Together with

Good Morning,

Nomura wants a piece of the private credit pie, OpenAI’s rivals are trying to capitalize on its turmoil, Barclays could slash 2,000 jobs, Nvidia delayed the launch of its China-focused AI chip, asset managers are quietly adding ‘ESG’ to their defense portfolios, and Congress is facing a retirement surge.

Want the best coverage of OpenAI news, as it develops? Check out and subscribe to The Information.

Let’s dive in.

Before The Bell

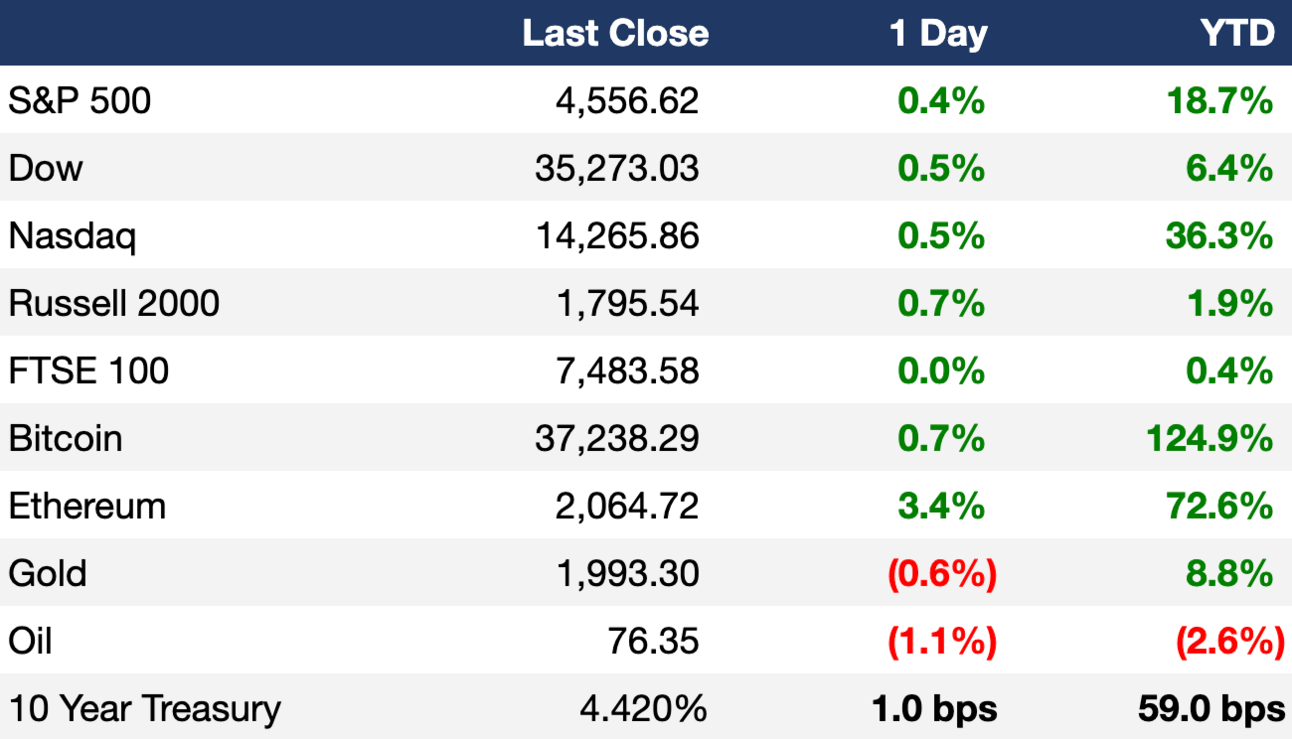

As of 11/22/2023 market close.

Markets

US stocks rose after yields briefly fell to their lowest level in two months

The Dow led indices with a 0.53% gain

Earnings

Headline Roundup

OpenAI rivals move to exploit leadership turmoil (WSJ)

Japanese bank Nomura Holdings is building a $1B strategy for private credit (BBG)

Barclays could slash 2,000 jobs in $1.3B cost cut (RT)

Nvidia delays launch of new China-focused AI chip (RT)

Asset managers quietly add ‘ESG’ to portfolios of defense stocks (BBG)

A more moderate Milei embraces trading partners he had previously shunned (BBG)

China races to end property panic, fill $446B gap (BBG)

Argentine banks flee to one-day notes amid government transition (BBG)

Israel’s $48B war bill leaves its fate with bond markets (BBG)

Oil and gas industry needs to let go of carbon capture as solution to climate change, IEA says (CNBC)

Voters see American Dream slipping out of reach, according to poll (WSJ)

Retirement surge in Congress in wake of GOP House Speaker drama (WSJ)

Amazon protests in Europe target warehouses, lockers on busy Black Friday (RT)

Mexican central bankers talk about rate cuts as inflation comes down (WSJ)

EU to put forward plan for $636B overhaul of power grids (BBG)

EU helps Finland secure its borders amid migrant influx from Russia (WSJ)

A Message From The Information

It seemed like we had a new development in the OpenAI story every 5 minutes this week. With Sam Altman being fired, rehired, fired, and rehired again, no one knew where to turn for reliable, timely information.

