constellation Brands

Full calendar here

Headline Roundup

PCE index cooled to a three-year low in May (RT)

Dealmakers optimistic on global M&A despite sluggish growth (RT)

US banks hike Q3 dividends after sailing through Fed stress test (RT)

Fund managers are most underweight in bonds since November 2022 (RT)

Global equity funds see biggest weekly inflows since March (RT)

Fed reverse repo inflows hit highest level YTD (RT)

Financial services shun AI over job and regulatory fears (FT)

Japan Q1 GDP growth was revised downwards to -2.9% YoY (RT)

China issued rare earth regulations to protect domestic supply (RT)

New Bain CEO says firm is pulling back from China (FT)

Reddit-traded 'Roaring Kitty' was sued for securities fraud (DYN)

US will criminally charge Boeing and seek a guilty plea (BBG)

Amazon investing more on AI than retail warehouses (WSJ)

Citigroup urged dismissal of ex-MD's whistleblower lawsuit (RT)

Warren Buffett will donate wealth to a new foundation upon death (FT)

Biden loses ground in alarming first presidential debate (WSJ)

A Message From Monetary Metals

Earn 12% on Silver, Paid in Silver

Monetary Metals is the Gold Yield Marketplace® – a platform for individuals and institutions to earn a Yield on Gold, Paid in Gold® (and silver!) by financing qualified businesses in the precious metals industry.

Our clients have been earning a yield on gold and silver for over 8 years. Now you can too: earn 12% on silver, paid in silver in our latest offering (available to accredited investors only).

Deal Flow

M&A / Investments

Boeing agreed to acquire Spirit AeroSystems in a $4.7B all-stock deal (RT)

PE firm TDR Capital is pursuing an acquisition of UK education business BPP, which could fetch a ~$3.2B valuation (FT)

BlackRock agreed to acquire UK private markets data firm Preqin for $3.2B in cash (FT)

PE firm Cinven will acquire a 70% stake in real estate platform Idealista from EQT at a $3.1B valuation (BBG)

PE firm EQT lowered its bid for UK video game services company Keywords Studios to ~$2.7B (FT)

Nokia will acquire optical telecom equipment maker Infinera in a $2.3B cash and stock deal (RT)

Swiss PE firm Partners Group will acquire a majority stake in biotech FairJourney Biologics at a $966M valuation (FT)

Hedge fund Citadel will acquire Japanese power firm Energy Grid, its first Japanese acquisition (RT)

Spanish energy company Repsol is in talks to merge its UK North Sea oil and gas business with PE-backed NEO Energy (RT)

VC

AI infrastructure startup Lambda Labs is seeking to raise an $800M round (FT)

Czech grocery delivery startup Rohlik raised $170M in funding led by EBRD (TC)

Seven AI, an AI-powered cybersecurity solutions, raised a $36M pre-seed round led by Greylock (VC)

Feather, a German health insurance platform for expats, raised a $6.5M seed round led by Keen Venture Partners (TC)

Battery electrolyte startup Feon Energy raised a $6.1M seed round led by Fine Structure Ventures (FN)

Synthpop, an AI-driven platform for healthcare workflows, raised a $5.6M seed round led by Peterson Ventures (FN)

Prescribe FIT, a remote patient monitoring and health coaching solutions, raised a $4.8M Series A from Jim Grote, Tamarind Hill, and more (FN)

IPO / Direct Listings / Issuances / Block Trades

Bill Ackman’s Pershing Square set the IPO price of its potential $25B US closed-end vehicle at $50 per share (BBG)

Spanish bakery firm Europastry postponed its $537M Madrid IPO citing election volatility (BBG)

Biotech Alumis fell ~17% in its trading debut after a downsized $250M IPO (BBG)

Clinical stage biotech Bicara Therapeutics is working with Morgan Stanley on a $100M-$150M US IPO (BBG)

US small jet manufacturer Cirrus plans to raise up to $197M at a $1.3B valuation in a Hong Kong IPO (RT)

Riding hailing app Chenqi Technology plans to raise $175M in a Hong Kong IPO (RT)

KKR-backed software company OneStream filed for a US IPO (BBG)

French PE firm Astorg hired Evercore to explore a capital raise (BBG)

SPAC

Canadian cannabis extraction company Ayurcann will merge with Arogo Capital Acquisition Corp. in a $210M deal (GNW)

Debt

Bankruptcy / Restructuring

French tech group Atos reached a restructuring deal to convert ~$3.1B of debt into equity and receive a $250M capital injection (RT)

Rite Aid received court approval for a restructuring plan to cut $2B of debt and provide $2.5B in exit financing (BBG)

Redbox-owner Chicken Soup for the Soul Entertainment filed for Chapter 11 bankruptcy (BBG)

Fundraising

Crypto Corner

Exec’s Picks

WSJ published six charts depicting the state of the US stock market in Q2.

WSJ also published interesting insights on the advantages of being a 'personality hire.'

If you're currently a junior banker looking to break into the buy side, lateral to another investment bank, or explore new paths amid changing market dynamics, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, debt funds, and investment banking.

To get started, simply head over to Litney Partners and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter