Together with

Good Morning,

Jamie Dimon hinted at early retirement, Janet Yellen is against a global billionaire tax, JPMorgan’s Kolanovic is the last prominent Wall St bear, and Scarlett Johansson rebuked OpenAI for ripping off her voice…which naturally called for some hilarious memes.

Chill out with BILL—check out BILL's automated expense management platform and they’ll send you a Yeti cooler!

Let’s dive in.

Before The Bell

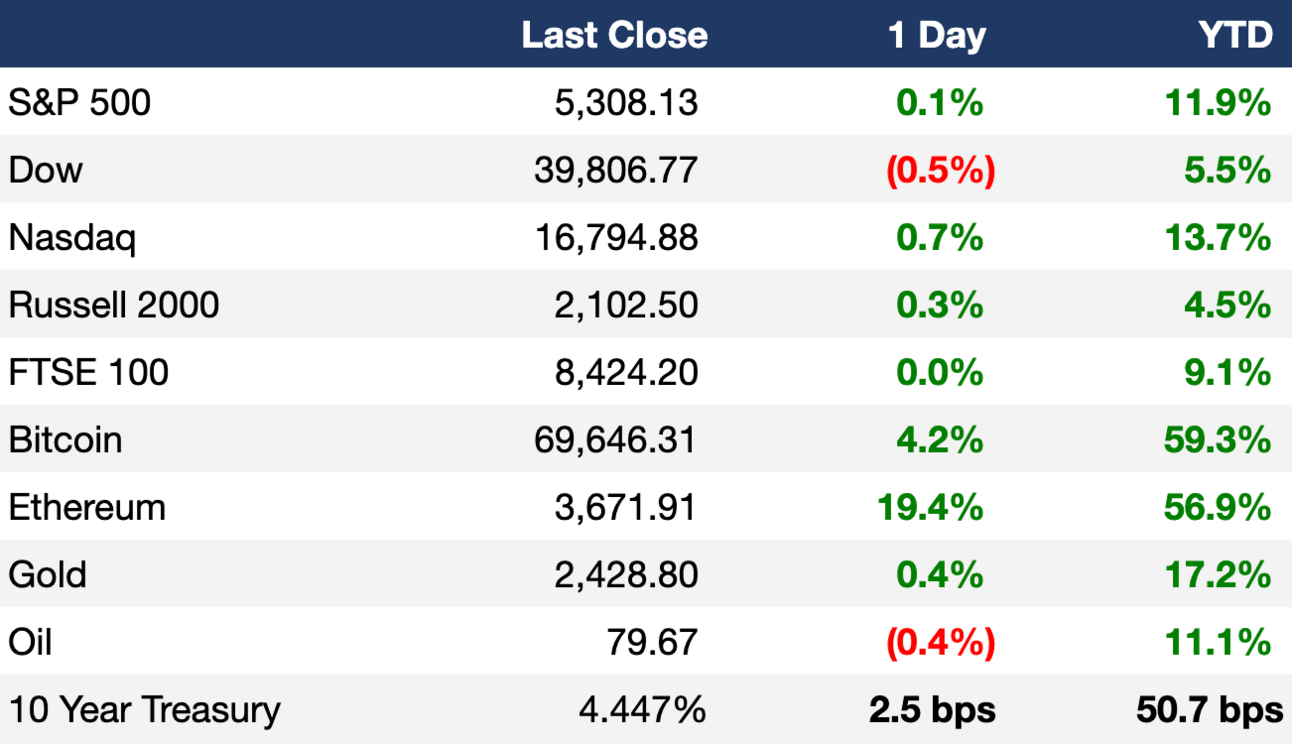

As of 05/20/2024 market close.

Markets

US stocks closed mixed yesterday as investors weighed hawkish statements from Fed officials

The Nasdaq closed at an ATH

Gold jumped to an ATH

Copper surged past $11k/ton to an ATH as investors bet on a looming supply shortage

US dollar is on track for its first down month this year

Earnings

Palo Alto Networks fell ~9% despite beating Q3 top and bottom line estimates due to a disappointing FY forecast for billings and Q4 revenue (YF)

Zoom beat Q1 earnings estimates and raised its FY earnings and revenue forecast thanks to robust demand as companies adopt hybrid work models (RT)

What we're watching this week:

Today: Macy’s, Lowe’s

Wednesday: Nvidia, Target

Thursday: Intuit, Workday, Ralph Lauren

Full calendar here

Headline Roundup

Jamie Dimon hinted at earlier retirement (WSJ)

JPMorgan leaders shape strategy as succession comes into focus (RT)

Jamie Dimon is 'cautiously pessimistic' on economy (RT)

JPMorgan’s Kolanovic is last prominent stock market bear (BBG)

JPMorgan emphasizes employee health after BofA banker death (RT)

All JPMorgan hires will receive AI training (BBG)