Personally, I kept up with everything by reading The Information. Who turned down the OpenAI CEO role? Which board members were plotting against Sam? The Information provided breaking coverage on these topics and more, all week long. Click below to get started:

Deal Flow

M&A / Investments

Broadcom completed its $61B acquisition of software maker VMware (BBG)

Abu Dhabi National Oil is exploring a potential acquisition of Wintershall Dea, the European energy explorer backed by BASF, in a deal that could value the energy firm at over $11B (BBG)

Blackstone will purchase UK-based software developer Civica at an undisclosed valuation; the valuation was previously estimated to be ~$2.5B, including debt (WSJ)

Czech gunmaker Colt CZ Group made a cash-and-stock merger offer to Vista Outdoor valuing the sporting and outdoor goods group at ~$1.7B (RT)

Amazon is set to win unconditional EU antitrust approval for its $1.4B acquisition of robot vacuum maker iRobot (RT)

UK is poised to order a probe on public-interest grounds of the proposed $1.1B takeover of Telegraph Media Group by Abu Dhabi-backed RedBird IMI (FT)

Building materials company Sigmarock will acquire CRH’s lime operations in Europe for $1.1B (BBG)

Prima Assicurazioni, which is backed by Blackstone, is seeking a new minority investor; a potential deal could value the insurance startup at $1.1B (RT)

State Grid Corp. of China’s Brazilian unit is seeking to raise ~$1B by selling a 25% stake (BBG)

Italian telecom operator Fastweb is exploring a potential deal for Vodafone Group’s Italian operations (BBG)

Cameroon is in talks to acquire London-based PE firm Actis’ 51% stake in energy distributor Energy of Cameroon (BBG)

Mexican telecom America Movil denied a report that it is in talks with Argentine President-elect Javier Milei's team to buy Argentina's state telecoms company Arsat (RT)

VC

Indian audio entertainment startup Pocket FM is in talks to raise a ~$100M round at an $800M valuation led by Lightspeed (TC)

Quotient Therapeutics, a startup working on somatic genomics, raised a $50M round led by Flagship Pioneering (FN)

Vivodyne, a startup creating drugs from lab-grown human organs, raised a $38M seed round led by Khosla Ventures (BW)

Crezco, a payments integration platform, raised a $12M Series A from MMC Ventures and 13books (TC)

Quantum computing startup Entropica Labs raised an $11M Series A led by CerraCap Ventures (PRN)

UK-based parcel delivery startup Relay raised a $10M seed round led by Project A Ventures and Prologis Ventures (TC)

Lasso Security, a Tel Aviv, Israel-based large language models cybersecurity startup, raised a $6M seed round led by Entrée Capital (FN)

Craftwork, a home repairs startup, raised a $6M round led by Forerunner Ventures (FN)

Birdseye, a Toronto-based AI-powered marketing platform, raised $3M in a seed round led by Drive Capital (TC)

Osium AI, a French startup using AI to speed up materials innovation, raised a $2.6M seed round from Y Combinator, Singular, Kima Ventures, and more (TC)

Cameroonian healthtech startup Waspito raised a $2.5M seed extension led by DP World (TC)

NanobOx, a Dublin-based nanobubble technology provider, raised a $1M round led by The Yield Lab (FN)

IPO / Direct Listings / Issuances / Block Trades

China’s Contemporary Amperex Technology is studying a potential second listing in Hong Kong; the Shenzhen-listed CATL has a market cap of $109B (BBG)

Middle Eastern e-commerce firm Floward is working with HSBC and Goldman Sachs for a planned IPO in Saudi Arabia (BBG)

Chinese smartphone maker Honor Device began preparations for an IPO three years after it was spun off from Huawei Technologies (BBG)

Debt

Saudi Arabia raised $11B through a syndicated loan from a group of banks including Industrial and Commercial Bank of China, Citigroup, First Abu Dhabi, and HSBC, to fund its budget deficit (BBG)

Silver Lake Management is seeking a loan from private credit funds of ~$624M for Ticketek-owner TEG to give itself a payout (BBG)

Bankruptcy / Restructuring

A group of lenders at Endo International proposed to pay up to $465M to US government agencies that objected to the bankrupt pharmaceutical company’s restructuring plan to hand control to creditors (WSJ)

Fundraising

Fidelity International raised $700M for its first fixed income mutual fund in China (RT)

Crypto Corner

Bankrupt crypto lender Genesis Global filed a lawsuit to recover $684M worth of digital assets that a former business partner withdrew from the cryptocurrency lender before it filed for bankruptcy protection (WSJ)

US prosecutors do not want Binance's former CEO Changpeng Zhao to be allowed to leave the US ahead of his February sentencing due to flight risk (CD)

Exec’s Picks

Joe Pompliano explained how Amazon is using its NFL streaming contract to drive Black Friday sales.

Jack Raines wrote about six things that society has gotten wrong, despite our progress over the last century.

Sam Bankman-Fried’s life behind bars: Crypto tips and paying with fish.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter