Together with

Good Morning,

Musk is considering raising $3B to help pay his Twitter debt, Tesla beat estimates on best-ever revenue, Bank of Canada is done hiking rates, UK's competition regulator is investigating Broadcom's purchase of VMware, Chevron announced a $75B buyback program, Credit Suisse dismissed most of its Mexico-based bankers, Trump has been reinstated by Facebook / Instagram, and Hindenburg Research dropped another bombshell short report.

Nobody Studios is a dynamic venture studio that has created 100 companies in the last five years, and you can invest in them today through their fundraise on Republic.

Let's dive in.

Before The Bell

If you want to learn more about crypto trading strategies and the world of DeFi, check out our Foot Guns newsletter.

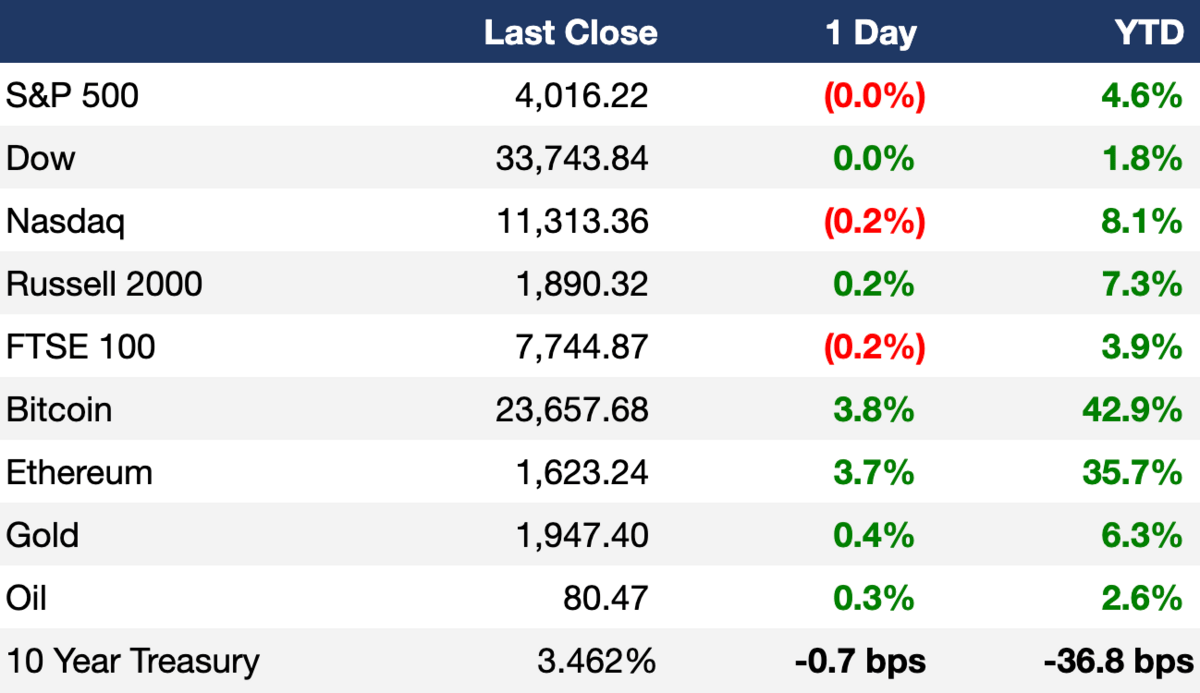

Markets

All three major US indexes rebounded after morning losses to close flat yesterday as investors continue to digest major earnings and await crucial economic data today

The Dow finished green for a fourth straight day

US natural gas futures fell below $3 for the first time since May 2021, amid mild winter weather

Earnings

Tesla beat Q4 analyst estimates on their best-ever quarterly revenue, but warned for the need to cut prices amid growing EV competition; their stock rose 5.5% AH (CNBC)

Raymond James missed on Q1 revenue but beat EPS estimates on record quarterly earnings due to higher interest rates which more than offset their decline in capital markets; their stock is less than 5% off all-time highs (YH)

AT&T posted a large Q4 loss driven by a $25B charge on landlines but posted better-than-expected subscriber growth causing their shares to rise 6.6% (WSJ)

What we're watching this week:

Today: Blackstone, Intel, Visa, Southwest Airlines

Full calendar here

Headline Roundup

Bank of Canada raised rates by 25 bps to 4.5% and signaled end of rate hikes (RT)

SEC plans to ban ABS traders from betting against assets they sell to investors (RT)

60k tech workers have been laid off this year, on top of the 160k last year (LYF)

UK's competition regulator started the first phase of an investigation into US chipmaker Broadcom’s $61B purchase of cloud-computing firm VMware (RT)

Surge in small business hiring is complicating Fed’s fight against inflation (WSJ)

Pandemic surge in entrepreneurship is still going strong (AX)

Germany expects its economy to grow 0.2% this year (WSJ)

Chevron announced a $75B stock buyback program and a dividend hike (CNBC)

Ad spending on Twitter dropped by 71% in December (RT)

Hindenburg Research released a short report aimed at Adani Group (led by Asia's richest man), causing a $12B loss in market capitalization (BBG)

Bank of America will give stock awards to 96% of employees (RT)

BNP Paribas vowed to slash oil lending by 80% by 2030 (RT)

World's largest container shippers Maersk and MSC will end their alliance in 2025 (RT)

BNP Paribas Frankfurt office was searched in cum-ex probe (RT)

Natural disasters caused economic losses of $313B in 2022 (RT)

Credit Suisse dismissed most of its Mexico-based bankers as part of global IBD shrink (BBG)

A manual error triggered yesterday's NYSE trading glitch (RT)

Facebook and Instagram will reinstate Donald Trump's accounts after two-year ban (CNBC)

A Message From Nobody Studios

Nobody Studios - Invest once. Own 100 companies.

We achieved a 15x valuation, and we expect the same increase over the next 24 months.

Meet Nobody Studios.

Company creation and ownership needs an overhaul. As technology rapidly innovates, so must the way in which companies are built, funded, and operated.

Too many people miss out, get marginalized or struggle to have the opportunity to contribute to the companies that will shape our future.

Capital is either hard to come by, or startups are overfunded without any proven product in the market.

Nobody Studios is building 100 companies in 5 years alongside top execs from Amazon, Facebook, Google, Stripe, Coca-Cola and more.

Join our crowdfund for a minimum of $100, and become part of a community of business leaders turning ideas into profitable companies!

Deal Flow

M&A / Investments

State-owned QatarEnergy in talks to acquire a 30% stake in TotalEnergies' $27B Iraqi energy projects (RT)

PE firm Apollo Global Management and Sprint exec Marcelo Claure are in talks with LatAm telecoms company Millicom International Cellular about a takeover that could fetch a $10B valuation, including debt (FT)

Manufacturer Emerson Electric’s $7B offer for measurement systems maker National Instrument has been backed by its co-founder (BBG)

Commercial property owner CoStar is in talks to buy media and publishing company News Corp’s online real estate business Move in a potential ~$3B deal (BBG)

Pharmacy chain Walgreens Boots Alliance is weighing a sale of its pharmacy automation business iA which could fetch up to $2B (BBG)

Tobacco giants Philip Morris International, Japan Tobacco Group and Altria Group are in early talks with e-cigarette maker Juul Labs over a potential acquisition; Altria valued Juul at $1B in October (WSJ)

US investment firm MSP Sports Capital is considering a potential investment in England's Everton Football Club (BBG)

Singapore-based gaming and e-commerce company Sea is considering a sale of Vancouver-based indie developer Phoenix Labs (BBG)

VC

Digital-first health insurance provider Angle Health raised a $58M Series A led by Portage (PRN)

Software development platform Crowdbotics raised a $40M Series B led by NEA (TC)

Miach Orthopaedics, a company developing a bio-engineered implant for ACL repair, raised $40M: $10M in venture debt from SVB and a $30M Series B led by Sectoral Asset Management and Endeavor Vision (BW)

Cloud-native 911 mapping and analytics platform RapidDeploy raised $34M in funding led by Edison Partners (PRN)

RNA drug discovery startup Atomic AI raised a $35M Series A led by Playground Global (BW)

Identity orchestration platform Strata raised a $26M Series B led by Telstra Ventures (TC)

Healthcare financing solutions startup Health Payment Systems raised $25M in funding led by SVB Capital (PRN)

AtomicJar, the company behind the popular open source library Testcontainers, raised a $25M Series A led by Insight Partners (BW)

Corporate VR training platform Gemba raised an $18M Series A led by Parkway Venture Capital (TC)

Japanese drone startup Terra Drone raised a $14M Series C from Wa’ed Ventures (TC)

EV charging management platform Ampeco raised a $13M Series A led by BMW iVentures (TC)

Myosana Therapeutics, a company developing a muscle-specific gene therapy platform, raised a $5M+ seed round led by John Ballantyne, PhD (BW)

Caura, an all-in-one app for drivers to manager their administrative rigmarole, received a £4M ($5M) strategic investment from Lloyds Banking Group (BBG)

Dubai-based accounting and financial compliance startup Wafeq raised a $3M seed round led by Raed Ventures (TC)

Iaso Therapeutics, a Michigan State University startup developing novel technologies for next-generation vaccines, raised a $1.25M seed round from the Michigan Rise Pre-Seed III Fund, Red Cedar Ventures Pre-Seed Fund, and Michigan-based angel investors (PRN)

IPO / Direct Listings / Issuances / Block Trades

Elon Musk is exploring raising $3B in equity to pay off part of the $13B in debt tacked onto Twitter for his buyout of the company; Musk denied this in a tweet however (WSJ)

Middle Eastern investors including International Holding Co. and Abu Dhabi Investment Authority are bidding to buy stock in the $2.5B follow-on share sale floated by Indian conglomerate Adani Enterprises (BBG)

Italian gaming company Lottomatica picked UniCredit, Goldman Sachs, Barclays, Deutsche Bank, JPMorgan and Credit Suisse for a potential Q2 IPO which could raise over $1.1B (RT)

Japan's Hitachi Transport System will issue $975M worth of single preferred share to majority shareholder KKR (RT)

SPAC

Freight-booking platform Freightos will go public today via a merger with Gesher I Acquisition Corp in a $500M deal (BBG)

Debt

Music and entertainment investment firm HarbourView Equity Partners raised a $200M senior-secured credit facility to buy music royalty assets and general corporate purposes; Fifth Third Bancorp was the lead arranger of the facility (BBG)

Bankruptcy / Restructuring

Brazilian retailer Americanas owes creditors ~$8B (RT)

Fundraising

Sky Leasing, an alternative asset manager focused on providing capital solutions to airlines seeking fleet modernization, raised a $770M fifth fund (PRN)

Asset manager Schroders won a mandate to invest $620M of Welsh pension fund cash into private companies (FT)

VC firm Dimension raised $350M for their oversubscribed first fund to invest in firms at the intersection of life and computer sciences (FRB)

Berlin-based PE firm FLEX Capital raised a $327M second fund to roll up medium-sized German-speaking tech companies (TC)

Sapphire Sport, an early-stage investment platform at the intersection of tech, sport, media and entertainment, raised an oversubscribed $181M second fund to focus on Seed to Series B companies (PRN)

Injective, a decentralized smart contracts platform designed for building finance applications, launched a $150M ecosystem fund with support from Pantera Capital, Kraken Ventures, Jump Crypto, and more (PRN)

Pender Ventures raised $37M for its ~$75M second VC fund (BTK)

Crypto Corner

Mistakenly uploaded documents revealed a $1.2B relationship between BlockFi and SBF's FTX and Alameda Research (CNBC)

Crypto asset manager Grayscale Investments is taking SEC to court over SEC's decision to reject their spot bitcoin ETF proposal (CD)

Coinbase trading volume increased this month while other exchanges' declined (CD)

Tesla did not buy or sell any Bitcoin in Q4 (BW)

Crypto options exchange Deribit plans to move to Dubai (CD)

Crypto miners are firing up their machines as prices rally (FT)

Ireland's central bank chief called for a ban on crypto advertising (RT)

South Korean prosecutors are seeking the arrest of Kang Jong-Hyun, the owner of crypto exchange Bithumb (CD)

Exec's Picks

Eight Sleep is a high-tech smart bed system that has taken Silicon Valley by storm. With a built-in heating and cooling system, multiple foam layers to deliver comfort, and analytics tracking to help you optimize your sleep and recovery, Eight Sleep is the complete package. Upgrade your mattress game here, and use code "LIT" at checkout for a great discount!

Trapital founder Dan Runcie gave a great breakdown of Justin Bieber's music rights sale to Hipgnosis here.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.