Together with

Good Morning,

The Fed paused rate cuts, OpenAI accused DeepSeek of IP theft, activists outed CEOs in record number last year, and KKR is establishing itself as a white knight for companies under activist pressure.

Take your career to the next step in 2025! Level up your PE skills in Wharton Online–Wall Street Prep's globally acclaimed Private Equity Certificate Program. Save $300 with our Litquidity discount!

Let's dive in.

Before The Bell

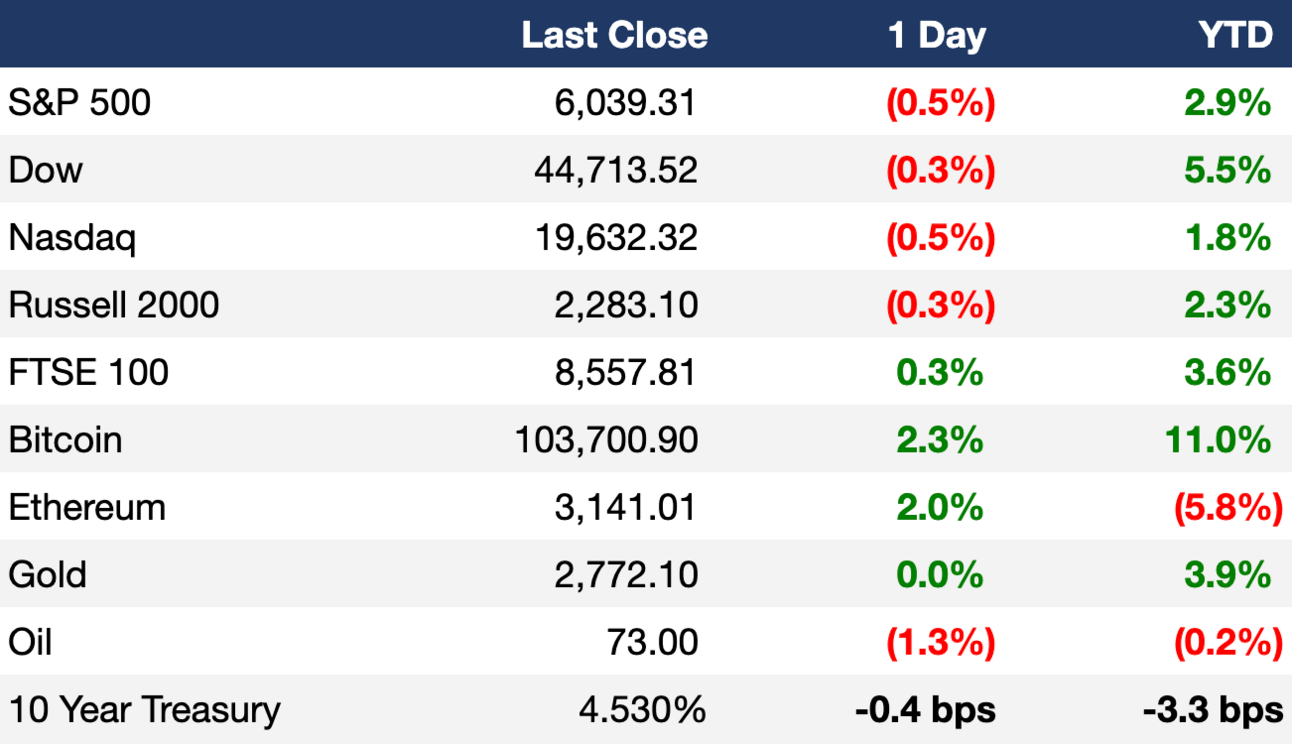

As of 1/29/2025 market close.

Markets

US stocks fell as investors digested the Fed's decision to keep rates unchanged

Europe's Stoxx 600 hit a new ATH

Earnings

Tesla missed Q4 earnings and revenue estimates as automotive revenue fell 8% YoY (CNBC)

Meta beat Q4 earnings and revenue estimates as AI improvements to its ads business drove record revenue (WSJ)

Microsoft beat Q2 earnings and revenue estimates but reported lower-than-expected growth in its Azure cloud unit; its AI business grew to $13B in annualized revenue (CNBC)

ASML beat Q4 earnings estimates thanks to a strong jump in net bookings, suggesting strong demand for its AI chip making tools (CNBC)

IBM surged 9% after beating Q4 earnings estimates thanks to growth in its software segment (CNBC)

T-Mobile jumped 6% after beating Q4 earnings and subscriber growth estimates and forecasting strong subscriber additions for 2025 (BBG)

What we're watching this week:

Today: Apple, Intel, Visa, UPS, Mastercard, Blackstone, Southwest

Friday: Brookfield, ExxonMobil, Chevron

Full calendar here

Prediction Markets

Super Bowl ads hit a record $8M for this year but we're yet to see who's about to feature.

Headline Roundup

Fed held rates at 4.25%-4.5%, sees no hurry to cut again (CNBC)

BoC cut rates by 25 bps to 3% (RT)

Bond traders kept in limbo after Fed offers few clues (BBG)

Fed entering tough period for measuring money market liquidity (RT)

Stock hedge funds posted big one-day drop in DeepSeek rout (RT)

Credit skeptics are short $10B on high-yield corporate bond ETFs (BBG)

Tokyo stock exchange looks to protect small investors as LBOs surge (FT)

Global CEO departures hit record high in 2024 amid investor pressure (RT)

India's IPO boom is defying stock market's slump (BBG)

KPMG UK partners made record pay last year (FT)

Gold stockpiling in New York leads to London shortage (FT)

Norway's SWF posts record $222B profit but warns tech boom won't last (RT)

Global firms' office leasing in India hit a record high (BBG)

Europe office dealmaking hit a record low (BBG)

Barclays tightened WFH rules (FT)

Alberta targets $173B fund to wean itself off oil revenue (BBG)

Surge in European power trading is set to continue (BBG)

Coffee's 94% rally finally hits the last holdouts for demand (BBG)

OpenAI has evidence that its models helped train China's DeepSeek (TV)

Meta will pay $25M to settle Trump ban lawsuit (WSJ)

Theft leaves UK retailers with a record $2.7B in losses (BBG)

A Message from Wall Street Prep

Don't miss the chance to transform your finance career with Wharton Online

Time is running out to join the Private Equity Certificate Program from Wharton Online and Wall Street Prep. This certificate program offers a comprehensive 8-week online journey, designed for those looking to upskill their PE knowledge or those aspiring to break into the industry.

Learn technical skills from Wall Street’s best instructors and gain insights from top executives like David Rubenstein, Co-founder of The Carlyle Group, and Martin Brand, Sr. Managing Director at Blackstone.

Additional benefits when enrolling include:

Exclusive networking and recruitment events

Invitation to closing ceremony in NYC

Certificate issued by Wharton Online and Wall Street Prep

The last day to enroll in the program is February 10th. Use coupon code LITQUIDITY to save $300 off tuition and secure your spot today.

Deal Flow

M&A / Investments

A group of American investors including YouTuber MrBeast, Roblox founder David Baszucki, and Anchorage Digital founder Nathan McCauley secured over $20B to bid for TikTok

Telecoms infrastructure firm Zayo Group is in talks to acquire Crown Castle's fiber business for over $8B

Shareholders of Australia's Sigma Healthcare approved a merger with Chemist Warehouse to create a $5.5B pharmacy and retailing giant

Japanese technology group NEC is considering a bid for $1.7B-listed telecom customer care and billing solutions provider CSG Systems

American Axle & Manufacturing agreed to acquire UK car parts group Dowlais for $1.4B in cash and stock

Warner Bros. Discovery received at least three bids, including from broadcaster MFE-MediaForEurope and Polish businessman Michal Solowow, for $1B Polish broadcaster TVN

Goldman Sachs' alternative investments unit agreed to acquire a $300M portfolio of warehouses from Blackstone

Spanish telecoms giant Telefonica is exploring a sale of its Argentina business

VC

OpenAI is in talks raise up to $25B from SoftBank

Turkish mobile game developer Dream Games is seeking to raise $2.5B in private credit and equity to buyout existing investors and double its valuation

Castelion, a defense manufacturer producing long range hypersonic strike weapons, raised a $100M Series A led by Lightspeed Venture Partners

Grid-enhancing tech and services provider Smart Wires raised $65M in funding led by BP Energy Partners

Freedx, a newly-launched crypto exchange, raised a $50M round

Application detection and response platform Oligo Security raised a $50M Series B led by Greenfield Partners

Finout, a cloud cost management service, raised a $40M Series C led by Insight Partners

D3, a DomainFi infrastructure company, raised a $25M Series A led by Paradigm

Conifers.ai, a native cybersecurity AI platform helping organizations solve security operations center challenges, raised $25M in funding from SYN Ventures, Picus Capital, and others

Weather forecasting startup Meteomatics raised a $22M Series C led by Armira Growth

Formance, a French startup building an open-source, programmable financial ledger, raised a $21M Series A co-led by PayPal Ventures and Portage

Concierge-style corporate event booking platform Naboo raised a $21M Series A led by Notion Capital

iPronics, a Spanish optical networking engine for AI data centers, raised a $20.8M Series A led by Triatomic Capital

OneVest, a wealth management tech platform, raised a $20M Series B led by Salesforce Ventures

Delfina Care, a healthcare technology company, raised a $17M Series A led by USVP

Crypto accounting platform Cryptio raised a $15M Series A extension led by Alven

DarwinCX, a SaaS provider enhancing the customer experience for publishers and subscription-based businesses, raised $12M in additional funding from First Ascent Ventures, New Era Capital Partners, and others

Climate data startup OCELL raised a $10.4M Series A led by Capnamic

Canvas, a 3D measurement and modeling solutions for real estate, raised a $10M Series A led by Trilogy Equity Partners and Foundry Group

Mexican virtual power plant startup Niko raised an $8M equity round led by QED Investors

Tradeverifyd, an intelligence platform for supply chain risk management, raised an $8M Series A led by Silicon Road VC and Bread & Butter Ventures

Waterlily, a startup using AI to guide families through long-term care, raised a $7M seed round led by Brewer Lane Ventures

Rynse, a fleet management software provider, raised a $5M seed round led by Autotech Ventures

IPO / Direct Listings / Issuances / Block Trades

KKR took a 12% strategic stake in $10B-listed medical products distributor Henry Schein

India's Adani Power plans to raise $580M in a share sale

Activist Third Point took a 10% stake in SoHo House to fight against a buyout proposal

Activist HG Vora launched a proxy fight at Penn Entertainment after cutting its stake below 5%

Hedge fund D.E. Shaw built a stake in Bitcoin miner Riot Platforms and may pursue an activist role

Debt

Citigroup is marketing $390M in rare exchangeable bonds linked to Airbus shares

Film producer 3 Arts Entertainment is seeking to raise $250M in debt or equity

Bankruptcy / Restructuring / Distressed

Ghana is in talks to restructure $2.7B of commercial loans

Bankrupt Spirit Airlines rejected a $2.2B takeover offer from peer Frontier, calling the offer 'inadequate and unactionable'

Bankrupt Swedish EV battery maker Northvolt agreed to sell its stake in its Volvo battery JV Novo Energy to Volvo

Fundraising

Blackstone raised $8.5B for its first PE fund targeting individuals

Palantir founder Joe Lonsdale's 8VC is seeking $1B for its sixth fund

Jun Bei Liu will launch her new Australia L/S hedge fund Ten Cap with $940M

Biotech accelerator Curie.Bio raised $340M for a new seed fund

Crypto Sum Snapshot

Czech National Bank governor is weighing a Bitcoin reserve

Trump Media surged after expanding into crypto and ETFs

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Invest in the backbone of the digital economy fueling Bitcoin, AI and global data centers. Chicago Atlantic Digital Mining Fund offers 29.8%1 historical annualized distributions, monthly cash flows, and leverages appreciating energy infrastructure in a power-starved market – Invest now to lock in 2025's 40% bonus depreciation.

1As of 12/31/24.

Jack Raines wrote a great piece on the late-20-something's professional dilemma.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.