Together with

Good Morning,

Yesterday was one of the most information-heavy days for markets in a while. We've got it all summarized for you, but one thing stands out: even the Fed isn't immune to Trump's politics.

The same VCs who invested in ebay, Uber, and Venmo before they got big are now backing another up-and-comer: Pacaso. Founded by a former Zillow exec, Pacaso brings co-ownership to the $1.3T vacation home market. And you can invest in Pacaso as a private company today. Check out the offering.

Let's dive in.

Before The Bell

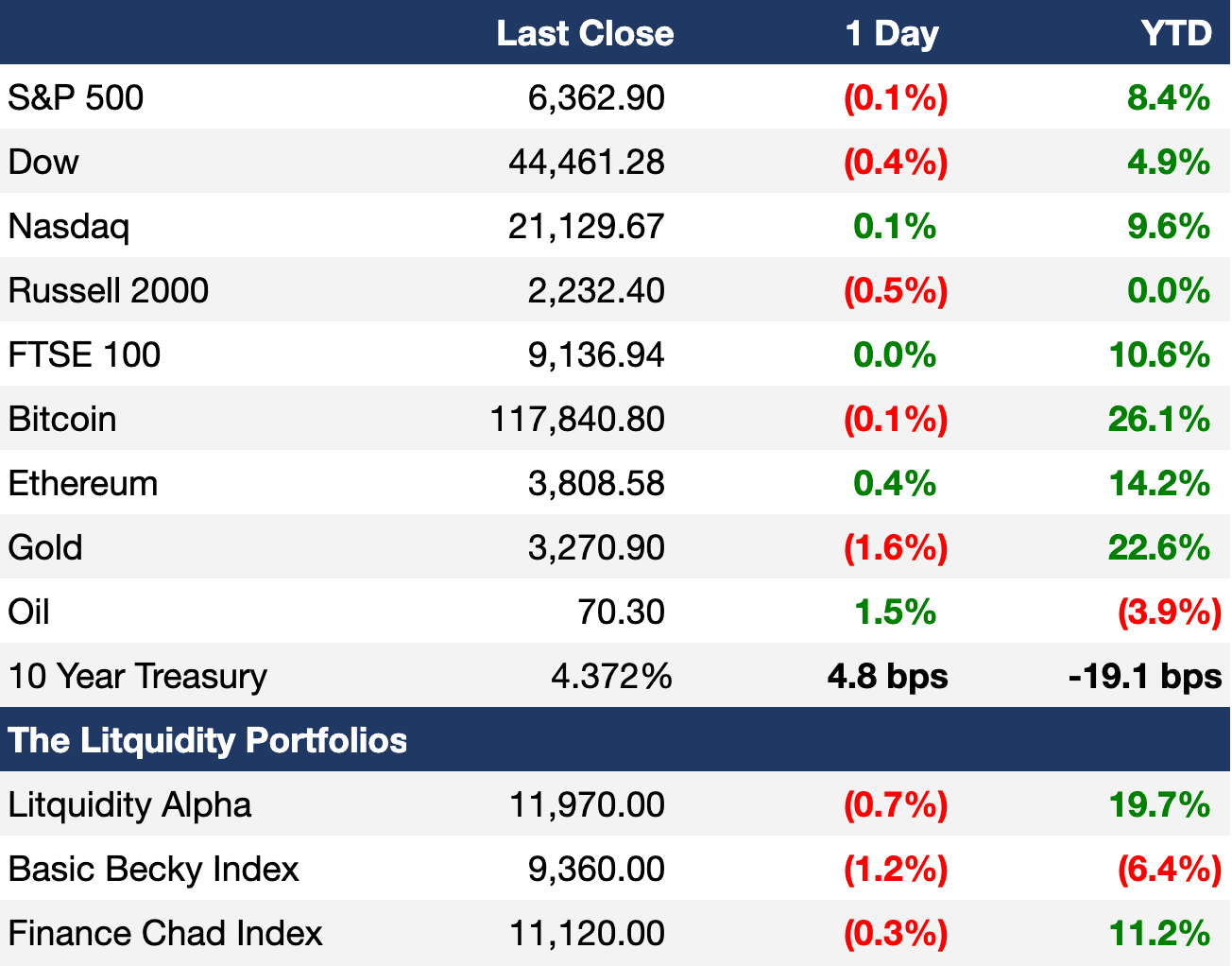

As of 7/30/2025 market close.

Click here to learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks closed somewhat mixed yesterday as traders digested a slew of information including a historic Fed decision dissent, strong GDP and jobs data, blockbuster Mag 7 earnings, and last-minute tariff announcements

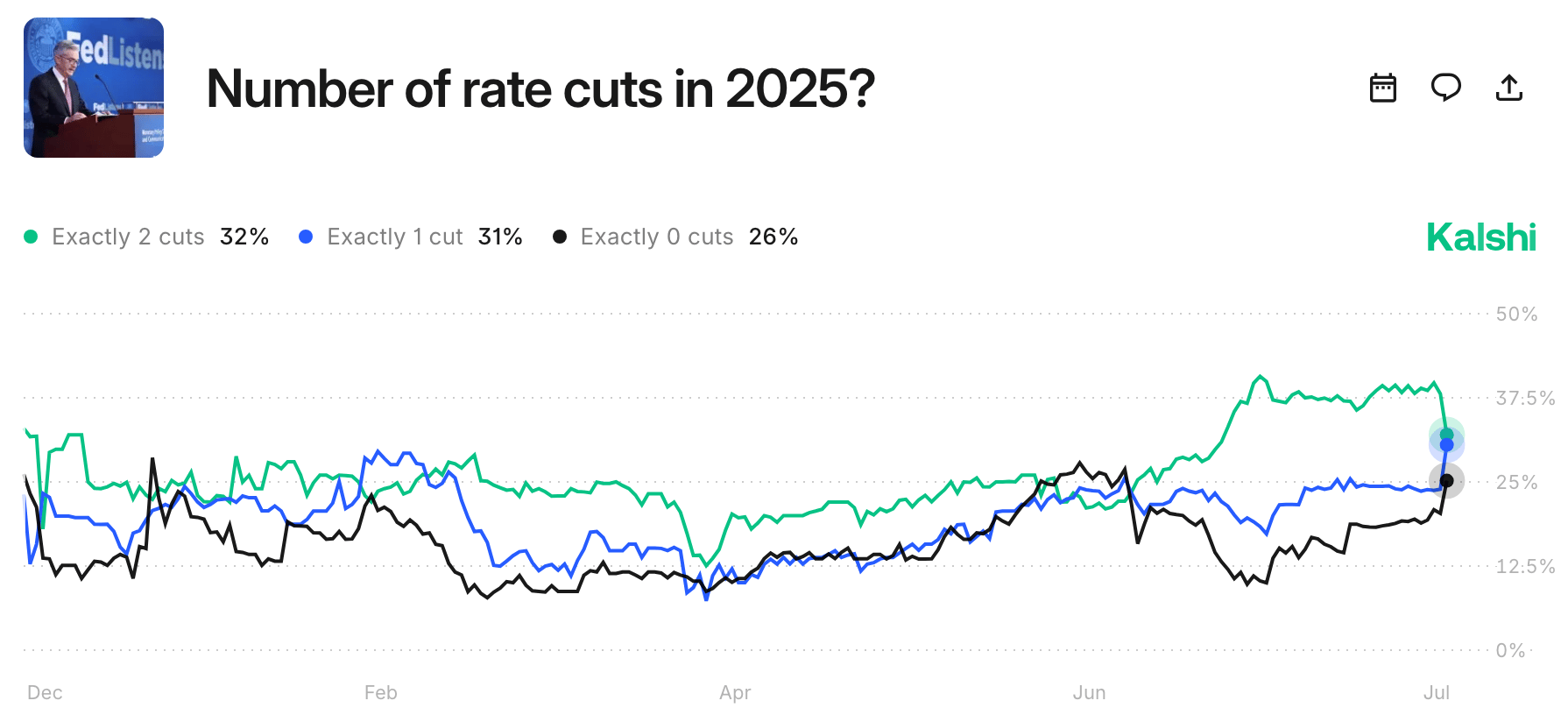

Rates traders lowered odds of a September rate cut from 65% to 50%

China's CSI 300 index is up 5% MTD to match the S&P YTD

China bonds are set for their biggest monthly loss since March

CSI 300-China Treasuries correlation is headed to its most negative level since 2020

US yields climbed across the curve

Dollar is set for longest win streak since February

EM currencies fell for a fourth-straight day

Oil held near a six-week high as US targets India-Russia oil trade

US copper slumped 20% in its worst day ever

Earnings

Meta crushed Q2 with a beat-and-raise on the back AI-driven efficiency and gains across ad systems and broad DAU growth; the firm also raised CapEx projections amid its 'superintelligence' push marked by high-profile talent poaching, where compensation related to hiring will be the second-largest driver of expense growth (CNBC)

Microsoft topped Q2 earnings and revenue estimates on continued growth in Azure cloud and cloud services and Office and forecast a record $30B in Q3 CapEx as its AI investment pays off; Microsoft became the second company ever to hit a $4T market cap (CNBC)

Robinhood topped Q2 earnings and revenue estimates as options trading boosted transaction-based revenue, while crypto and equities lagged; the firm is closing the gap with Coinbase as it pushes beyond retail trading into full-scale wealth management (CNBC)

HSBC Q2 profits fell 29% profits on an impairment charge to its stake in China's Bank of Communications and broad restructuring costs related to the bank's overhaul (FT)

Kraft Heinz beat Q2 earnings and revenue estimates and reaffirmed its FY outlook as price increases helped offset a 2% drop in organic revenue amid inflationary pressures, competition, and shifting consumer preferences toward healthier options; the firm is planning a major breakup (BBG)

Carvana topped Q2 earnings and revenue estimates on a sixfold surge in profit on record used car sales and $274M in loan gains (BBG)

Ford beat Q2 earnings and revenue estimates with US vehicle sales rising 14% as hybrid sales offset a slump in EVs; the firm reinstated FY guidance, despite a $2B net tariff hit contributing to its first loss since 2023, citing strong execution of its Ford+ plan and improved cost and quality controls (CNBC)

Hershey beat Q2 earnings and revenue estimates driven by strong sales and market-share gains in US confectionery and salty-snacks, though it lowered FY guidance due to rising tariff expenses and cocoa costs (MNS)

What we're watching this week:

Today: Apple, Amazon, Coinbase, Reddit, Mastercard, Strategy, CVS Health, Roblox

Friday: ExxonMobil, Chevron

Full calendar here

Prediction Markets

A hawkish J Pow put a September rate cut in doubt. But one thing is certain: even the Fed is susceptible to Trump's politics.

Headline Roundup

US Q2 GDP grew 3% YoY despite tariffs (CNBC)

Fed held rates steady and gave no clues on September (CNBC)

Fed saw its first double dissent since 1993 (CNBC)

Fed does not consider government debt costs in rate policy (RT)

Trump and Bessent embrace active management of US debt (WSJ)

Trump and Dimon are talking again after years of tension (WSJ)

US announced a trade deal with South Korea with 15% tariffs (CNBC)

US announced a 25% tariff on India (BBG)

US announced a 50% of Brazil (RT)

US announced a 50% tariff on copper products (WSJ)

US private-sector payrolls rose by 104k in July (BBG)

China manufacturing declined for a fourth-straight month (CNBC)

Equity L/S hedge funds are making a historic comeback (FT)

Systematic funds are ramping up stock-buying (BBG)

Boutique investment banks are upbeat about IPOs rebounding in H2 (BBG)

Leveraged-loan launches hit a record $208B in July (BBG)

Wall Street's big loans to EM spark risk worries (BBG)

China bond traders are getting bowled over by stock bulls (BBG)

EM revival hopes run into dollar difficulties (RT)

Rio Tinto profits fell to a five-year low amid trade uncertainty (BBG)

Microsoft and Meta added a combined $500B in market cap yesterday (RT)

Evergrande faces delisting as China property debt revamp drags on (RT)

China vies to unseat US in fight for $4.8T AI market (BBG)

Starbucks is rolling out a healthier menu (BBG)

Hermes says heir no longer holds shares worth $16B (BBG)

High Noon recalled vodka seltzer packs mislabeled as Celcius (BBG)

Bill banning Congressmember stock trading advanced in Senate (NYT)

A Message from Pacaso

Major investors bet big on this "unlisted" stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That's why the same VC firms that backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso's streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits to date.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on the Nasdaq is subject to approvals.

Deal Flow

M&A / Investments

Palo Alto Networks agreed to acquire Israeli cybersecurity firm CyberArk in a $25B cash-and-stock deal at a 26% premium

South Africa launched a bidding process for a $22B grid expansion project to boost energy infrastructure

French energy management giant Schneider Electric agreed to buy the remaining 35% stake in its India JV from Singapore SWF Temasek for $6.4B in cash

Tata Motors, a unit of Indian conglomerate Tata, will acquire Italian truck maker IVECO for $4.3B amid a breakup

Aston Martin agreed to sell its minority stake in Aston Martin F1 Team for ~$146M at a $3.2B valuation

Bain Capital and KKR are eyeing bids for Japanese food and beverage firm Sapporo's real estate unit; which could fetch ~$2.7B

Chinese e-commerce giant JD.com is nearing a $2.5B takeover of German electronics retailer Ceconomy

Ohio-based O&G firm MPLX is in advanced discussions to purchase midstream infrastructure provider Northwind Midstream Partners from Five Point Infrastructure for ~$2.3B

Italian aerospace and defense tech firm Leonardo agreed to acquire IVECO's defense business for $1.95B

New Mountain Capital is in advanced talks to acquire a 40% stake in accounting firm Wipfli at an over $1B valuation

Thoma Bravo agreed to acquire a stake in derivatives trading software provider Trading Technologies at an over $1B valuation

BC Partners entered exclusive talks to acquire Les Laboratoires Servier's generic drug unit Biogaran at an over $925M valuation

CleanPeak Energy, a distributed energy platform, raised $322M from KKR to expand operations in Australia

Coca-Cola agreed to divest CHI, a Nigerian beverage company that acquired six years ago

KKR acquired a majority stake in HealthCare Royalty Partners, a $3B AUM firm that acquires rights to royalty streams from pharma companies

KKR-backed infertility treatments firm IVI RMA Global acquired Gulf Capital's stake in its Middle Eastern fertility business

Glencore JV Aquarius Energy acquired a 37% stake in Africa's largest oil storage site MOGS Saldanha from Oiltanking

UK fintech giant Revolut is weighing buying a US bank to get a license

VC

Ramp, a financial operations platform, raised a $500M Series E-2 at a $22.5B valuation led by ICONIQ

AI text generation platform Writer raised a $200M Series C at a $1.9B valuation led by Premji Invest, Radical Ventures, and ICONIQ Growth

Observability platform Observe raised a $156M Series C led by Sutter Hill Ventures

Fleet tracking and driver safety startup Motive Technologies raised a $150M round led by Kleiner Perkins ahead of a potential IPO

On-premise cloud computing startup Oxide raised a $100M Series B led by USIT

Positron AI, a startup building semiconductors and inference hardware, raised a $51.6M Series A led by Valor Equity, Atreides Management, and DFJ Growth

RD Technologies, a Hong Kong-based fintech group of companies, raised a $40M Series A-2 led by ZA Global, China Harbour, Bright Venture, and Hivemind Capital

Sparrow, an end-to-end leave management solution provider, raised a $35M Series B led by SLW

Human risk management platform Fable Security raised a $31M round from Greylock Partners and Redpoint Ventures

Conversion, an AI-powered marketing automation startup, raised a $28M Series A led by Abstract

eVTOL startup AIR raised a $23M Series A led by Entree Capital

C8 Health, a best practices implementation platform for healthcare, raised a $12M Series A led by Team8

Due, a UK borderless payment startup, raised a $7.3M seed extension led by Speedinvest

AI-powered customs compliance startup Caspian raised a $5.4M seed round led by Primary Venture Partners

ArcSpan, a publisher-first monetization platform, raised a $5.2M seed extension

Rapidise, a startup building AI-connected devices, raised a $4M seed round led by Napino Tech Ventures and Teksun Microsys

Retab, a developer-focused document automation platform, raised a $3.5M pre-seed round led by VentureFriends, Kima Ventures, and K5 Global

IPO / Direct Listings / Issuances / Block Trades

Korean industrials conglomerate SK Group is seeking to raise $5.8B via share sales to restructure energy units and reduce debt

India's Jio Financial Services plans to raise $1.8B in a share sale to its founders

Tech investor Prosus sold over $250M in Chinese food-delivery app Meituan shares as it begins offloading a $4B stake

Black Rock Coffee Bar confidentially filed for a US IPO which could fetch an over $1B valuation

Kuwaiti O&G firm Action Energy is planning a Kuwait IPO in Kuwait's first energy listing since 2008

Debt

Indian EV maker Ola Electric recently held talks to raise $116M in high-yield debt

Bankruptcy / Restructuring / Distressed

Dog-walking startup Wag, once valued at $650M, filed for Chapter 11 with plans to hand ownership to lender Retriever

Fundraising / Secondaries

KKR raised $6.5B for its biggest credit fund yet, targeting private ABF deals

KKR's insurance unit Global Atlantic secured a $2B commitment from Japan Post Insurance

Media and entertainment investor HarbourView Equity Partners raised $630M for its music royalties fund

PE firm Skyline Investors raised $125M for its debut fund focusing on 'micromarket' investment opportunities

Canadian VC Yaletown Partners raised $100M for its third tech-focused VC fund

Vietnam is seeking to raise $100M for a government-backed VC fund

Uncorrelated Capital raised $53M to debut its litigation finance-focused investment platform

JPMorgan Chase is partnering with Independent Restaurant Coalition to launch a $4M grant fund to support restaurants impacted by natural disasters

Crypto Sum Snapshot

JPMorgan and Coinbase partnered to link bank accounts and crypto wallets

White House released a long-promised crypto report

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

AI is no longer just disrupting workflows – it's redefining how entire industries operate. That was a key takeaway from Mizuho's 2025 Technology Conference, a two-day event in New York City which brought together over 60 leading technology companies and nearly 300. Read more.

Finance & Startup Recruiting 💼

Litney Partners

If you're a junior banker looking for your next career move, check out our recruiting firm, Litney Partners. Established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm), Litney Partners has placed strong candidates across leading firms spanning private equity, hedge funds, venture capital, growth equity, private credit, investment banking, and fintech. Head over to our website to drop your resume / create your profile and we'd love to get in touch!

We move faster than most firms due to our paralleled reach, decades of industry expertise, and ability to attract high caliber candidates.

Next Play

If you're down bad, realizing finance isn't for you, and/or are curious to explore the world of startups (BizOps, chief of staff, strategic finance, etc.), fill out this form. Next Play reviews every submission and will reach out to schedule a 1:1 video call if they think they can be helpful as your own, personal startup matchmaker. They've grown their community to over 50k talented individuals and have strong relationships across the tech ecosystem.

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.