Together with

Good Morning,

Amazon employees will be able to use company stock as collateral for mortgages, BAC expects the Fed to raise rates to 6%, Mastercard paused its crypto push, UK grocery inflation hit 17%, Bain Capital Ventures raised $1.9B for new funds (#proudscout), and Japanese banks are bumping up salaries for new college grads.

If you're looking for a great book about investing written by a legendary financier, check out David Rubenstein's latest book: How To Invest.

Let's dive in.

Before The Bell

Markets

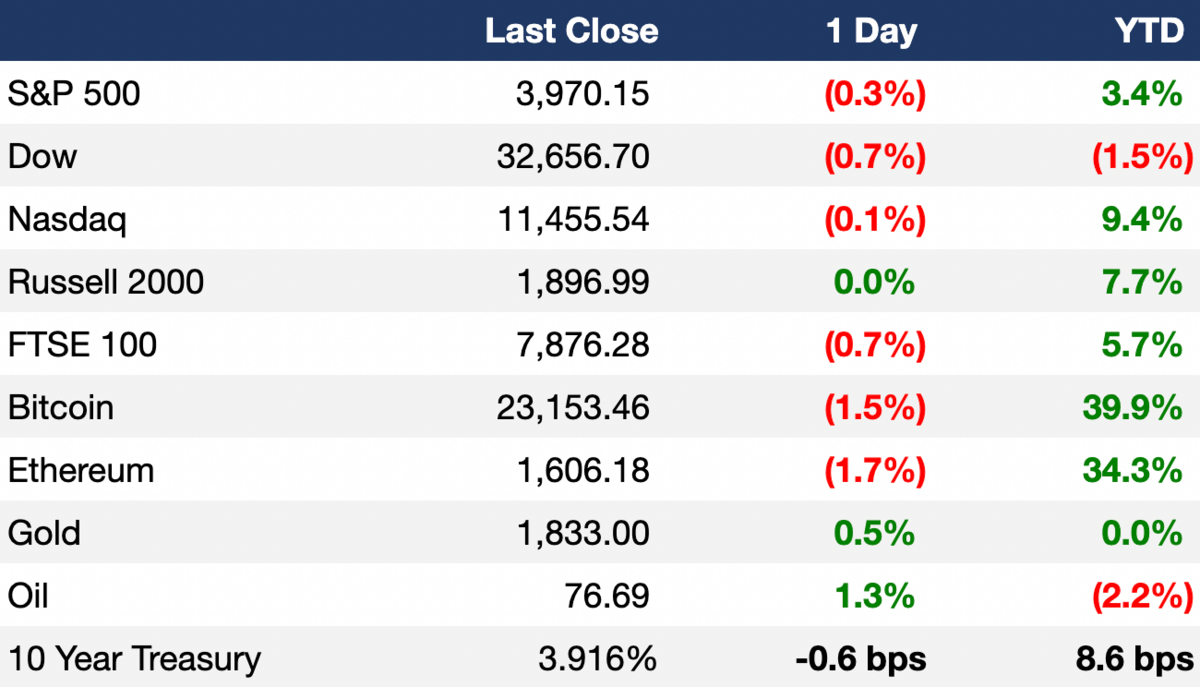

All three major US indexes inched slightly lower yesterday on persisting Fed rate hike concerns

The S&P, Nasdaq and Dow lost 2.6%, 1.1% and 4.2% respectively in a February reversal of January's rally

The pan-European Stoxx 600 gained 2.07% in February

10Y Treasury yield hit its highest level since November

The 10Y-2Y yield inversion is at its deepest point since inverting in July 2022

The dollar index rose 2.6% in February to snap a four-month losing streak

Earnings

Target topped Q4 EPS and revenue estimates for the first time in a year as household essentials boosted sales despite 'a very challenging environment'; the firm also revealed shrinking profit and a conservative FY outlook (CNBC)

Rivian posted a smaller-than-expected Q4 loss but missed on revenue as it grapples with supply chain issues and unexpected pricing pressures, while showing underwhelming FY production forecasts; their stock fell 10.1% AH (CNBC)

What we're watching this week:

Today: RBC, Salesforce, Lowe's, Kohl's

Thursday: TD Bank Group, Costco, Best Buy, Dell, Broadcom, Nordstrom, Victoria's Secret

Full calendar here

Headline Roundup

Bank of America expects the Fed to raise rates to 6% (RT)

Canada's economy grew 0% in Q4 (RT)

US house price inflation slowed to 6.6% YoY in December (RT)

US firms are hiring with ease despite low jobless rate (FT)

Highly-rated US firms issued $144B in debt in a record-breaking February (RT)

Over $1T of risky US corporate loans are still shackled to LIBOR as deadline looms (FT)

UK grocery inflation hit a record high 17.1% (RT)

PE firms are back to selling junk bonds to pay dividends (BBG)

India's PE investments fell 23% in 2022 (RT)

Tesla's Mexico plant to require a ~$5B investment (BBG)

Goldman Sachs will double down on asset/wealth management, while shrinking consumer segment (WSJ)

Japanese banking giants bump up graduate starting salaries in talent war (BBG)

Chevron CEO is not ruling out consolidation among oil giants (RT)

Amazon employees will be able to use stock as home loan collateral (WSJ)

GM cut 500 salaried employees (CNBC)

Eventbrite will cut 8% of its workforce (RT)

Glencore was fined $700M in connection with its bribery scheme guilty plea (RT)

US return to office rate severely lags Europe and Asia (WSJ)

Lori Lightfoot becomes the first Chicago mayor to lose reelection in 40 years (BBG)

A Message From Simon & Schuster

David M. Rubenstein, cofounder of The Carlyle Group, speaks with some of the most successful, forward-thinking investors across a range of finance disciplines.

Conversations with financiers such as Stan Druckenmiller, Larry Fink, Mike Novogratz, Seth Klarman, and many more reveal deep insights into the principles of investing, portfolio growth, decision making, and indispensable wisdom from the world’s leading investors.

How to Invest is an authoritative guide to the world of finance, private equity, and more, one that can transform your own approach to investing.

Deal Flow

M&A / Investments

Cleveland Browns owners Jimmy and Dee Haslam agreed to buy HF manager Marc Lasry's ~25% stake in NBA team Milwaukee Bucks at a $3.5B valuation (ESPN)

Singapore-based shipbuilder Sembcorp Marine completed a $3.3B buyout of Singaporean infrastructure conglomerate Keppel's offshore & marine unit (RT)

Apollo is in talks to buy aerospace equipment and parts developer Arconic, which has a market value of ~$2.6B (BBG)

Canadian energy company Baytex agreed to buy US peer Ranger Oil in a $2.5B deal (RT)

Belgium is preparing to sell a third of its 7.8% stake in BNP Paribas for over $2B (RT)

Italian energy services group Saipem aims to raise ~$796M from the partial sale of its drilling business assets (RT)

UAE-based telecoms group (and Vodafone's biggest shareholder) e& raised its stake in Vodafone to 14% (RT)

French insurer AXA sold almost all of its 8% stake in Italian bank Banca Monte dei Paschi di Siena (FT)

Goldman Sachs is considering ‘strategic alternatives’ for its consumer arm (RT)

VC

Paratus Sciences, a biotech startup focused on bat biology, raised a $100M Series A co-led by Polaris Partners, Arch Venture Partners, ClavystBio, EcoR1 Capital and Leaps (AX)

Bitwise Industries, a software development and managed services business, raised an $80M Series B (TC)

BetterNight, a sleep care platform, raised $33M in funding led by NewSpring (PRN)

Novata, a platform providing private markets with ESG solutions, raised a $30M Series B led by Hamilton Lane (BW)

Employee recognition startup Bonusly raised an $18.9M Series B led by Ankona Capital (TC)

REALLY, a decentralized mobile network, raised an $18M seed round led by Polychain (PRN)

Gable, a startup helping distributed companies manage office space for their workforce, raised $16M in funding led by SemperVirens and Foundation Capital (PRN)

Consumer fintech platform Archway raised a $15M Series A led by Madrona and WaFd Bank (BW)

Entertainment NFT startup Orange Comet raised a $7M round from new and existing investors (CD)

Verismo Therapeutics, a clinical-stage CAR-T company, raised a $7M pre-Series A led by BRV Capital (PRN)

Blockchain R&D company Term Labs raised a $2.5M seed round led by Electric Capital (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

State-owned State Bank of India raised $1B via a syndicated social loan from Japan-based MUFG Bank and Taiwan-based Taipei Fubon Commercial Bank (RT)

Adani Green Energy plans to refinance its 2024 bonds via an $800M three-year credit line (RT)

India's Adani Group plans to prepay or repay share-backed loans worth $790M by March-end (RT)

Fundraising

Oaktree Capital plans to raise $10B for a new fund to help finance large LBOs (FT)

Bain Capital Ventures raised $1.9B for two new funds: a ~$1.4B fund to invest in seed to growth-stage startups and a $493M fund targeting later-stage opportunities (BBG)

Investcorp raised $1.2B for Investcorp North American PE Fund I to make control buy-out investments in North America middle market services businesses (PRN)

SixThirty Ventures raised a $66M Fund III to invest in companies at the intersection of finance, health and privacy (FN)

Crypto Corner

Ex-FTX chief engineer Nishad Singh pleaded guilty to Federal charges over FTX collapse (AX)

Bluesky, Twitter's decentralized alternative backed by Jack Dorsey, hit the App Store (TV)

Crypto conglomerate Digital Currency Group reported a $1.1B loss in 2022 (CD)

Payments giant Mastercard paused crypto push amid industry meltdown (RT)

Visa's crypto strategy remains intact despite crypto winter (CD)

Exec's Picks

Internal documents reveal that banks want to move their HQs to Ohio in an attempt to “further sh*t on their employees”. If that’s not what you signed up for when you joined investment banking, maybe a freelance career is the right move? Check out Fintalent.io, the platform for freelance M&A and Private Equity consultants.

Forbes covered JPMorgan's ongoing cleanup of its disastrous $175M Frank acquisition.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.