AI-intensive sectors are showing a productivity surge (RT)

Fed policymakers still cautious on inflation and policy (RT)

Auditors failed to raise alarm before 75% of UK corporate collapses (FT)

Wall Street firms increasingly looking to Sun Belt for expansion efforts (QZ)

Janet Yellen is against a global tax on billionaires (WSJ)

Millennium hired GIC's Naeimi as senior portfolio manager (BBG)

CalPERS opposed all Exxon directors amid shareholders dispute (BBG)

Target will lower prices on 5k items (RT)

Starwood's $10B REIT is getting crunched (WSJ)

FDIC chair will step down after scathing report (BBG)

Scarlett Johansson accused OpenAI of ripping off her voice (CNBC)

A Message From BILL

Chill out with BILL and get a Yeti cooler

Don’t spend your summer sweating over spreadsheets. Take a BILL Spend & Expense demo to see how we can:

Automate your expense reports

Issue as many virtual cards as you need

Offer business credit lines

Flexible credit means no more sweating the small stuff—and also getting the cash you need to grow.

Take a demo by the end of the month and we’ll send a Yeti cooler your way. We hope it helps you beat the heat this summer.

Deal Flow

M&A / Investments

Brazilian pulp and paper company Suzano is in talks to sweeten its $15B acquisition offer for International Paper (RT)

French animal health firm Ceva Santé Animale is mulling raising new funds at a $7.6B EV (BBG)

PE firms including Warburg Pincus expressed takeover interest for $4.2B listed education software provider PowerSchool (BBG)

Regional lender SouthState will acquire smaller rival Independent Bank Group in a ~$2B all-stock deal (RT)

Information security company CyberArk will acquire cybersecurity firm Venafi from PE firm Thoma Bravo in a $1.54B cash-and-stock deal (RT)

Blackstone led a ~$1B preferred-equity investment backing healthcare company Press Ganey’s debt refinancing (BBG)

Logistics firm Saltchuk Resources, the largest shareholder of Overseas Shipholding, will acquire the liquid bulk carrier in a $950M all-cash deal (WSJ)

Carlyle launched a bid to buy KFC's Japan operations for $910M (FT)

A consortium including a Hard Rock Hotels & Resorts is considering a bid for $864M troubled Australian casino operator Star Entertainment (BBG)

Energy company Phillips 66 agreed to acquire midstream company Pinnacle Midland from PE firm Energy Spectrum Capital for $550M in cash (RT)

Norway's SWF Norges Bank Investment Management acquired the remaining 50% stake it didn’t own in Sheffield’s Meadowhall Shopping Centre from UK REIT British Land for $457M (BBG)

China’s SDIC Mining Investment is in advanced talks for a potential 49% stake in Thai potash mine Asia Pacific Potash in a deal worth up to $400M (BBG)

VC

280 Earth, a DAC startup, raised a $50M Series B led by Builders VC (BW)

AssetWatch, a condition monitoring and predictive maintenance company, raised a $38M Series B led by Wellington Management (FN)

Online bookkeeping and accounting software provider Osome raised a $17M Series B (FN)

Caeli Wind, a platform for analyzing and marketing wind energy locations, raised an $11M round led by Notion Capital (FN)

Merit, a customer and engagement tech startup, raised a $12M pre-Series B led by Alisthithmar Capital (FN)

Autonomous drone startup Neros raised $10.9M seed round from Sequoia Capital (RT)

Overland AI, an autonomous ground vehicle tech for the defense sector, raised a $10M seed round led by Point72 Ventures (FN)

Teal, an accounting infrastructure for vertical SaaS businesses, raised an $8M seed round led by Torch Capital (BW)

Subeca, a startup providing low cost and easy-to-use water technology, raised a $6M Series A led by SUEZ (PRN)

Daffodil Health, a provider of healthcare pricing and administration solutions, raised a $4.6M seed round led by Maverick Ventures (FN)

QA.tech, a Swedish quality assurance testing startup, raised a $3.3M seed round led by PROfounders (EU)

IPO / Direct Listings / Issuances / Block Trades

Debt

Japan's Norinchukin Bank is considering raising $7.7B to boost capital and cover losses related to low-yielding bonds (BBG)

SoftBank plans to issue $3.5B of seven-year yen bonds (BBG)

Peloton Interactive launched a $1B leveraged loan offering to refinance debt and a $275M sale of convertible senior notes (BBG)

Broadcaster Gray Television plans to sell $1B in senior unsecured notes as part of a refinancing effort (BBG)

Bankruptcy / Restructuring

Crypto Corner

Exec’s Picks

Work smarter and faster with Rogo, the GenAI Platform for finance. Rogo combines the data you need with finance-specific AI models. Supercharge your research, streamline your diligence process, and automate your recurring work. See Rogo in action here!

Inc. published an piece observing how younger workers are rejecting assignments in search for purpose-driven work.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter