Together with

Good Morning,

The Fed may hike rates another 50-75bps this month, the EU officially labeled natural gas and nuclear power as green energy, France is nationalizing a nuclear company, North Korea is trying to hack US healthcare companies, the Biden administration proposed new steps to alleviate student debt, and GameStop announced a stock split.

Let's dive in.

Before The Bell

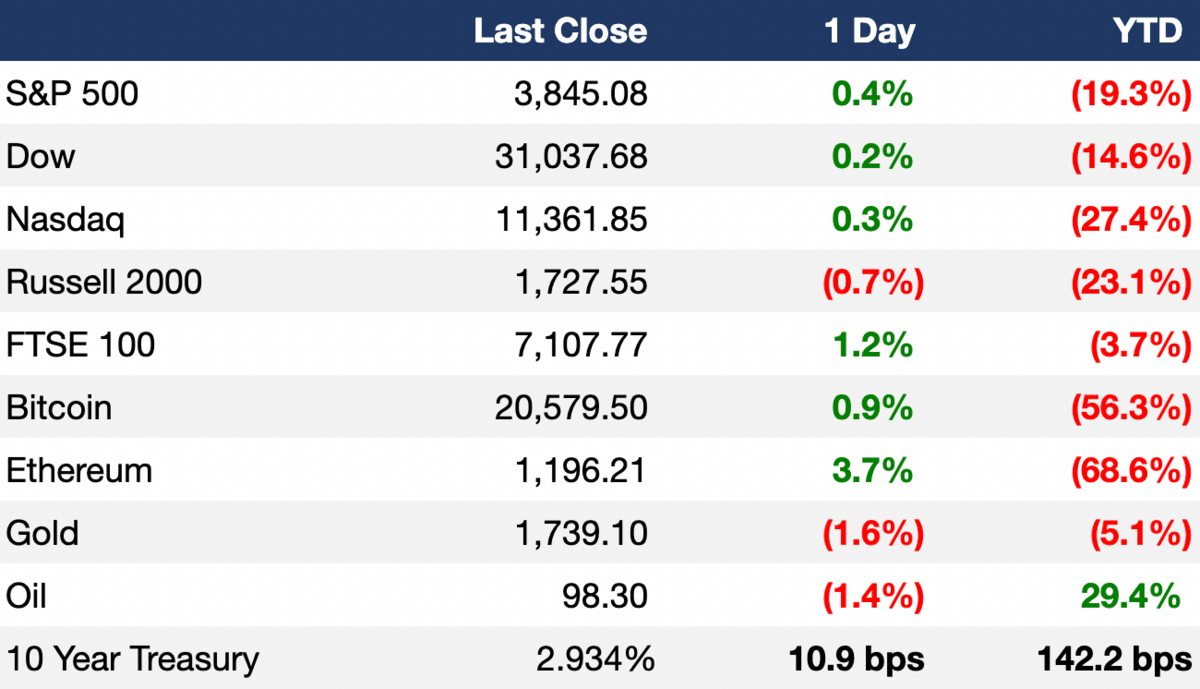

As of 7/6/2022 market close.

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

Markets

Stocks rose slightly after the minutes from the June Fed meeting showed a hawkish stance on monetary policy and another possible 75 bps interest rate hike in July

The two-year Treasury yield surpassed the 10-year yield, forming a well-known recession indicator

Mortgage rates dropped for the second week in a row, and total demand for mortgages dropped as well

Semiconductor giant TSMC jumped 5%+ after Samsung reported better than expected sales

Earnings

What we’re watching today: Levi Strauss & Co.

Full calendar here

Headline Roundup

Fed sees 'more restrictive' rates possible if inflation persists (BBG)

Labor Department figures for May showed that the tight labor market has started to loosen amid signs of slowing economic growth (WSJ)

IMF chief said the outlook for the global economy had 'darkened significantly' and she ‘cannot rule out’ a possible global recession (CNBC)

European Union lawmakers voted in favor to label natural gas and nuclear power 'green' or 'sustainable' sources of energy (RT)

The French government will nationalize its financially struggling nuclear giant Electricite de France amid Europe’s on-going energy crisis (BBG)

Boris Johnson's leadership is under threat as senior officials continue to resign in waves (FRB)

The heads of the FBI and MI5, Britain’s domestic security service, issued a joint warning about Chinese espionage aimed at stealing Western technology companies’ intellectual property (WSJ)

The US government warned that North Korean hackers are targeting American healthcare organizations with ransomware (TC)

Experian, Equifax and TransUnion will remove fully-paid medical debt from credit reports (MW)

Vanguard reached a settlement to pay $6.25M to Massachusetts investors who were hit last year with unexpectedly high tax bills (WSJ)

General Motors reported its worst quarterly sales in China since the beginning of the Covid-19 pandemic (CNBC)

GameStop announced a 4-for-1 stock split which was followed by an 8% share price increase in extended trading (CNBC)

British Airways slashes more than 10,000 flights amid industry staffing shortages (WSJ)

A Message From Amberjack

Rated #1 Best Overall Dress Shoes

Amberjack is a modern footwear brand started by former executives from Adidas, Cole Haan, & McKinsey. They've created the world's most advanced dress shoes, made with proprietary athletic materials that deliver incredible comfort and A-grade leather vertically sourced from one of the world’s leading tanneries.

They’ve been featured in Forbes, Business Insider, and Yahoo, and were just ranked the #1 best overall dress shoes in 2021 by Rolling Stone. Only downside is they constantly sell out – get yours today before they’re gone (or pre-order to ensure availability).

Deal Flow

M&A / Investments

Semiconductor manufacturer Broadcom's $61B deal for cloud computing company VMware will move forward after a rival bidder failed to emerge during the company's go-shop period (BBG)

Merck is in advanced talks to acquire cancer biotech company Seagen for ~$40B (WSJ)

Kuwait Finance House agreed to buy Bahrain’s Ahli United Bank for ~$11.6B (BBG)

Canadian pulp-and-paper producer Paper Excellence agreed to buy pulp-and-paper company Resolute Forest Products in a $2.7B deal (RT)

Energy solutions company New Fortress Energy formed a new liquefied natural gas JV with Apollo Global Management and sold 11 vessels and storage units to the JV for $2B (RT)

Canadian pension fund manager Omers is nearing a deal to acquire British utility services provider Network Plus for ~$714M (BBG)

Blackstone will invest $400M into environmental commodity exchange platform Xpansiv (WSJ)

UK-based investment bank Marex Group is close to a deal to buy the majority of agricultural commodities merchant ED&F Man's brokerage business for ~$235M (BBG)

Meat and poultry industry giant Tyson Foods will acquire a stake in Saudi poultry processing company Tanmiah Food in a $70M deal (BBG)

Piper Sandler agreed to buy tech-focused investment bank DBO Partners (BBG)

British bank HSBC is in talks to sell its Russia unit to local lender Expobank (BBG)

Amazon agreed to acquire a small stake in food delivery platform Grubhub to offer Prime users meal delivery perks through the app (BBG)

IBM is acquiring Databand, a startup developing an observability platform for data and machine learning pipelines (TC)

VC

Flexe, a Seattle-based startup helping retailers optimize their supply chains, raised a $119M Series D at a $1B+ valuation from BlackRock, Tiger Global, Redpoint Ventures, and others (PRN)

EV fast-charging network operator EVCS raised $68.8M in funding: a $50M debt facility from Spring Lane Capital, and an $18.8M Series A led by Abdo Partners, Spring Lane Capital and Copulos Group (PRN)

Planetarium Labs, a Singapore-based web3 gaming technology firm, raised a $32M Series A led by Animoca Brands (CD)

UnDosTres, a Mexican fintech which provides offerings such as airtime top-ups, service payments and entertainment purchases, raised a $30M Series B led by IDC Ventures (PRN)

Celus, which uses AI to automate circuit board design, raised a $25.6M Series A led by Earlybird Venture Capital (TC)

South Korean AI chip developer Rebellions raised a $22.8M extension to its Series A from strategic investor KT, one of the largest telecommunication companies in South Korea (TC)

Voyantis, a startup developing tools to estimate a customer’s lifetime value, raised a $19M seed round from Target Global, Square Peg, and others (TC)

Scottish engineering firm Orbital Marine Power raised $9.64M in funding from Scottish National Investment Bank and Abundance Investment (CNBC)

Crypto gaming firm Cauldron raised a $6.6M seed round led by Cherry Ventures (TC)

Finli, a payment management platform built for service-based small businesses in the US, raised a $6M seed round led by the Urban Innovation Fund (TC)

Blockchain startup Bitmark raised a $5.6M funding round co-led by Galaxy Interactive and North Island Ventures (CD)

Crescent, a cash-management platform that aggregates top business-friendly yields, raised a $5M pre-seed round from angel investors and tech founders (PRN)

Antacid producer and Tums competitor Wonderbelly raised a $3.4M seed round led by SLOW, Brand Project, and Elizabeth Street (TC)

Online education and examination software platform Azota raised a $2.4M pre-Series A round led by GGV Capital (TC)

IPO / Direct Listings / Issuances / Block Trades

Chinese mining and manufacturing company Tianqi Lithium raised ~$1.7B in Hong Kong's biggest IPO of 2022 (FT)

Debt

EV battery maker Northvolt raised a $1.1B convertible note from a range of investors including Volkswagen and Goldman Sachs Asset Management (CNBC)

Bankruptcy / Restructuring

Crypto brokerage Voyager Digital filed for Chapter 11 bankruptcy protection (CNBC)

Crypto Corner

Crypto trading platform Binance will cut bitcoin trading fees to zero worldwide starting July 8th (CD)

A class action suit filed in California federal court last week accuses key players in the Solana ecosystem of illegally profiting from SOL, the blockchain’s native token (CD)

A new legal advisory from the Office of Government Ethics bars federal workers who own crypto from working on policies that could influence the value of their digital assets (CD)

Exec's Picks

Sophia Kunthara wrote a great piece on crunchbase about how venture capitalists are betting on the creator economy by investing in startups that are helping individuals monetize their content. Check out her piece here.

Check out our new "Out of Office" tees in the store. Make sure no one disturbs you when you're getting turnt on vacation. It's a perfect gift for your European colleagues who are offline all Summer long.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.