Together with

Good Morning,

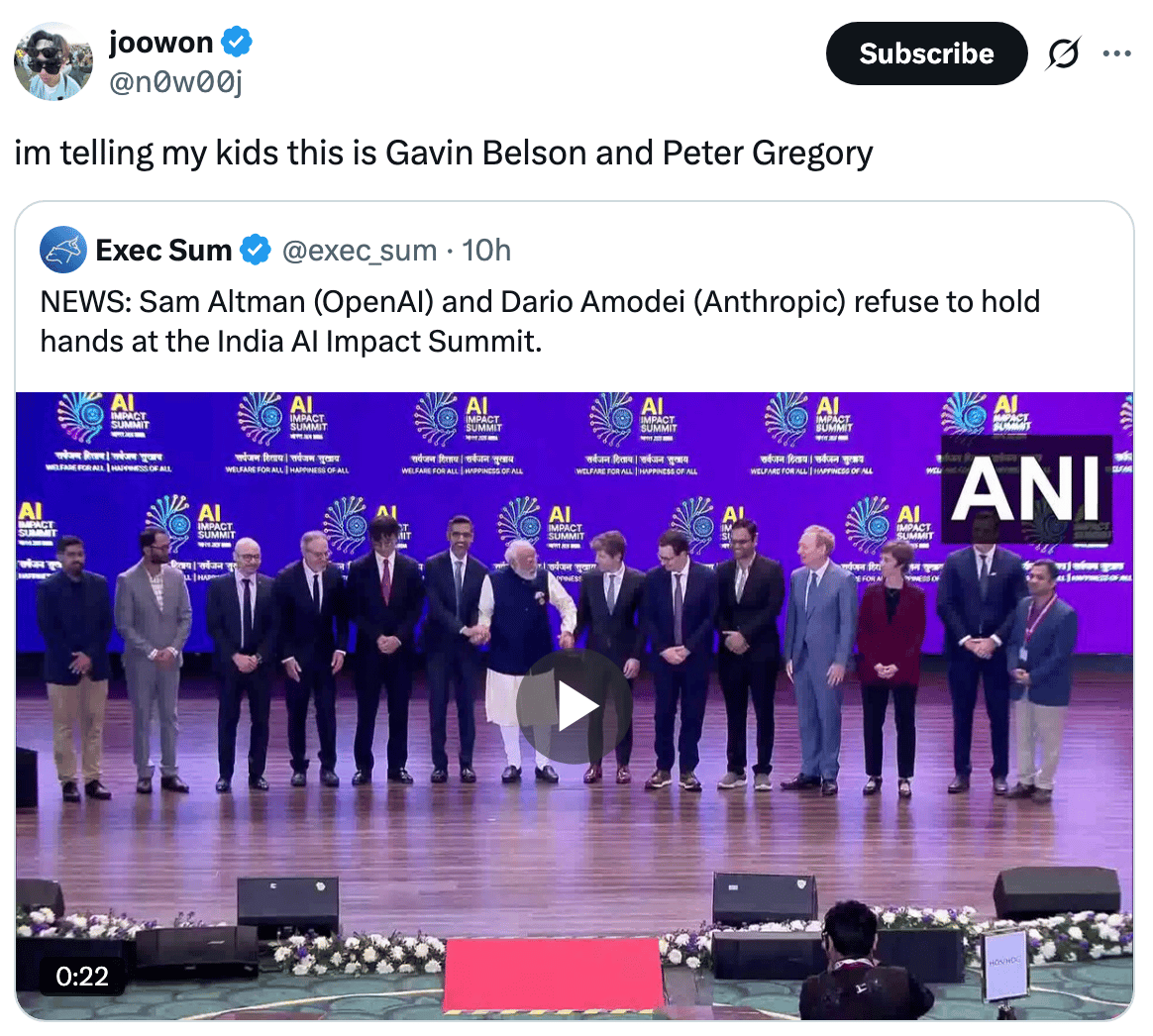

A lawsuit on junior banker work hours is headed to trial, Steve Cohen was the highest-paid hedge fund manager last year, US partnered with tech billionaires to train 'elite' government coders, Blue Owl is getting cooked, and Sam Altman and Dario Amodei refused to join hands at the India AI summit in the most comical sign of AI rivalry.

Imagine owing the IRS $100k in penalties because you tried to save $15k on an accountant. "We hear this story from new clients every week," says Corey from OLarry. Upgrade to white-glove tax advisory for a transparent, flat price and set yourself up for success down the road.

Let's dive in.

Before The Bell

As of 2/19/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks fell yesterday as private credit woes and Iran worries weighed

Earnings

Walmart beat Q4 earnings and revenue estimates as higher-income shoppers boosted gains in e-commerce, online pickup, and delivery; the firm highlighted a normalized price environment after absorbing tariff impacts (CNBC)

Comfort Systems beat Q4 earnings and revenue estimates with net income surging 130% on unprecedented demand in technology and industrial sectors, including hyperscale data centers (BRN)

Opendoor missed Q4 earnings estimates but boasted accelerating acquisition volumes as it attempts to pivot towards higher velocity and lower capital intensity amid a volatile housing market (SI)

John Deere issued a Q4 beat-and-raise on surging demand for small farm tractors and construction and forestry equipment despite tariffs (WSJ)

Klarna beat Q4 revenue estimates but net losses widened on a 59% increase in loan loss provisions (BBG)

Wayfair beat Q4 earnings and revenue estimates with its first annual sales growth since Covid amid a third-straight quarter of new customer growth and healthy growth in repeat orders (CNBC)

Full calendar here

Prediction Markets

Another weekend, another situation to monitor

Trade event contracts on Polymarket, the world's largest prediction market.

Headline Roundup

Centerview lawsuit on IB analyst work hours is headed to trial (FT)

US government recruits tech bosses to train 'elite' government coders (FT)

JPMorgan is in talks to bank for Trump's Board of Peace (FT)

JPMorgan says Trump's $5B suit 'fraudulently' included Jamie Dimon (BBG)

US trade deficit barely moved last year despite tariffs (CNBC)

Japan inflation fell below 2% for the first time in four years (CNBC)

Blue Owl woes expose private credit risks for retail investors (BBG)

Megafund stocks slide on Blue Owl woes (FT)

US convertible bond sales is set for another banner year on AI (BBG)

Foreigners rebuke 'Sell America' with $1.6T US inflows last year (BBG)

Japan stocks saw the biggest foreign inflows since 2014 (BBG)

Foreign investors resume Indian IT stocks selloff on AI scare (BBG)

Large-cap stock pickers beating the market is the highest since 2007 (BBG)

Steve Cohen topped hedge fund ranks with $3.4B pay last year (BBG)

ETFs push at SEC limit in rush to buy private stocks and credit (FT)

Amazon overtook Walmart as the world's biggest company by sales (BBG)

Big Tech giants commit billions of dollars to India at AI summit (RT)

Sam Altman and Dario Amodei refused to join hands at AI summit (CNBC)

Meta cut staff stock awards for a second-straight year (FT)

BofA will offer art consulting to HNWIs as loan demand rises (RT)

Guyana plans 'Norway on steroids' to avoid oil curse (BBG)

Tata scion struggles to consolidate control at India's largest conglomerate (FT)

Morgan Stanley opened accounts for Epstein trusts days before arrest (RT)

Charles Schwab moved $28M in payments for Epstein days before arrest (RT)

Former Prince Andrew was arrested on Epstein ties (BBG)

Sergey Brin-backed group seeks to undercut California billionaire tax (WSJ)

A Message from OLarry

OLarry was built to solve this problem. They provide year-round Private Client services for individuals and businesses with complex taxes, with top talent from the country's best accounting firms.

All for a transparent flat fee, locked in at the beginning of the year.

Go beyond traditional tax filing with:

Unlimited Strategy: Unlimited year round service, whether you want to meet 4 times or 52 times per year

Zero Cross-Selling: Real strategy without the worry about being sold annuities, insurance or other financial products

Proven Track Record: Trusted by thousands of individuals and businesses

Multidisciplinary Advisory: Specializing in K-1s, Multi-State Compliance, Trusts/Estates, and Corporate Entities (S-Corp, C-Corp, Partnerships) and more

"Easily the best and most strategic tax convos I've had." -Raj, CEO

Book a free consultation today and get 10% off with code Execsum.

Deal Flow

M&A / Strategic

Netflix could bump up its $83B offer for Warner Bros. Discovery if competing bidder Paramount Skydance raises its own hostile bid

Johnson & Johnson is preparing a $20B sale of its orthopedics unit DePuy Synthes

Leonardo Maria Del Vecchio, the son of eyewear firm EssilorLuxottica's founder, is considering making an offer to buy stakes worth $16.5B from two siblings

$7.2B-listed Texas pipeline operator Kinetik is weighing a sale after receiving takeover interest from Occidental Petroleum-backed Western Midstream Partners

Management led by CEO Gary Pedersen will buyout commodity trading giant Gunvor from founder/owner Torbjorn Tornqvist at a $5B valuation

Bain Capital is considering a sale or IPO of dessert maker Dessert Holdings at an over $3B valuation

CVC is exploring a $1.2B sale of Mediterranean marina operator D-Marin

Hims & Hers Health agreed to acquire Aussie digital health company Eucalyptus in a $1.15B cash-and-stock deal

Saudi's PIF-owned gaming studio Scopely agreed to acquire a majority stake in Turkish mobile game developer Loom Games for $1B

Ronaldo acquired a 10% stake in Herbalife's health and wellness tracking service HBL Pro2col Software for $7.5M

Froneri, the ice cream JV between Swiss food giant Nestle and French PE firm PAI Partners, is in talks to acquire Nestle's remaining in-house ice cream business

Visa agreed to buy payment platforms Prisma and Newpay from PE firm Advent

Polymarket agreed to acquire prediction market API startup Dome

VC

OpenAI is close to raising over $100B at a $730M pre-money valuation in its latest funding round from Big Tech giants, major VCs, SWFs, and others

Code Metal, a verifiable AI code-translation startup, raised a $125M Series B at a $1.25B valuation led by Salesforce Ventures

Jump, an AI OS for financial advisors, raised an $80M Series B led by Insight Partners

Metal 3D-printing startup Freeform raised a $67M Series B from Apandion, Founders Fund, Two Sigma Ventures, and others

Origen, a UAE AI workflow integration company, raised a $50M strategic investment from Bluefive Capital

UAE digital real-estate platform Stake raised a $31M Series B round led by Emirates NBD

Stacks, a UK AI-driven accounting automation startup, raised a $23M Series A led by Lightspeed

NuCube Energy, a high-temperature micro-reactor startup, raised a $13M funding round led by Arizona Nuclear Ventures

On-device AI startup Mirai raised a $10M seed round led by Uncork Capital

Social music platform Hook raised a $10M Series A led by Khosla Ventures

Rapidata, a Swiss AI data-labeling infrastructure startup, raised an $8.5M seed round led by Canaan Partners

Access the complete VC deal flow on Fundable

IPO / Direct Listings / Issuances / Block Trades

Wall Street brokerage fintech Clear Street withdrew IPO plans to raise $364M due to deteriorating market conditions and valuation concerns

SPAC / SPV

Israeli EV battery company StoreDot canceled its $880M merger with Andretti Acquisition Corp. II

Debt

Gunvor's founder Torbjorn Tornqvist provided an over $4B loan to management led by CEO Gary Pedersen for the $5B MBO of Gunvor

Ares priced a $358M European private credit CLO

A $330M leveraged loan for Consolidated Energy is being marketed at 88¢, the largest discount in over two years

AMD will backstop a $300M loan to cloud computing startup Crusoe to buy and deploy its AI chips

Bankruptcy / Restructuring / Distressed

Global Counsel, the UK advisory firm of Lord Peter Mandelson, is entering administration after a client exodus following Epstein ties

Hedge funds are clashing over Apollo-backed French chemicals maker Kem One's debt, with Apollo-backed Diameter Capital, Sona Asset Management, and Polus Capital shorting bonds, while other lenders Arini and Monarch extend financing amid the sector's worst crisis in 30 years

Funds / Secondaries

Bank of America is committing $25B to private credit deals in a new private credit initiative

Hall of Fame QB Steve Young's PE firm HGGC raised $3.2B for its fifth fund

$3B AUM macro hedge fund Deem Global is closing to new cash

Dylan Patel's chip and infrastructure research firm SemiAnalysis is considering raising hundreds of millions for a VC fund

Crypto Sum Snapshot

CME is moving closer to 24/7 crypto derivatives trading

Trump Jr. calls banking a 'Ponzi scheme' that forced family to create crypto business

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Barry Ritholtz wrote an incredible piece on the fundamental illusion of stock-picking based on publicly available data.

Also, Ben Carlson sees people finally waking up to international stock outperformance.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.