Together with

Good Morning,

Williams F1 seemingly ran its entire F1 operation on one excel sheet, global IPO headlines were booming yesterday, Switzerland surprised with a rate cut, Germany betrayed Adidas for Nike, Amazon is fearsome of Temu and Shein competition, and US yield curve inversion is now the longest on record.

Spring season means it’s time for a wardrobe overhaul. So check out our personal favorite Mizzen+Main for the most comfortable men's dress shirts in the game!

Let’s dive in.

Before The Bell

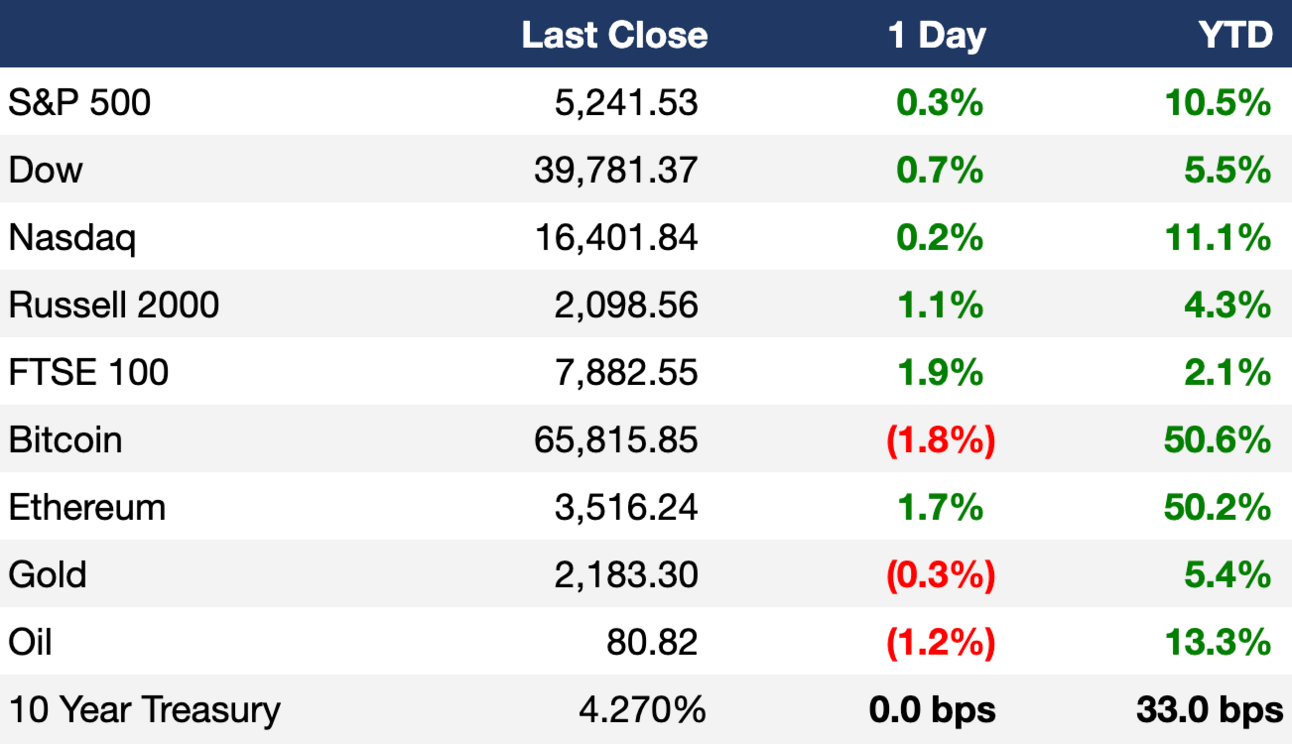

As of 03/21/2024 market close.

Markets

All three major US indexes closed at record highs for a second-straight day after the Fed reassured investors about prospects for 2024 rate cuts

Europe's Stoxx 600 and Japan's Nikkei 225 also hit fresh record highs

The US 2Y-10Y yield curve inversion is now the longest inversion on record; 625 days since July 2022

Swiss franc fell to an eight-month low against the euro while Swiss bonds rallied

Earnings

Nike beat Q3 earnings and revenue estimates on better-than-expected North America growth, but growth in China continued to slow (CNBC)

FedEx surged 13% after reporting better-than-expected Q3 earnings and announcing a $5B share buy back as cost-cutting efforts continue to help boost profits (YH)

Lululemon shares plunged 11% despite beating holiday earnings estimates thanks to weak guidance as growth in North America stagnates (CNBC)

Full calendar here

Headline Roundup

Swiss National Bank surprised global markets with a rate cut (RT)

Bank of England held key policy rate steady at 5.25% (WSJ)

Temu and Shein are gaining fast on Amazon (WSJ)

FDIC will unveil new bank M&A rules (RT)

Eurozone is edging closer to a private-sector rebound (WSJ)

Short sellers up wagers against CRE again (BBG)

French family offices like PE more than private credit (WSJ)

US regulators urge Congress to look into grocery profits (RT)

German national football team ends 77 years of Adidas sponsorship (FT)

LVMH deputy CEO Antonio Belloni will step down after 23 years (FT)

Target will double employee bonuses this year (BBG)

Medicare to start covering certain weight loss drugs (CNBC)

Trump could make $4.3B if his Truth Social network lists via SPAC (WSJ)

A Message From Mizzen+Main

“I legit love my Mizzen+Main shirts” - Lit, CEO of Litquidity

Spring season means it’s time to consider a wardrobe overhaul, but it's hard to find a shirt that meets all our needs. Don’t stress, Mizzen+Main has your back.

With their Leeward No Tuck Dress Shirt, you can have all the comfort of your favorite homey t-shirt with the style of that dress shirt you can wear to the office every day. This shirt is made from machine washable performance fabric that's quick drying and wrinkle resistant – so you'll never have to worry about looking your best.

Stop sacrificing comfort for style, because you can have both in your Mizzen+Main's Leeward dress shirt. Make sure to use code EXECSUM and take $35 off any order of $125+ today!

Deal Flow

M&A / Investments

Unilever is seeking PE interest for its ice cream unit, which includes Wall’s, Magnum and Ben & Jerry’s; the unit could be worth up to $18.4B (FT)

Paramount Global is unconvinced by an $11B offer from Apollo Global for its Hollywood studio and is negotiating a rival deal with billionaire David Ellison’s Skydance Media (FT)

Investment group Penta Investments is weighing a possible sale of its betting and gaming operator Fortuna Entertainment Group, which could fetch a $2.2B valuation (RT)

$1.4B online betting firm Rush Street Interactive is exploring strategic options including a potential sale (BBG)

Niagara Energy is launching a bid to buy up to the entirety of shares in Enel Generacion Peru, a South American subsidiary of Italian utility Enel; Enel earlier announced a deal to sell the unit for ~$1.4B (RT)

Tech-focused PE firm Francisco Partners will acquire Jama Software for $1.2B (WSJ)

Italian financial services specialist DoValue is in exclusive talks with Elliott to buy its Gardant servicing unit (BBG)

PE firm Apex Capital will acquire bleach maker Clorox’s operations in Argentina, Uruguay and Paraguay (RT)

Siemens will acquire German machine manufacturer ebm-papst's industrial drive technology division (RT)

VC

AI startup Cohere is in advanced talks to raise $500M at a ~$5B valuation (RT)

Expense management startup Coast raised $92M in funding: a $25M equity round led by BoxGroup and Avid Ventures and $67M in debt from Silicon Valley Bank and Triple Point Capital (TC)

Foundry, a startup building a public cloud platform tailored for AI/ML workloads, raised an $80M seed and Series A co-led by Sequoia Capital and Lightspeed (BW)

Greenly, a Paris-based carbon accounting startup, raised a $52M Series B led by Fidelity International Strategic Ventures (TC)

The Browser Company, a startup building an ‘internet computer’, raised a $50M round at a $550M valuation led by Pace Capital (TC)

Loyal, a biotech focused on dog longevity, raised a $45M Series B led by Bain Capital Ventures (BW)

Pandion, a parcel network startup for residential delivery, raised a $41.5M Series B led by Revolution Growth (BW)

Profluent, an AI-first protein design company, raised $35M in funding led by Spark Capital (BW)

Borderless AI, a Canadian AI-powered startup for Employer of Record (EOR) space, raised a $27M seed round led by Susquehanna and Aglaé Ventures (FN)

NX Technologies, a German fintech operating an automotive payment management platform, raised a $24M Series B led by PayPal Ventures (FN)

UK-based bank integration provider AccessPay raised $24M in strategic funding led by True Ventures (FN)

Fuel procurement and management platform Fuel Me raised an $18M Series A led by Pritzker Group Venture Capital and Tribeca Venture Partners (PRN)

Web3 base layer Mystiko.Network raised an $18M seed round led by Peak XV Partners (FN)

Sevco Security, a cloud-native CAASM platform, raised $17M in funding led by SYN Ventures (BW)

Firestorm Labs, an unmanned aerial system manufacturer, raised a $12.5M seed round led by Lockheed Martin Ventures (PRN)

Ediphi, a cloud-based estimating solution for preconstruction, raised a $12M Series A led by Norwest Venture Partners (PRN)

SDLC security startup BlueFlag Security raised an $11.5M seed round led by Maverick Ventures and Ten Eleven Ventures (BW)

Rails, a decentralized crypto exchange, raised a $6.2M round led by Slow Ventures (TC)

Personal finance app Copilot raised a $6M Series A led by Adjacent (TC)

Security data movement startup Tarsal raised a $6M seed round led by Harpoon Ventures and Mango Capital (PRN)

Moondance Labs, the creators of the Tanssi appchain infrastructure protocol, raised a $6M round led by Scytale Digital, KR1, and SNZ (PRN)

EV leasing solution Pelikan Mobility raised a $4.4M seed round from Pale Blue Dot, Seedcamp, and others (TC)

Cleric, an AI platform for managing infrastructure, raised a $4.3M seed round led by Zetta Venture Partners (PRN)

Blockhouse Digital, a crypto asset management firm, raised a $2M seed round led by BlockFills (PRN)

IPO / Direct Listings / Issuances / Block Trades

Abu Dhabi’s largest listed company IHC is looking to list 2PointZero, a holding firm worth more than $27B, by next year (BBG)

Skincare company Galderma Group priced its $2.6B IPO at the top of the marketed range (BBG)

Shares of German perfume retailer Douglas fell 11% in its trading debut after its $923M IPO (BBG)

Reddit shares jumped 48% in their trading debut after its $748M IPO, giving the social media platform a market cap of ~$9.5B (CNBC)

Thai shopping mall owner Siam Piwat is moving closer to Thailand's biggest IPO since 2022, which could raise $500M-$750M (BBG)

Dubai parking operator Parkin jumped as much as 31% in its Dubai debut after its $429M IPO (BBG)

Discount-store chain operator Trial Holdings rose 29% in its Tokyo trading debut after its $258M IPO, Japan’s largest this year (BBG)

LuLu Group International, a Middle East conglomerate operator of hypermarkets and retailers, appointed Abu Dhabi Commercial Bank, Citigroup, Emirates NBD Capital and HSBC for what could be one of the biggest Middle East IPOs this year (BBG)

Technology and consulting services firm Synechron confidentially filed for a US IPO as soon as H1 2024 (RT)

Debt

A group of debt arrangers led by Morgan Stanley kicked off marketing on a $2.8B high-yield bond that will support Stone Point Capital and CD&R’s LBO of Truist Financial’s insurance business (BBG)

Indian conglomerate Shapoorji Pallonji is in talks with lenders including Cerberus and Davidson Kempner to raise as much as $2.4B (BBG)

Bankruptcy / Restructuring

Petersen Health Care, a senior living company that runs nearly 100 facilities in the US Midwest, filed for bankruptcy (BBG)

Fundraising

Goldman Sachs Asset Management raised over $700M for its Union Bridge Partners I FoF to invest in private credit funds and hedge funds (RT)

Frontline Ventures raised $200M across its Frontline Growth and Frontline Seed funds (TC)

OTB Ventures raised a $185M deep tech fund backed by EIF and NATO Innovation Fund (TC)

Crypto Corner

Exec’s Picks

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter