Together with

Good Morning,

Elon Musk merged SpaceX with xAI, which he previously merged with X. The combined entity is valued at $1.25T. Talk about 'strategic' M&A.

Upgrade your dealmaking and investment workflows with Blueflame AI, the only AI solution for dealmakers that integrates directly with VDRs. Learn more below.

Let's dive in.

Before The Bell

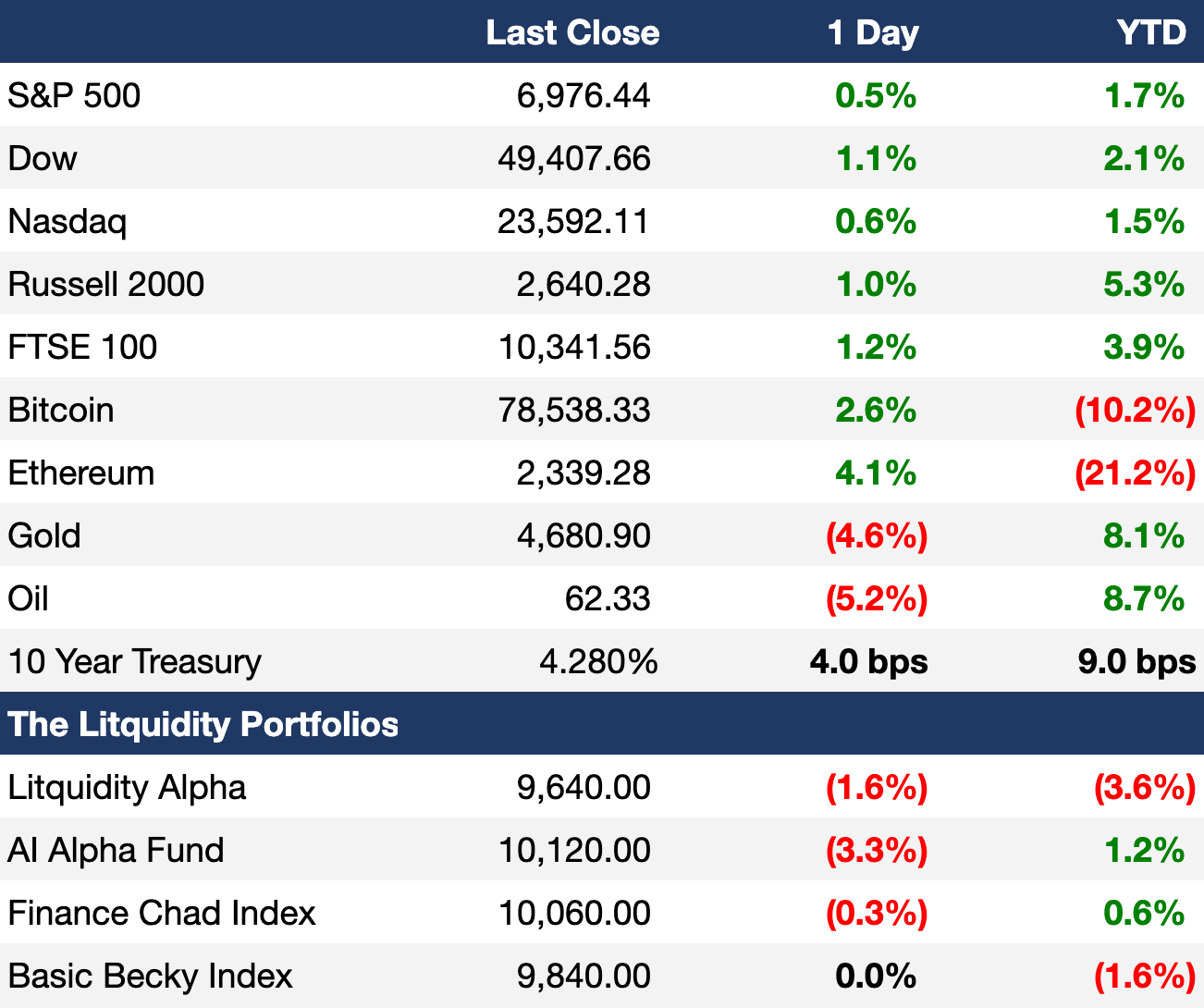

As of 2/2/2026 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rallied yesterday on solid economic data

S&P is inches away from an ATH

Europe's Stoxx 600 hit an ATH

UK's FTSE 100 hit an ATH

Korea's KOSPI index tumbled 5.3%

Australia 10Y yield is teasing 5% as traders price in a 70% chance of a 25 bps rate hike

India 10Y yield rose to 6.8% to a one-year high on a record deficit plans

Gold volatility topped Bitcoin and hit its highest level since 2008

Earnings

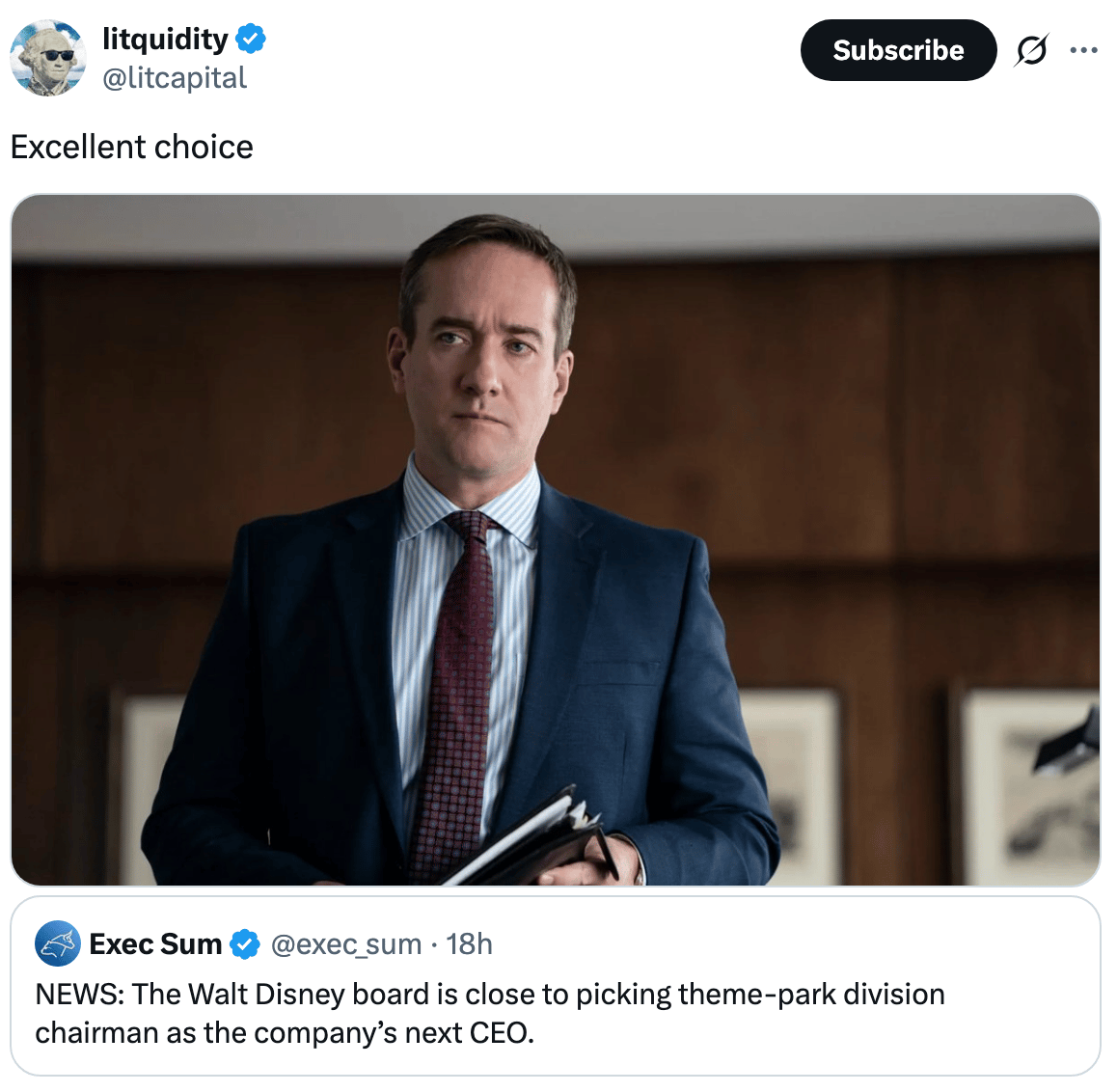

Walt Disney beat Q4 earnings and revenue estimates driven by strength in theme parks and streaming, but issued a tepid outlook as it prepares to name a new CEO (CNBC)

Palantir posted record Q4 earnings and revenue on strong demand for its AI platform from government and commercial customers (WSJ)

What we're watching this week:

Today: AMD, Supermicro, PepsiCo, PayPal, Chipotle, Merck

Wednesday: Alphabet, UBS, Uber, Eli Lilly, Novo Nordisk

Thursday: Amazon, Shell, Reddit, Roblox

Friday: Toyota

Full calendar here

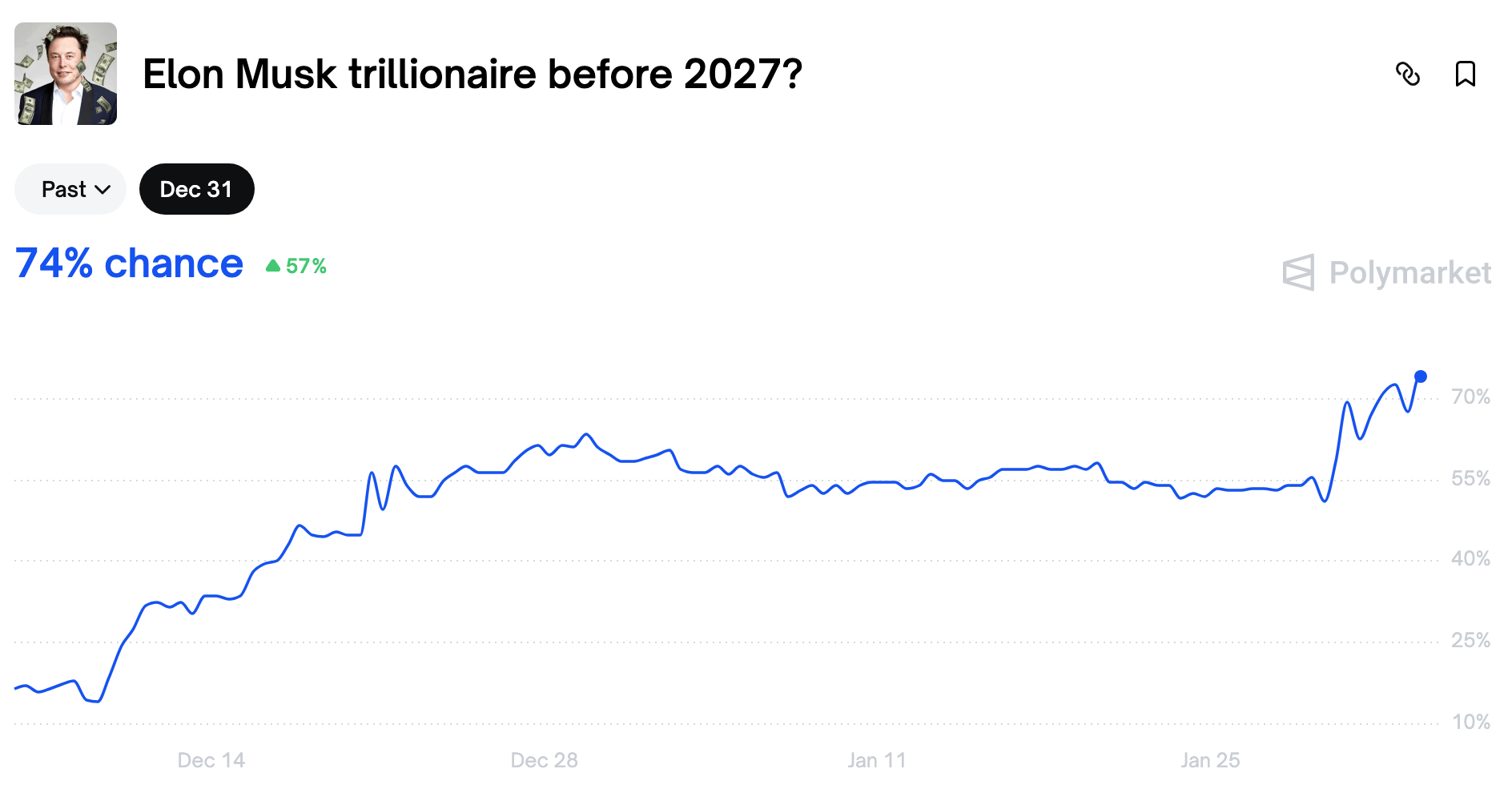

Prediction Markets

SpaceX take-private of Tesla at a 30% premium should get the job done.

Track and trade live odds on Polymarket.

Headline Roundup

Treasury secretary and new Fed chair are both Druckenmiller mentees (WSJ)

US manufacturing grew for the first time in a year (RT)

Record-high margin levels in Asia help explain selling intensity (BBG)

Commodities slump rattles global markets (RT)

EM stocks rally appears intact after buoyant January inflows (RT)

Private credit-linked shares dropped on software exposure concerns (BBG)

US cut tariffs on India to 18% after Russian oil agreement (RT)

US Treasury trimmed Q1 borrowing outlook (RT)

US banks expect stronger loan demand in 2026 (RT)

US will launch a $12B strategic rare earths stockpile (WSJ)

EU is struggling to diversify its rare earths supply (FT)

Global bond sales hit $1T at the fastest pace ever (BBG)

Hedge funds significantly cut North America exposure in past year (RT)

Foreign investors bought US credit at the fastest pace in three years (BBG)

CAT bond sales surged to record highs last year (CNBC)

India weighs 49% foreign limit in state banks to fund growth (BBG)

Two Blackstone RX veterans launched new advisory Ensis Partners (BBG)

OpenAI is unsatisfied with Nvidia chips and looking for alternatives (RT)

Japan PM Takaichi must face bond investors before winning over voters (RT)

A Message from Blueflame

Introducing virtual data rooms in Blueflame AI – AI-powered deal intelligence, built directly on your data room.

Together, Blueflame AI and Datasite are transforming data rooms into living sources of intelligence.

With a secure, real-time integration to Datasite, VDR content flows directly into Blueflame AI, making diligence materials continuously available for AI analysis. The result is faster diligence, ongoing monitoring, and AI-driven insight—without manual document handling.

As the only AI solution for dealmakers that integrates directly with virtual data rooms, Blueflame AI introduces a new standard for diligence. Instead of working file by file, Blueflame's agentic AI reasons across the full data room – connecting information, tracking change, and supporting higher-confidence decisions as deals evolve.

All without rebuilding context for every deal.

This is AI designed for how investment actually professionals work: continuously, across complex information, and with decisions on the line.

Deal Flow

M&A / Strategic

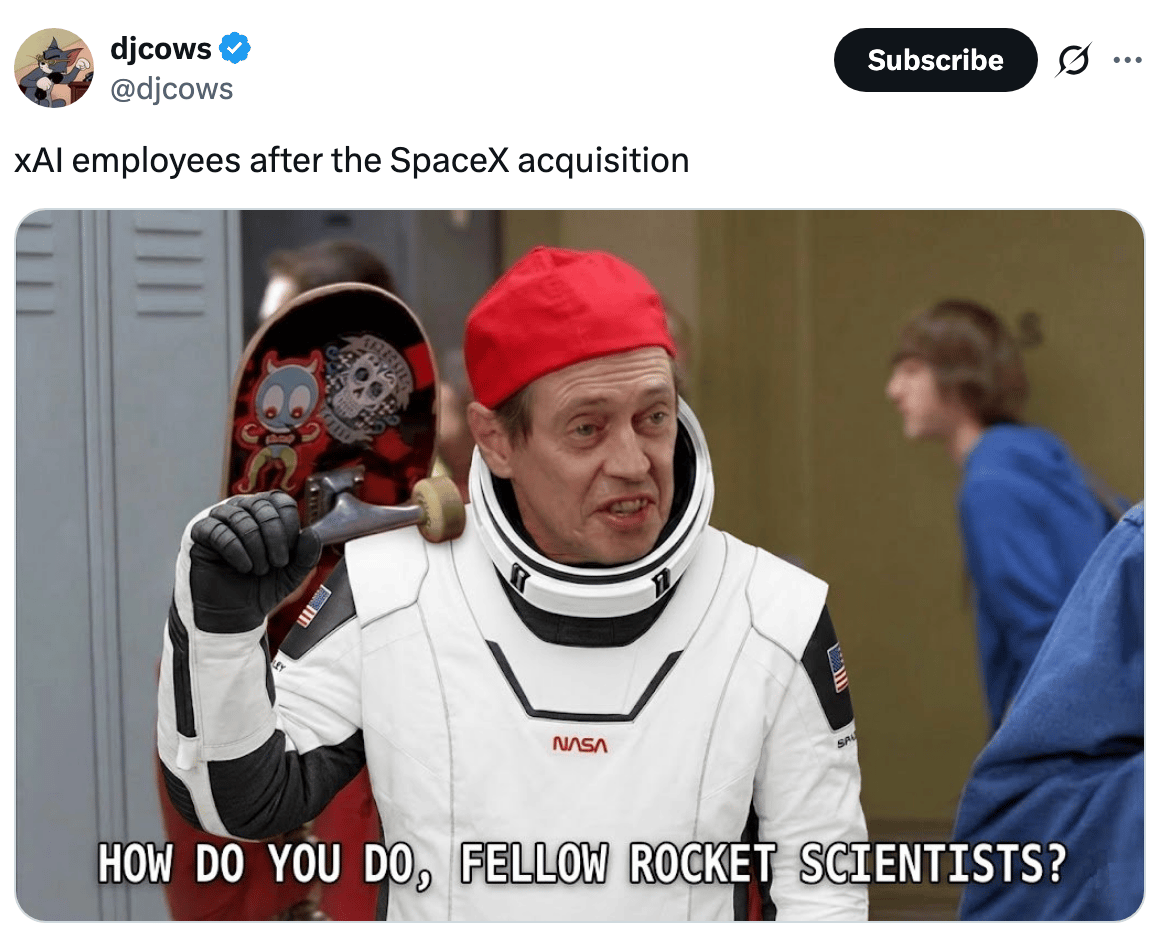

Musk's SpaceX acquired Musk's AI and social media firm xAI to form a combined $1.25T entity

Mining giant Glencore is set to hire Citigroup as its lead investment bank on its potential $200B merger with rival Rio Tinto

Devon Energy agreed to acquire rival shale driller Coterra Energy in a $21.4B all-stock deal to form a $58B entity

Activist hedge fund Elliott is maintaining opposition to Toyota Group's $35B+ buyout bid for Toyota Industries

Investment firm Architect Capital is in advanced talks to acquire a 60% stake in creator platform OnlyFans at a $5.5B valuation, including debt

Gold miner Eldorado agreed to buy copper-focused Foran Mining in a $2.8B cash-and-stock deal

Apollo agreed to acquire a minority stake in Canada's largest fitness club operator The GoodLife at a $1.46B valuation

Welding gear maker ESAB agreed to acquire Canadian testing equipment maker Eddyfi for $1.45B

Ares will lead a $120M equity investment in Italian airport investor Finint's syndicate meant to back Finint and French PE firm Ardian's $1.42B purchase of Italian airport owner Milione

Brookfield agreed to acquire industrial REIT Peakstone Realty Trust in a $1.2B all-cash deal

Investment group Donerail offered to acquire super-yacht service company MarineMax in a $1B cash deal

Two major shareholders in Canada's GDI Integrated Facility Services plan to reject a $650M take-private bid from Birch Hill Equity Partners

New Jersey-based lenders Columbia and Northfield agreed to merge in $597M deal

Zurich Insurance Group disclosed a 1.5% stake worth $144M in UK insurer Beazley two weeks after the firm rejected their $10.3B takeover

VC

Space-connectivity company CesiumAstro raised a $470M Series C led by Trousdale Ventures

Digital consumer bank Varo Bank, a, raised a $124M Series G co-led by Warburg Pincus and Coliseum Capital Management

IT services and AI automation platform Shield raised a $100M equity investment from Thrive Holdings

Fieldguide, an AI-native audit and advisory platform, raised a $75M Series C led by Goldman Sachs Alternatives

Spanish AI clinical-trial platform Biorce raised a $52M Series A led by DST Global Partners

GrubMarket, an AI-powered food-supply-chain platform, raised a ~$50M Series H from Future Food Fund, Portfolia Funds, and others

Additive Drives, a European maker of high-performance 3D-printed electric motors, raised a $30M round led by Nordic Alpha Partners

Messaging-infrastructure startup Linq raised a $20M Series A round led by TQ Ventures

Used-EV marketplace Plug raised a $20M Series A round led by Lightspeed

Bits Technology, a Swedish compliance infrastructure startup for fintechs, raised a $14M Series A round led by Alstin Capital

Restaurant back-office automation startup Loop AI raised a $14 M Series A led by Nyca Partners

Incard, a UK financial OS for digital businesses, raised a $14M Series A led by Smartfin

Arbor, an AI operational-intelligence startup, raised a $6.3M seed round led by 645 Ventures

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

Oracle plans to raise $45B-$50B in equity and debt this year to fund its AI infrastructure ambitions

Abu Dhabi's Emirates Global Aluminum began investor meetings for an IPO that could fetch a $10B-$15B valuation

SWF Temasek, Life Insurance Corporation of India, State Bank of India, and and SBI Capital Markets are set to offload shares in National Stock Exchange of India's $2.5B IPO

Chinese energy and sports drink maker Eastoc raised $1.3B at a $22B valuation in its Hong Kong IPO

Debt

Oracle saw a record $129B of orders for a $25B bond sale

Abu Dhabi's $1T SWF ADIA is seeking a $2.6B loan backed by four Australian infrastructure assets

German healthcare software firm Dedalus paused a $1.5B leveraged loan deal

Argentina bought $808M in drawing rights from US to pay the IMF

Poland plans to raise bonds in Japan for the first time in two years

Kazakh tech conglomerate Freedom Holdings is weighing a dollar and yuan bond sale or a $300M to $500M bond sale to US investors

European software firm Team.Blue paused a leveraged loan deal

Bankruptcy / Restructuring / Distressed

Bondholders are preparing to sue Ethiopia over its $1B debt default

Brazilian asset manager Fictor filed for bankruptcy to restructure $760M of debt, less than three months after its failed bid for failed lender Banco Master

Oil field vendor Nine Energy Service filed for Chapter 11 bankruptcy to cut $320M in debt amid a drilling slowdown

CD&R-backed label design and printing business Multi-Color won court approval for a $250M DIP loan, defeating a competing proposal from rival lenders

Kenya cut debt costs by $167M after restructuring dollar loans into yuan, paying ~$290M on a semi-annual railway installment to China

UK FX broker Argentex's customers face 98% losses after administrators disclaimed thousands of FX derivatives trades that contributed to the firm's July collapse

Funds / Secondaries

Qatar's $600B SWF QIA plans to invest in Greycroft, Ion Pacific, Liberty City Ventures, Shorooq, and Speedinvest as part of its expanded $3B VC FOF program

Investment firm Hamilton Lane raised ~$2B for its second infrastructure opportunities fund

Australian VC Square Peg Capital raised $650M across its sixth fund and third opportunities fund

PIF and Mubadala-backed private credit firm Ruya Partners is seeking to raise $400M for one of the Mideast's largest private credit funds

Biotech VC Santé Ventures raised $330M for its fifth fund

Crypto Sum Snapshot

Crypto market volatility triggered $2.6B in Bitcoin liquidations

Crypto exchanges buckle as stock losses mount amid exodus

Stablecoin yield deadlock persists in White House crypto talks

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Netflix and Intel have become some of the first companies to comply with new accounting rules requiring more details about their corporate tax payments. WSJ summarized some findings here.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

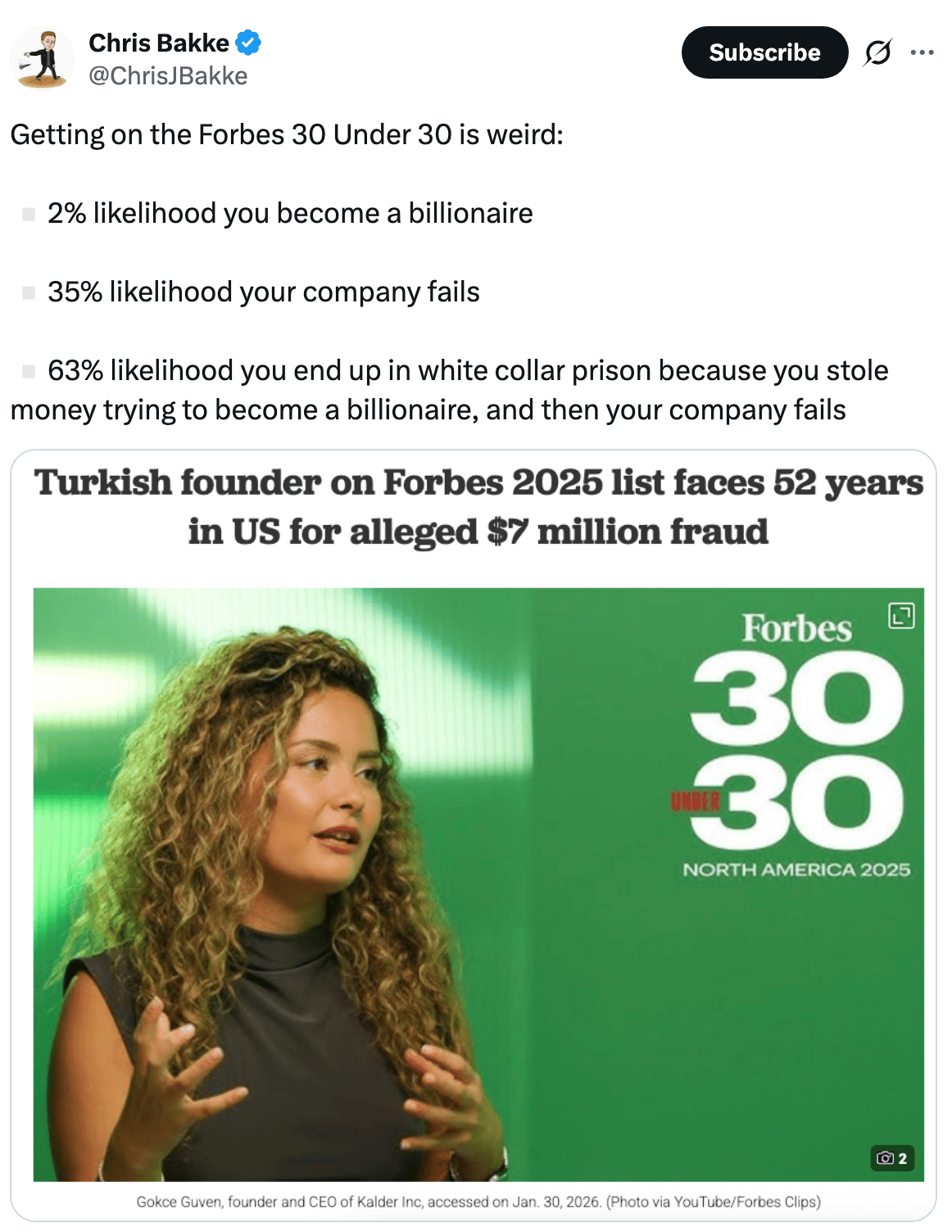

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.